Wyckoff Distribution Pattern

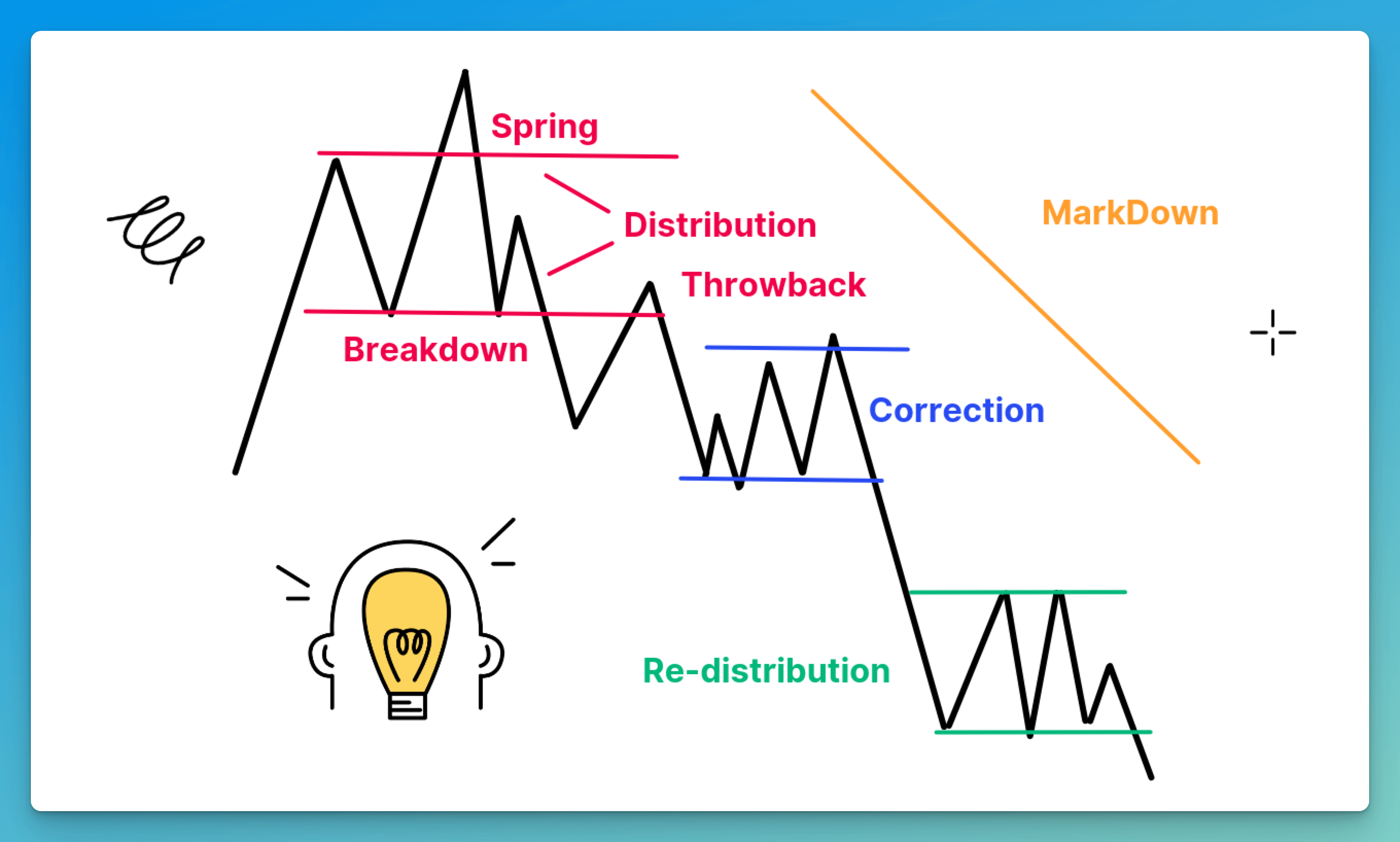

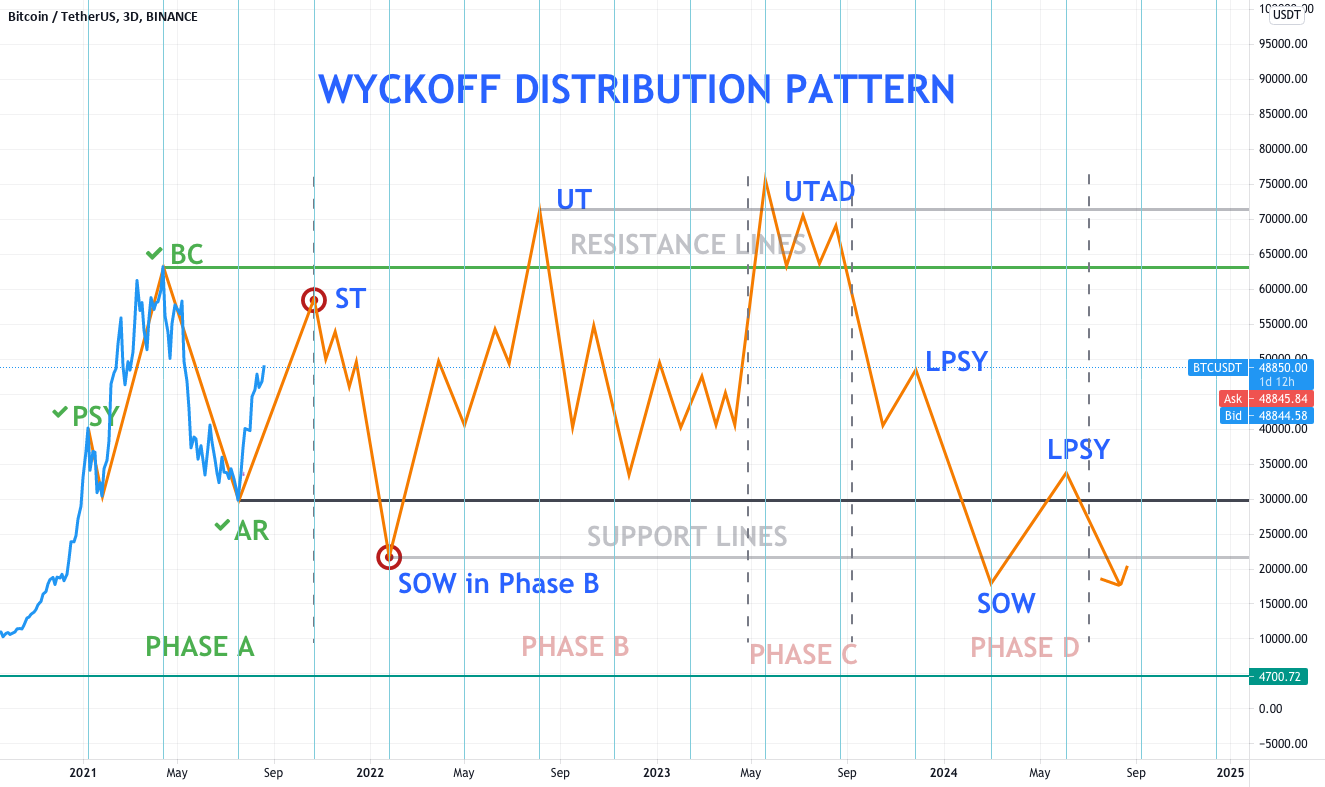

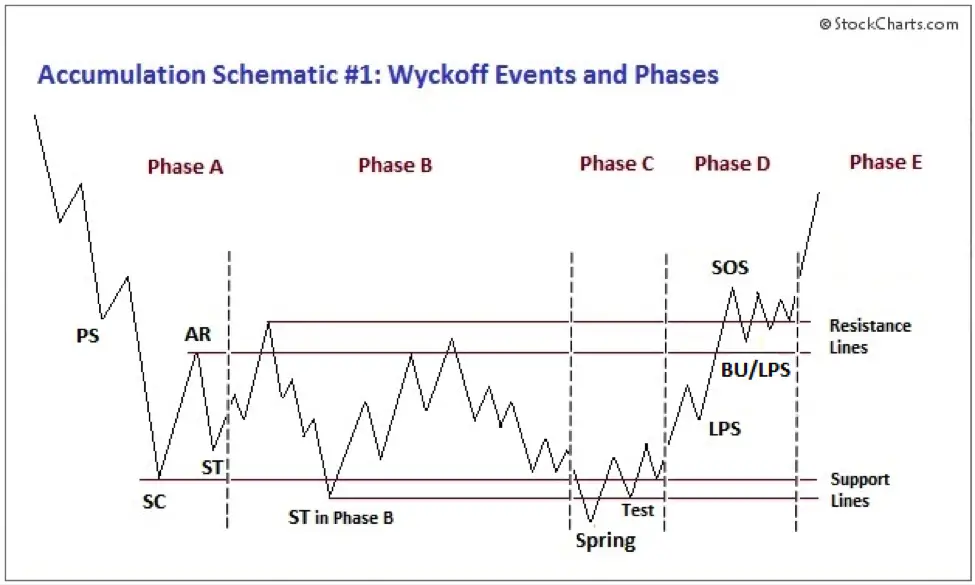

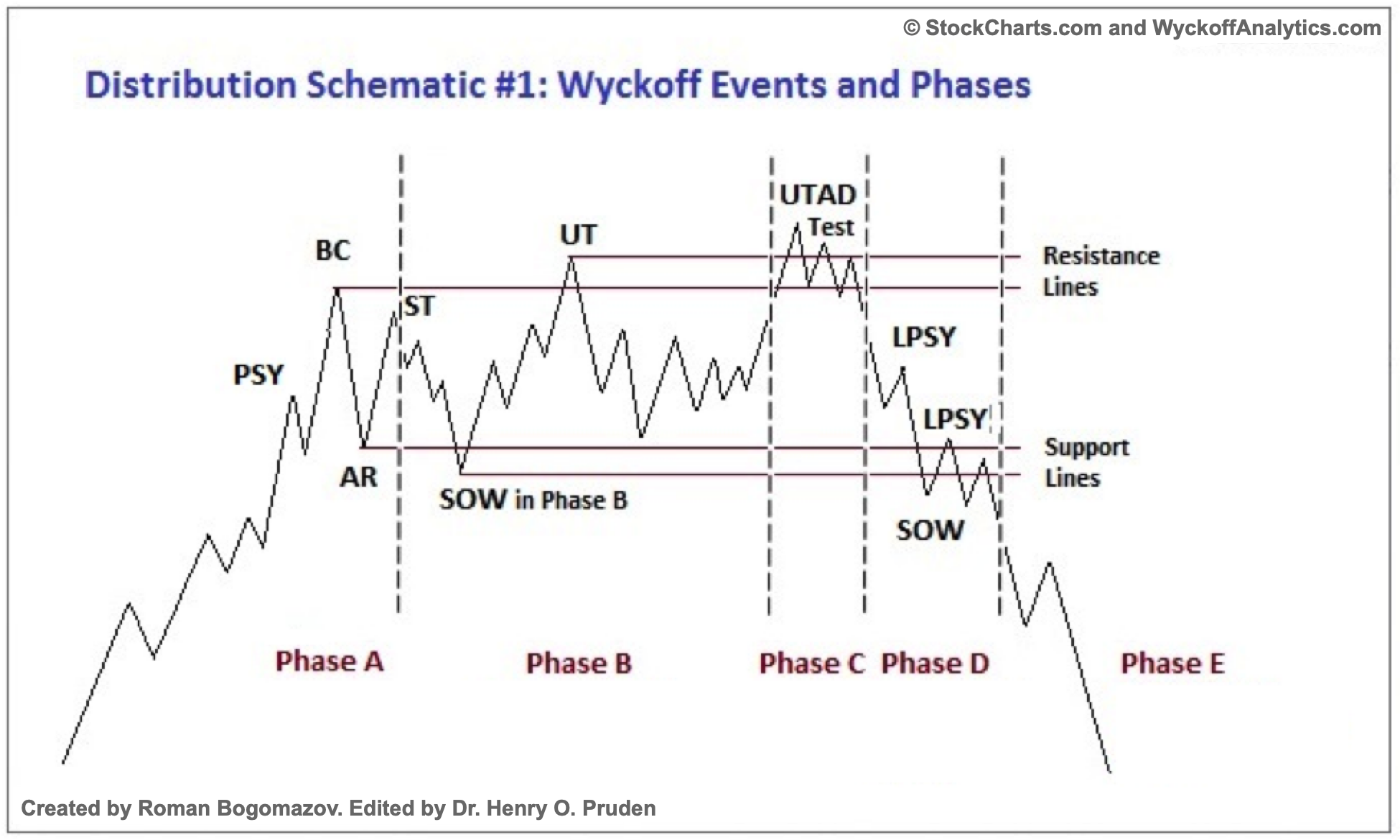

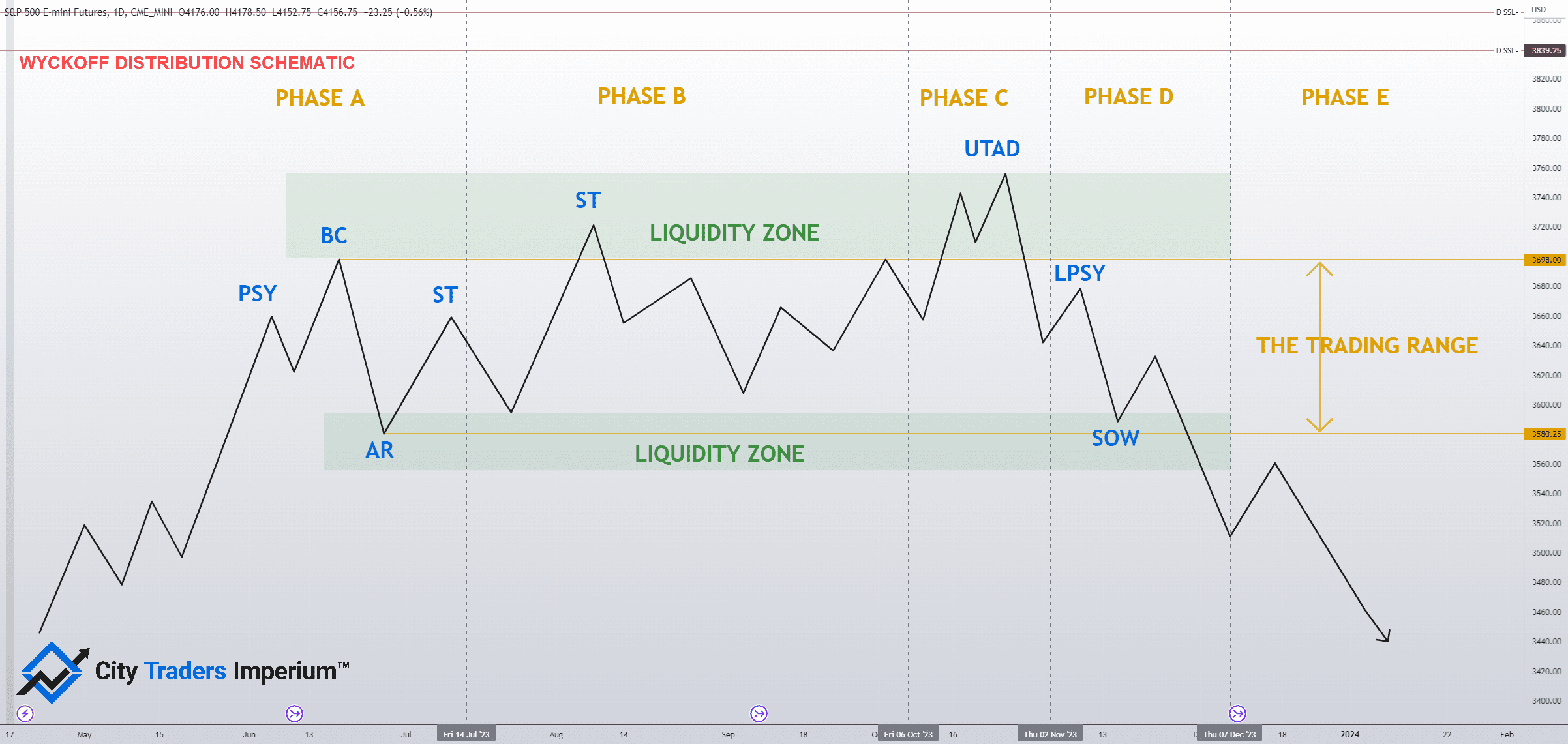

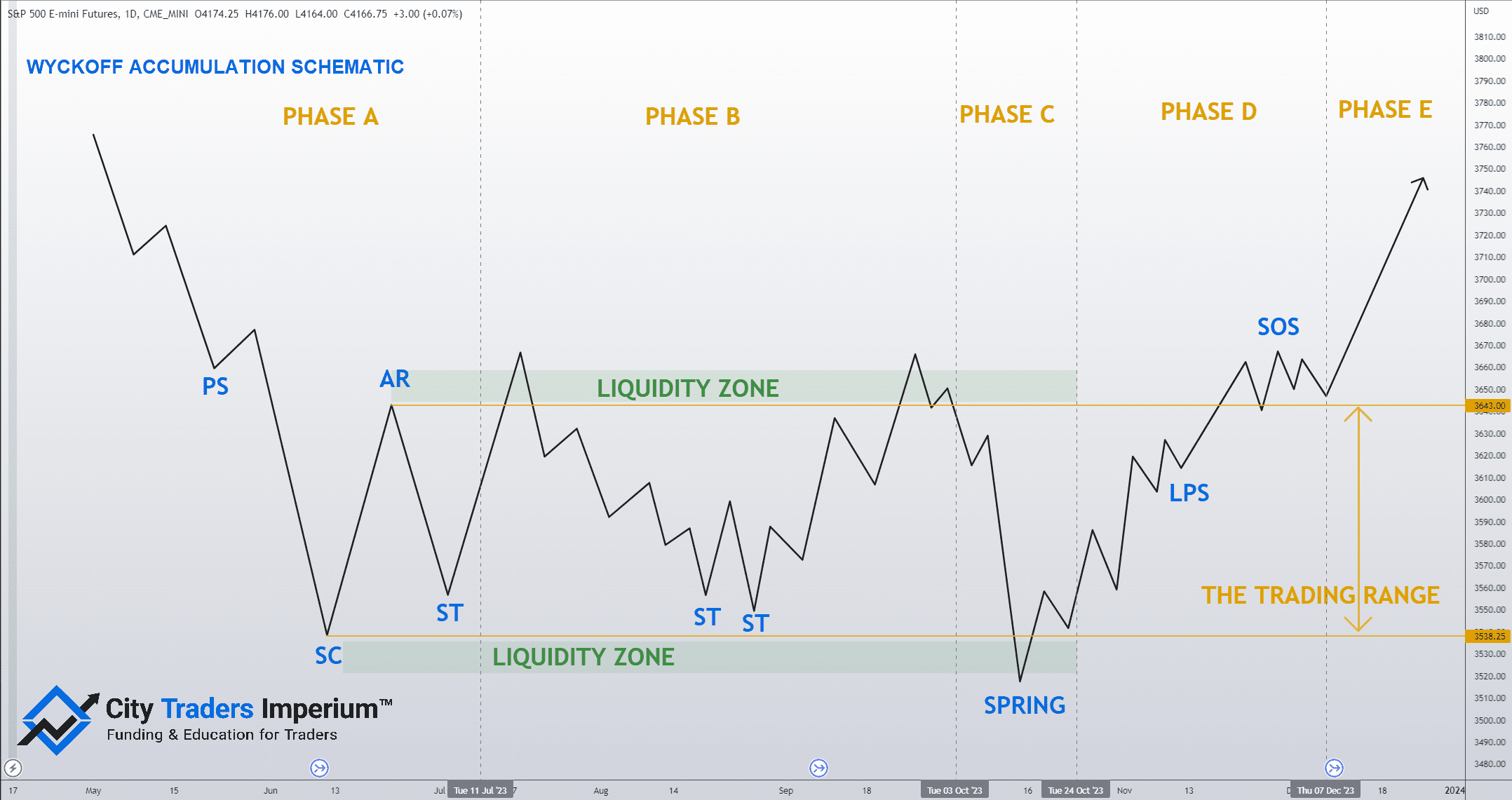

Wyckoff Distribution Pattern - The price movement exists within two market cycles: Web the wyckoff distribution pattern is a widely recognized chart pattern in technical analysis that helps traders identify potential market reversals and breakdowns. Distribution occurs with greater accuracy and credibility on. Web what is wyckoff method? The law of supply and demand, the law of cause and effect, and the law of effort versus result. Web accumulation and distribution can be identified with chart patterns; The wyckoff method is a technical analysis approach that can help investors decide what stocks to buy and when to buy them. Web in last thursday’s marketwatchers live (recording available here) we discussed the wyckoff distribution concept of the upthrust after distribution (utad). The wyckoff method explained that these phases continue repeatedly as trading continues. Web the wyckoff distribution is a price pattern in technical analysis that suggests a potential downtrend in the price of an asset. The law of supply and demand, the law of cause and effect, and the law of effort versus result. Web the wyckoff distribution pattern consists of multiple sections: Web distribution of shares by the c.o. Navigating trends with wyckoff analysis. Understanding these components and their sequential progression is key to mastering the wyckoff method. The accumulation stage is caused by increased institutional demand. The wyckoff market cycle reflects wyckoff’s theory. Web distribution of shares by the c.o. Web demand > supply = price rises. The price movement exists within two market cycles: Implementing stop loss and take profit levels. There are five parts of the wyckoff distribution phase: This article will explain how this method works and how to identify and use the wyckoff chart pattern. Confirming markup and markdown phases. Your trade will occur when the price action breaks a range in the desired direction of movement. Web the wyckoff accumulation pattern is a chart formation that indicates the accumulation phase of an asset. How supply and demand dynamics shape price trends. Web this article provides an overview of wyckoff's theoretical and practical approaches to the markets, including guidelines for identifying trade candidates and entering long and short positions, analysis of accumulation and distribution trading ranges, and. Wykoff also came up with specific rules to be used along with these phases to predict the significance of a price within the broader spectrum of uptrends, downtrends, and sideways markets. Web accumulation and distribution can be identified with chart patterns; Utilizing wyckoff principles to identify and follow trends. By understanding its key characteristics and components, traders can effectively identify. The price movement exists within two market cycles: The wyckoff market cycle reflects wyckoff’s theory. Web the wyckoff distribution pattern is a widely recognized chart pattern in technical analysis that helps traders identify potential market reversals and breakdowns. Confirming markup and markdown phases. By understanding its key characteristics and components, traders can effectively identify potential buying opportunities and anticipate price. Web distribution of shares by the c.o. Wyckoff, it is the opposite of the wyckoff accumulation pattern, which suggests a potential uptrend. 5 accumulation /distribution price spring. Recognizing accumulation and distribution phases. Web distribution happens when an equilibrium has been reached in price after an uptrend, where price stalls and begins to form a range. Implementing stop loss and take profit levels. 6 the three of wyckoff’s laws. Understanding these components and their sequential progression is key to mastering the wyckoff method. Navigating trends with wyckoff analysis. Markdown, accumulation, markup, and distribution. Web in last thursday’s marketwatchers live (recording available here) we discussed the wyckoff distribution concept of the upthrust after distribution (utad). The wyckoff method explained that these phases continue repeatedly as trading continues. Web the wyckoff method revolves around identifying supply and demand dynamics to predict price movements. Web the wyckoff method is a type of technical analysis methodology and. Web the wyckoff accumulation pattern is a chart formation that indicates the accumulation phase of an asset. Preliminary supply (psy), buying climax (bc), automatic reaction (ar), secondary test (st), upthrust after distribution (utad), and the last point of supply (lpsy). Web the wyckoff distribution uses price and volume analysis to identify the amount of effort that is being put into. Web accumulation and distribution can be identified with chart patterns; Web this article provides an overview of wyckoff's theoretical and practical approaches to the markets, including guidelines for identifying trade candidates and entering long and short positions, analysis of accumulation and distribution trading ranges, and an explanation of using point and figure charts to identify price targets. Confirming markup and markdown phases. Recognizing accumulation and distribution phases. Web what is wyckoff method? The price movement exists within two market cycles: 6.3 the wyckoff’s law of effort and result. Traders look for accumulation and distribution patterns as they adhere to three fundamental laws: 5 accumulation /distribution price spring. Web in last thursday’s marketwatchers live (recording available here) we discussed the wyckoff distribution concept of the upthrust after distribution (utad). Furthermore, these phases contain opportunities to sell or buy. Web demand > supply = price rises. 6.1 the wyckoff’s law of supply and demand. This article will explain how this method works and how to identify and use the wyckoff chart pattern. Multiple lpsy points on a scale down can and will occur often. How to identify each wyckoff accumulation and distribution phase.

How to Make Better Trading Decisions with the Wyckoff Method

Chart Patterns Wyckoff Distribution TrendSpider Learning Center

WYCKOFF DISTRIBUTION PATTERN (update) for BINANCEBTCUSDT by SPYvsGME

Wyckoff Theory Accumulation And Distribution Schematics

Richard Wyckoff Theory of Accumulation and Distribution New Trader U

Wyckoff Distribution Schematic for KRAKENXBTUSD by BrenFren — TradingView

WyckoffMethode, Akkumulation, Pattern erklärt (2024)

Wyckoff Theory Accumulation And Distribution Schematics

Wyckoff Theory Accumulation And Distribution Schematics

WyckoffMethode, Akkumulation, Pattern erklärt (2024)

Web Distribution Happens When An Equilibrium Has Been Reached In Price After An Uptrend, Where Price Stalls And Begins To Form A Range.

What Is Wyckoff Distribution Cycle?

The Law Of Supply And Demand, The Law Of Cause And Effect, And The Law Of Effort Versus Result.

The Accumulation Stage Is Caused By Increased Institutional Demand.

Related Post: