Usury Laws Are Designed To Protect Consumers From

Usury Laws Are Designed To Protect Consumers From - The usury laws definition refers to laws that set caps on the amount of interest a lender can charge consumers. However, they normally limit the highest interest rate that may be imposed on loans. These usury laws (also known as interest rate. But these standards don’t necessarily apply to all credit types. But many states have loopholes in their laws, and the united states generally lacks national interest rate limits. And because usury laws are primarily regulated by individual states, they can vary depending on where you live. Usury laws specifically target the practice of charging excessively high rates on loans by setting caps. Usury laws aim to keep lenders in check by setting standards around the interest rates they can charge you. Web in a nutshell. Financial institutions employ strategies to circumvent usury laws, impacting their effectiveness. Financial institutions employ strategies to circumvent usury laws, impacting their effectiveness. On may 29, the office of the comptroller of the currency (occ) finalized a rule concerning federal banking regulation and state usury law that has pitted the financial industry against consumer advocacy groups. And because usury laws are primarily regulated by individual states, they can vary depending on where. Web the military lending act is a federal law that trumps state rules. The ongoing debate centers around the ability. For example, in california, the maximum legal amount a lender can charge for goods or money for family, household, or personal use is 10%. Web what is usury law? It requires that loans made to active duty military members or. Usury laws vary depending on the state you live in and by financial product. The usury laws definition refers to laws that set caps on the amount of interest a lender can charge consumers. Some states have no usury regulations, while others permit higher interest rates on certain loans. But many states have loopholes in their laws, and the united. Interest rate limits are the simplest, most effective way to stop predatory lending and unaffordable debt traps. On may 29, the office of the comptroller of the currency (occ) finalized a rule concerning federal banking regulation and state usury law that has pitted the financial industry against consumer advocacy groups. But these standards don’t necessarily apply to all credit types.. Web usury is the act of charging excessive interest rates on a loan. However, they normally limit the highest interest rate that may be imposed on loans. Web usury laws safeguard consumers by setting limits on interest rates for various loans. Web usury laws, also known as usury statutes, are regulations put in place to govern the maximum amount of. Web usury laws are put in place to protect consumers from being overcharged when they borrow money. The ongoing debate centers around the ability. These usury laws (also known as interest rate limits) are common. Usury laws aim to keep lenders in check by setting standards around the interest rates they can charge you. Delaware has passed a number of. Web in a nutshell. Credit cards represent one of the most notable exemptions. And because usury laws are primarily regulated by individual states, they can vary depending on where you live. Web usury laws are designed to protect consumers from these high interest rates, and the perpetual indebtedness that may result. In this guide, we’ll take a closer look at. For example, in california, the maximum legal amount a lender can charge for goods or money for family, household, or personal use is 10%. Web conventional theories of contract law do not satisfactorily account for laws that restrict contractual freedom, such as usury laws, the unconscionability and related doctrines, and certain bankruptcy laws. Financial institutions employ strategies to circumvent usury. Usury laws specifically target the practice of charging excessively high rates on loans by setting caps. Violations of usury laws, depending on the state, can result in criminal penalties and can also render the underlying loan void in the civil. Massachusetts has passed a number of laws designed to protect consumers and borrowers from exploitative lenders. But many states have. Web the word “usury” means an unethical lending practice, such as an excessively high interest rate. Web in a nutshell. Financial institutions employ strategies to circumvent usury laws, impacting their effectiveness. In this guide, we’ll take a closer look at what usury means and how state usury laws help protect. Massachusetts has passed a number of laws designed to protect. Violations of usury laws, depending on the state, can result in criminal penalties and can also render the underlying loan void in the civil. Web what is usury law? Financial institutions employ strategies to circumvent usury laws, impacting their effectiveness. The usury laws definition refers to laws that set caps on the amount of interest a lender can charge consumers. When you take out a loan, the lender will charge you an interest rate as payment for their service. Web usury laws, also known as usury statutes, are regulations put in place to govern the maximum amount of interest that can be charged on loans. Web usury laws by state often differ; Web conventional theories of contract law do not satisfactorily account for laws that restrict contractual freedom, such as usury laws, the unconscionability and related doctrines, and certain bankruptcy laws. Usury is another word for predatory lending, which is the act of imposing unfair and abusive loan terms on borrowers. Web usury is the act of charging excessive interest rates on a loan. For example, in california, the maximum legal amount a lender can charge for goods or money for family, household, or personal use is 10%. The ongoing debate centers around the ability. Usury laws specifically target the practice of charging excessively high rates on loans by setting caps. However, they normally limit the highest interest rate that may be imposed on loans. Massachusetts has passed a number of laws designed to protect consumers and borrowers from exploitative lenders. Web usury laws are designed to protect consumers from these high interest rates, and the perpetual indebtedness that may result.

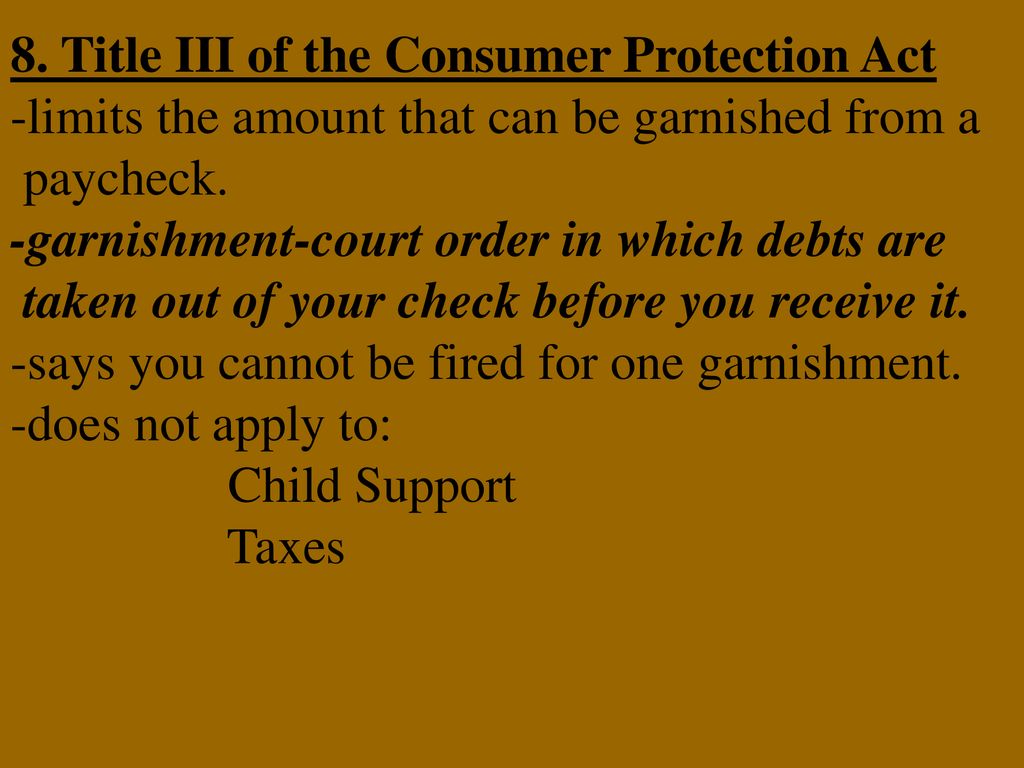

Gov’t Regulations of Credit *Usury Laws state laws ppt download

Chpt. 14 and 15 Agencies, Business Structures, Warranties, and Consumer

Consumer protection act 2019 Guarding interest of consumers Getlegal

PPT PDF/ READ Usury and Consumer Credit Regulation (Consumer Credit

Uniform Consumer Credit Code (UCCC) AwesomeFinTech Blog

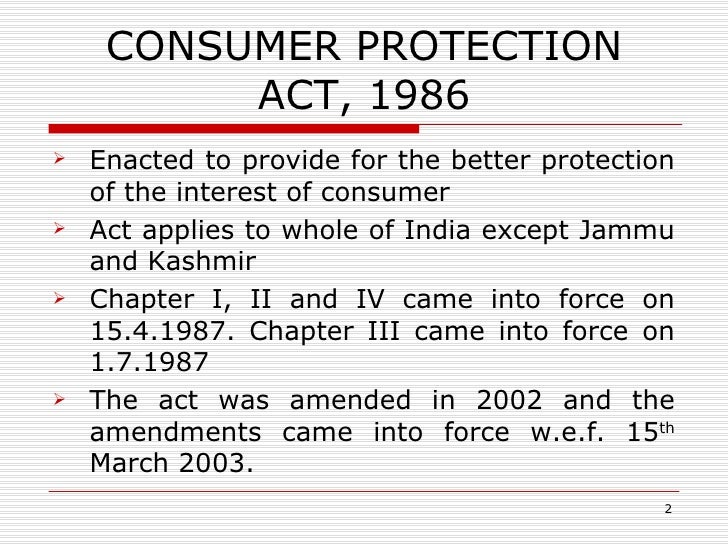

Consumer protection act, 1986

:max_bytes(150000):strip_icc()/GettyImages-1009414098-c26c444e8e314eecaf7394d4650594a2.jpg)

What Is Usury? Definition, How It Works, Legality, and Example

PPT CONSUMER PROTECTION ACT PowerPoint Presentation, free download

ANALYSIS OF CONSUMER PROTECTION ACT, 2019 A DICHOTOMY OF CONSUMER’S

PPT Consumer Protection Act 1986 PowerPoint Presentation, free

The Occ’s Rule Addresses The Scope Of A Federal Law Empowering National Banks To “Export” The Maximum Interest.

These Laws Are Designed To Protect Consumers From Being Charged Exorbitant Interest Rates That Could Lead To Debt Traps And Financial Hardship.

These Usury Laws (Also Known As Interest Rate Limits) Are Common.

Web The Military Lending Act Is A Federal Law That Trumps State Rules.

Related Post: