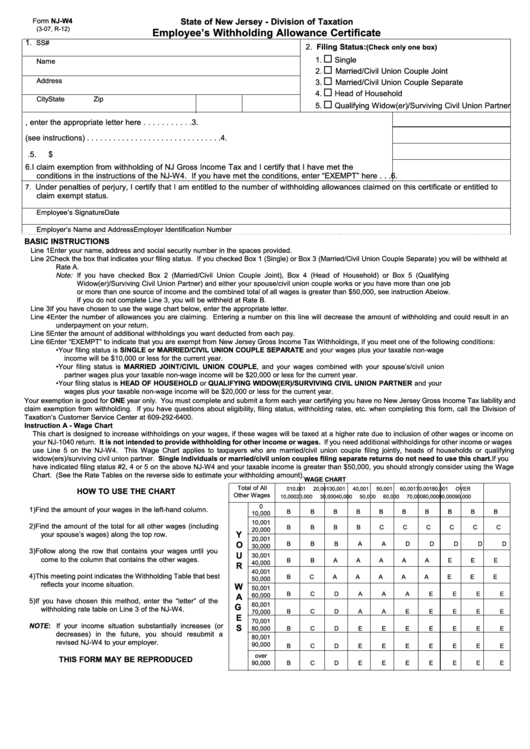

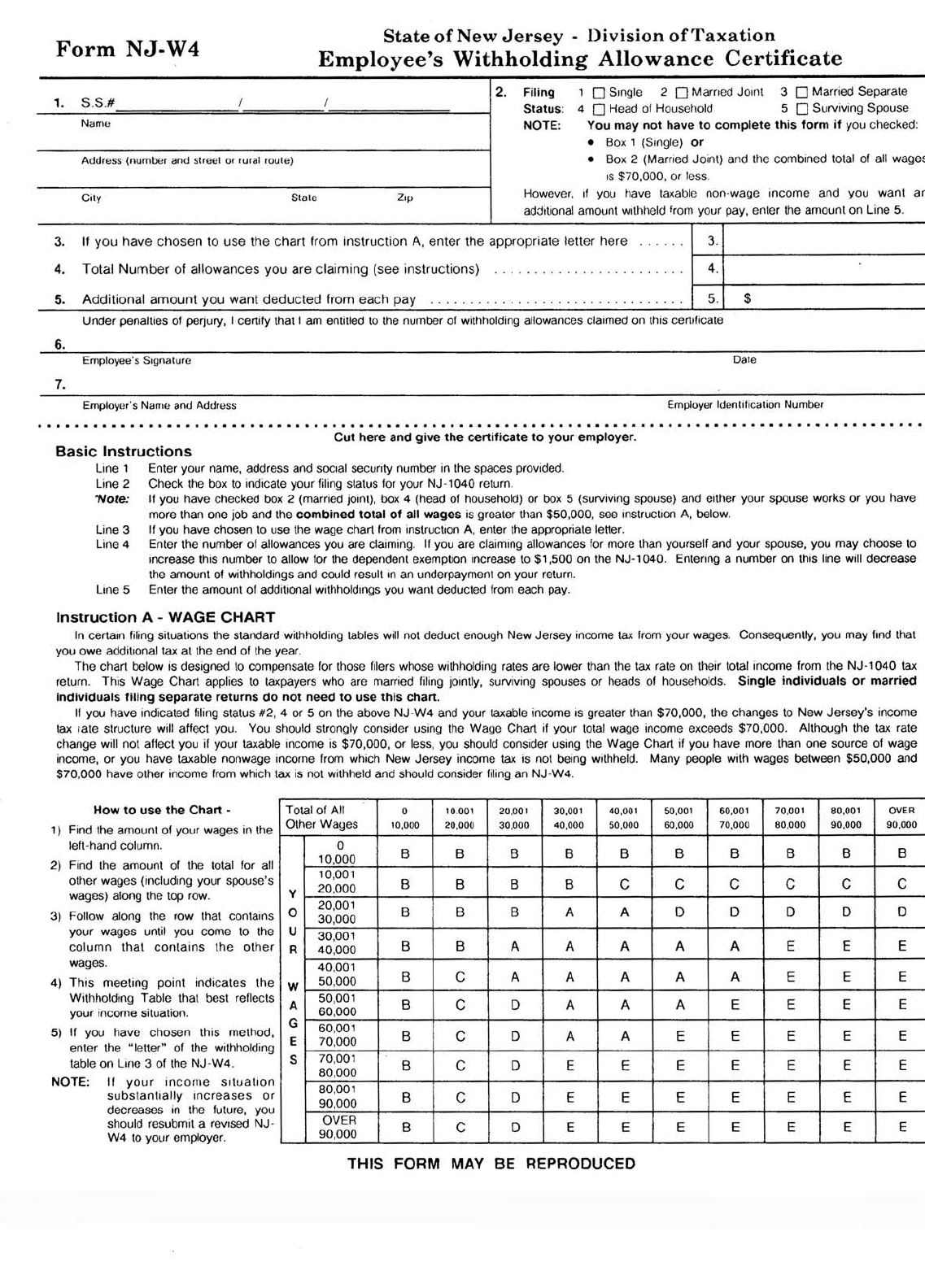

Wage Chart On Form Njw4

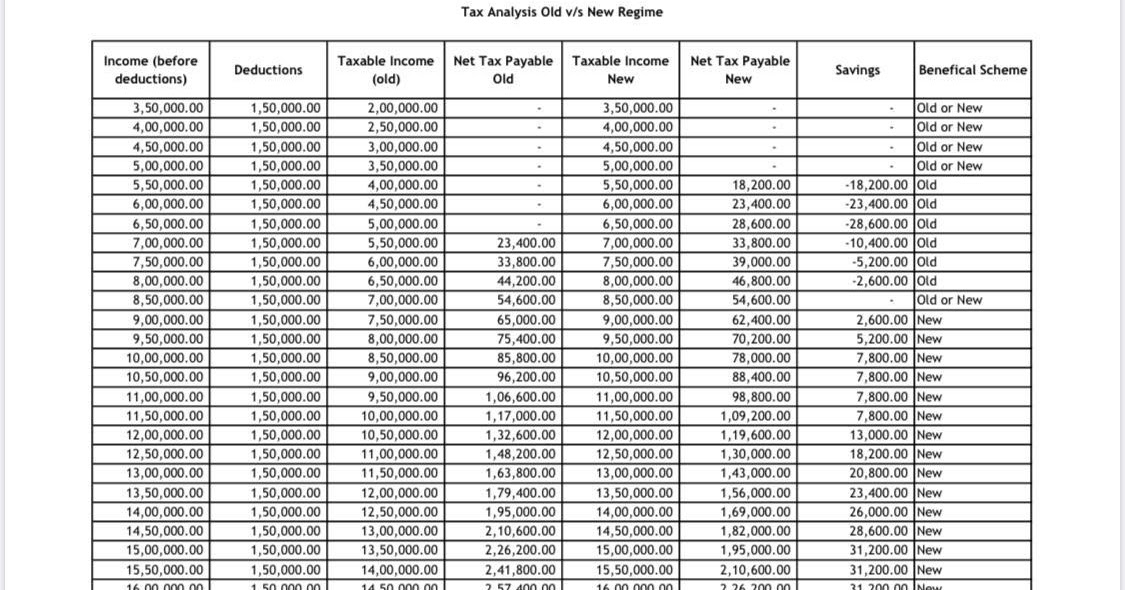

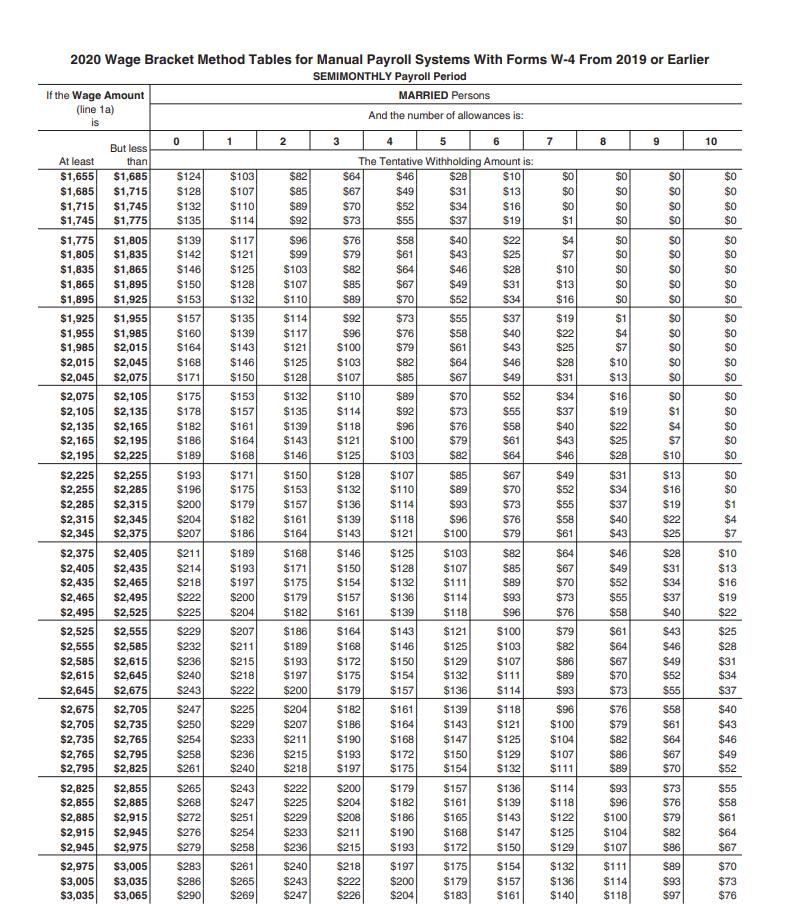

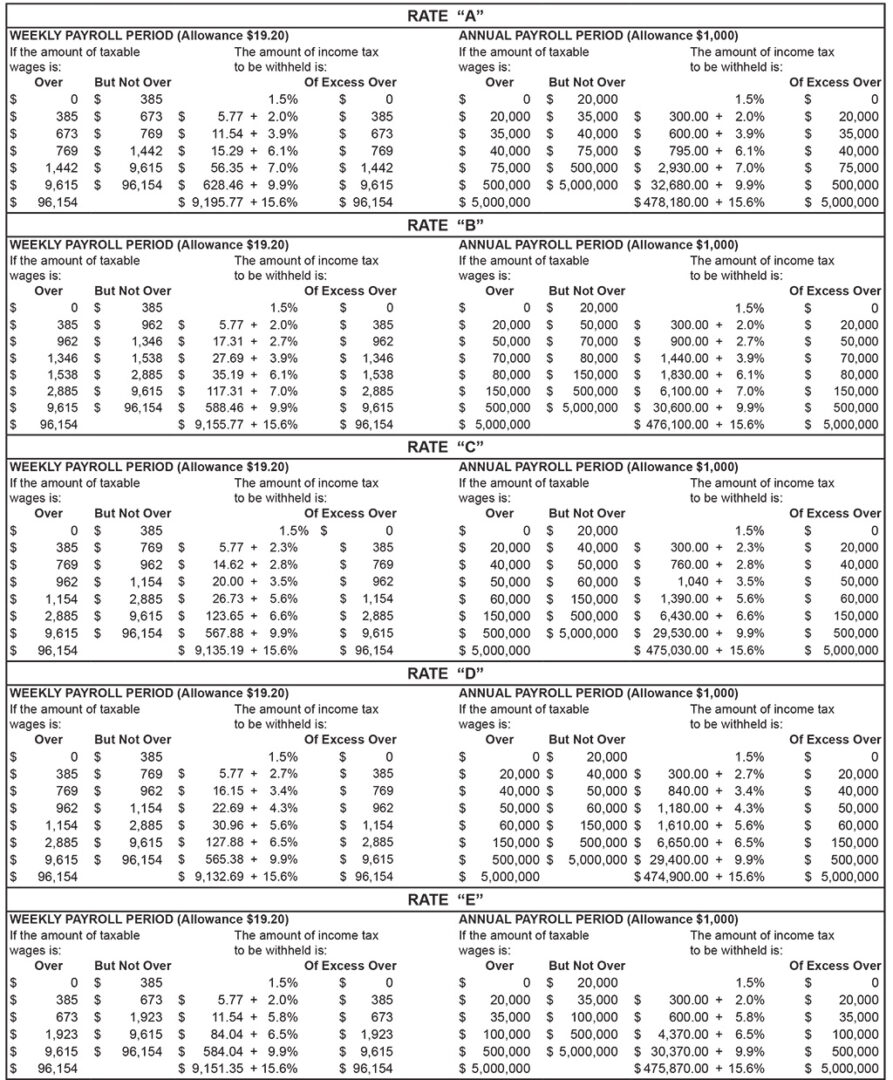

Wage Chart On Form Njw4 - Use these to estimate the. Web determine how much your tax liability will be for the federal with taxcaster tax calculator. Rate tables for wage chart. You may be required to make estimated. If you employ new jersey residents working in new jersey, you must. Web 3) for higher earning employees, there is an optional wage chart that can be used to increase withholding amounts based on total individual and spouse wages to avoid. Its purpose is to determine the withholding rates you are subjected to, particularly if your household works two jobs. Decide if you want a big refund, let's say you. Web in cases like these, an employee should use the wage chart on the form to determine the rate to use when calculating state withholding amounts when filing form. Applicable to wages, salaries, and commissions paid on and after. Web if you have indicated filing status #2, 4 or 5 on the above njw4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. The rate tables listed below correspond to the letters in the wage chart on the front page. (see the rate tables on the reverse side to estimate your withholding.. (see the rate tables on the reverse side to estimate your withholding. (see the rate tables on the reverse side to estimate your withholding. Web information on filing requirements for income tax for the state of new jersey division of taxation. Web all wages and employee compensation paid to a resident working in new jersey is subject to withholding. (see. (see the rate tables on the reverse side to estimate your withholding. Web you will have no nj income tax withholding from your university wages. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. You may be required to make estimated. (see the rate tables on the reverse side to estimate. Decide if you want a big refund, let's say you. Use these to estimate the. Any nj state income tax liability will be your responsibility. Web in cases like these, an employee should use the wage chart on the form to determine the rate to use when calculating state withholding amounts when filing form. Web new jersey withholding rate tables. Use these to estimate the. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. (see the rate tables on the reverse side to estimate your withholding. The rate tables listed below correspond to the letters in the wage chart on the front page. (see the rate tables on the reverse side. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Web information on filing requirements for income tax for the state of new jersey division of taxation. (see the rate tables on the reverse side to estimate your withholding. Web if you are under full retirement age for the entire year, we. (see the rate tables on the reverse side to estimate your withholding. Web new jersey withholding rate tables. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of. Web you will have no nj income tax withholding from your university wages. Web if you have indicated filing status #2, 4 or 5 on the above njw4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Tables for percentage method of withholding. Web 3) for higher earning employees, there is an optional. This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of other wages or income. Web you will have no nj income tax withholding from your university wages. Web in cases like these, an employee should use the wage chart on the form to determine the rate. Use these to estimate the. Applicable to wages, salaries, and commissions paid on and after. This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of other wages or income. (see the rate tables on the reverse side to estimate your withholding. (see the rate tables on. Any nj state income tax liability will be your responsibility. The rate tables listed below correspond to the letters in the wage chart on the front page. Applicable to wages, salaries, and commissions paid on and after. Rate tables for wage chart. (see the rate tables on the reverse side to estimate your withholding. Web you will have no nj income tax withholding from your university wages. Web determine how much your tax liability will be for the federal with taxcaster tax calculator. Use these to estimate the. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Web information on filing requirements for income tax for the state of new jersey division of taxation. This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of other wages or income. (see the rate tables on the reverse side to estimate your withholding. Its purpose is to determine the withholding rates you are subjected to, particularly if your household works two jobs. Web 3) for higher earning employees, there is an optional wage chart that can be used to increase withholding amounts based on total individual and spouse wages to avoid. Web if you have indicated filing status #2, 4 or 5 on the above njw4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. You may be required to make estimated.

Njw4 Wage Chart

W4 2024 Calculator Kelsy Mellisa

Memo NJ's Minimum Wage Increasing on July 1, 2019 and Will Climb To

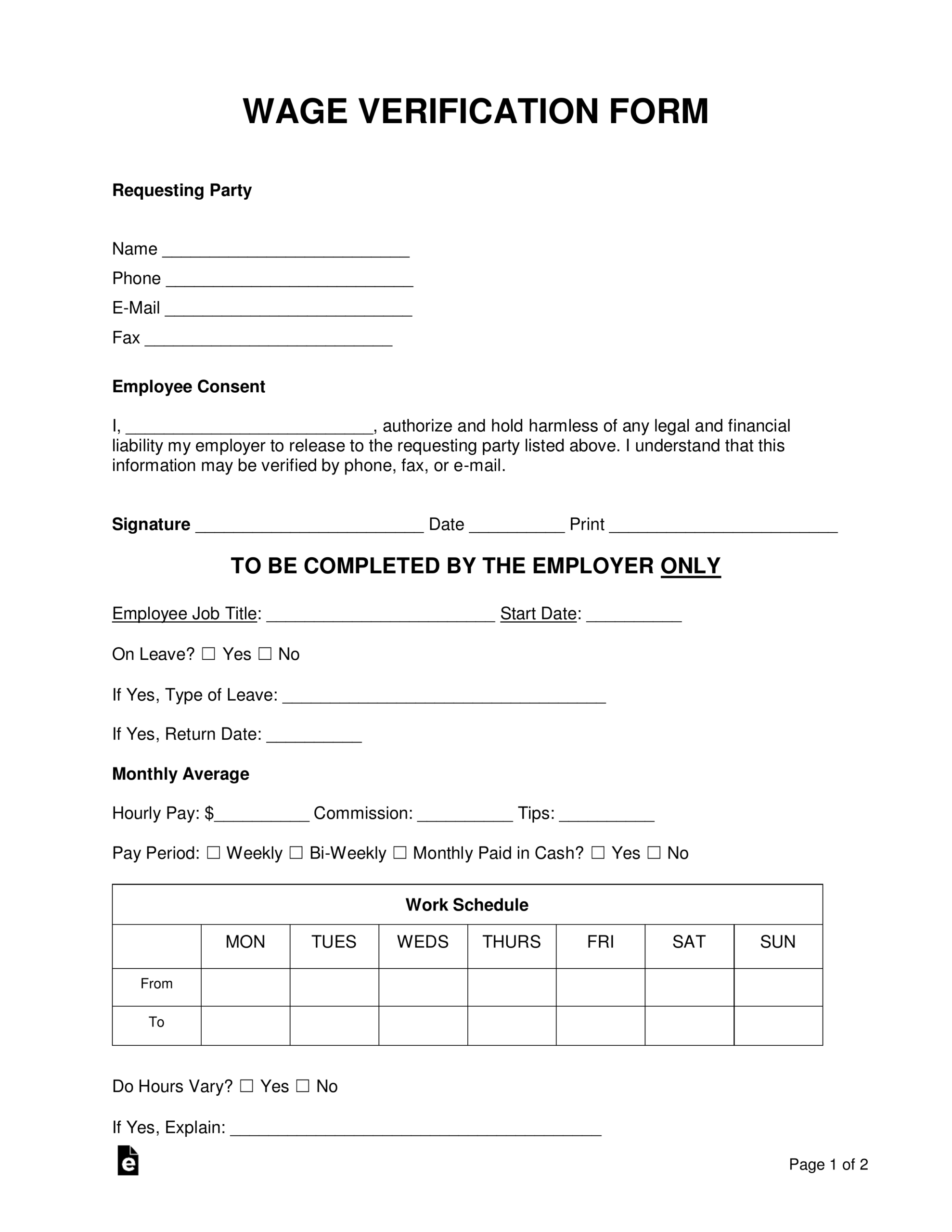

Printable Wage Verification Forms Printable Forms Free Online

Nj W4 Form 2025 Tani Therese

Free New Jersey Form NJW PDF 534KB 2 Page(s)

Federal Tax Withholding Forms For 2022

Fill Free fillable Form NJW4 Head of Household Employees

2021 W4 Guide How to Fill Out a W4 This Year Gusto

Wage Chart On Form Njw4

For 2024 That Limit Is $22,320.

Web If You Are Under Full Retirement Age For The Entire Year, We Deduct $1 From Your Benefit Payments For Every $2 You Earn Above The Annual Limit.

Decide If You Want A Big Refund, Let's Say You.

Web New Jersey Withholding Rate Tables.

Related Post: