New York State Estate Tax Chart

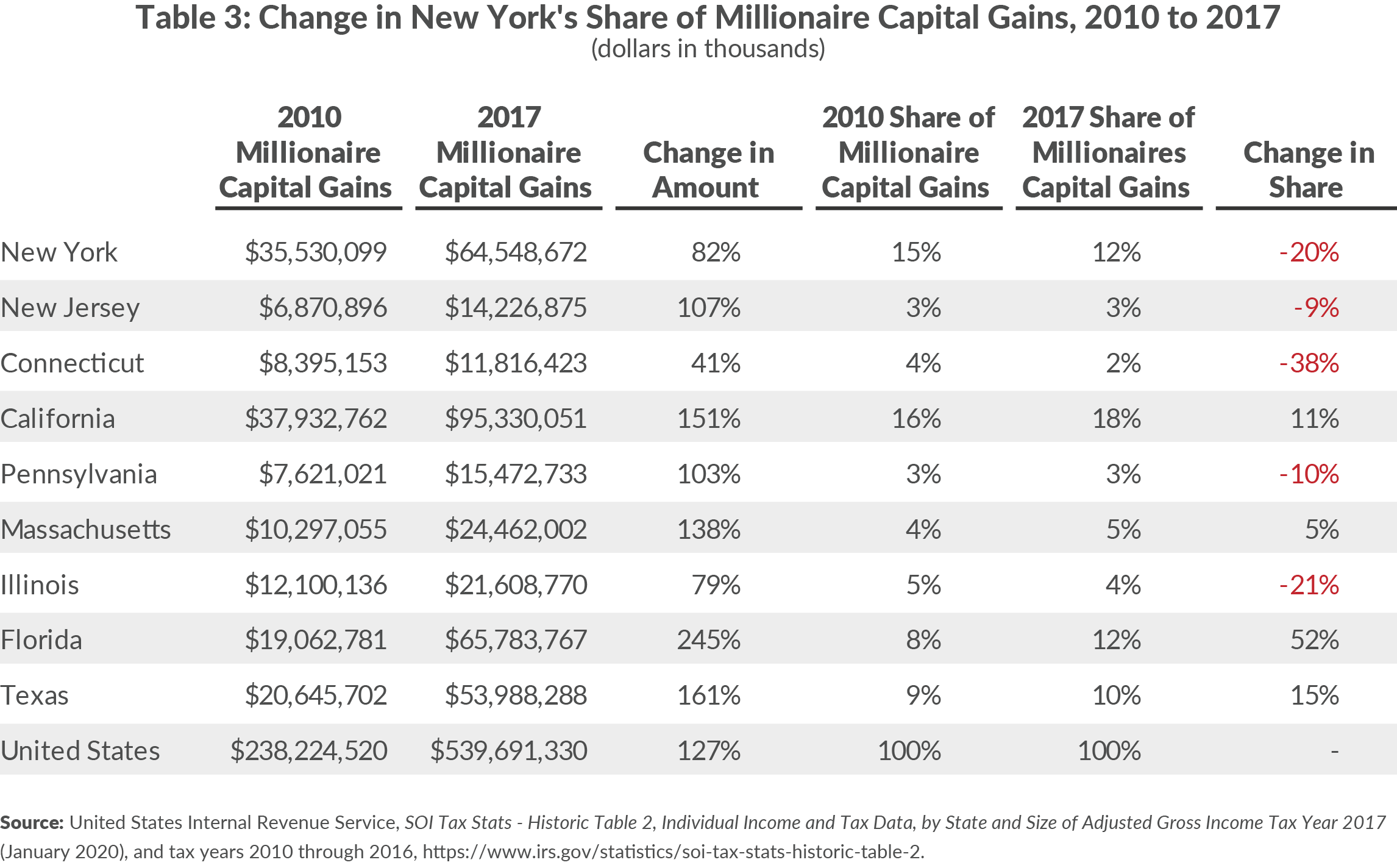

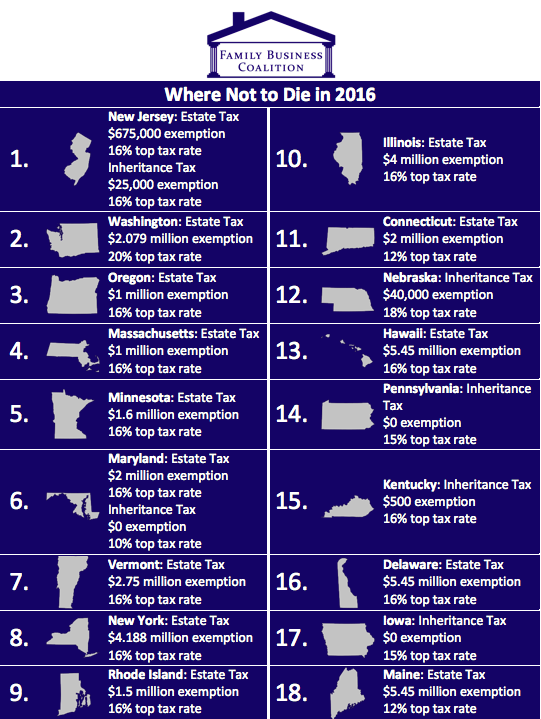

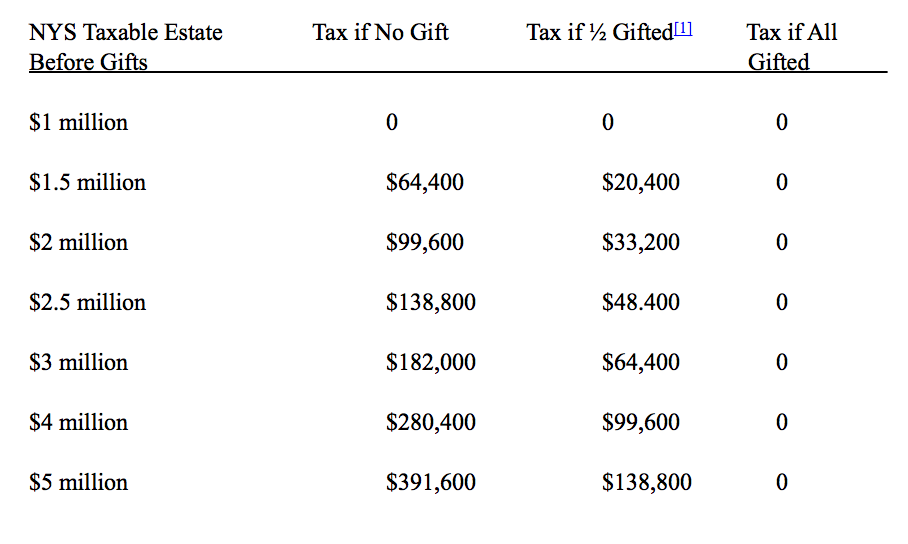

New York State Estate Tax Chart - Web master the intricacies of federal and new york state estate taxes with our comprehensive guide. So even if your estate isn't large enough to owe federal estate tax, it might still owe new york estate tax. Web the state has set a $6.94 million estate tax exemption for 2024 (up from $6.58 million in 2023), meaning if the decedent’s estate exceeds that amount, the estate is required to file a new york estate tax return. The basic exclusion amount (bea) the basic exclusion amount is used to determine the estate’s filing threshold and also to determine the amount of the applicable credit (if any). Web the estate tax rate for new york is graduated. Web the estate tax is computed based on the new york taxable estate of a resident or nonresident using the following tax table: Learn about tax implications, filing requirements, and deadlines to ensure timely and accurate compliance. Web the new york estate tax is different from the federal estate tax, which is imposed on estates worth more than $13.61 million (for deaths in 2024). The estate tax rates in new york state are progressive, starting at 3% and reaching a maximum of 16%. Web new york imposes an estate tax which is calculated against the overall worth of the assets and funds possessed by the deceased person at the moment of their passing. Web the estate tax is computed based on the new york taxable estate of a resident or nonresident using the following tax table: The estate tax rates in new york state are progressive, starting at 3% and reaching a maximum of 16%. Web the state has set a $6.94 million estate tax exemption for 2024 (up from $6.58 million in. Web the estate tax rate for new york is graduated. The estate tax rates in new york state are progressive, starting at 3% and reaching a maximum of 16%. Web master the intricacies of federal and new york state estate taxes with our comprehensive guide. So even if your estate isn't large enough to owe federal estate tax, it might. The estate tax rates in new york state are progressive, starting at 3% and reaching a maximum of 16%. Web the estate tax is computed based on the new york taxable estate of a resident or nonresident using the following tax table: Web the new york estate tax is different from the federal estate tax, which is imposed on estates. Web the state has set a $6.94 million estate tax exemption for 2024 (up from $6.58 million in 2023), meaning if the decedent’s estate exceeds that amount, the estate is required to file a new york estate tax return. Web the new york estate tax is different from the federal estate tax, which is imposed on estates worth more than. Web the estate tax rate for new york is graduated. Web the estate tax is computed based on the new york taxable estate of a resident or nonresident using the following tax table: The taxable estate is the value of the estate above the $6.94 million exemption (unless the estate reaches that cliff of 105% of $6.94 million, then the. So even if your estate isn't large enough to owe federal estate tax, it might still owe new york estate tax. It starts at 3.06% and goes up to 16%. Web a chart that provides the key new york estate tax figures for 2023 and 2024, including the estate tax exemption amount and top tax rate. Learn about tax implications,. It starts at 3.06% and goes up to 16%. Web master the intricacies of federal and new york state estate taxes with our comprehensive guide. Web the state has set a $6.94 million estate tax exemption for 2024 (up from $6.58 million in 2023), meaning if the decedent’s estate exceeds that amount, the estate is required to file a new. Learn about tax implications, filing requirements, and deadlines to ensure timely and accurate compliance. Web the estate tax rate for new york is graduated. The taxable estate is the value of the estate above the $6.94 million exemption (unless the estate reaches that cliff of 105% of $6.94 million, then the whole estate is. So even if your estate isn't. Learn about tax implications, filing requirements, and deadlines to ensure timely and accurate compliance. The estate tax rates in new york state are progressive, starting at 3% and reaching a maximum of 16%. Web new york imposes an estate tax which is calculated against the overall worth of the assets and funds possessed by the deceased person at the moment. Web new york imposes an estate tax which is calculated against the overall worth of the assets and funds possessed by the deceased person at the moment of their passing. Web master the intricacies of federal and new york state estate taxes with our comprehensive guide. The estate tax rates in new york state are progressive, starting at 3% and. Web the state has set a $6.94 million estate tax exemption for 2024 (up from $6.58 million in 2023), meaning if the decedent’s estate exceeds that amount, the estate is required to file a new york estate tax return. Web a chart that provides the key new york estate tax figures for 2023 and 2024, including the estate tax exemption amount and top tax rate. Be sure to use the version that corresponds to the decedent's date of death. Web the estate tax is computed based on the new york taxable estate of a resident or nonresident using the following tax table: Learn about tax implications, filing requirements, and deadlines to ensure timely and accurate compliance. The estate tax rates in new york state are progressive, starting at 3% and reaching a maximum of 16%. It starts at 3.06% and goes up to 16%. Web the estate tax rate for new york is graduated. Web new york imposes an estate tax which is calculated against the overall worth of the assets and funds possessed by the deceased person at the moment of their passing. The basic exclusion amount (bea) the basic exclusion amount is used to determine the estate’s filing threshold and also to determine the amount of the applicable credit (if any). The taxable estate is the value of the estate above the $6.94 million exemption (unless the estate reaches that cliff of 105% of $6.94 million, then the whole estate is.

Does Your State Have an Estate or Inheritance Tax? Tax Foundation

Ny State Estate Tax Exemption 2024 Loree Ranique

PPT New York State Department of Taxation and Finance PowerPoint

States With Estate Tax 2024 Albina Tiffie

New York Taxes Layers of Liability CBCNY

Estate and Inheritance Taxes Urban Institute

State Estate Tax Chart A Visual Reference of Charts Chart Master

new york state tax tables

NY Sales Tax Chart

Why Gifting Now Can Dramatically Reduce or Eliminate NYS Estate Taxes

Web The New York Estate Tax Is Different From The Federal Estate Tax, Which Is Imposed On Estates Worth More Than $13.61 Million (For Deaths In 2024).

So Even If Your Estate Isn't Large Enough To Owe Federal Estate Tax, It Might Still Owe New York Estate Tax.

Web Master The Intricacies Of Federal And New York State Estate Taxes With Our Comprehensive Guide.

Related Post: