Double Bottom Stock Chart Pattern

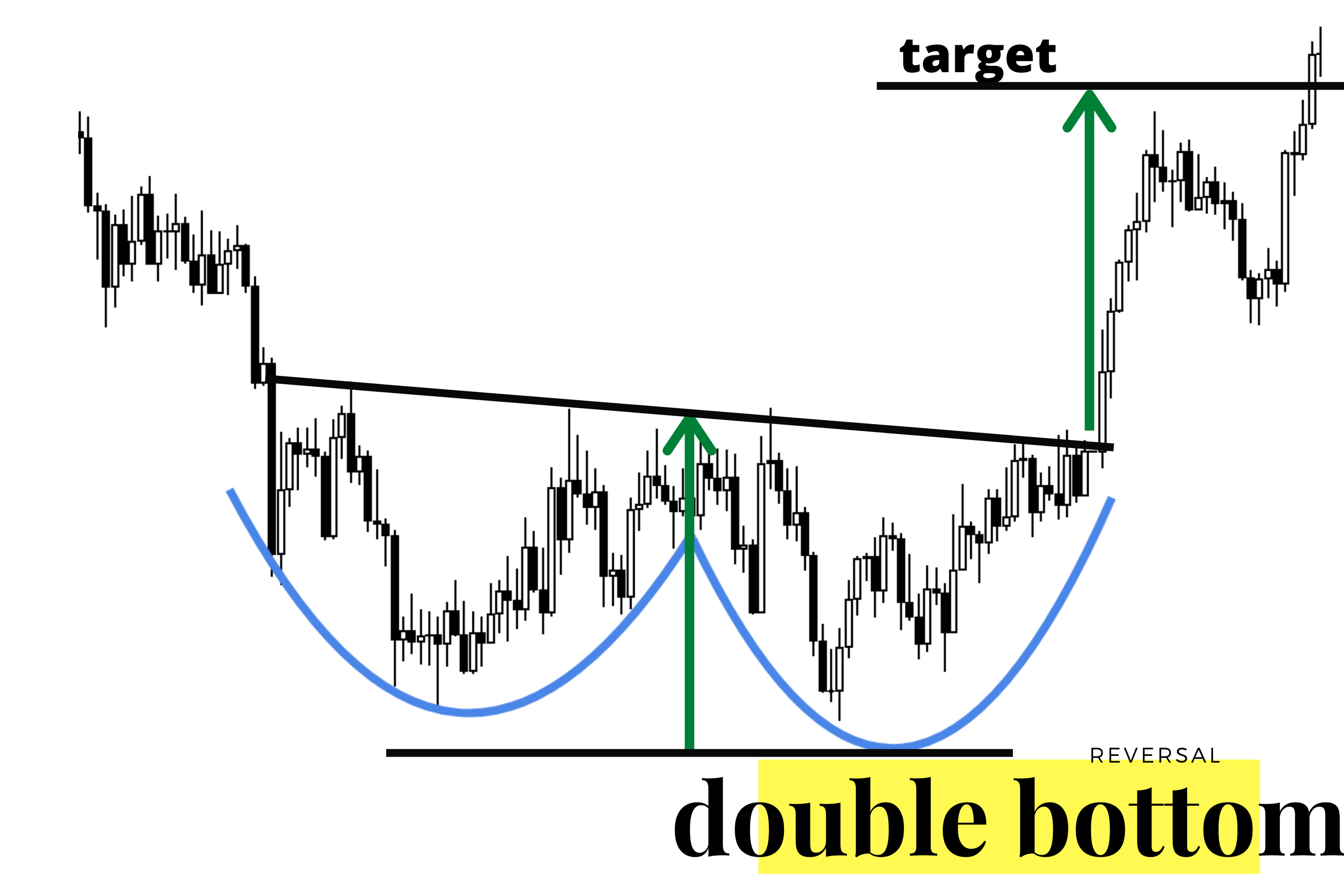

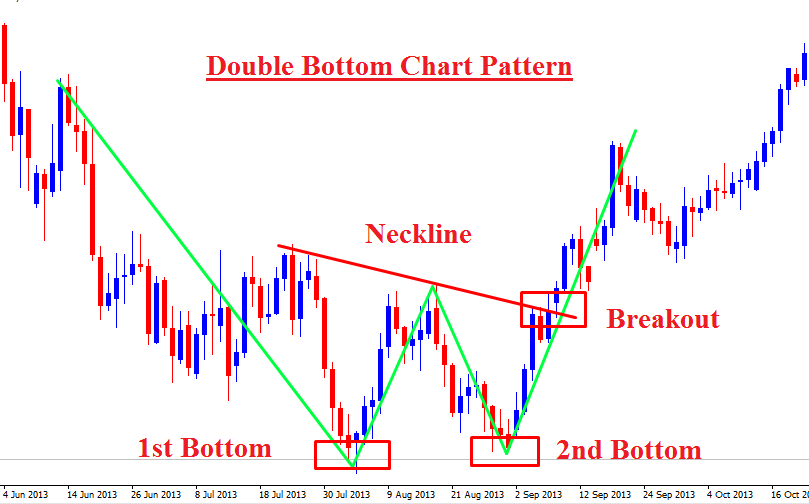

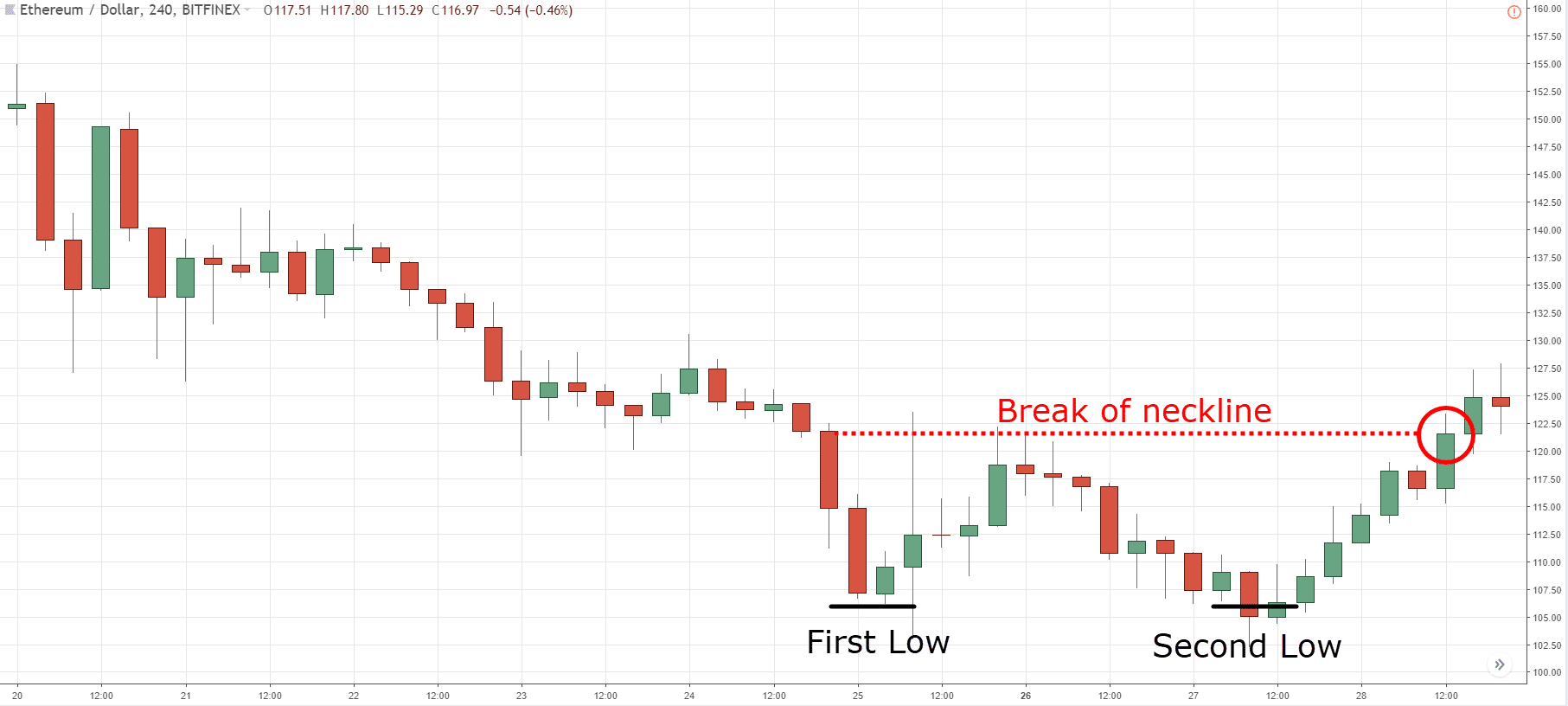

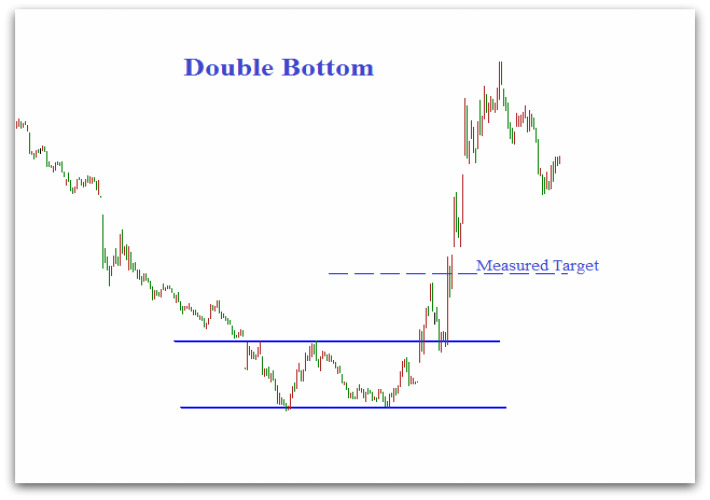

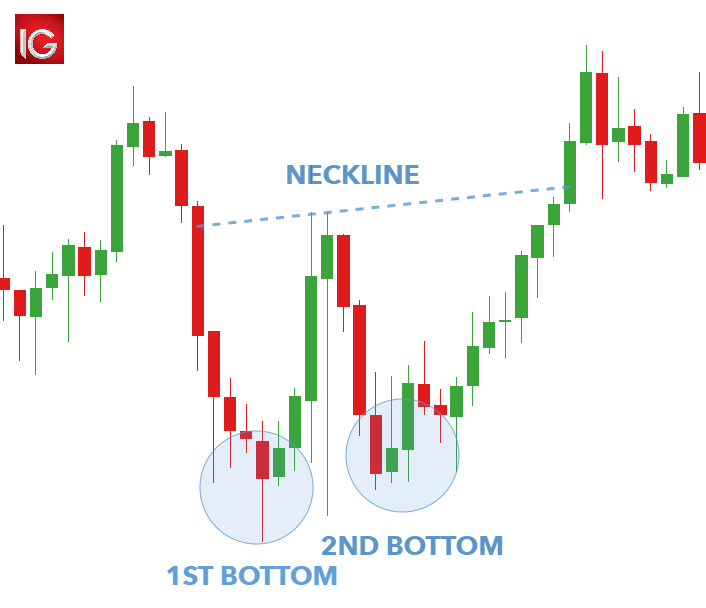

Double Bottom Stock Chart Pattern - The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a bullish reversal pattern. It is formed by two consecutive troughs, or bottoms, that are roughly equal in price. Double bottom chart pattern by andrews pitchfork follow @tradingmafia__ #trading #forex #forextrading #reels #explore #doublebottom #intraday #forexanalysis #igtrends #trending #analysis #live. To trade the pattern, you follow three simple steps: Web a double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade stocks, forex markets, or cryptocurrencies. Web double bottom shows immediate support level of stocks (last 2 support levels). Usually, a double bottom pattern signals a price reversal. It represents a major change in trend and a momentum reversal from a prior downtrend. Web the double bottom is one of the easiest chart patterns to trade, which makes it perfect for beginners or anyone who wants to quickly add another profitable set up to their overall trading strategy. Web a double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down move in market trading. Web double bottom is a bullish trend reversal chart pattern. Web a double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade stocks, forex markets, or cryptocurrencies. It is formed by two consecutive troughs, or bottoms, that are roughly equal in price. Web a double bottom chart pattern is. Examples of reversal patterns include double top and. Identify the two distinct bottoms of similar width and height. Double bottom is a bullish trend reversal chart pattern formed after good bearish price move (a continuous price down for a good duration) where the downward price movement looses its steam (first bottom) and it retraces a bit (to neck line or. Web double bottom technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. They may also consider to hover around their support level of some time, but if broken, a short call could be taken. The pattern is seen in a downtrend and may indicate the end of. Double bottom patterns may also have handles, but this is not essential. Web the double bottom pattern is a trend reversal pattern observed on charts, such as bar and japanese candlestick charts. When observed in dalmia bharat's stock chart, this pattern indicates a potential increase in the stock's price. They may also consider to hover around their support level of. Web what is double bottom pattern? Web a double bottom pattern is a technical analysis charting pattern that characterizes a major change in a market trend, from down to up. Web in general, it is fairly simple to identify a double bottom pattern on a trading chart. Web a double bottom chart pattern is used in technical stock analysis to. Web the double bottom chart pattern is a reversal pattern that signals a potential trend change from a downtrend to an uptrend. Double bottom chart pattern by andrews pitchfork follow @tradingmafia__ #trading #forex #forextrading #reels #explore #doublebottom #intraday #forexanalysis #igtrends #trending #analysis #live. Web the double bottom chart pattern creates a pointed w shape. The pattern is seen in a. Identify the two distinct bottoms of similar width and height. When observed in dalmia bharat's stock chart, this pattern indicates a potential increase in the stock's price. Web stock screener for investors and traders, financial visualizations. It took almost 2 months to complete the pattern. It resembles a w, and has a choppy, seesaw look to it. It took almost 2 months to complete the pattern. This pattern can be identified when the price retests the support line and rises up again above the neckline. Web a double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a stock or index, followed by a rebound, then another drop. Web double bottom technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web a double bottom pattern is a classic technical analysis charting formation that signals a potential reversal in the price trend of a security. The price successively makes two troughs (lowest points) at approximately the. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. They may also consider to hover around their support level of some time, but if broken, a short call could be taken. The double bottom is another pattern that repeats in every market cycle. Usually, a double bottom pattern signals a. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. Double bottom is a bullish trend reversal chart pattern formed after good bearish price move (a continuous price down for a good duration) where the downward price movement looses its steam (first bottom) and it retraces a bit (to neck line or mid point). Web double bottom technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. When observed in dalmia bharat's stock chart, this pattern indicates a potential increase in the stock's price. As the name suggests, reversal patterns signal a shift in the trend direction. Web a double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade stocks, forex markets, or cryptocurrencies. The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a bullish reversal pattern. Web a double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a stock or index, followed by a rebound, then another drop to a level that’s roughly similar to the original drop (sound familiar?), and finally another rebound. Web what is double bottom pattern? Web the double bottom pattern is a bullish reversal chart pattern that suggests the end of a downtrend and the beginning of an uptrend. It represents a major change in trend and a momentum reversal from a prior downtrend. To trade the pattern, you follow three simple steps: Web the double bottom is one of the easiest chart patterns to trade, which makes it perfect for beginners or anyone who wants to quickly add another profitable set up to their overall trading strategy. Web the double bottom pattern is a trend reversal pattern observed on charts, such as bar and japanese candlestick charts. It took almost 2 months to complete the pattern. Double bottom patterns may also have handles, but this is not essential.

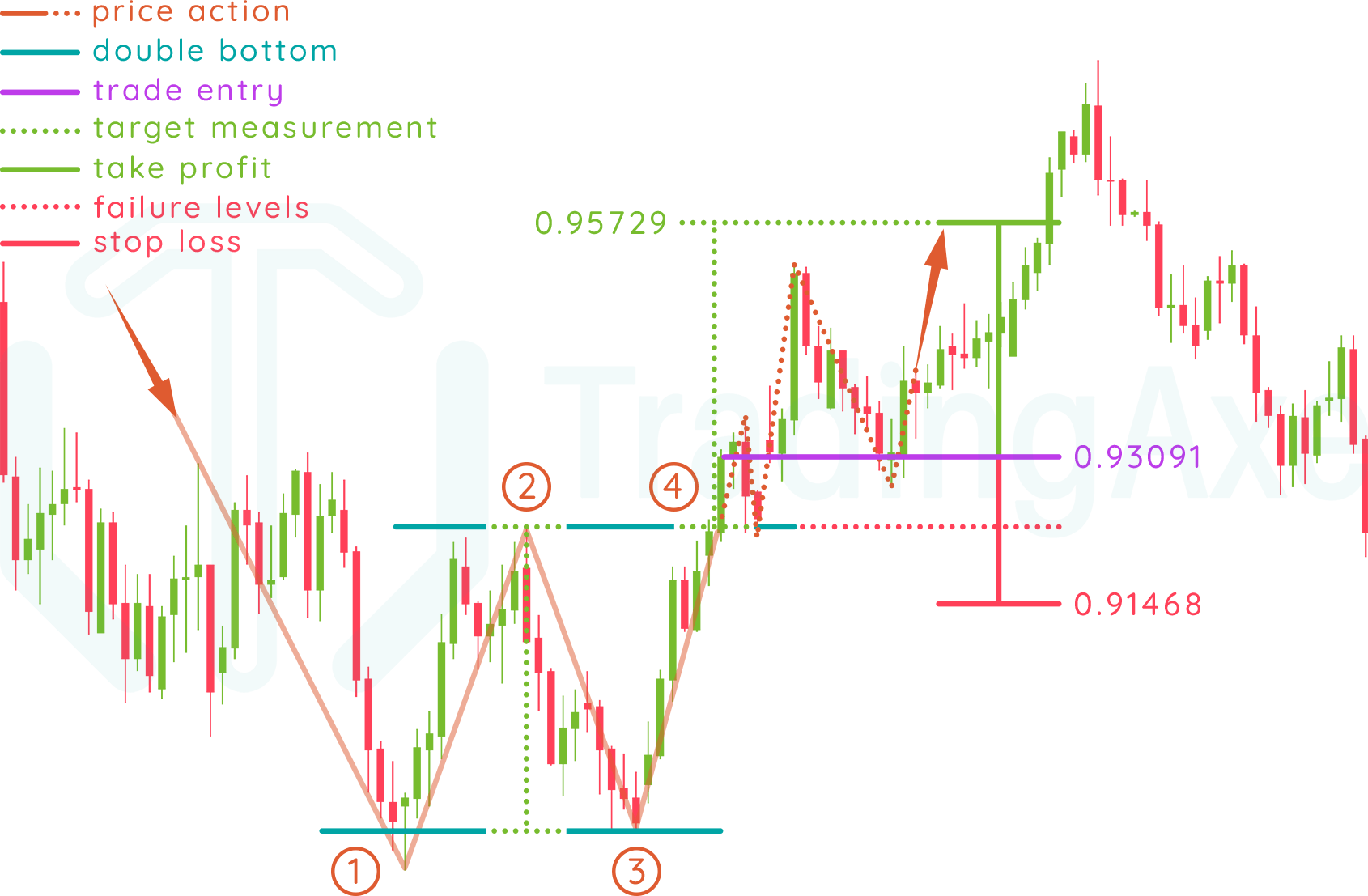

How To Trade Double Bottom Chart Pattern TradingAxe

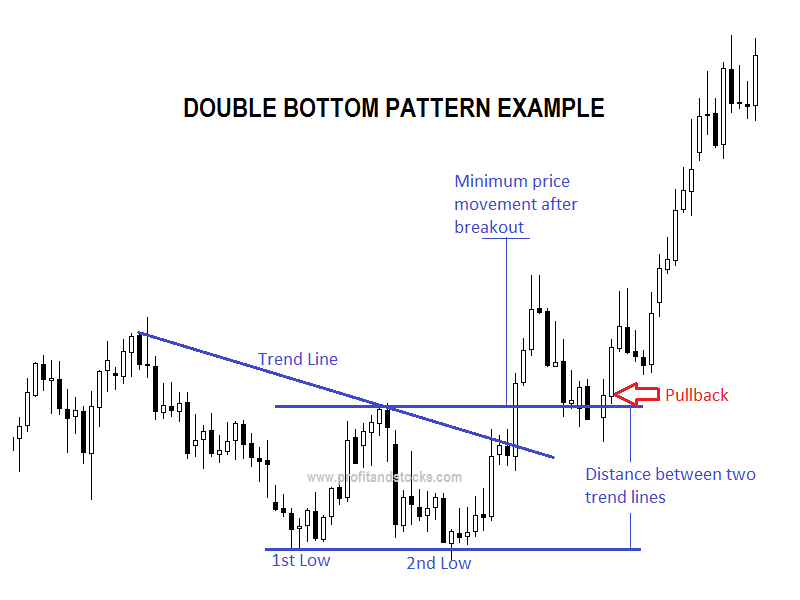

Double Bottom Chart Pattern Profit and Stocks

How To Trade Blog What Is A Double Bottom Pattern? How To Use It

Double Bottom Chart Pattern 101 Should You Invest? Cabot Wealth Network

Double Bottom Pattern New Trader U

Double Bottom Chart Pattern Forex Trading

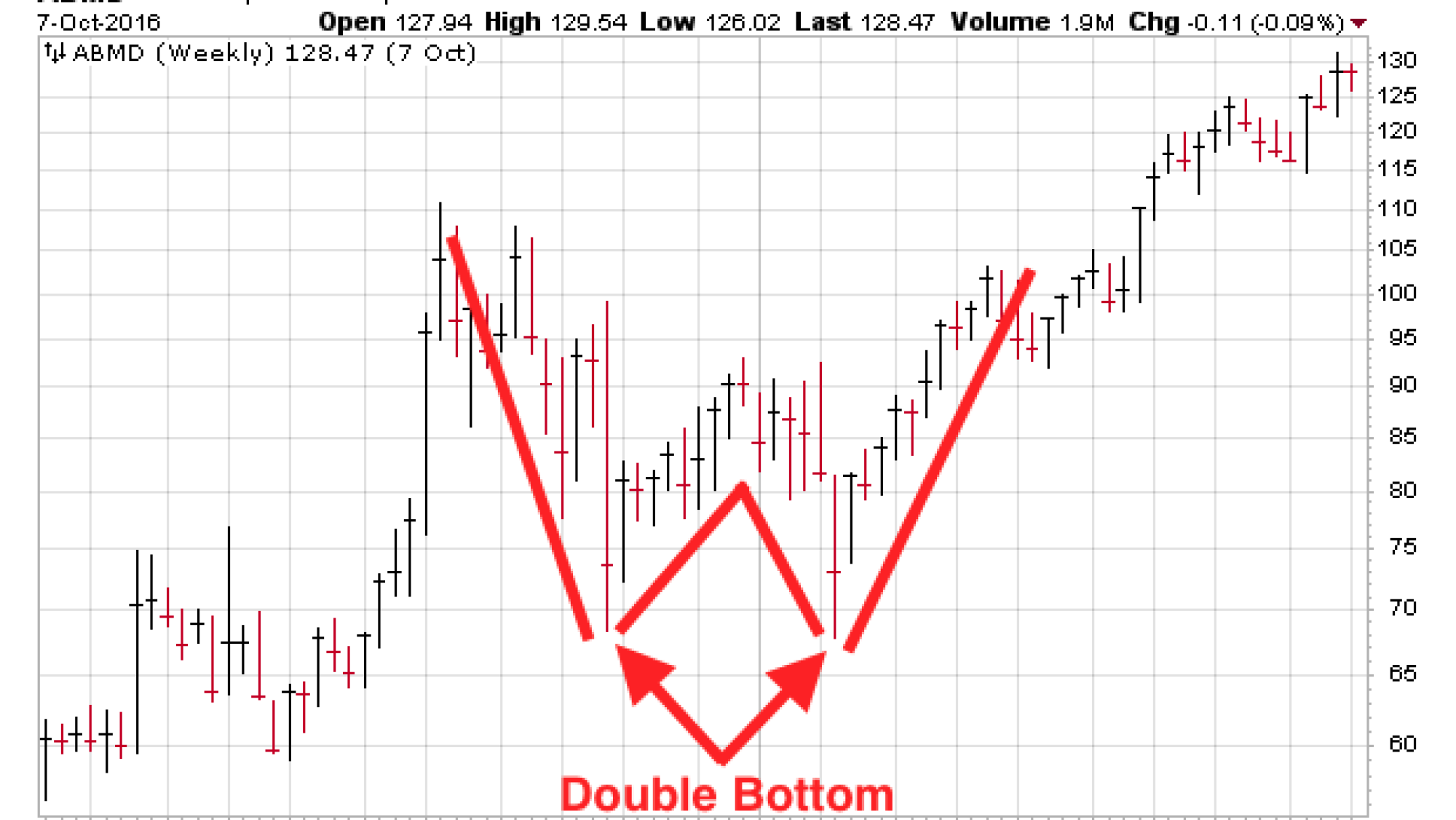

Double Bottom Pattern Rules and Example StockManiacs

The Double Bottom Pattern Trading Strategy Guide

Double Bottom Pattern,Double Bottom Technical analysis chart Pattern

Double Bottom Pattern A Trader’s Guide

This Pattern Can Be Identified When The Price Retests The Support Line And Rises Up Again Above The Neckline.

Web Stock Screener For Investors And Traders, Financial Visualizations.

Web A Double Bottom Pattern Is A Classic Technical Analysis Charting Formation That Represents A Major Change In Trend And A Momentum Reversal From A Prior Down Move In Market Trading.

The Price Successively Makes Two Troughs (Lowest Points) At Approximately The Same Level, Indicating Significant Support.

Related Post: