Double Bottom Pattern

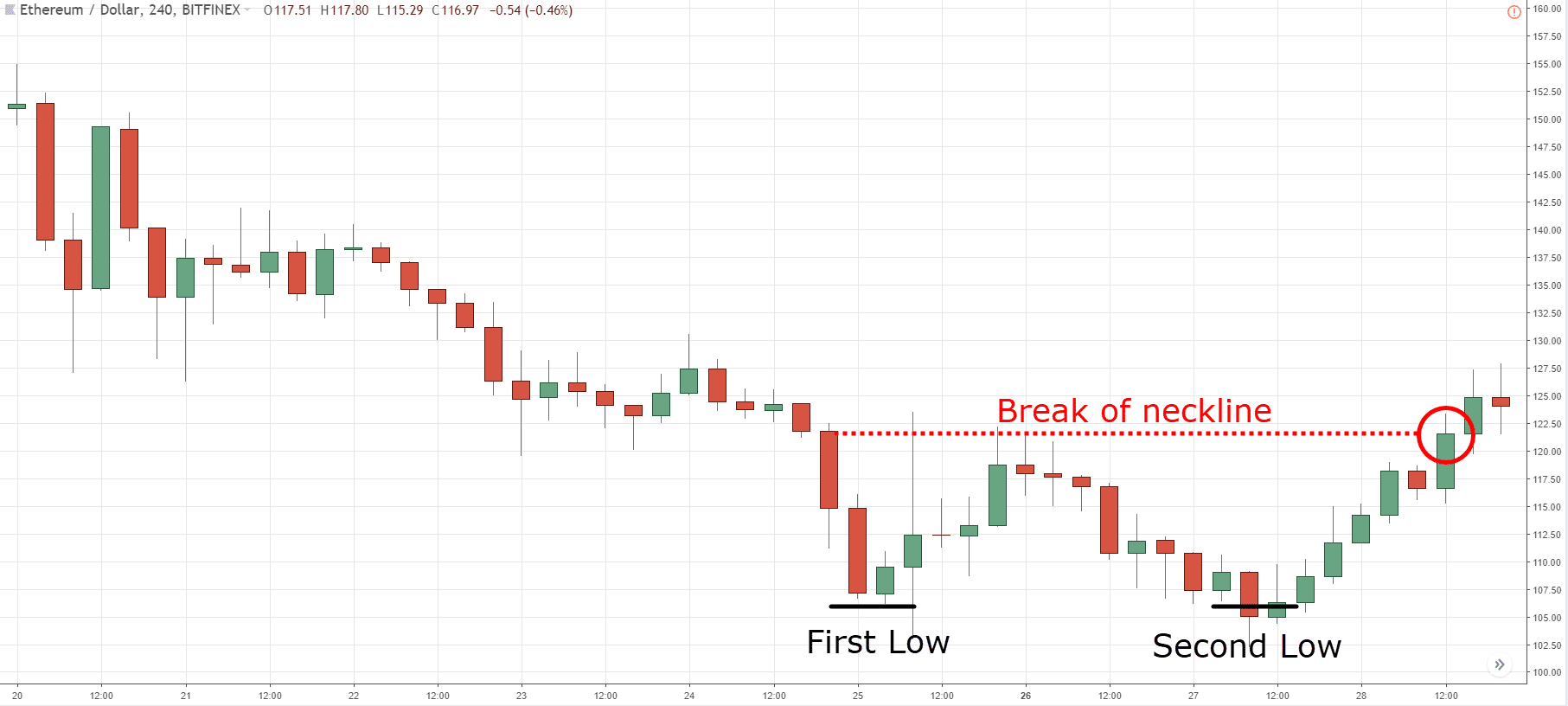

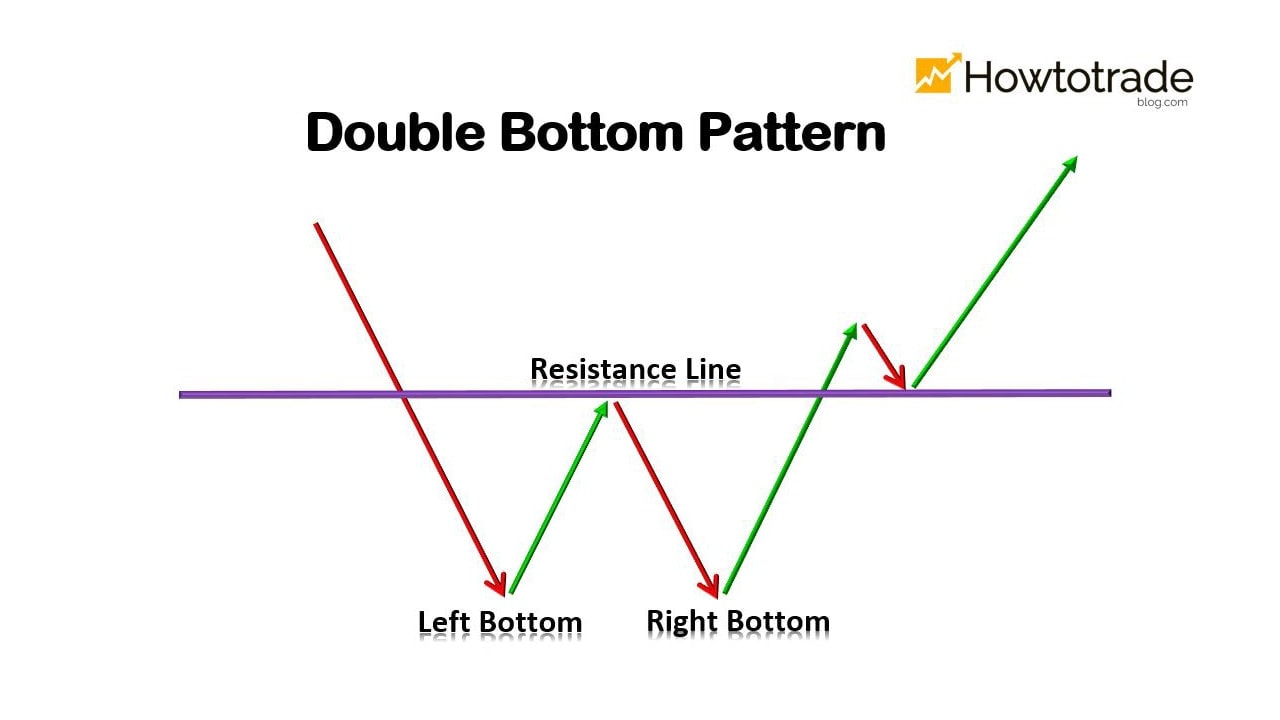

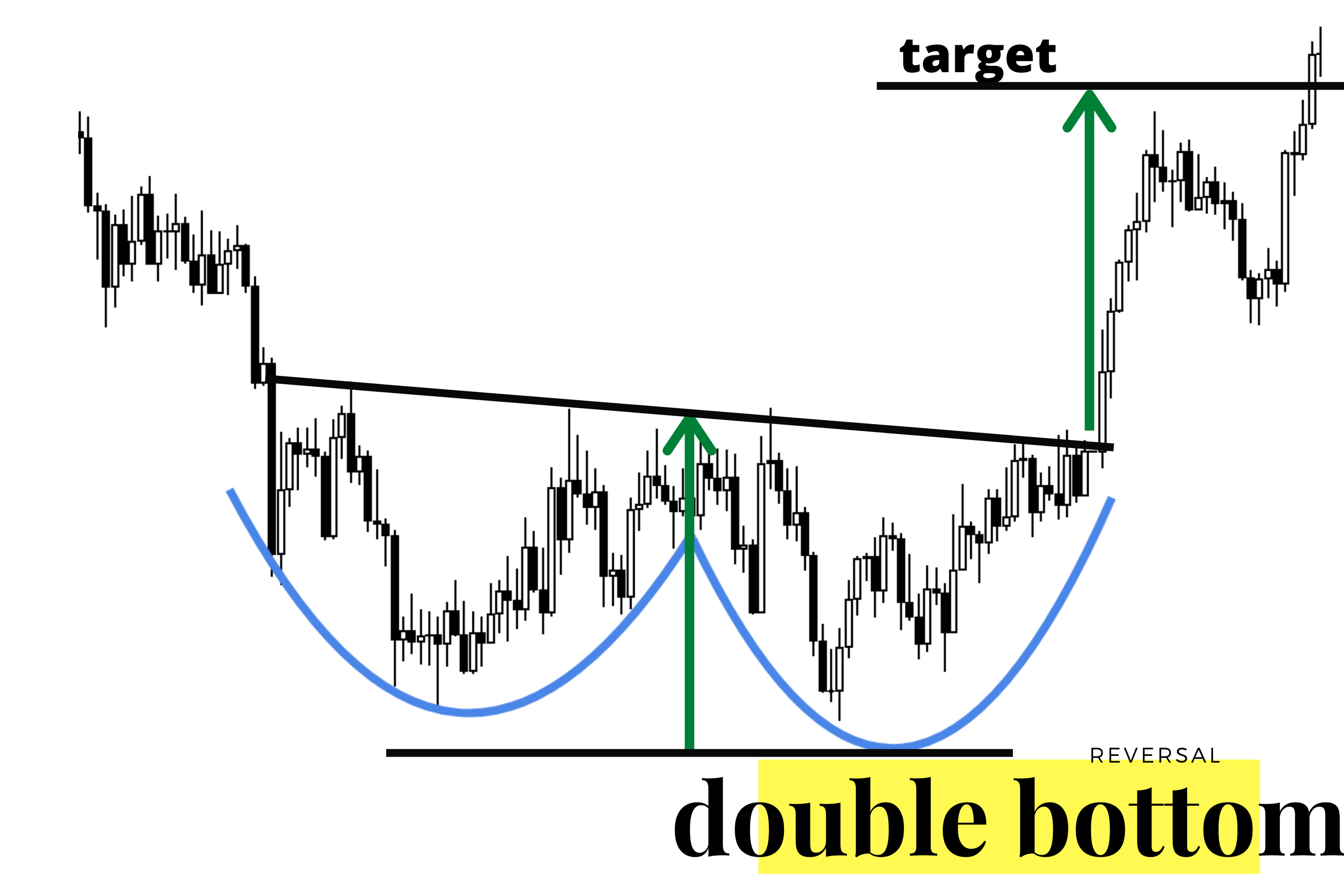

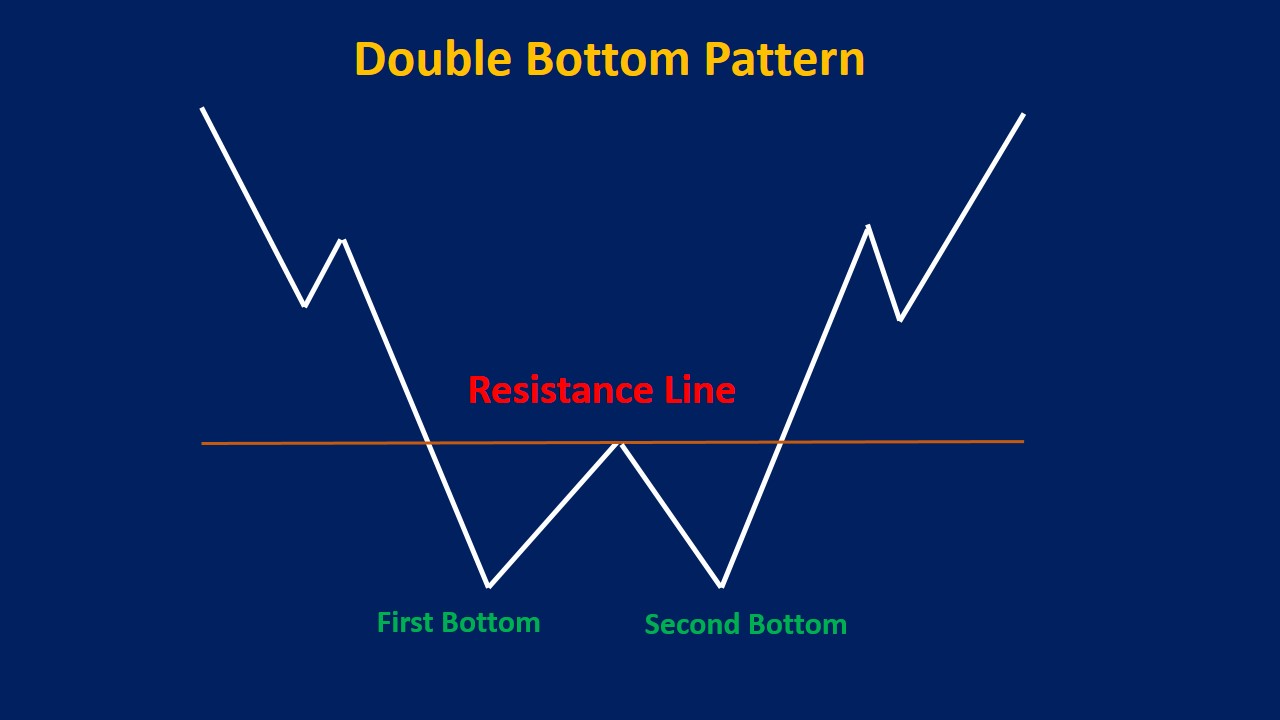

Double Bottom Pattern - Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. Web a double bottom pattern is a technical analysis charting pattern that characterizes a major change in a market trend, from down to up. Along with it’s brother (the double top), the double bottom is a reversal pattern that forms often in forex. Web the double bottom pattern entails two low points forming near a similar horizontal price level and signifies a potential bullish reversal signal. Usually, a double bottom pattern signals a price reversal. Web the double bottom pattern is a bullish trend reversal pattern that occurs when two low levels are forming near a support horizontal level. Web a double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade stocks, forex markets, or cryptocurrencies. Web the double bottom pattern is a trend reversal pattern observed on charts, such as bar and japanese candlestick charts. Web yes, i’m talking about the double bottom pattern. Web a double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down move in market trading. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. Web yes, i’m talking about the double bottom pattern. Web a double bottom pattern is a technical analysis charting pattern that characterizes a major change in a market trend, from down to up. Web the double bottom pattern is a trend. Web a double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down move in market trading. Along with it’s brother (the double top), the double bottom is a reversal pattern that forms often in forex. Web yes, i’m talking about the double bottom pattern. Web. Web a double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade stocks, forex markets, or cryptocurrencies. Web the double bottom pattern is a trend reversal pattern observed on charts, such as bar and japanese candlestick charts. Usually, a double bottom pattern signals a price reversal. Along with it’s. Web the double bottom pattern entails two low points forming near a similar horizontal price level and signifies a potential bullish reversal signal. Web the double bottom pattern is a bullish trend reversal pattern that occurs when two low levels are forming near a support horizontal level. Along with it’s brother (the double top), the double bottom is a reversal. Web yes, i’m talking about the double bottom pattern. Along with it’s brother (the double top), the double bottom is a reversal pattern that forms often in forex. Web a double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade stocks, forex markets, or cryptocurrencies. Web the double bottom. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. Web the double bottom pattern entails two low points forming near a similar horizontal price level and signifies a potential bullish reversal signal. Usually, a double bottom pattern signals a price reversal. Web the double bottom pattern is a trend reversal. Web a double bottom pattern is a technical analysis charting pattern that characterizes a major change in a market trend, from down to up. Web the double bottom pattern entails two low points forming near a similar horizontal price level and signifies a potential bullish reversal signal. Web yes, i’m talking about the double bottom pattern. Along with it’s brother. Web a double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade stocks, forex markets, or cryptocurrencies. Web yes, i’m talking about the double bottom pattern. Usually, a double bottom pattern signals a price reversal. Web the double bottom pattern is a bullish trend reversal pattern that occurs when. Web yes, i’m talking about the double bottom pattern. Web a double bottom pattern is a technical analysis charting pattern that characterizes a major change in a market trend, from down to up. Usually, a double bottom pattern signals a price reversal. Web the double bottom pattern entails two low points forming near a similar horizontal price level and signifies. Web the double bottom pattern entails two low points forming near a similar horizontal price level and signifies a potential bullish reversal signal. Web yes, i’m talking about the double bottom pattern. Web the double bottom pattern is a bullish trend reversal pattern that occurs when two low levels are forming near a support horizontal level. Along with it’s brother. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. Web yes, i’m talking about the double bottom pattern. Web the double bottom pattern is a trend reversal pattern observed on charts, such as bar and japanese candlestick charts. Along with it’s brother (the double top), the double bottom is a reversal pattern that forms often in forex. Usually, a double bottom pattern signals a price reversal. Web a double bottom pattern is a technical analysis charting pattern that characterizes a major change in a market trend, from down to up. Web the double bottom pattern is a bullish trend reversal pattern that occurs when two low levels are forming near a support horizontal level. Web the double bottom pattern entails two low points forming near a similar horizontal price level and signifies a potential bullish reversal signal.

Double Bottom Chart Pattern Best Analysis

The Double Bottom Pattern Trading Strategy Guide

Double Bottom Pattern A Trader’s Guide

The Ultimate Guide To Double Top And Double Bottom Pa vrogue.co

Double Bottom Pattern Rules and Example StockManiacs

The Double Bottom Pattern Trading Guide

Double Bottom Pattern A Trader’s Guide

Double Bottom Pattern A Trader’s Guide

Double Bottom Pattern New Trader U

Double Bottom Pattern How to Trade and Examples

Web A Double Bottom Pattern Is A Stock Chart Formation Used In Technical Analysis For Identifying And Executing Profitable Trades, Commonly To Trade Stocks, Forex Markets, Or Cryptocurrencies.

Web A Double Bottom Pattern Is A Classic Technical Analysis Charting Formation That Represents A Major Change In Trend And A Momentum Reversal From A Prior Down Move In Market Trading.

As Such, When You Identify The Pattern And The Price Rises Above The Neckline, Then You Buy The Asset.

Related Post: