Enterprise Value Chart

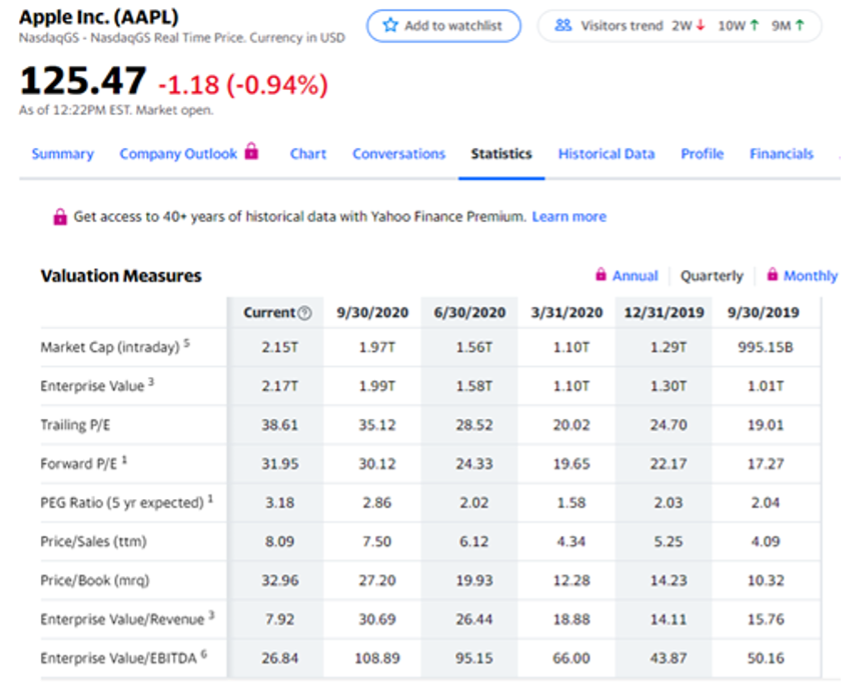

Enterprise Value Chart - View and export this data back to 1984. Enterprise value takes into account the debt that the company. Web enterprise value (ev), also known as entity value, is an economic measure reflecting the market value of the whole business. How to calculate equity value and enterprise value, answer tricky interview questions, and more. Web enterprise value (ev) is the measure of a company’s total value. Find out how investors calculate and use it. Web enterprise value calculates the potential cost to acquire a business based on the company’s capital structure. Web the enterprise value (ev) to the earnings before interest, taxes, depreciation, and amortization (ebitda) ratio varies by industry. Multiply the share price by the total number of shares outstanding (the number of shares of common stock a company has. Enterprise value (tev) → the value of a. It looks at the entire market value rather than just the equity value, so all ownership interests and asset. View and export this data back to 1984. It is a useful ratio when comparing companies that have. Web enterprise value (ev), also known as entity value, is an economic measure reflecting the market value of the whole business. To download. It is a useful ratio when comparing companies that have. Web calculating the market cap is simple: Web enterprise value calculates the potential cost to acquire a business based on the company’s capital structure. Web enterprise value (ev) is the measure of a company’s total value. Enterprise value takes into account the debt that the company. Learn more in this article. View and export this data back to 1984. Web enterprise value vs equity value explained: Web the two primary methods to measure a company’s valuation are 1) enterprise value and 2) equity value. It looks at the entire market value rather than just the equity value, so all ownership interests and asset. Web enterprise value (ev) is a widely used financial metric that is used to determine the total value of a company's operating assets. Web 26 rows in depth view into alphabet enterprise value including historical data from. Web enterprise value (ev) is the measure of a company’s total value. It looks at the entire market value rather than just the. Web enterprise value calculates the potential cost to acquire a business based on the company’s capital structure. Learn more in this article. Web enterprise value, or ev, is the measure of the total value of a company, including equity and debt. Enterprise value (tev) → the value of a. Market capitalization is the sum total of all the outstanding shares. How to calculate equity value and enterprise value, answer tricky interview questions, and more. Web enterprise value (ev) is a metric used in fundamental analysis to determine the value of a company. View and export this data back to 1984. As distinct from market price). Enterprise value (tev) → the value of a. Web enterprise value (ev) is the measure of a company’s total value. Web learn about the enterprise value with the definition and formula explained in detail. Web enterprise value, or ev, is the measure of the total value of a company, including equity and debt. Web enterprise value (ev), total enterprise value (tev), or firm value (fv) is an economic. Web learn about the enterprise value with the definition and formula explained in detail. As distinct from market price). Web calculating the market cap is simple: Web enterprise value calculates the potential cost to acquire a business based on the company’s capital structure. Web enterprise value (ev), total enterprise value (tev), or firm value (fv) is an economic measure reflecting. Web the two primary methods to measure a company’s valuation are 1) enterprise value and 2) equity value. Web enterprise value, or ev, is the measure of the total value of a company, including equity and debt. Web enterprise value (ev) is a widely used financial metric that is used to determine the total value of a company's operating assets.. Enterprise value takes into account the debt that the company. It looks at the entire market value rather than just the equity value, so all ownership interests and asset. Find out how investors calculate and use it. Market capitalization is the sum total of all the outstanding shares of a company. Web enterprise value calculates the potential cost to acquire. Web calculating the market cap is simple: Web enterprise value (ev), total enterprise value (tev), or firm value (fv) is an economic measure reflecting the market value of a business (i.e. To download eval's historic valuation multiples by industry reports, please click on the relevant download link below. Web enterprise value (ev) is a widely used financial metric that is used to determine the total value of a company's operating assets. Web enterprise value (ev) is a metric used in fundamental analysis to determine the value of a company. View and export this data back to 1984. Web 26 rows in depth view into alphabet enterprise value including historical data from. It looks at the entire market value rather than just the equity value, so all ownership interests and asset. Multiply the share price by the total number of shares outstanding (the number of shares of common stock a company has. Web enterprise value vs equity value explained: Enterprise value (tev) → the value of a. Enterprise value takes into account the debt that the company. Web enterprise value (ev), also known as entity value, is an economic measure reflecting the market value of the whole business. Web the two primary methods to measure a company’s valuation are 1) enterprise value and 2) equity value. It is calculated by adding a. As distinct from market price).

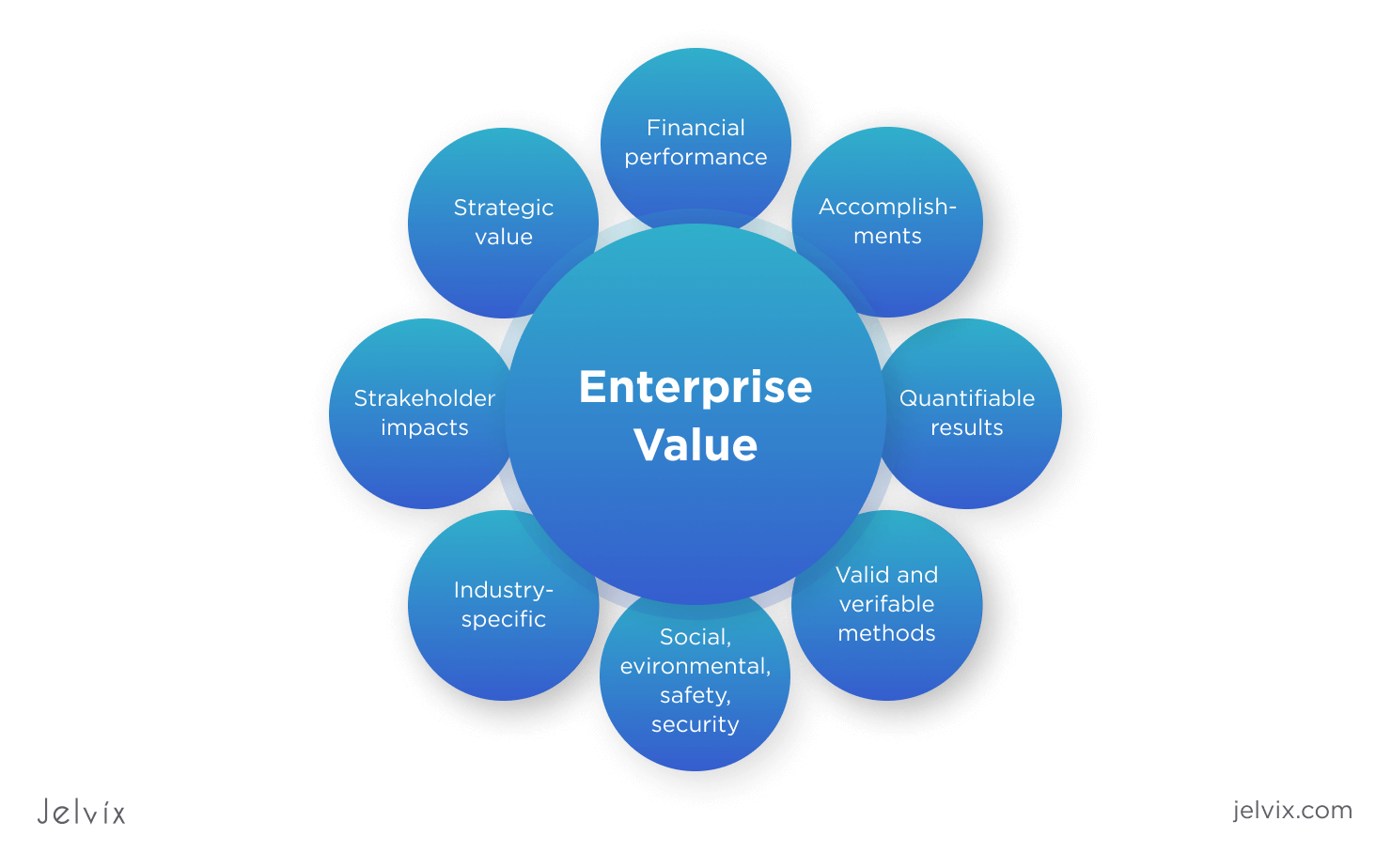

Enterprise value, Reputation management, Business ethics

How to Calculate the Enterprise Value? Jelvix

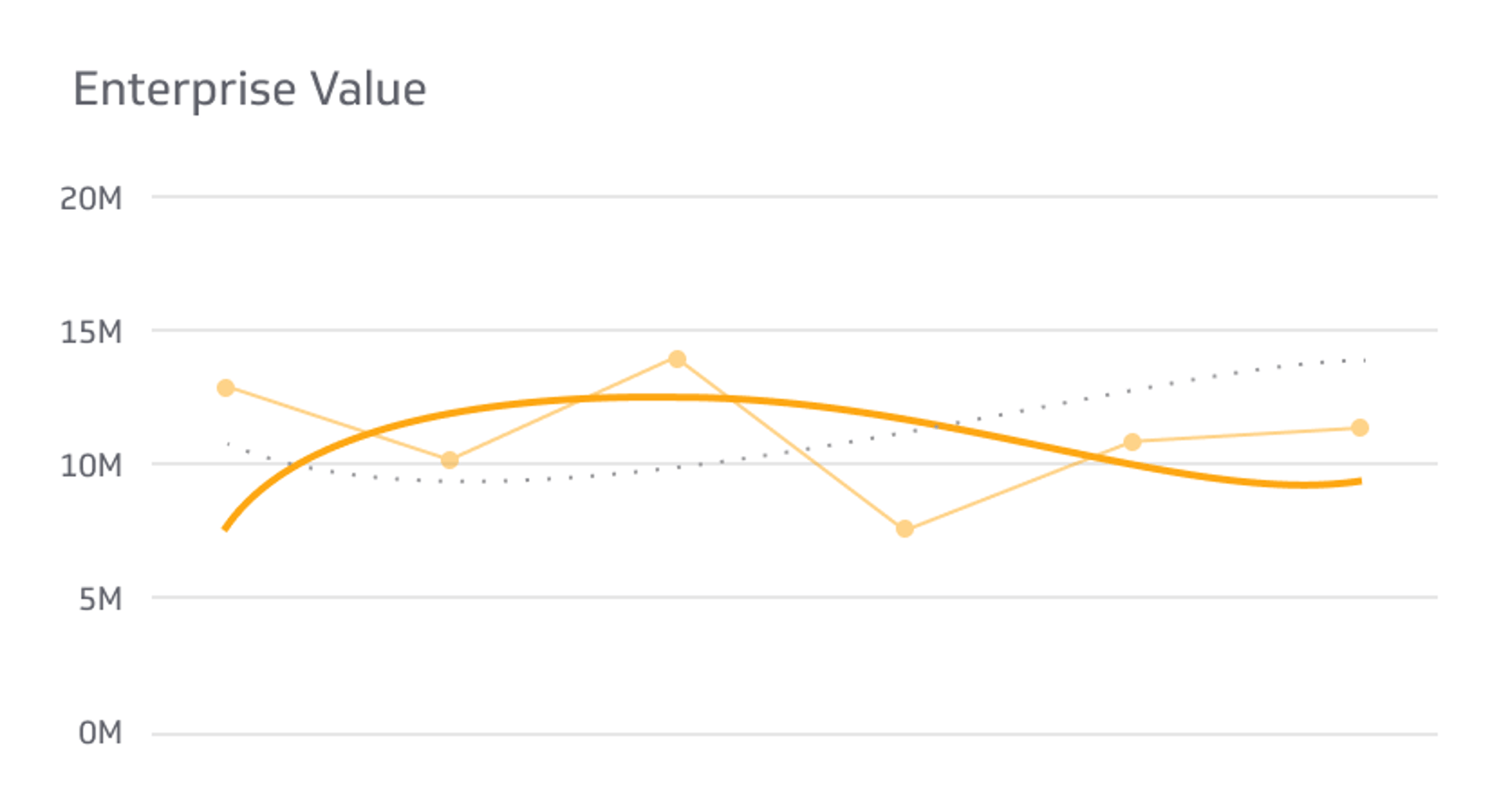

Enterprise Value Importance, Formula, and How To Calculate It Klipfolio

A New Value System The Sustainable Value Map™ Deloitte US

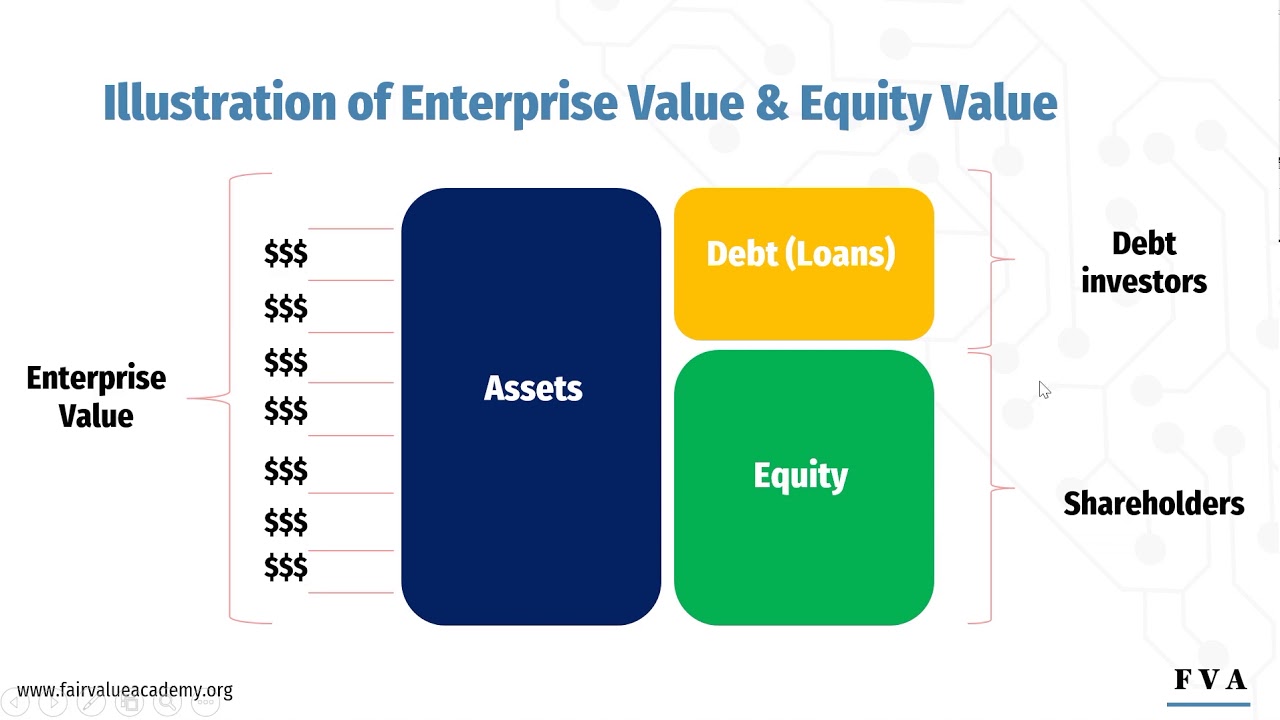

What is Enterprise Value? Formula + Calculator

Deloitte Enterprise Value Map PDF Value Added Tax Sales

What is Enterprise Value Speck & Company

2 Enterprise Value vs. Equity Value YouTube

Enterprise Value (EV) Meaning, Stock Examples, Calculate

How To Calculate Enterprise Value Multiple Haiper

Web Learn About The Enterprise Value With The Definition And Formula Explained In Detail.

Market Capitalization Is The Sum Total Of All The Outstanding Shares Of A Company.

It Is A Useful Ratio When Comparing Companies That Have.

Web The Enterprise Value (Ev) To The Earnings Before Interest, Taxes, Depreciation, And Amortization (Ebitda) Ratio Varies By Industry.

Related Post: