Hammer Candle Pattern

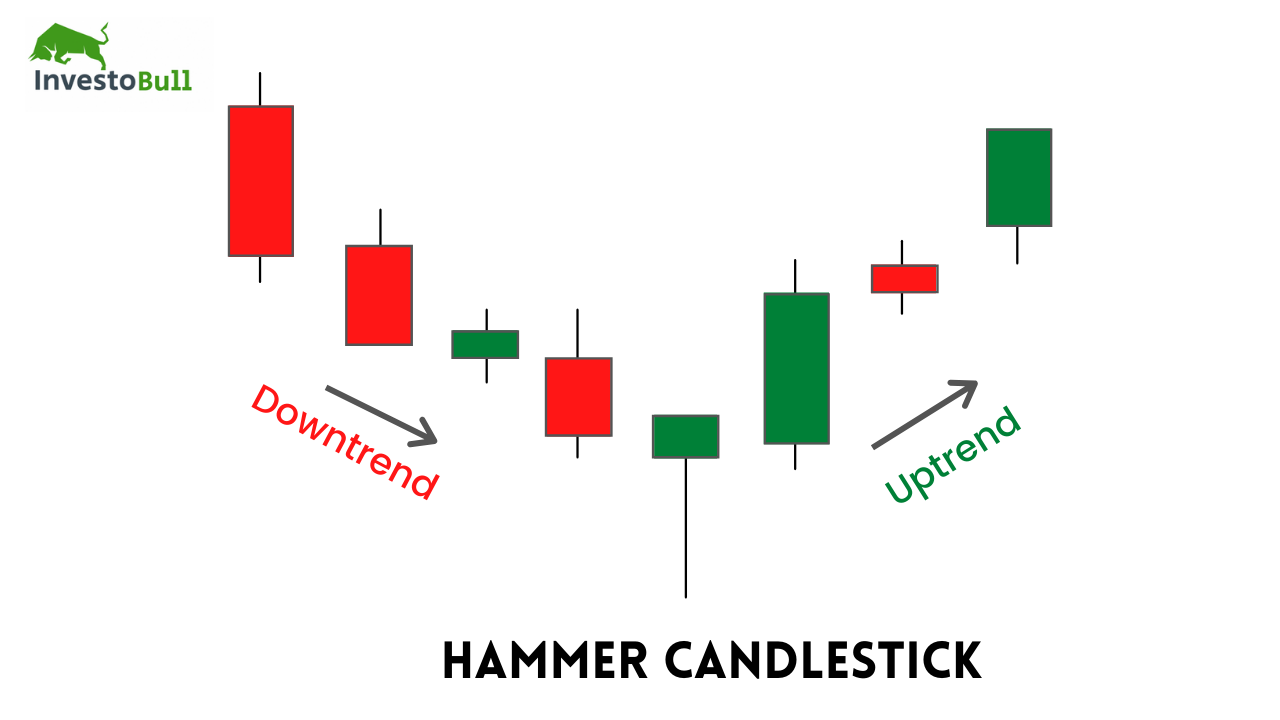

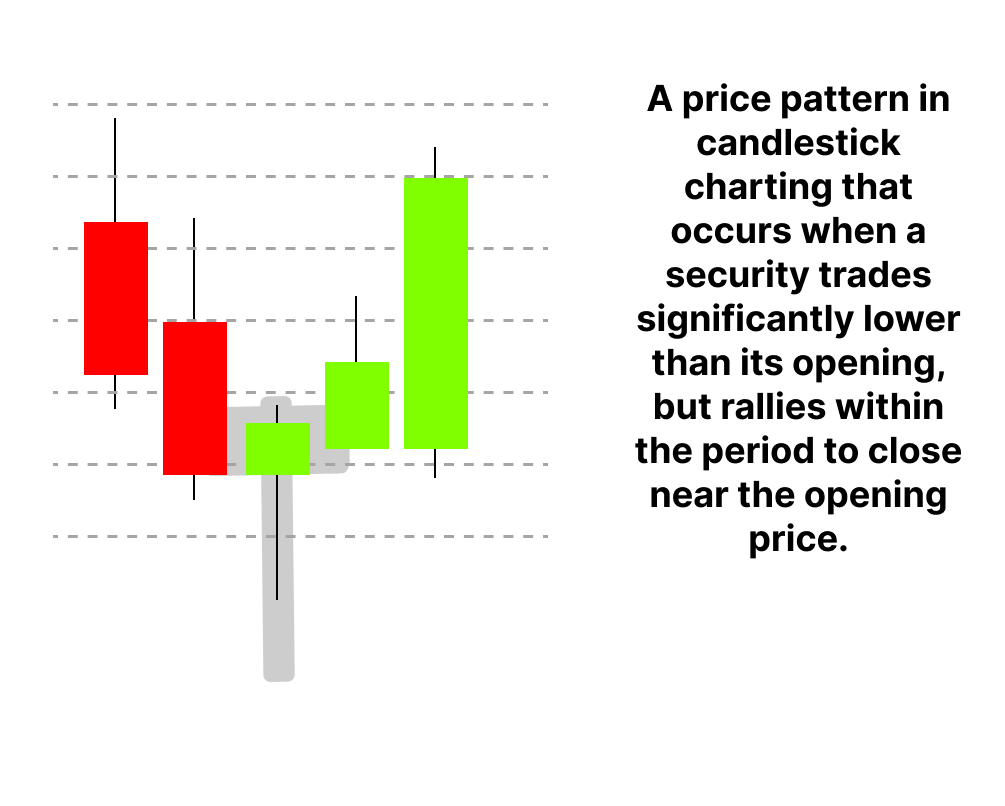

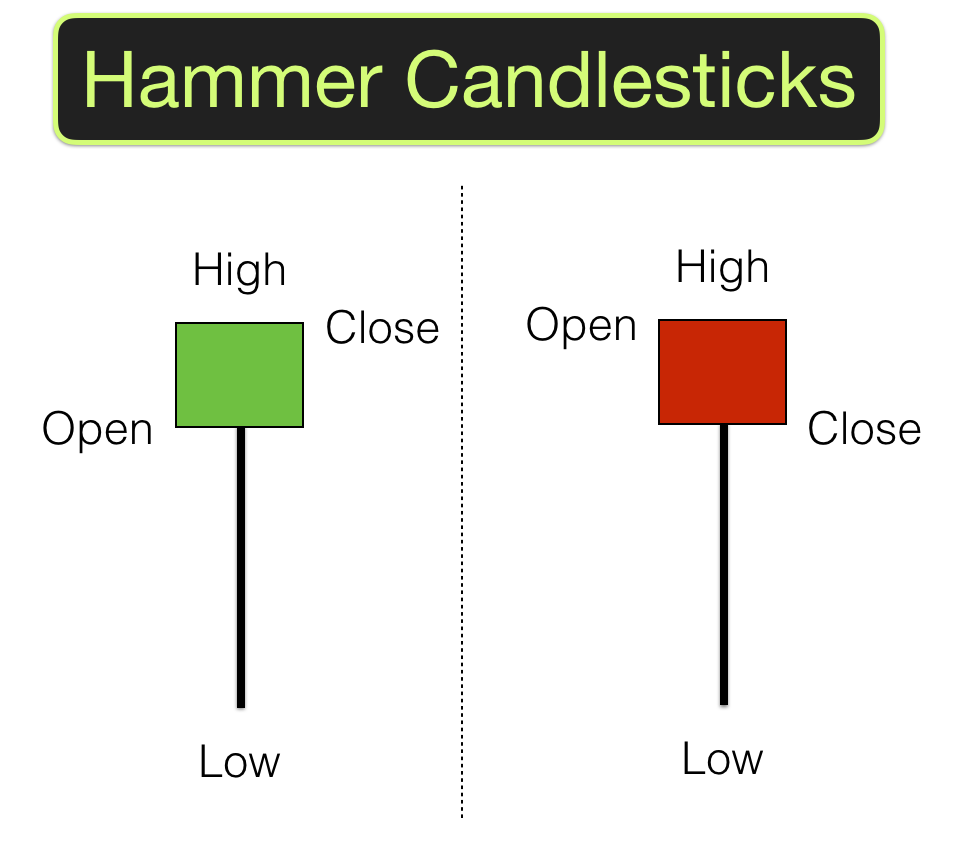

Hammer Candle Pattern - It is often referred to as a bullish pin bar, or bullish rejection candle. Web hammer heads gift & smoke shop, llc has been set up 7/18/2012 in state fl. Web the japanese candlestick chart patterns are the most popular way of reading trading charts. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. On the daily chart, the pair has formed a hammer pattern, a popular reversal sign. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. It resembles a candlestick with a small body and a long lower wick. Web the hammer pattern is one of the first candlestick formations that price action traders learn in their career. The information below will help you identify this pattern on the charts and predict further price dynamics. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. I'll be there at the end of november for 5 days thank. Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. Web hammer candlesticks are a. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. In this post we look at exactly what the hammer candlestick pattern is and how you can use it in your trading. They consist of small to medium size lower shadows, a real body,. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. This coupled with an upward trend in earnings. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. It signals that the market is about to change trend direction and advance to new heights. In short,. In this post we look at exactly what the hammer candlestick pattern is and how you can use it in your trading. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. The long. It dropped to a low of 0.6478 and then quickly bounced back. This shows a hammering out of a base and reversal setup. Our guide includes expert trading tips and examples. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. Web the japanese candlestick chart patterns are the most popular way of. Web the hammer pattern is one of the first candlestick formations that price action traders learn in their career. Web the hammer is a classic bottom reversal pattern that warns traders that prices have reached the bottom and are going to move up. At its core, the hammer pattern is considered a reversal signal that can often pinpoint the end. Web a hammer candle or candlestick is a widely recognized chart pattern that can be used by forex traders to identify potential bullish or bearish trend reversals. It signals that the market is about to change trend direction and advance to new heights. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. It. It signals that the market is about to change trend direction and advance to new heights. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. At its core, the hammer pattern is considered a reversal signal that can often pinpoint the end of a prolonged trend or retracement phase. Web. Web hammer heads gift & smoke shop, llc has been set up 7/18/2012 in state fl. We aid in the selection of standard product as well as the design, development, and implementation Meanwhile you can send your letters to 824 e eau gallie blvd, indian harbor. It dropped to a low of 0.6478 and then quickly bounced back. Web hammer. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. This pattern appears like a hammer, hence its name: Meanwhile you can send your letters to 824 e eau gallie blvd, indian harbor. The hammer signals that price may be about to make a reversal back higher after a recent swing lower. Web a hammer. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. We aid in the selection of standard product as well as the design, development, and implementation This pattern is typically seen as a bullish reversal signal, indicating that a downward price swing has likely reached its bottom and is poised to move higher. On the daily chart, the pair has formed a hammer pattern, a popular reversal sign. Web hammer heads gift & smoke shop, llc has been set up 7/18/2012 in state fl. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. Web the hammer pattern is one of the first candlestick formations that price action traders learn in their career. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. Our guide includes expert trading tips and examples. This pattern appears like a hammer, hence its name: The long lower shadow of the hammer shows that the stock attempted to sell off during the trading session, but the demand for shares helped bring the stock back up, closer to the opening price, with a green candle indicating the stock managed to close higher than. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. Web the hammer candlestick pattern is a technical analysis tool used by traders to identify potential reversals in price trends. In this post we look at exactly what the hammer candlestick pattern is and how you can use it in your trading. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends.

Hammer Candlestick Pattern Trading Guide

Candle Patterns Picking the "RIGHT" Hammer Pattern YouTube

Hammer Candlestick Patterns (Types, Strategies & Examples)

Hammer Candlestick Pattern Strategy Guide for Day Traders DTTW™

What is Hammer Candlestick Pattern June 2024

Candlestick Patterns The Definitive Guide (2021)

Hammer Candlestick Pattern The Complete Guide 2022 (2022)

Hammer Candlestick Pattern Trading Guide

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

Candlestick Hammer Pattern Bios Pics

The Current Status Of The Business Is Active.

Learn What It Is, How To Identify It, And How To Use It For Intraday Trading.

This Pattern Typically Appears When A Downward Trend In Stock Prices Is Coming To An End, Indicating A Bullish Reversal Signal.

Web The Hammer Candlestick Is A Significant Pattern In The Realm Of Technical Analysis, Vital For Predicting Potential Price Reversals In Markets.

Related Post: