W Pattern In Chart

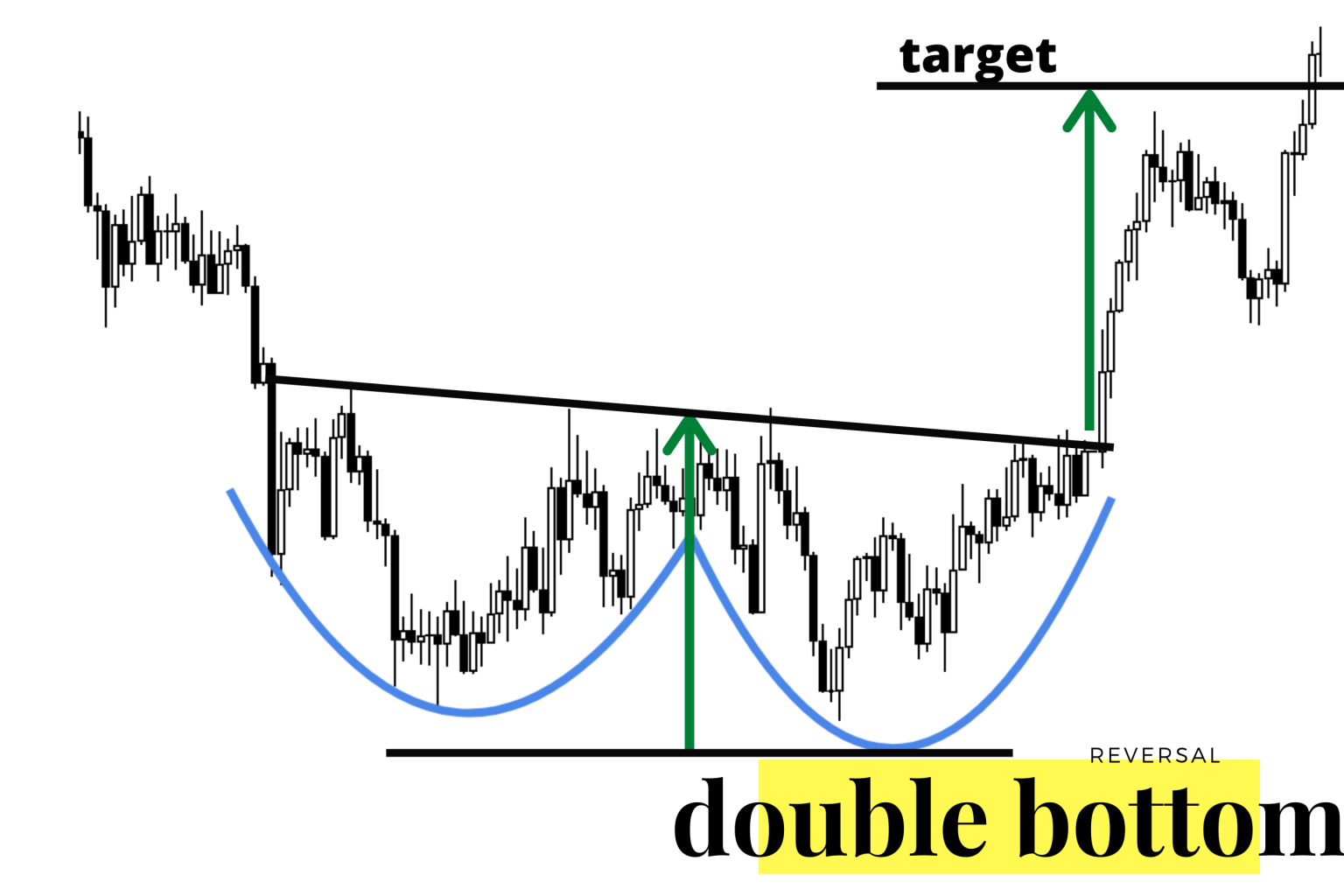

W Pattern In Chart - The double bottom pattern occurs when the price of a currency pair reaches a low point, bounces back up, dips again to the same level,. Web on stock charts, the w pattern can be identified by spotting two low points, representing strong support that the price has been unable to break through, with a peak in between forming the central part of the “w”. Web one popular pattern that traders often look out for is the double bottom, also known as the w pattern. Web this “w” pattern forms when prices register two distinct lows on a chart. The double bottom pattern looks like the letter w. In this article, we will enter into the w pattern in trading, exploring its formation, significance, and how traders can leverage it to enhance their trading. However, the definition of a true double bottom is achieved only when prices rise above the highest point of the entire formation, leaving the entire pattern behind. In the moments when the lows are attained, requests to purchase an asset can happen. The w chart pattern is a reversal pattern that is bullish as a downtrend holds support after the second test and rallies back higher. Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. 📈 whether you're a beginner or an experienced trader, understanding this double bottom formation is crucial. Web the w pattern in trading is a formation on price charts that signifies a potential bullish reversal after a downward trend. Many patterns fall under “ pattern trading ;” however, w and m pattern trading is an essential tool. One such pattern that. How to spot a double bottom pattern in a w pattern chart. This first trend reversal is usually short in duration and does not last long and the price falls again. The double bottom pattern looks like the letter w. Web a double bottom pattern is a classic technical analysis charting formation showing a major change in trend from a. Understanding the fundamentals of w pattern chart in the stock market. The w and m patterns trading. The pattern is characterized by two distinct troughs or peaks that mark. Importance of w pattern chart in trading strategies. The article includes identification guidelines, trading tactics, and performance statistics, by internationally known author and trader thomas bulkowski. Web on stock charts, the w pattern can be identified by spotting two low points, representing strong support that the price has been unable to break through, with a peak in between forming the central part of the “w”. How to spot a double bottom pattern in a w pattern chart. When the “w” pattern is qualified after noticing. Understanding. The world of trading is filled with patterns and signals that traders use to make informed decisions. However, the definition of a true double bottom is achieved only when prices rise above the highest point of the entire formation, leaving the entire pattern behind. Web one popular pattern that traders often look out for is the double bottom, also known. Web the w pattern, a technical trading indicator, signals a bullish market reversal. Web a w pattern is a charting pattern used in technical analysis that indicates a bullish reversal. 📈 whether you're a beginner or an experienced trader, understanding this double bottom formation is crucial. It is formed by drawing two downward legs followed by an upward move that. This first trend reversal is usually short in duration and does not last long and the price falls again. Pattern trading is one of the technical analyses applicable in predicting reoccurring patterns. It's characterized by two troughs at roughly the same low level, separated by a peak. In this article, we will enter into the w pattern in trading, exploring. The w and m patterns trading. However, the definition of a true double bottom is achieved only when prices rise above the highest point of the entire formation, leaving the entire pattern behind. It is formed by drawing two downward legs followed by an upward move that retraces a significant portion of the prior decline. Understanding the fundamentals of w. Many patterns fall under “ pattern trading ;” however, w and m pattern trading is an essential tool. The pattern starts emerging when the prices first jump off after the constant horizontal trend line of an asset. It resembles the letter ‘w’ due to its structure formed by two consecutive price declines and recoveries. The w refers to the physical. Many patterns fall under “ pattern trading ;” however, w and m pattern trading is an essential tool. In this article, we will enter into the w pattern in trading, exploring its formation, significance, and how traders can leverage it to enhance their trading. Web m and w patterns are chart formations in technical analysis that resemble the letters ‘m’. The m pattern, also known as the double top, indicates a bearish reversal, suggesting that a current uptrend may reverse into a downtrend. Web double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). The double top and double bottom chart patterns are usually formed after consecutive rounding tops and bottoms. The double bottom pattern looks like the letter w. 📈 whether you're a beginner or an experienced trader, understanding this double bottom formation is crucial. It is formed by drawing two downward legs followed by an upward move that retraces a significant portion of the prior decline. However, the definition of a true double bottom is achieved only when prices rise above the highest point of the entire formation, leaving the entire pattern behind. Traders may use w bottoms and tops chart patterns as powerful indicators for buying and selling decisions. Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. The world of trading is filled with patterns and signals that traders use to make informed decisions. Web big w is a double bottom chart pattern with talls sides. Web the w pattern resembles the letter w and is considered a bullish reversal pattern. The w refers to the physical shape that appears on the stock. Web on stock charts, the w pattern can be identified by spotting two low points, representing strong support that the price has been unable to break through, with a peak in between forming the central part of the “w”. When the “w” pattern is qualified after noticing. This first trend reversal is usually short in duration and does not last long and the price falls again.

W Pattern Trading The Forex Geek

Technical Analysis 101 A Pattern Forms the W Breakout Pattern!!

Stock Market Chart Analysis FORD Bullish W pattern

Three Types of W Patterns MATI Trader

W pattern forex

W Pattern Trading New Trader U

Wpattern — TradingView

Three Types of W Patterns MATI Trader

W Forex Pattern Fast Scalping Forex Hedge Fund

Three Types of W Patterns MATI Trader

Understanding The Fundamentals Of W Pattern Chart In The Stock Market.

The Double Bottom Pattern Occurs When The Price Of A Currency Pair Reaches A Low Point, Bounces Back Up, Dips Again To The Same Level,.

Therefore, When A “W” Renko Chart Pattern Is Spotted, We Always Take A Short Position As Described Below.

Web The W Pattern In Trading Is A Formation On Price Charts That Signifies A Potential Bullish Reversal After A Downward Trend.

Related Post: