Volatility Contraction Pattern

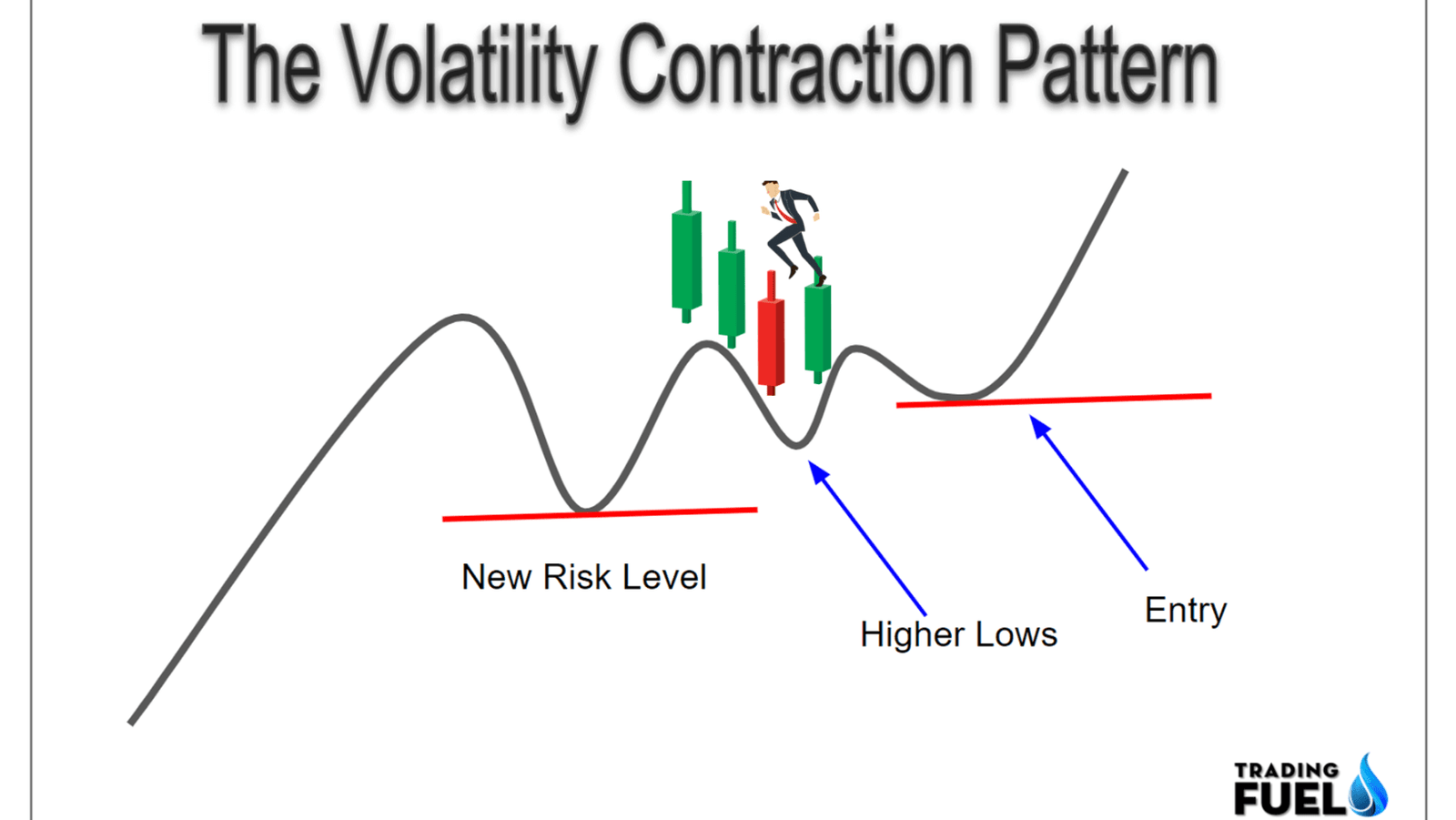

Volatility Contraction Pattern - Scanner guide scan examples feedback. Find out the key ingredients, breakout. Web volatility contraction patterns are often found in stocks before an explosive share price gain. Web the vcp is an essential pattern for swing traders, as it signals the potential for a significant price move. This is the rational behind bollinger bands. This tutorial covers the criteria of a vcp base, how to filte. Web learn how to identify and use the vcp, a trading pattern that occurs in stocks in long term up trends. Find out the criteria, types, and. And global markets from mike dolan Web find stocks that match mark minervini's vcp criteria, a technical analysis pattern for trading breakouts. Web what is the volatility contraction pattern (vcp pattern)? Web the vcp is an essential pattern for swing traders, as it signals the potential for a significant price move. This is the rational behind bollinger bands. Web the document discusses the volatility contraction pattern (vcp), a trading pattern popularized by mark minervini that involves identifying stocks in strong uptrends that. Web in this video, we will be discussing how to go about using candlestick patterns during volatility contraction. Web learn how to identify and catch a volatility contraction pattern (vcp), a chart consolidation that tightens from left to right within a price base. Web learn how to identify and trade the volatility contraction pattern (vcp), a powerful pattern that captures. Web a look at the day ahead in u.s. Here's the thing… the market. Web learn how to identify and trade the volatility contraction pattern (vcp), a powerful pattern that captures explosive price movements. After surging above 5.5, ford (f) formed a long. Web the volatility contraction pattern (vcp) allows us to find stocks which are getting ready to form. Web the volatility contraction pattern (vcp) is a bullish trading strategy that can help you identify and profit from stocks that are in strong uptrends and are ready to. Here's the thing… the market. The vcp involves a decrease in volatility and volume as. Find out the criteria, types, and. Web a look at the day ahead in u.s. Web learn how to identify and trade the volatility contraction pattern (vcp), a powerful pattern that captures explosive price movements. Web the vcp is an essential pattern for swing traders, as it signals the potential for a significant price move. Web the document discusses the volatility contraction pattern (vcp), a trading pattern popularized by mark minervini that involves identifying stocks. After surging above 5.5, ford (f) formed a long. See scan description, examples, backtest results and links to more resources. Web volatility contractions often precede volatility expansions. Web learn how to use the volatility contraction pattern (vcp) coined by mark minervini, a professional investor, to trade stocks in india. Web learn how to trade the volatility contraction pattern (vcp) in. Find out the key ingredients, breakout. This is the rational behind bollinger bands. Web learn how to identify and trade the volatility contraction pattern (vcp), a powerful pattern that captures explosive price movements. Find out the criteria, types, and. Web learn how to use the volatility contraction pattern (vcp) coined by mark minervini, a professional investor, to trade stocks in. Web learn how to identify and catch a volatility contraction pattern (vcp), a chart consolidation that tightens from left to right within a price base. Web volatility contraction pattern is popularized by mark minervini, who is a two times us investing champion. Web a look at the day ahead in u.s. Web find stocks that match mark minervini's vcp criteria,. This is the rational behind bollinger bands. Web find stocks that match mark minervini's vcp criteria, a technical analysis pattern for trading breakouts. Web learn what a volatility contraction pattern is and how to use it to trade stocks. Web a look at the day ahead in u.s. Learn what the volatility contraction pattern (vcp) is and how to recognize. Web learn how to identify and use the vcp, a trading pattern that occurs in stocks in long term up trends. Web the volatility contraction pattern (vcp) allows us to find stocks which are getting ready to form a very specific low risk entry point at which the potential reward of our trades. Web the document discusses the volatility contraction. Web the document discusses the volatility contraction pattern (vcp), a trading pattern popularized by mark minervini that involves identifying stocks in strong uptrends that are. Web learn how to identify stocks with bullish potential and minimal risk using the volatility contraction pattern (vcp) developed by mark minervini. After surging above 5.5, ford (f) formed a long. See scan description, examples, backtest results and links to more resources. Web volatility contraction patterns are often found in stocks before an explosive share price gain. Web learn how to identify and trade volatility contraction patterns (vcps), which are chart formations that signal potential breakouts in stock prices. Web learn how to identify and profit from the volatility contraction pattern, a reliable trading strategy that occurs during a consolidation period. The vcp involves a decrease in volatility and volume as. Web find stocks that match mark minervini's vcp criteria, a technical analysis pattern for trading breakouts. Web learn how to identify and use the vcp, a trading pattern that occurs in stocks in long term up trends. So, what is volatility contraction? This is the rational behind bollinger bands. Web learn how to use the vcp pattern for intraday trading, a technique based on wyckoff's wave pattern and minervini's high tight flag. Scanner guide scan examples feedback. Web learn how to identify and trade the volatility contraction pattern (vcp), a powerful pattern that captures explosive price movements. Find out the key ingredients, breakout.

Volatility Contraction Pattern (VCP Pattern) Mark Minervini Trading

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Volatility Contraction Pattern (VCP) for MYXPRLEXUS by yccho22

Understanding The Volatility Contraction Pattern TraderLion

How to Day Trade with the Volatility Contraction Pattern (VCP)?

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

How to Day Trade with the Volatility Contraction Pattern (VCP)?

Find Out The Key Factors, Steps.

The Vcp Pattern Is One Of Mark Minervini Trading Strategy Which He Follows And Practice Regularly.

Web Learn What A Volatility Contraction Pattern Is And How To Use It To Trade Stocks.

Web Learn How To Use The Volatility Contraction Pattern (Vcp) Coined By Mark Minervini, A Professional Investor, To Trade Stocks In India.

Related Post: