Heikin Ashi Chart

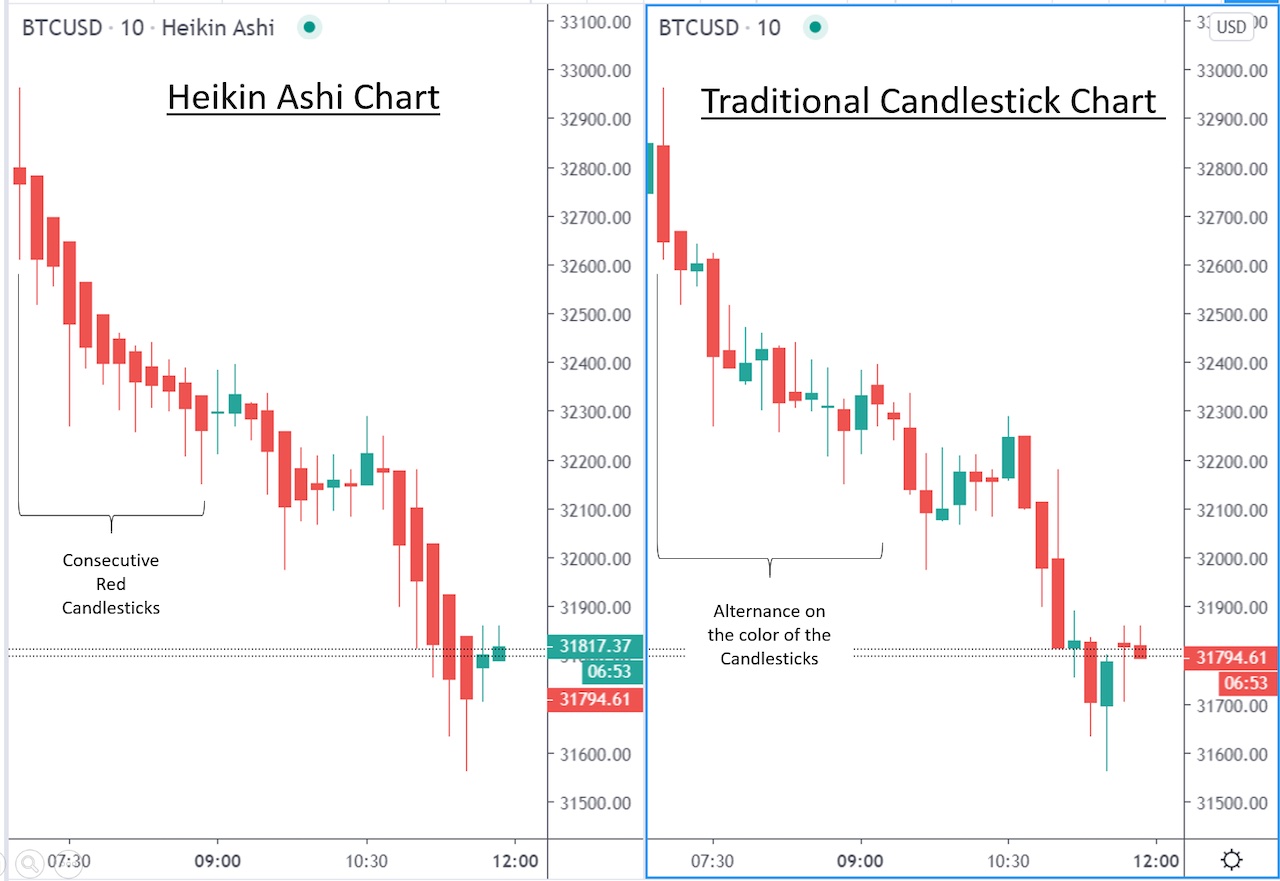

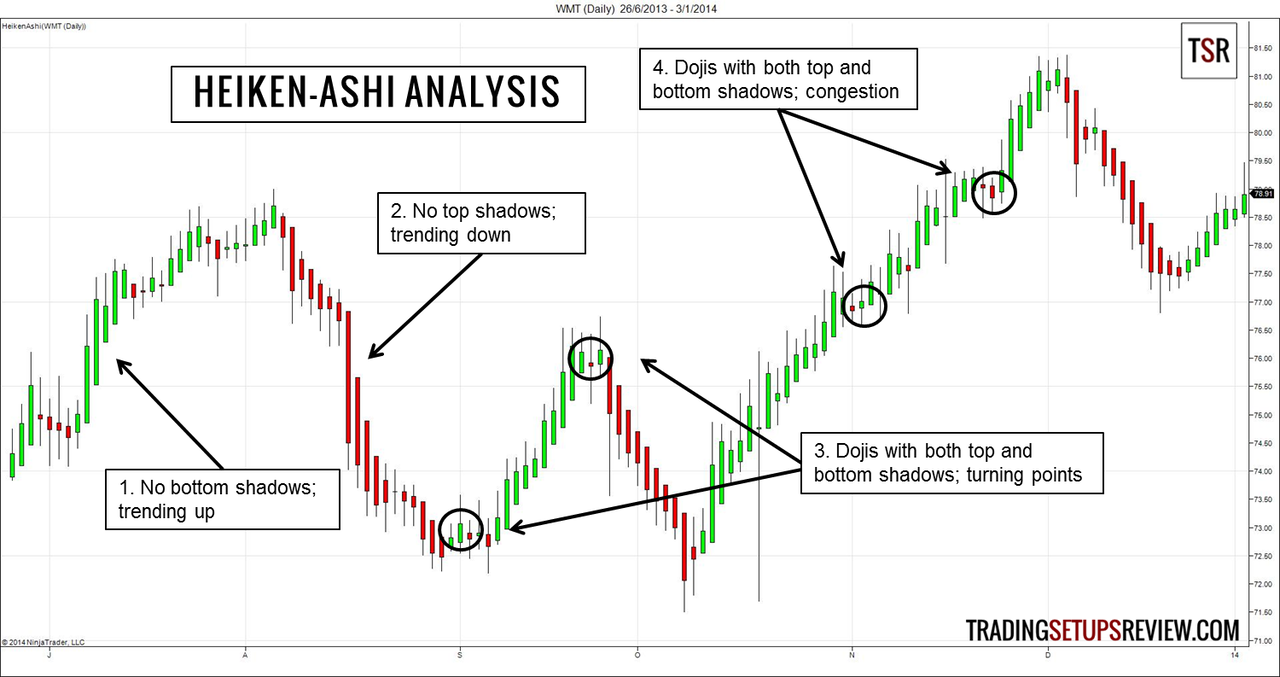

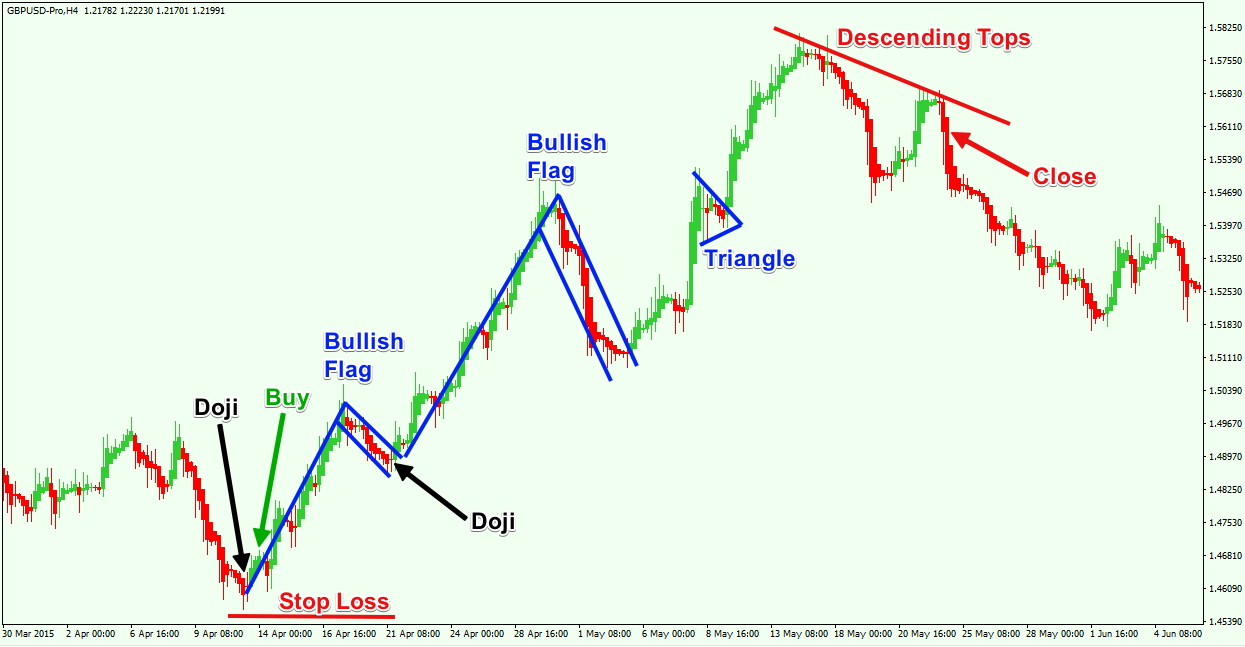

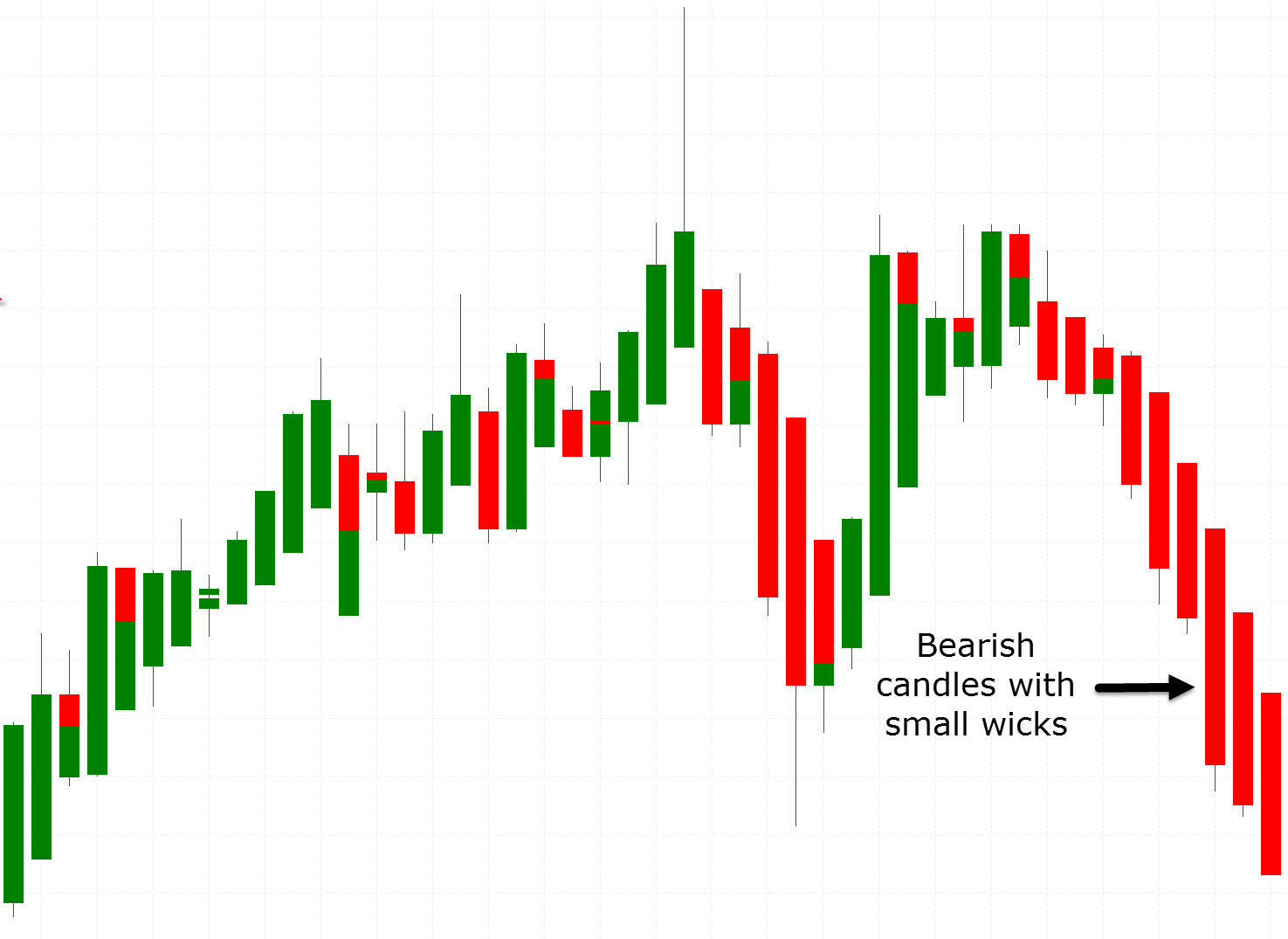

Heikin Ashi Chart - But, it differs in one key area: It helps to more easily identify the trending direction. Web heikin ashi charts can potentially help traders identify when trends are likely to reverse. In fact, all aspects of classical technical analysis can be applied to these charts. Web the heikin ashi — also spelled heiken ashi — is both a technical analysis indicator and a chart type, depending on how it is used. The heikin ashi chart is a type of candle chart. A heikin ashi chart filters market noise and provides a clearer visual representation of the trend. Web heikin ashi is a type of price chart that consists of candlesticks. It plots smooth price activity by calculating average values. Web heikin ashi candlesticks filter out market noise from the traditional japanese candlestick chart and highlight trend and/or consolidation patterns. But what is this heikin ashi chart? It helps you by creating an entry signal which needs to be. Learn how to read these charts and how to use them in your trading. Web the heikin ashi (ha) chart is visually similar to a candlestick chart. The heikin ashi chart is a type of candle chart. Heikin ashi charts use a modified formula to smooth out price movements and eliminate noise, making it easier to identify trends and support and resistance levels. Web heikin ashi is a type of trading chart created in japan. Web the heikin ashi (ha) is a type of price chart that uses averages to show the price movement of an asset.. A green candle is telling you that trend is up. A red candle is telling you that the trend is down. Heikin ashi charts use a modified formula to smooth out price movements and eliminate noise, making it easier to identify trends and support and resistance levels. It might help to find a valid entry signal among others (you know. Web heikin ashi charts look like typical candlestick charts, but they smooth out price action because their bars are computed out of price ranges rather than every tick movement. Heikin ashi charts use a modified formula to smooth out price movements and eliminate noise, making it easier to identify trends and support and resistance levels. Web heikin ashi candlesticks are. Web the heikin ashi (ha) is a type of price chart that uses averages to show the price movement of an asset. In fact, all aspects of classical technical analysis can be applied to these charts. A main advantage is that heikin ashi charts are much smoother looking. However, unlike a regular candlestick chart, the heikin ashi chart tries to. But, it differs in one key area: Web many traders prefer the heikin ashi chart to normal japanese candlesticks. This strategy is based on the harsi indicator by jay rogers and gives entry signals based on the heikin ashi candles. It helps to more easily identify the trending direction. But what is this heikin ashi chart? But what is this heikin ashi chart? A heiken ashi point is composed of a body and an upper and a lower wick similarly to the candlestick. 4.5/5 (289 reviews) Web many traders prefer the heikin ashi chart to normal japanese candlesticks. This strategy is based on the harsi indicator by jay rogers and gives entry signals based on the. Web heikin ashi charts can potentially help traders identify when trends are likely to reverse. Unlike a traditional candlestick that offers open and close prices for a specific period. Web heikin ashi is a type of trading chart created in japan. But what is this heikin ashi chart? Web a heikin ashi chart is a charting technique used in the. However, unlike a regular candlestick chart, the heikin ashi chart tries to filter out some of the market noise by smoothing out strong price swings to better identify trend movements in the market. A heikin ashi chart filters market noise and provides a clearer visual representation of the trend. The heikin ashi chart is a type of candle chart. Unlike. Web many traders prefer the heikin ashi chart to normal japanese candlesticks. The difference is the method used in how candlesticks are calculated and plotted on a. Web the heikin ashi (ha) is a type of price chart that uses averages to show the price movement of an asset. Unlike regular candlesticks—which utilize only the open, high, low, and close. A green candle is telling you that trend is up. Web heikin ashi candlesticks are a variation of traditional japanese candlestick charts, with slightly different bar building rules that better highlight current trends. Web the heikin ashi (ha) is a type of price chart that uses averages to show the price movement of an asset. Its coloring is similar to the coloring on the candle chart, however, the open, close, high, and low prices are based on midpoints of current and previous candles. Web heikin ashi candlesticks filter out market noise from the traditional japanese candlestick chart and highlight trend and/or consolidation patterns. Unlike a traditional candlestick that offers open and close prices for a specific period. It might help to find a valid entry signal among others (you know it, sometimes signals get lost in the abundance of information). It is similar to traditional candlestick charts. Web many traders prefer the heikin ashi chart to normal japanese candlesticks. This chart is used as a form of technical analysis to look at an asset’s price movements with regard to an overall trend. Web the heikin ashi — also spelled heiken ashi — is both a technical analysis indicator and a chart type, depending on how it is used. A heiken ashi point is composed of a body and an upper and a lower wick similarly to the candlestick. Unlike regular candlesticks—which utilize only the open, high, low, and close prices of a specific bar—heikin ashi bars are calculated using a formula that also incorporates. Web heikin ashi is a charting technique that can be used to predict future price movements. Web the heikin ashi (ha) chart is visually similar to a candlestick chart. Ha charts don’t do this.

How to Use a Heikin Ashi Chart

A complete Guide to Trading with Heikin Ashi Candles Pro Trading School

What Is Heikin Ashi Chart and How to Trade with It? Bybit Learn

![Heikin Ashi Charts in Forex [Explained]](https://howtotrade.com/wp-content/uploads/2020/09/heikin-ashi-chart-howtotrade-1024x719.png)

Heikin Ashi Charts in Forex [Explained]

How To Catch Trends With HeikenAshi Candlestick Analysis Trading

How to Use a Heikin Ashi Chart

Ultimate Guide to Trading with Heikin Ashi Candles Forex Training Group

A complete Guide to Trading with Heikin Ashi Candles Pro Trading School

![Heikin Ashi Charts in Forex [Explained]](https://bpcdn.co/images/2020/04/18162040/heikin-ashi-candles-start-from-middle-of-previous-candle.png)

Heikin Ashi Charts in Forex [Explained]

What is Heikin Ashi and How You Use it With Free PDF

It Plots Smooth Price Activity By Calculating Average Values.

A Main Advantage Is That Heikin Ashi Charts Are Much Smoother Looking.

Learn How To Read These Charts And How To Use Them In Your Trading.

Web Heikin Ashi Charts Look Like Typical Candlestick Charts, But They Smooth Out Price Action Because Their Bars Are Computed Out Of Price Ranges Rather Than Every Tick Movement.

Related Post: