Designating A Trust As An Ira Beneficiary

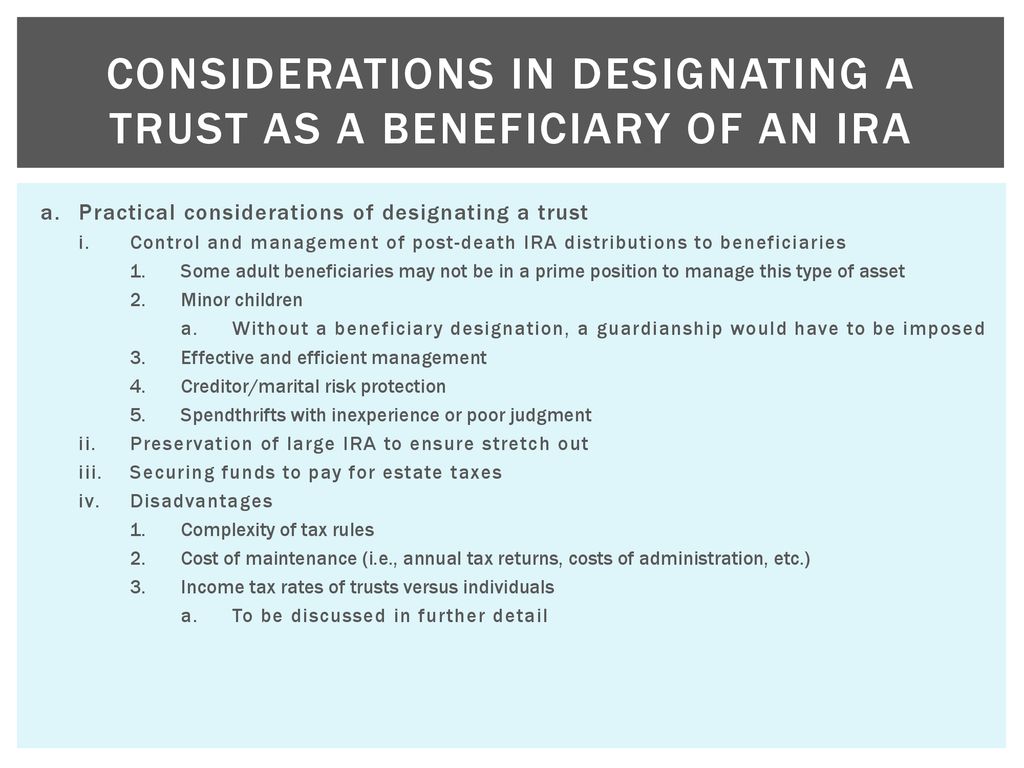

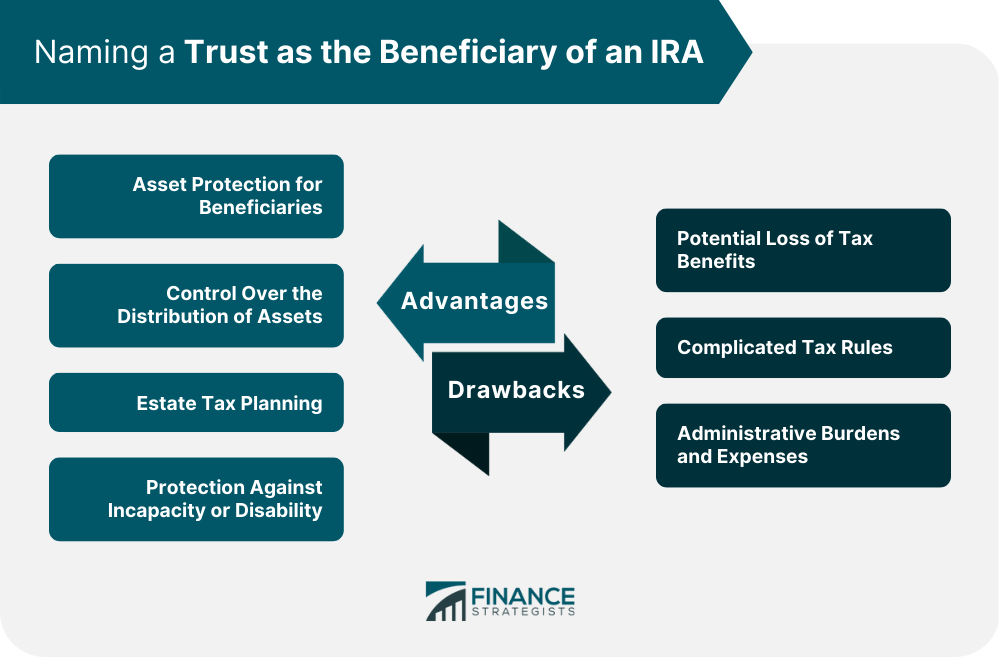

Designating A Trust As An Ira Beneficiary - Web if your client also chooses an ira to leave assets to their family, naming a trust as the beneficiary can have tax implications for their beneficiaries or heirs. Web in general, naming a trust as the beneficiary of an ira account can be problematic because the ira beneficiary must be determined to be an individual (s) whose life expectancy may be used to. One of the most commonly asked questions we encounter is whether or not to designate your revocable living trust as the beneficiary of a retirement account and what are the tax consequences of doing so. Web to illustrate, let’s say that a designated beneficiary inherited an ira in 2021 from a family member who had begun to take rmds. This article looks at key considerations, such as how an ira can be inherited, reasons to name a trust, and required minimum distribution (rmd) rules for trusts as ira beneficiaries. Web for an elderly ira owner who does not want to complicate their inheritor’s lives, who trusts them to manage their own money, and who wants them to take as many years as possible to make (taxable) withdrawals, they should choose to name beneficiaries for the ira instead of naming the trust as beneficiary of the ira. Web it’s generally a bad idea to name a trust as beneficiary of your ira. Web designating a trust as a beneficiary for a retirement account is a good idea if inheritors aren't capable of handling the money, but it creates complications. Web designating a trust as the beneficiary of your ira is a viable estate planning option in certain circumstances, such as for those who wish to leave their iras to individuals other than their spouse, or those wishing to leave assets to a. The beneficiary must, however, take annual rmds for 2025 through 2030, with the account fully distributed by the end of 2031. One of the most commonly asked questions we encounter is whether or not to designate your revocable living trust as the beneficiary of a retirement account and what are the tax consequences of doing so. Beneficiary designation typically takes precedence if. At the time of his death, frayda's father was 80 years old and, thus, past his required beginning date.. In this article, we’ll go. Sets go directly to the beneficiaries, avoiding a potentially lengthy probate process. A “legal entity” in this case can means your trust, your business, your favorite charity, your estate or any. Under the waivers, the beneficiary needn’t take rmds for 2022 through 2024. Web in general, naming a trust as the beneficiary of an ira. Sets go directly to the beneficiaries, avoiding a potentially lengthy probate process. Web to illustrate, let’s say that a designated beneficiary inherited an ira in 2021 from a family member who had begun to take rmds. Web if your client also chooses an ira to leave assets to their family, naming a trust as the beneficiary can have tax implications. Web if your client also chooses an ira to leave assets to their family, naming a trust as the beneficiary can have tax implications for their beneficiaries or heirs. Web naming a trust as a beneficiary of your retirement plan can be a good idea in some circumstances, but it can be dangerous if you are worried about credi. In. Web naming a beneficiary over your ira is a key step in the estate planning process. Web when planning your estate, one of the critical decisions you’ll face is naming beneficiaries for your individual retirement account (ira). Web learn about designating a trust as an ira beneficiary. Web as the significance of iras has grown, it has become more common. While many people designate their spouse, children, or other loved ones as direct beneficiaries, there are situations where naming a trust or your estate as the beneficiary may be advantageous. At the time of his death, frayda's father was 80 years old and, thus, past his required beginning date. This article looks at key considerations, such as how an ira. Web naming a trust as a beneficiary of your retirement plan can be a good idea in some circumstances, but it can be dangerous if you are worried about credi. Web to illustrate, let’s say that a designated beneficiary inherited an ira in 2021 from a family member who had begun to take rmds. The secure act, passed in 2019,. This article looks at key considerations, such as how an ira can be inherited, reasons to name a trust, and required minimum distribution (rmd) rules for trusts as ira beneficiaries. The law creates several designations for ira beneficiaries and defines which rules each designation follows. Web there are a few common reasons for naming a trust as beneficiary of an. The ira is then maintained as a separate account that is an asset of the trust. Web when a trust is named as the ira beneficiary, the trust inherits the ira when the ira owner dies. At the time of his death, frayda's father was 80 years old and, thus, past his required beginning date. Web if your client also. A “legal entity” in this case can means your trust, your business, your favorite charity, your estate or any. The beneficiary must, however, take annual rmds for 2025 through 2030, with the account fully distributed by the end of 2031. Web there are a few common reasons for naming a trust as beneficiary of an ira. Some good reasons to. Web if your client also chooses an ira to leave assets to their family, naming a trust as the beneficiary can have tax implications for their beneficiaries or heirs. Sets go directly to the beneficiaries, avoiding a potentially lengthy probate process. One of the most commonly asked questions we encounter is whether or not to designate your revocable living trust as the beneficiary of a retirement account and what are the tax consequences of doing so. The ira then is maintained as a separate account that is an asset of the. Web when a trust is named as the ira beneficiary, the trust inherits the ira when the ira owner dies. Under the waivers, the beneficiary needn’t take rmds for 2022 through 2024. Some good reasons to consider naming a trust as an ira beneficiary include: In this article, we’ll go. Web naming a trust as a beneficiary of your retirement plan can be a good idea in some circumstances, but it can be dangerous if you are worried about credi. Web when a trust is named as the beneficiary of an ira, the trust inherits the ira when the ira owner dies. The ira is then maintained as a separate account that is an asset of the trust. It’s a way to ensure the wealth you’ve accumulated throughout your working years goes to the beneficiary. Web learn about designating a trust as an ira beneficiary. At the time of his death, frayda's father was 80 years old and, thus, past his required beginning date. Web you can state a trust beneficiary of your ira and dictate how the assets are to be handled after your death. The steps taken regarding the treatment of an ira can significantly affect how.

Designating a Trust as an IRA Beneficiary Types, Pros, & Cons

IRA Beneficiary designations of trusts ppt download

How To Designate Your IRA Beneficiaries YouTube

Designating a Trust as an IRA Beneficiary Types, Pros, & Cons

Designating a Trust as Your IRA Beneficiary What You Need to Know

Designating a Trust as Your IRA Beneficiary What You Need to Know

Designating the Trust as the IRA Beneficiary Inflation Protection

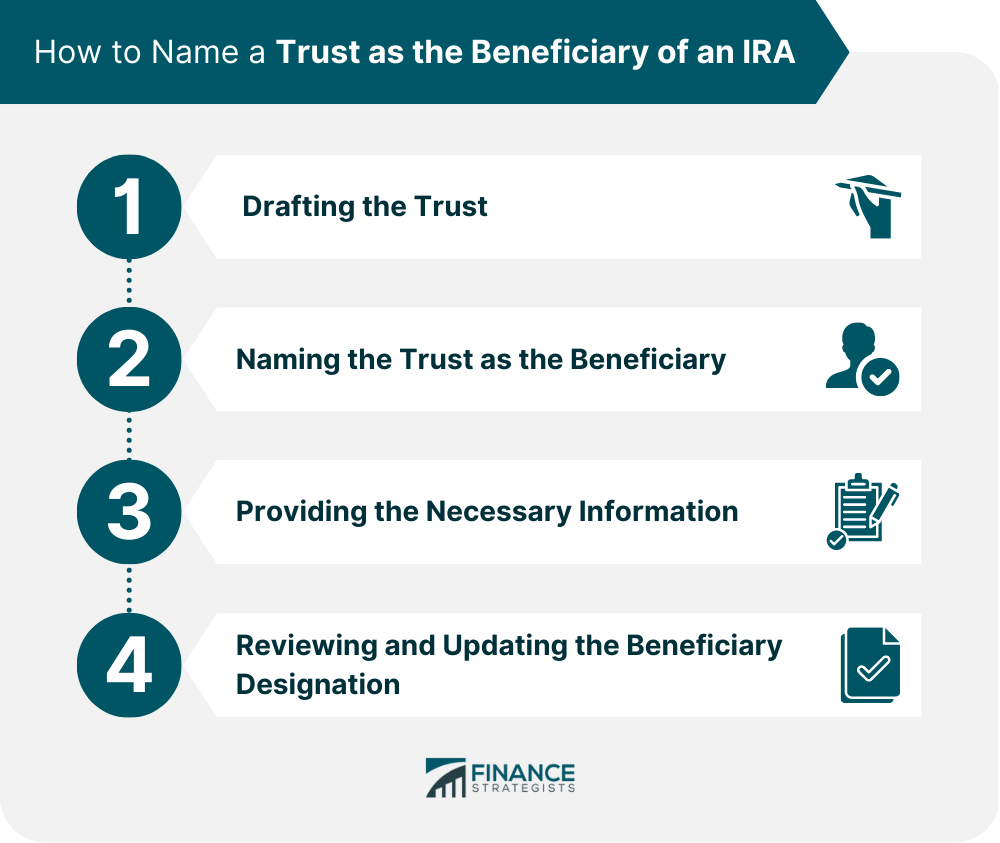

Designating a Trust as an IRA Beneficiary Finance Strategists

IRA Beneficiary designations of trusts ppt download

Designating a Trust as an IRA Beneficiary Types, Pros, & Cons

One Is To Maintain Control—To Ensure That The Assets Of The Ira Are Distributed According To The Same Plan That Is Set Up In Your Trust.

The Secure Act, Passed In 2019, Has Changed The Treatment Of.

While Many People Designate Their Spouse, Children, Or Other Loved Ones As Direct Beneficiaries, There Are Situations Where Naming A Trust Or Your Estate As The Beneficiary May Be Advantageous.

Web As The Significance Of Iras Has Grown, It Has Become More Common To Name Trusts As Ira Beneficiaries.

Related Post: