Tweezer Bottom Pattern

Tweezer Bottom Pattern - Typically, when the second candle forms, the price cannot break below the first candle and causes a tweezer breakout. The pattern is more important when there is a strong shift in momentum between the first candle and. It is recognized by the presence of two or more consecutive candlesticks with matching bottom prices. Web the tweezer bottom is a bullish reversal pattern seen on candlestick charts, typically at the end of a downtrend. The easiest way to visualize the tweezer bottom is by thinking of it as a shift in momentum. Web a tweezer bottom pattern consists of two candlesticks forming two valleys or support levels with equal bottoms. Web a tweezer bottom is a candlestick pattern that forms during a bearish trend reversal, typically consisting of two or more candles. Web a tweezer is a technical analysis pattern, commonly involving two candlesticks, that can signify either a market top or bottom. It consists of two candlesticks with equal lows, one appearing immediately after the other. Web a tweezers bottom occurs when two candles, back to back, occur with very similar lows. It is recognized by the presence of two or more consecutive candlesticks with matching bottom prices. Web a tweezers bottom occurs when two candles, back to back, occur with very similar lows. Typically, when the second candle forms, the price cannot break below the first candle and causes a tweezer breakout. Web the tweezer bottom pattern is a candlestick pattern. It consists of two candlesticks with equal lows, one appearing immediately after the other. It is recognized by the presence of two or more consecutive candlesticks with matching bottom prices. The pattern is more important when there is a strong shift in momentum between the first candle and. Web the tweezer bottom is a bullish reversal pattern seen on candlestick. The pattern is more important when there is a strong shift in momentum between the first candle and. It occurs when the market defends a low point, indicating a potential bullish reversal. Web a tweezer bottom is a candlestick pattern that forms during a bearish trend reversal, typically consisting of two or more candles. Web the tweezer bottom pattern is. It consists of two candlesticks and indicates a bullish reversal in a chart. The easiest way to visualize the tweezer bottom is by thinking of it as a shift in momentum. Web a tweezer is a technical analysis pattern, commonly involving two candlesticks, that can signify either a market top or bottom. The pattern is more important when there is. Web the tweezer bottom candlestick is a pattern that occurs on a candlestick chart of a financial instrument (like a stock or commodity). Web the tweezer bottom is a bullish reversal pattern seen on candlestick charts, typically at the end of a downtrend. This pattern can be seen as a reversal in a downtrend. Typically, when the second candle forms,. Web the tweezer bottom pattern is a candlestick pattern that every trader should have in their toolbox. Web the tweezer bottom candlestick is a pattern that occurs on a candlestick chart of a financial instrument (like a stock or commodity). The easiest way to visualize the tweezer bottom is by thinking of it as a shift in momentum. Web a. Web a tweezer bottom is a candlestick pattern that forms during a bearish trend reversal, typically consisting of two or more candles. The easiest way to visualize the tweezer bottom is by thinking of it as a shift in momentum. Web a tweezer bottom pattern consists of two candlesticks forming two valleys or support levels with equal bottoms. Web the. This pattern can be seen as a reversal in a downtrend. It occurs when the market defends a low point, indicating a potential bullish reversal. Web the tweezer bottom candlestick is a pattern that occurs on a candlestick chart of a financial instrument (like a stock or commodity). Web a tweezer bottom pattern consists of two candlesticks forming two valleys. Web a tweezers bottom occurs when two candles, back to back, occur with very similar lows. Web the tweezer bottom candlestick is a pattern that occurs on a candlestick chart of a financial instrument (like a stock or commodity). The pattern is more important when there is a strong shift in momentum between the first candle and. Web a tweezer. Web a tweezers bottom occurs when two candles, back to back, occur with very similar lows. Web a tweezer bottom is a candlestick pattern that forms during a bearish trend reversal, typically consisting of two or more candles. Web a tweezer bottom pattern consists of two candlesticks forming two valleys or support levels with equal bottoms. It consists of two. It consists of two candlesticks with equal lows, one appearing immediately after the other. Web a tweezers bottom occurs when two candles, back to back, occur with very similar lows. The easiest way to visualize the tweezer bottom is by thinking of it as a shift in momentum. Web a tweezer bottom is a candlestick pattern that forms during a bearish trend reversal, typically consisting of two or more candles. Web a tweezer bottom pattern consists of two candlesticks forming two valleys or support levels with equal bottoms. It consists of two candlesticks and indicates a bullish reversal in a chart. Typically, when the second candle forms, the price cannot break below the first candle and causes a tweezer breakout. Web a tweezer is a technical analysis pattern, commonly involving two candlesticks, that can signify either a market top or bottom. It occurs when the market defends a low point, indicating a potential bullish reversal. The pattern is more important when there is a strong shift in momentum between the first candle and. Web the tweezer bottom pattern is a candlestick pattern that every trader should have in their toolbox. It is recognized by the presence of two or more consecutive candlesticks with matching bottom prices.

Tweezer Bottom Candlestick Chart Pattern Japanese Can vrogue.co

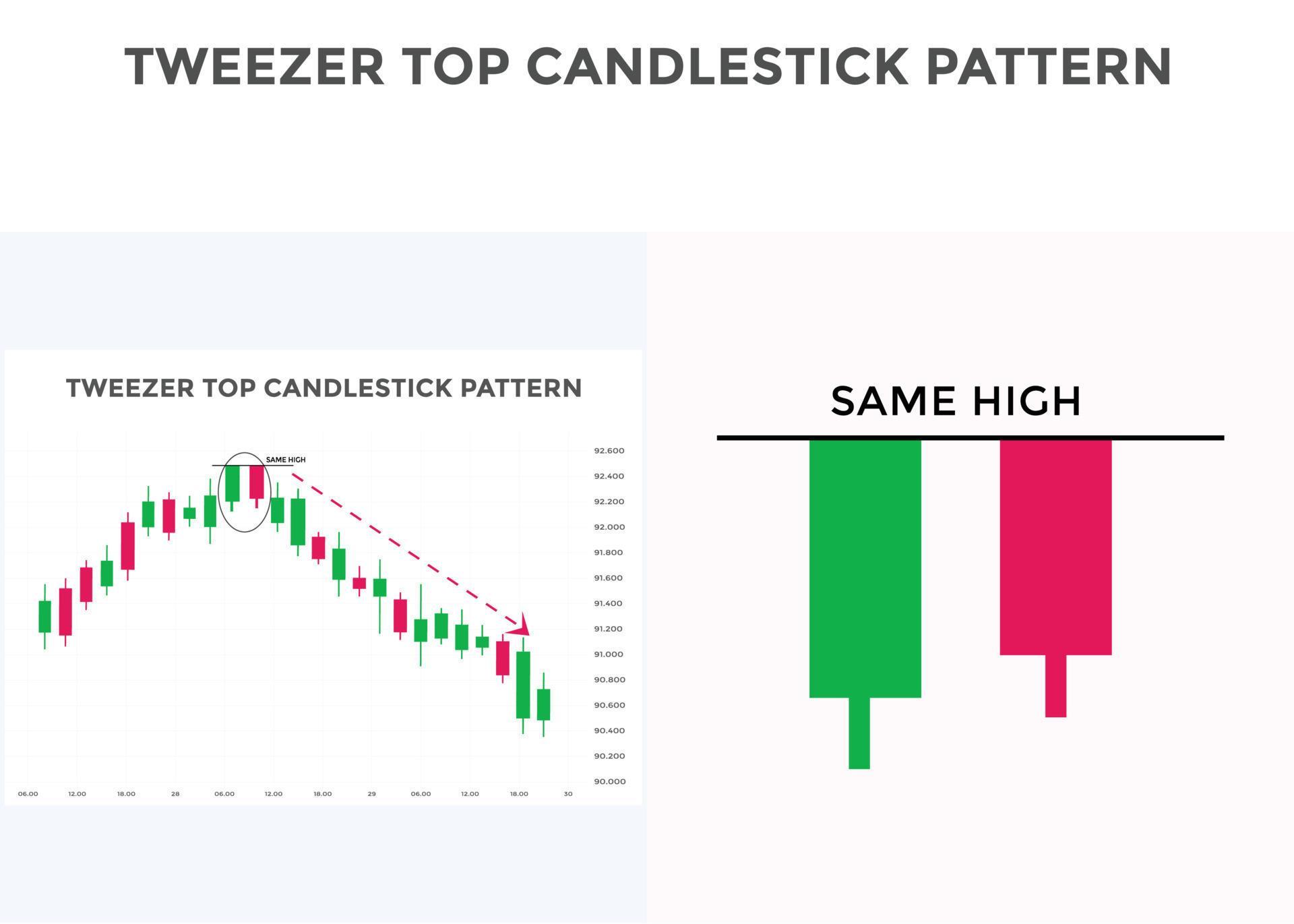

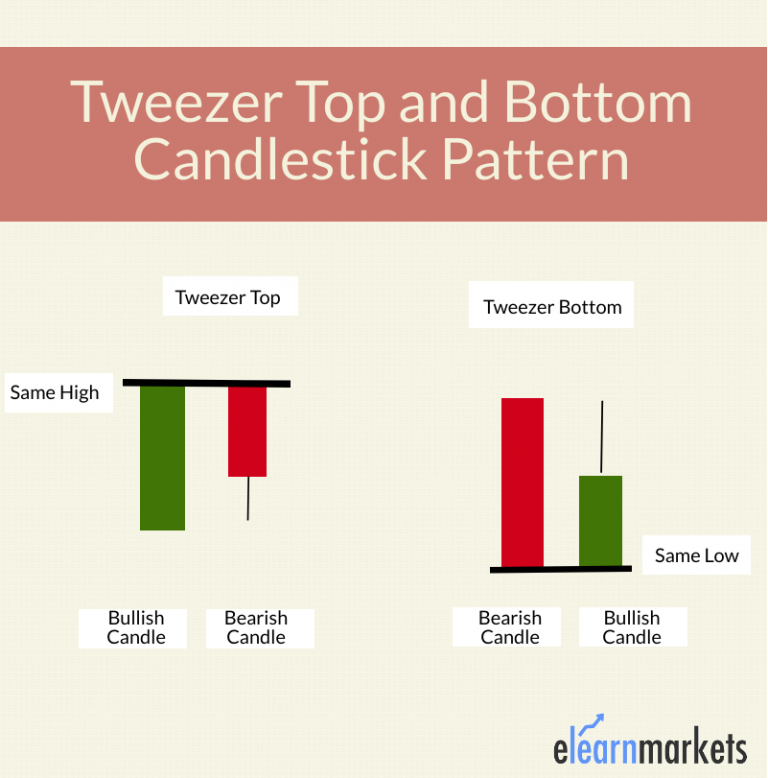

What are Top & Bottom Tweezer Candlestick Explained ELM

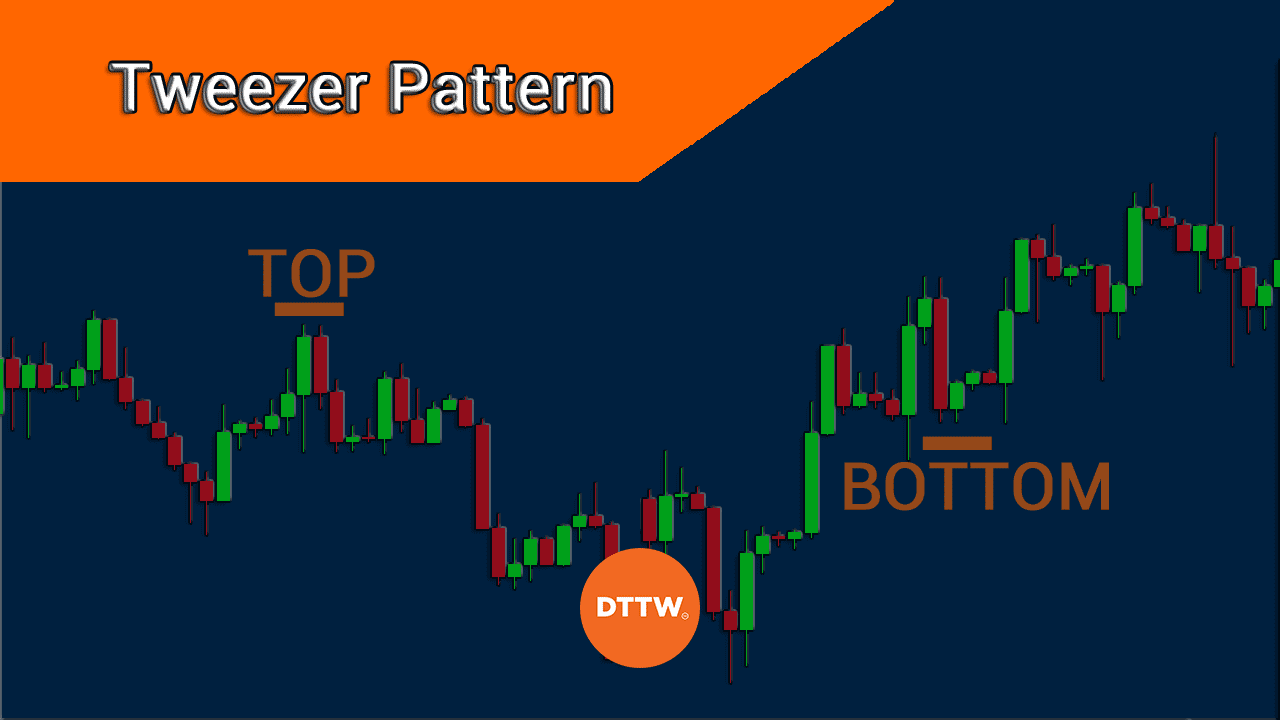

How To Trade Blog What Are Tweezer Tops And Tweezer Bottoms? Meaning

Learn About Tweezer Candlestick Patterns Today ThinkMarkets

Bearish Tweezer How To Read Tweezer Top & Bottom Candlestick YouTube

Tweezer bottom candlestick chart pattern. Japanese candlesticks pattern

Tweezer Bottom Patterns How To Trade Them Easily

Tweezer Top And Bottom Candlestick Patterns Hindi Urdu, CryptoCurrency

Tweezer Top and Bottom Explained! Spot and Trade with Them DTTW™

Tweezer Bottom Candlestick Pattern Meaning & Importance Finschool

This Pattern Can Be Seen As A Reversal In A Downtrend.

Web The Tweezer Bottom Candlestick Is A Pattern That Occurs On A Candlestick Chart Of A Financial Instrument (Like A Stock Or Commodity).

Web The Tweezer Bottom Is A Bullish Reversal Pattern Seen On Candlestick Charts, Typically At The End Of A Downtrend.

Related Post: