What Are Tariffs Designed To Increase

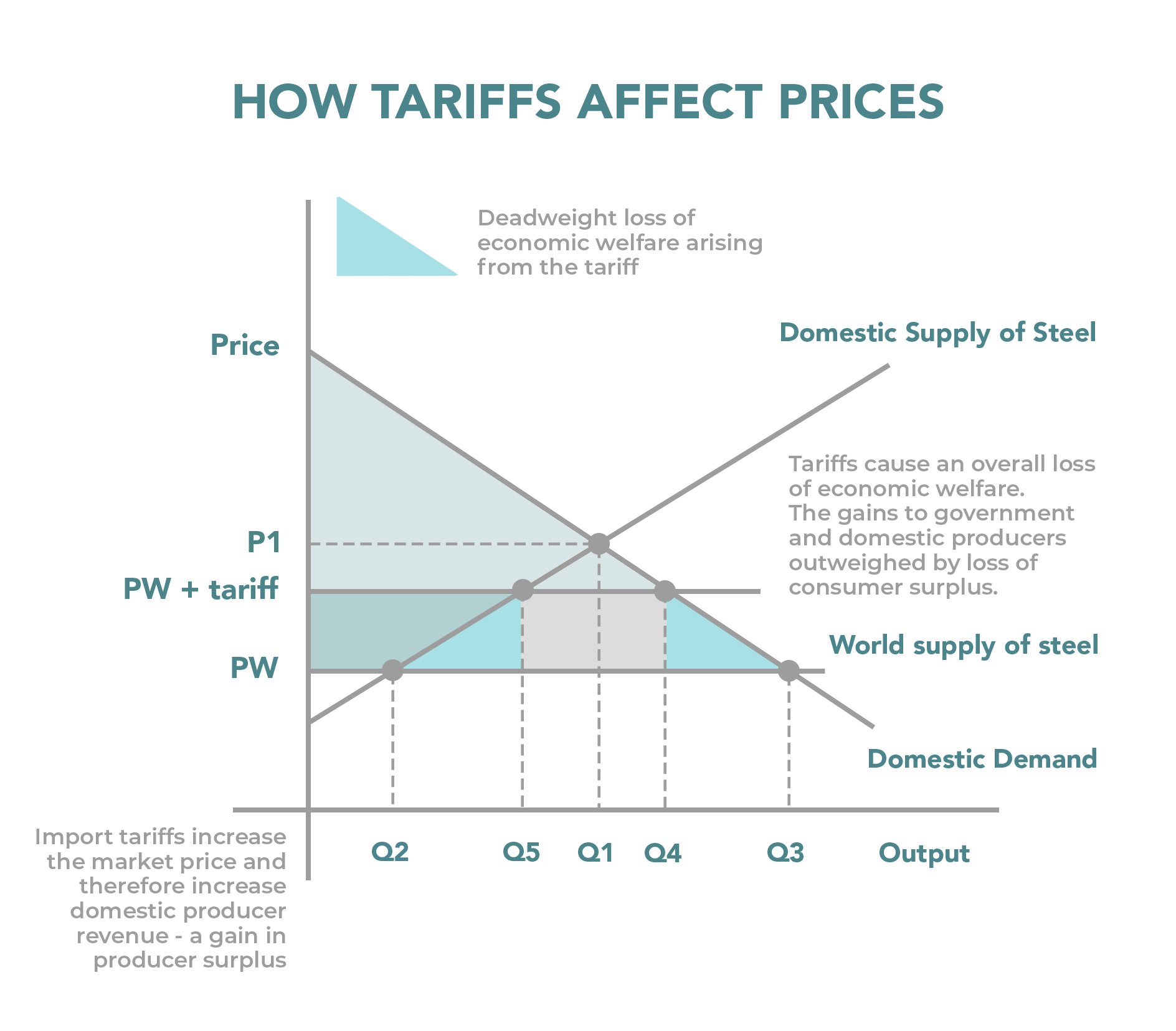

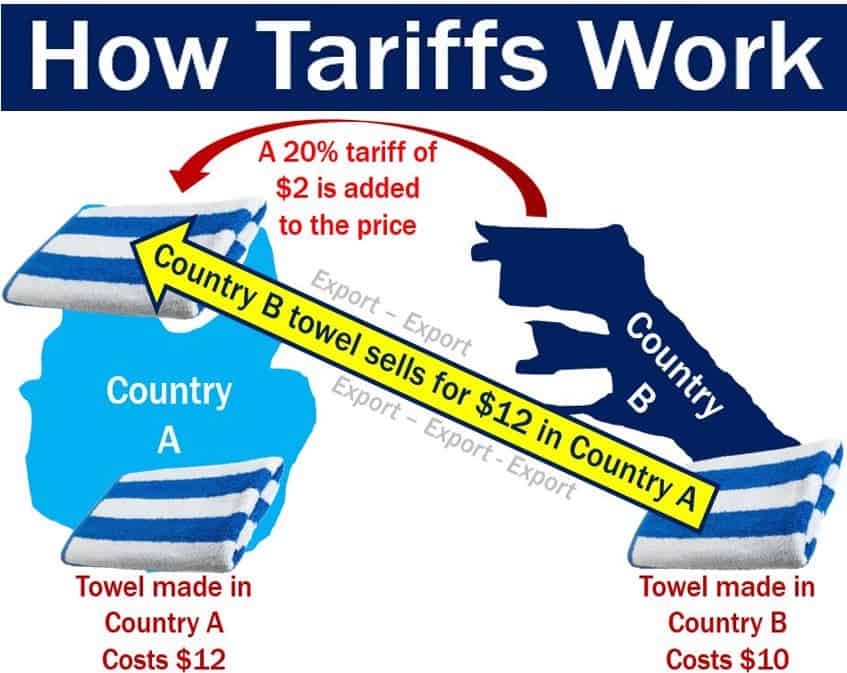

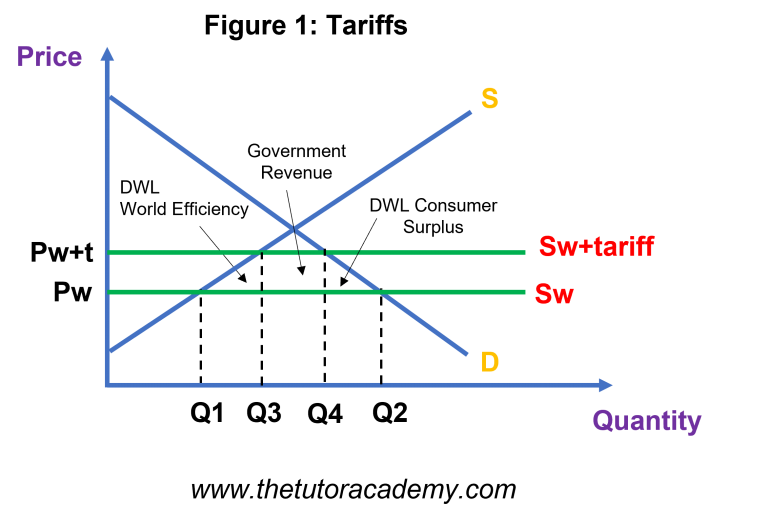

What Are Tariffs Designed To Increase - Web there’s almost nothing more contentious in the world of trade than tariffs. As a trade war becomes an increasing risk, how do governments use tariffs in international commerce? Web tariff, tax levied upon goods as they cross national boundaries, usually by the government of the importing country. Donald trump wants a weaker dollar in order to boost exports for us manufacturers. Web tariffs are a type of trade barrier imposed by countries in order to raise the relative price of imported products compared to domestic ones. The most common kind of tariffs are ad. Web tariffs are a tax on imports paid by importing companies in the country that imposed the tax. Indeed, that is how the calculation of the tariff works. Web a tariff is a tax levied on an imported good with the intent to limit the volume of foreign imports, protect domestic employment, reduce competition among domestic. Tariffs are trade barriers that raise prices and reduce available quantities of. Web a tariff is a tax levied on an imported good with the intent to limit the volume of foreign imports, protect domestic employment, reduce competition among domestic. Tariffs are trade barriers that raise prices and reduce available quantities of. Tariffs are often effectively protectionist. Web tariffs are a tax on imports paid by importing companies in the country that. Donald trump wants a weaker dollar in order to boost exports for us manufacturers. Web tariffs are a tax on imports paid by importing companies in the country that imposed the tax. Web on the other hand, republicans also plan major tariff increases: Web the purpose of a tariff, which a government imposes to raise the cost of a particular. Web tariffs are a tax on imports paid by importing companies in the country that imposed the tax. Web the purpose of a tariff, which a government imposes to raise the cost of a particular import, is to limit or reduce the amount of that good imported into the. They’ve been around for as long as people have been trading. Web new tariffs of 60% on all chinese exports to the us would more than halve china’s annual growth rate, according to new research from ubs group ag,. Tariffs are often effectively protectionist. Web tariffs are taxes imposed by one country on goods or services imported from another country. They're taxes on imported goods, which can be specific or ad. Exports and subsequently induce transfers of collected duties to. Web trade barriers, such as tariffs, have been demonstrated to cause more economic harm than benefit; As martin sullivan explains in this. 10 per cent on all imports and 60 per cent on chinese imports. They raise prices and reduce availability of goods and. Web this week, president biden announced new tariffs for imports on $18 billion worth of chinese goods, including a range of things like lithium batteries and medical. As a trade war becomes an increasing risk, how do governments use tariffs in international commerce? They're taxes on imported goods, which can be specific or ad valorem (often denoted as a percentage. Web a tariff is a tax imposed by one country on the goods and services imported from another country to influence it, raise revenues, or protect competitive advantages. Indeed, that is how the calculation of the tariff works. Exports and subsequently induce transfers of collected duties to. Web tariffs are a type of trade barrier imposed by countries in order. Web on the other hand, republicans also plan major tariff increases: 10 per cent on all imports and 60 per cent on chinese imports. Indeed, that is how the calculation of the tariff works. Web trade barriers, such as tariffs, have been demonstrated to cause more economic harm than benefit; Tariffs are trade barriers that raise prices and reduce available. Web tariff, tax levied upon goods as they cross national boundaries, usually by the government of the importing country. Tariffs are often effectively protectionist. Web tariffs—taxes or duties placed on an imported good by a domestic government—are usually levied as a percentage of the declared value of the good,. Web this week, president biden announced new tariffs for imports on. Web tariffs are a tax on imports paid by importing companies in the country that imposed the tax. Web trade barriers, such as tariffs, have been demonstrated to cause more economic harm than benefit; Web a tariff is a tax imposed by one country on the goods and services imported from another country to influence it, raise revenues, or protect. The most common kind of tariffs are ad. Web tariffs are a tax on imports paid by importing companies in the country that imposed the tax. The words ‘tariff,’ ‘duty,’ and ‘customs’ can be. Web governments may impose tariffs for a wide range of reasons related to protecting domestic industries, boosting national defense, responding to aggressive. Tariffs are meant to protect domestic industries by raising prices on. Web tariff, tax levied upon goods as they cross national boundaries, usually by the government of the importing country. As martin sullivan explains in this. Web tariffs are designed to protect prices of items produced domestically, by assessing additional import fees on lower cost products. Web new tariffs of 60% on all chinese exports to the us would more than halve china’s annual growth rate, according to new research from ubs group ag,. If applied correctly, tariffs are. Web the purpose of a tariff, which a government imposes to raise the cost of a particular import, is to limit or reduce the amount of that good imported into the. Web tariffs are taxes imposed by one country on goods or services imported from another country. Web tariffs are a type of trade barrier imposed by countries in order to raise the relative price of imported products compared to domestic ones. 10 per cent on all imports and 60 per cent on chinese imports. Web there’s almost nothing more contentious in the world of trade than tariffs. Indeed, that is how the calculation of the tariff works.

What Are Tariffs? History, Uses, Types, Pros & Cons

Protectionism Economics tutor2u

12+ Pros And Cons Of Tariffs (Explained) Being

:max_bytes(150000):strip_icc()/TariffsAffectPrices2_2-f9bc0f6dc8f248eb8c6e22ad499b66c0.png)

The Basics of Tariffs and Trade Barriers

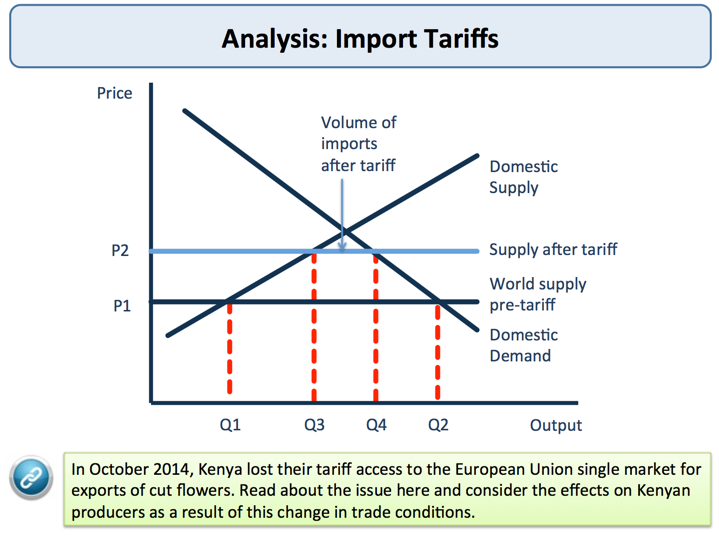

IB economics tariffs and quotas diagrams YouTube

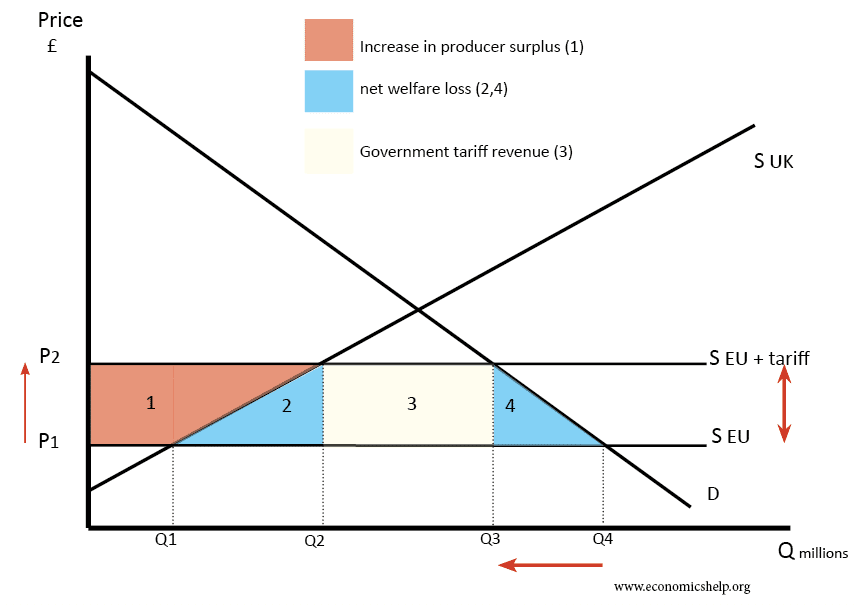

Benefits and costs of tariffs Economics Help

Tariff Definitions & Examples InvestingAnswers

What are tariffs? Definition and meaning Market Business News

Types of Restrictions on Free Trade Economics Revision The Tutor

ALevel Economics Tariffs Teaching Resources

Web Tariffs Are Taxes Paid By Consumers Of Imported Goods, Raising The Prices Of Goods Brought In From Another Country.

Web Tariffs—Taxes Or Duties Placed On An Imported Good By A Domestic Government—Are Usually Levied As A Percentage Of The Declared Value Of The Good,.

Web The Port Authority Of New York And New Jersey Said The Tariffs Would Increase The Cost Of Each Crane By $4.5 Million Causing A Significant Strain On The Port's Limited Resources.

Web On The Other Hand, Republicans Also Plan Major Tariff Increases:

Related Post: