W Chart Pattern

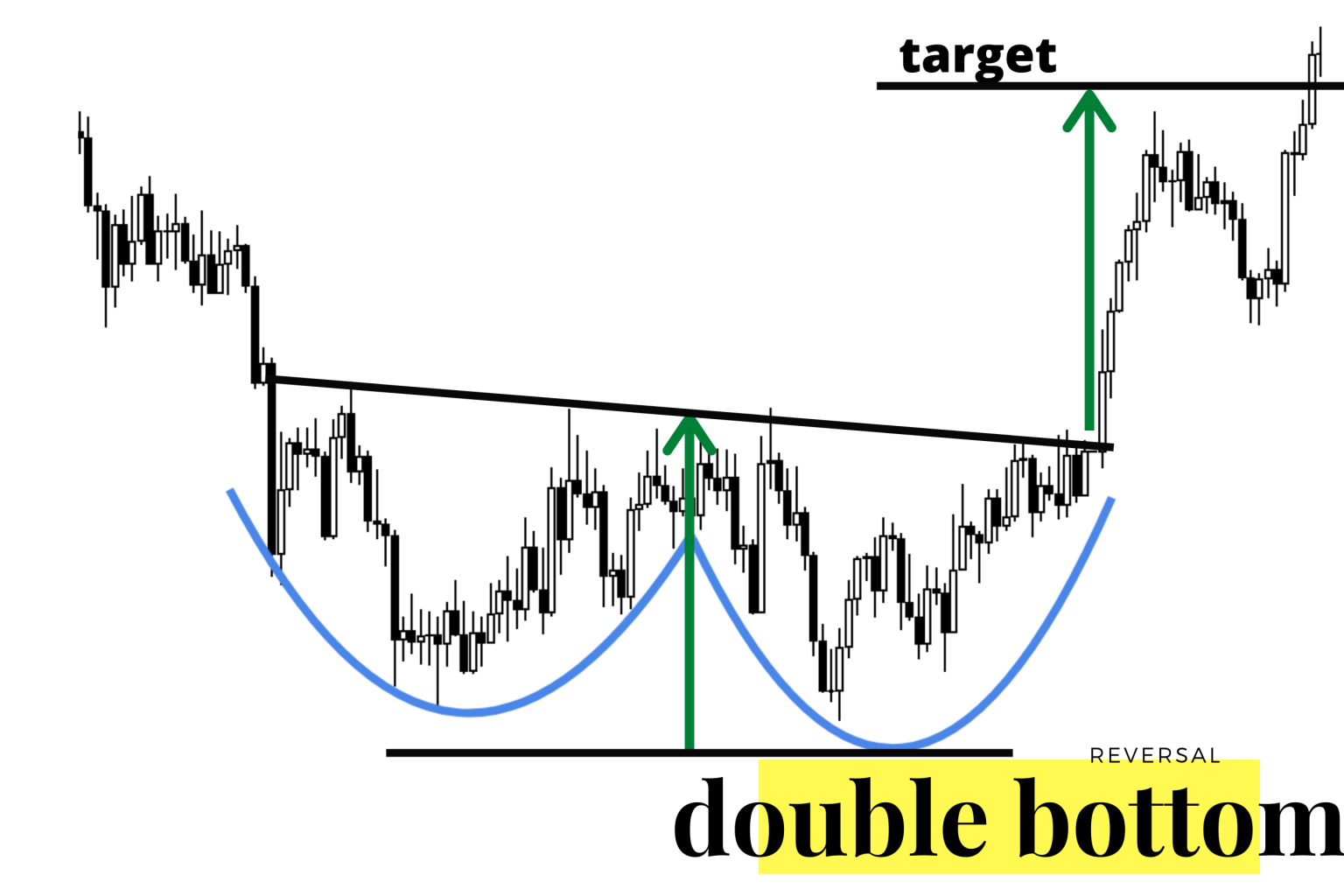

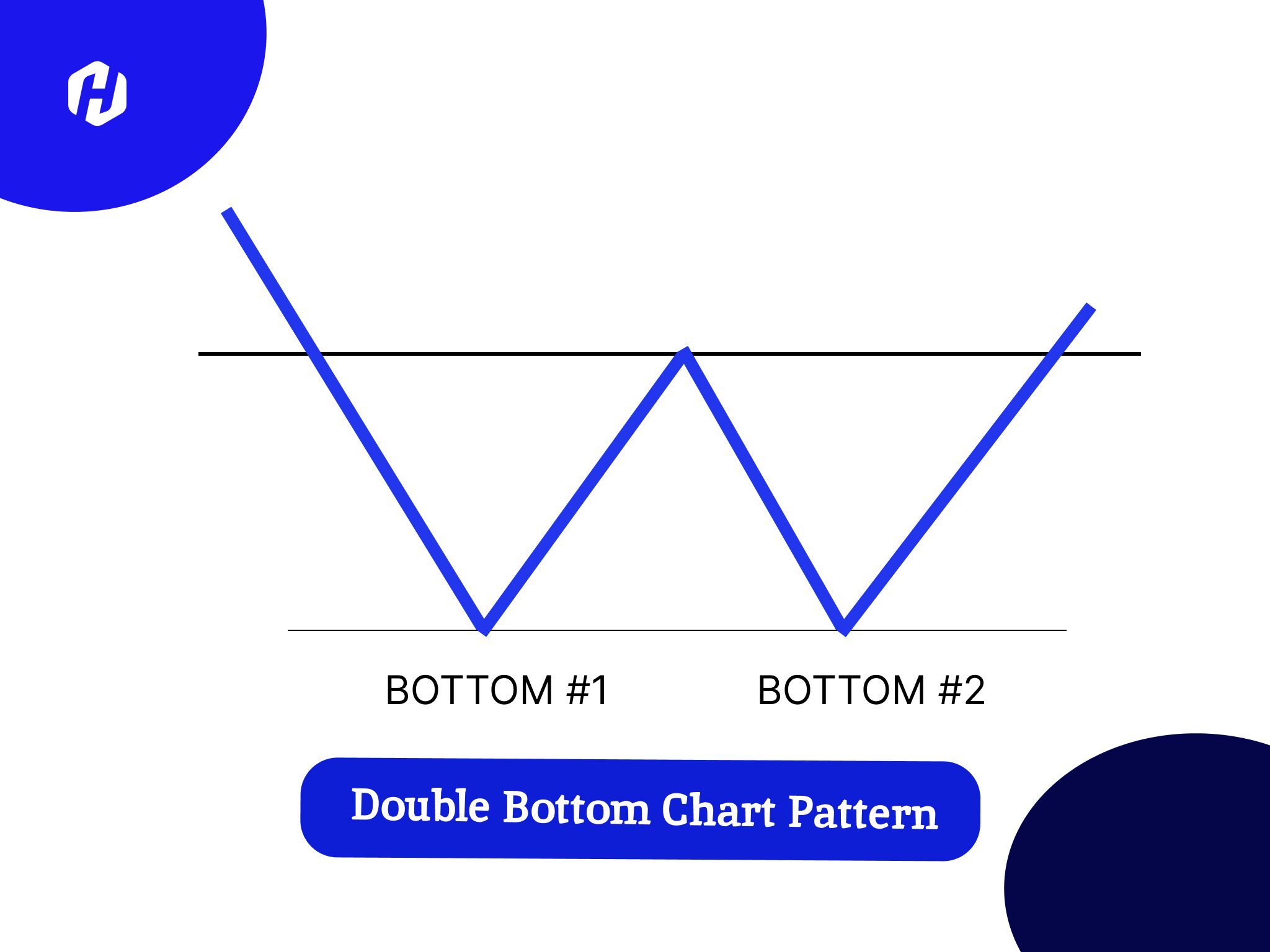

W Chart Pattern - The pattern starts emerging when the prices first jump off after the constant horizontal trend line of an asset. Frequently surfacing on charts as a bullish reversal pattern, adept traders survey this figure to pinpoint the emergence of upward potential. One popular pattern that traders often look out for is the double bottom, also known as the w pattern. Technical analysts and chartists seek to identify patterns. Each candle on a tick chart represents multiple trades. It is formed by drawing two downward legs followed by an upward move that retraces a significant portion of the prior decline. Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. Shorter candles show less price movement, while longer candles indicate higher. While analysing trading tick charts, identify breakout and reversal patterns and take advantage of this in predicting market movements. How to spot a double bottom pattern in a w pattern chart. Web a double bottom pattern is a classic technical analysis charting formation showing a major change in trend from a prior down move. Web a pattern is identified by a line connecting common price points, such as closing prices or highs or lows, during a specific period. As a result, the price action moves in the opposite direction than expected.. Summary of important points in the double bottom and double top patterns. Web the w pattern, as the name suggests, resembles the letter “w” and is formed by two successive downward price movements followed by an upward movement. From candlestick patterns to bear traps, triangle patterns to double bottoms, we’ll cover it all. The difference between w pattern and other. Web one of the classical indicators is the w pattern that is similar to the double tops and bottoms, the w formation is a pattern that frequently heralds a jump in market prices in a rapid way. When the “w” pattern is qualified after noticing. A chart pattern is a distinct formation on a stock chart that creates a trading. Web a double bottom pattern is a classic technical analysis charting formation showing a major change in trend from a prior down move. The structure of w pattern: The w chart pattern is a reversal pattern that is bullish as a downtrend holds support after the second test and rallies back higher. Web in this guide to chart patterns, we’ll. Web the w pattern in trading is a formation on price charts that signifies a potential bullish reversal after a downward trend. Web a double bottom pattern is a classic technical analysis charting formation showing a major change in trend from a prior down move. Web the “w” pattern is indicative of a corrective or reversal move. Over 7m customersunlimited. Web what are chart pattern failures? Web the w chart pattern is read as a bullish turnaround where prices are expected to increase after weeks or months of price decline. This can be any time frame. Summary of important points in the double bottom and double top patterns. Technical analysts and chartists seek to identify patterns. In the moments when the lows are attained, requests to purchase an asset can happen. This first trend reversal is usually short in duration and does not last long and the price falls again. Web a pattern is identified by a line connecting common price points, such as closing prices or highs or lows, during a specific period. Shorter candles. The double bottom pattern looks like the letter w. the. Web what are chart pattern failures? The difference between w pattern and other chart patterns. The pattern starts emerging when the prices first jump off after the constant horizontal trend line of an asset. From candlestick patterns to bear traps, triangle patterns to double bottoms, we’ll cover it all. The structure of w pattern: While analysing trading tick charts, identify breakout and reversal patterns and take advantage of this in predicting market movements. A chart pattern failure occurs when a specific chart pattern does not materialize as anticipated and is unable to achieve its potential. Traders may use w bottoms and tops chart patterns as powerful indicators for buying. Web trading with double bottom. Web when analyzing chart patterns, it's important to start with the basics. From candlestick patterns to bear traps, triangle patterns to double bottoms, we’ll cover it all. Technical analysts and chartists seek to identify patterns. A chart pattern is a distinct formation on a stock chart that creates a trading signal, or a sign of. The w chart pattern is a reversal pattern that is bullish as a downtrend holds support after the second test and rallies back higher. Web observe the pattern trends; As a result, the price action moves in the opposite direction than expected. The double bottom pattern looks like the letter w. the. It would help if you clearly understood the reason behind the application of w and m pattern trading, even though the importance of this pattern trading is essential to all technical traders. The structure of w pattern: The pattern is characterized by two distinct troughs or peaks that mark. Web a double bottom pattern is a classic technical analysis charting formation showing a major change in trend from a prior down move. Web the w trading pattern embodies a cornerstone concept in market analysis, spotlighting a crucial turn in the tides of investor sentiment. Very simply, a candlestick is a plot of price over time. Web the w pattern, as the name suggests, resembles the letter “w” and is formed by two successive downward price movements followed by an upward movement. Web the “w” pattern is indicative of a corrective or reversal move. Web the w chart pattern is read as a bullish turnaround where prices are expected to increase after weeks or months of price decline. Web a w pattern is a charting pattern used in technical analysis that indicates a bullish reversal. Web one of the classical indicators is the w pattern that is similar to the double tops and bottoms, the w formation is a pattern that frequently heralds a jump in market prices in a rapid way. Web a w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart.

W pattern forex

W Pattern Trading New Trader U

W Forex Pattern Fast Scalping Forex Hedge Fund

Wpattern — TradingView

W Pattern Trading The Forex Geek

Three Types of W Patterns MATI Trader

Panduan Lengkap Mengenai Pola W Trading Pattern HSB Investasi

Stock Market Chart Analysis FORD Bullish W pattern

Three Types of W Patterns MATI Trader

W Pattern In Technical Analysis Zigzag Pattern Indicator Strategy CNRI

Web Trading With Double Bottom.

In The Moments When The Lows Are Attained, Requests To Purchase An Asset Can Happen.

Summary Of Important Points In The Double Bottom And Double Top Patterns.

One Popular Pattern That Traders Often Look Out For Is The Double Bottom, Also Known As The W Pattern.

Related Post: