Windfall Elimination Chart

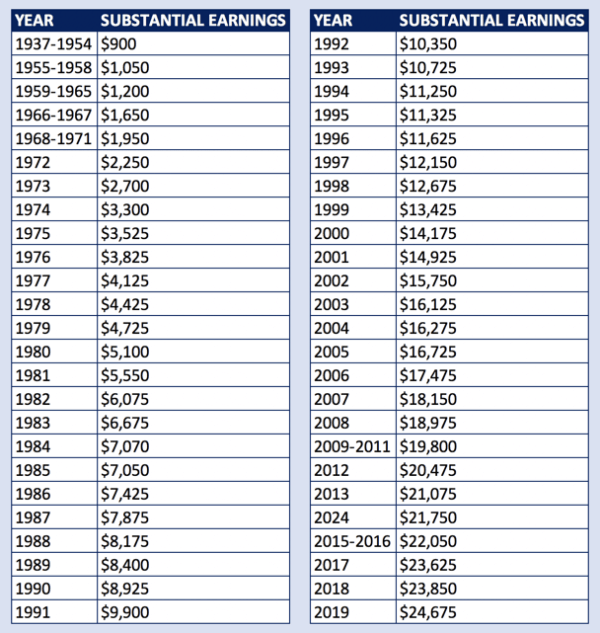

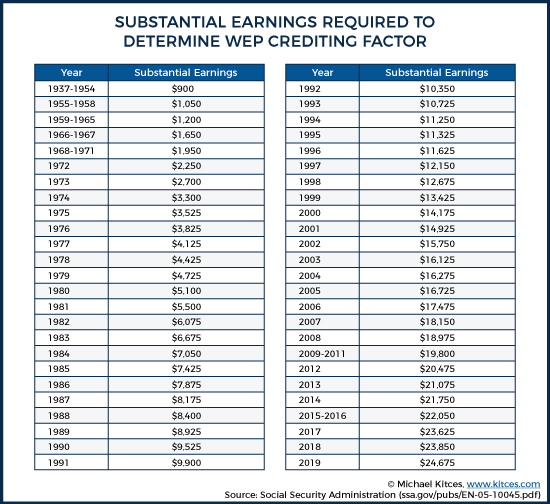

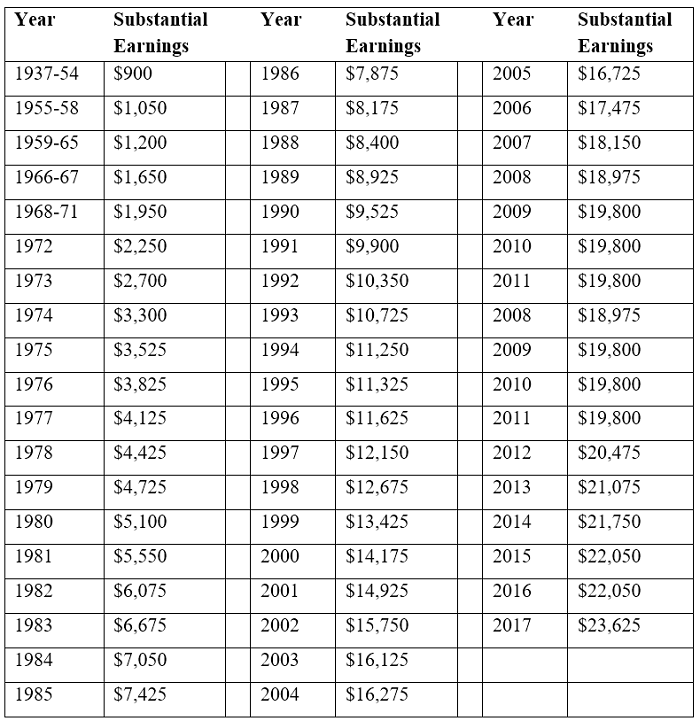

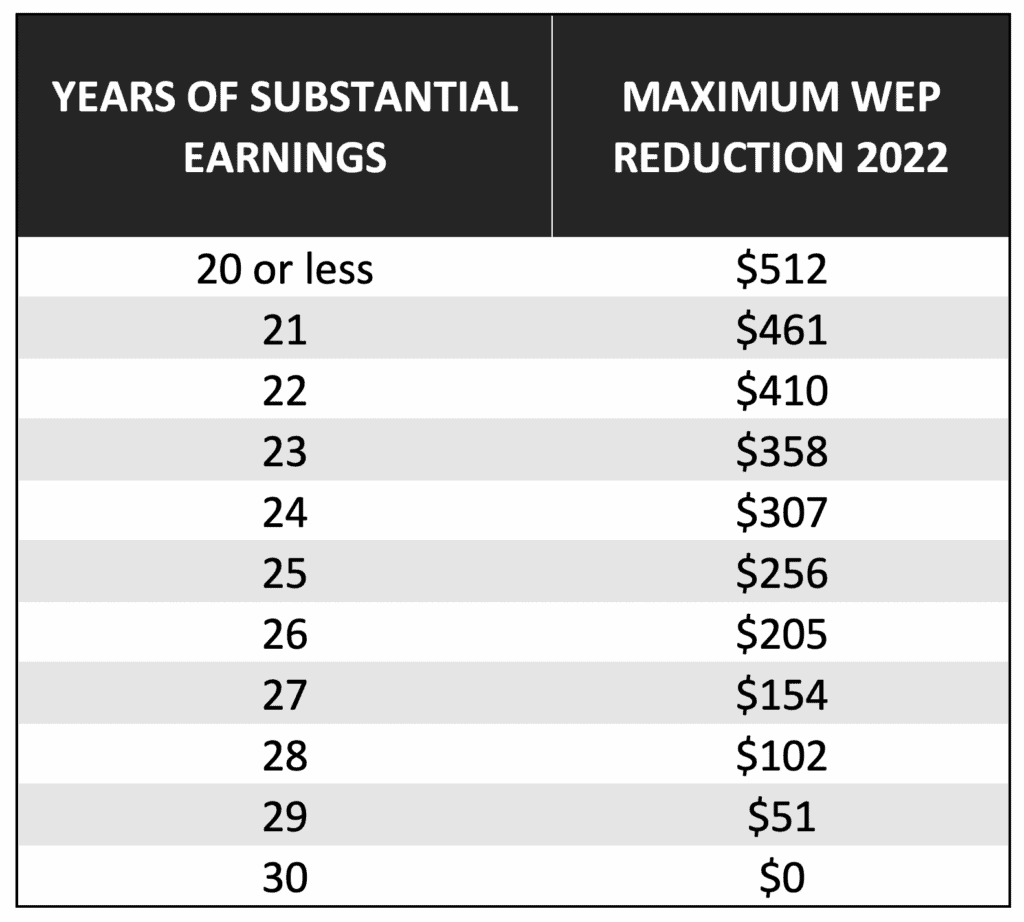

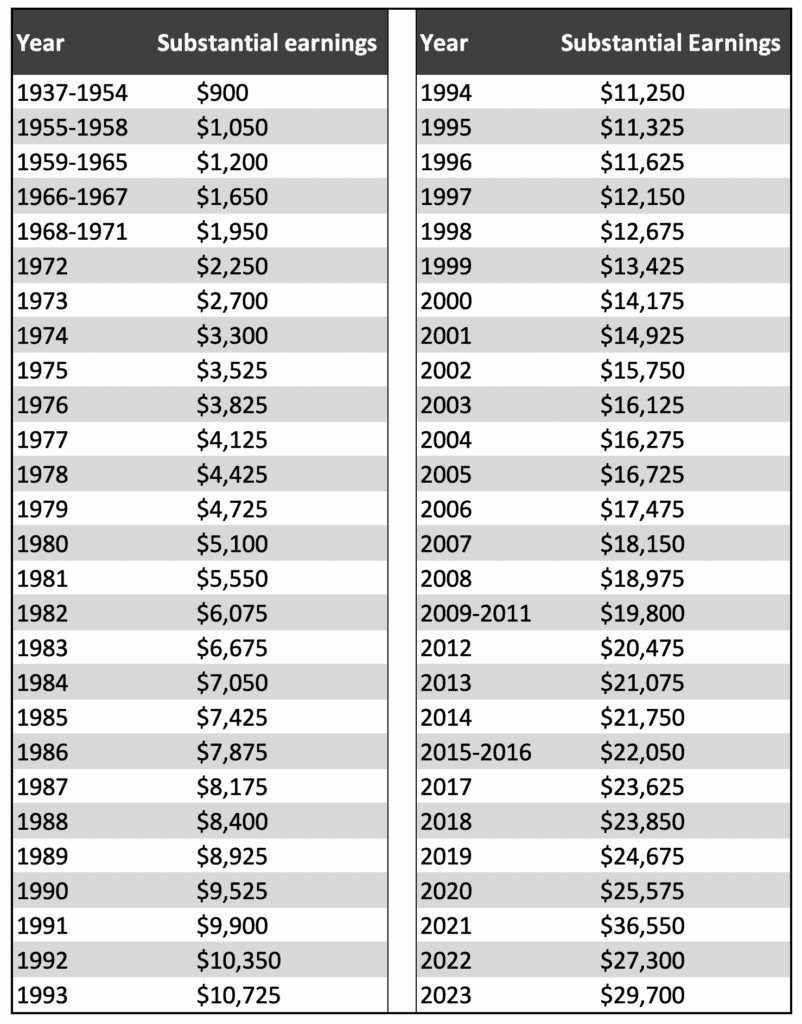

Windfall Elimination Chart - Exceptions to the windfall elimination provision Web look at our wep chart below to see how wep affects social security benefits. You can use the “review your full earnings record” option under the “eligibility and earnings” tab in your personal mysocial. Here’s what you need to know about both and how it might affect your social security payments. Web the windfall elimination provision (wep) is a formula that can reduce the size of your social security retirement or disability benefit if you receive a pension from a job in which you did not pay social security taxes. The windfall elimination provision reduces your eligibility year (ely) benefit amount before it is reduced or The first pia factor after wep adjustment years of covered employment 90% replacement rate reduced to: Web the windfall elimination provision (wep) is a social security rule that can impact the amount of benefits you receive. Use the wep online calculator to calculate your estimated retirement or disability benefits. Use our wep online calculator or download our detailed calculator to get an estimate of your benefits. Web but there’s a bill in congress, which has strong backing, that could eliminate both the windfall elimination provision and the government pension offset. 30 or more 90% 29 85% 28 80% 27 75% 26 70% 25 65% 24 60% 23 55% 22 50% 21 45% 20 40% source: Use our wep online calculator or download our detailed calculator to. The windfall elimination provision reduces your eligibility year (ely) benefit amount before it is reduced or Web the windfall elimination provision affects both social security and disability benefits. Wep reductions are applied on a sliding scale. Exceptions are also made if you have “substantial” earnings in 21 to 29 years. Use the wep online calculator to calculate your estimated retirement. The normal social security calculation formula is substituted with a new calculation that results in a lower benefit amount. Web your social security benefit might be reduced if you get a pension from an employer who wasn’t required to withhold social security taxes. The social security administration has developed a chart (external link) showing the maximum monthly amount that social. Web how much can the windfall elimination provision reduce my social security benefits? Web windfall elimination provision chart. Web but there’s a bill in congress, which has strong backing, that could eliminate both the windfall elimination provision and the government pension offset. Web see the chart below. If you work for an employer who doesn’t withhold social security taxes from. The windfall elimination provision reduces your eligibility year (ely) benefit amount before it is reduced or Web see the chart below. Web the windfall elimination provision (wep) is a formula that can reduce the size of your social security retirement or disability benefit if you receive a pension from a job in which you did not pay social security taxes.. The 90% factor is reduced as outlined below. Web the windfall elimination provision (wep) is a social security rule that can impact the amount of benefits you receive. The social security administration has developed a chart (external link) showing the maximum monthly amount that social security benefits can be reduced because of the windfall elimination provision (wep) if a person. After you determine the number of years of substantial earnings you have (as outlined above) you can determine the percentage used in the first bend point. Although it’s not widely known, the annual social security benefit estimate does not include the wep penalty in. Web how much can the windfall elimination provision reduce my social security benefits? Web windfall elimination. After you determine the number of years of substantial earnings you have (as outlined above) you can determine the percentage used in the first bend point. Web the windfall elimination provision (wep) and the government pension offset (gpo) are two separate provisions that reduce regular social security benefits for workers and their eligible family members if the worker receives (or. Web our windfall elimination provision (wep) online calculator can tell you how your benefits may be affected. It often affects public service workers who have “mixed” earnings, or working careers in which some of their jobs paid social security taxes while other positions might not have. The wep is simply an alternate formula for calculating social security benefits for those. Web the windfall elimination provision (wep) is a formula that can reduce the size of your social security retirement or disability benefit if you receive a pension from a job in which you did not pay social security taxes. You will need to enter all your earnings taxed by social security into the wep online calculator manually. Web repealing the. Web the following chart shows the wep reduction in 2021 for 20 or less substantial years and for each substantial year up to 30. Web your social security benefit might be reduced if you get a pension from an employer who wasn’t required to withhold social security taxes. Although it’s not widely known, the annual social security benefit estimate does not include the wep penalty in. For example, if you have 25 substantial years of earnings your social security monthly payment will be reduced by $223. 30 or more 90% 29 85% 28 80% 27 75% 26 70% 25 65% 24 60% 23 55% 22 50% 21 45% 20 40% source: Web the windfall elimination provision (wep) can affect how social security calculates your retirement or disability benefit. If you work for an employer who doesn’t withhold social security taxes from your salary, any retirement or disability pension you get from that work can reduce your social security benefits. Web the windfall elimination provision (wep) is a formula that can reduce the size of your social security retirement or disability benefit if you receive a pension from a job in which you did not pay social security taxes. Web how much can the windfall elimination provision reduce my social security benefits? Exceptions to the windfall elimination provision Use our wep online calculator or download our detailed calculator to get an estimate of your benefits. Web our windfall elimination provision (wep) online calculator can tell you how your benefits may be affected. Web the windfall elimination provision affects both social security and disability benefits. Web look at our wep chart below to see how wep affects social security benefits. You will need to enter all your earnings taxed by social security into the wep online calculator manually. Exceptions are also made if you have “substantial” earnings in 21 to 29 years.

The Best Explanation of the Windfall Elimination Provision (2021 Update

Windfall Elimination Provison

Peabody Council on Aging Resource Library Social Security Windfall

Navigating The Windfall Elimination Provision With A Government Pension

Windfall Elimination Program (WEP) 2018 Social Security Retirement Guide

Social security windfall elimination calculator LuviniaClinton

Windfall Elimination Provision (How To Reduce It) YouTube

Substantial Earnings for Social Security’s Windfall Elimination

What Is The Ss Limit For 2024 Donny Genevra

Peabody Council on Aging Resource Library Social Security Windfall

It Often Affects Public Service Workers Who Have “Mixed” Earnings, Or Working Careers In Which Some Of Their Jobs Paid Social Security Taxes While Other Positions Might Not Have.

If You Get A Low Pension You Are Protected.

Here’s What You Need To Know About Both And How It Might Affect Your Social Security Payments.

Who Does The Windfall Elimination Provision Affect?

Related Post: