Trust Accounting Template California

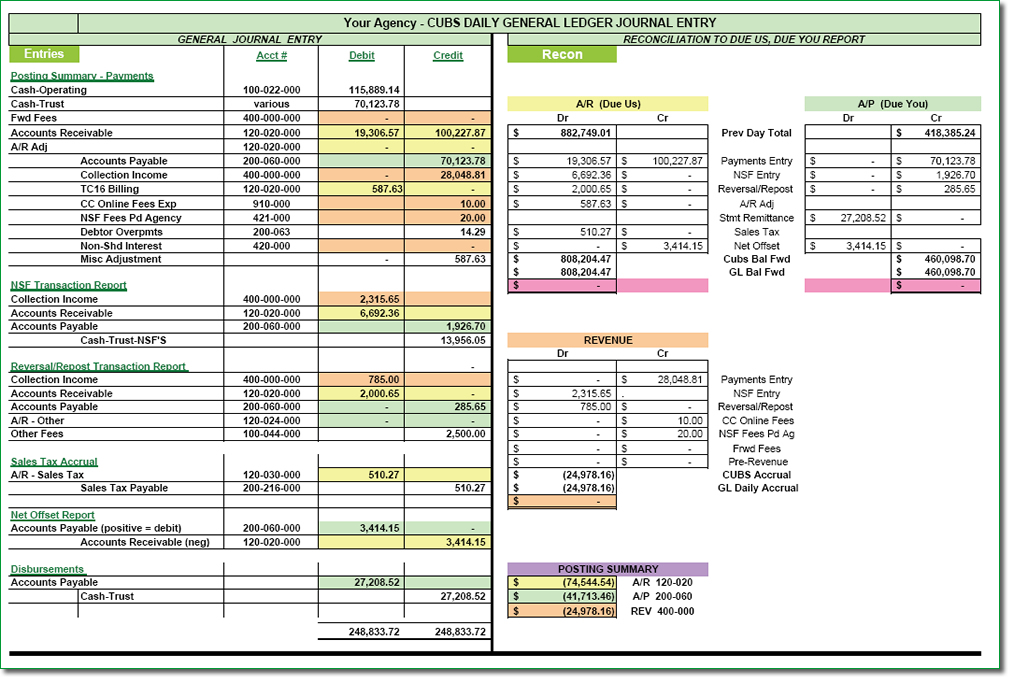

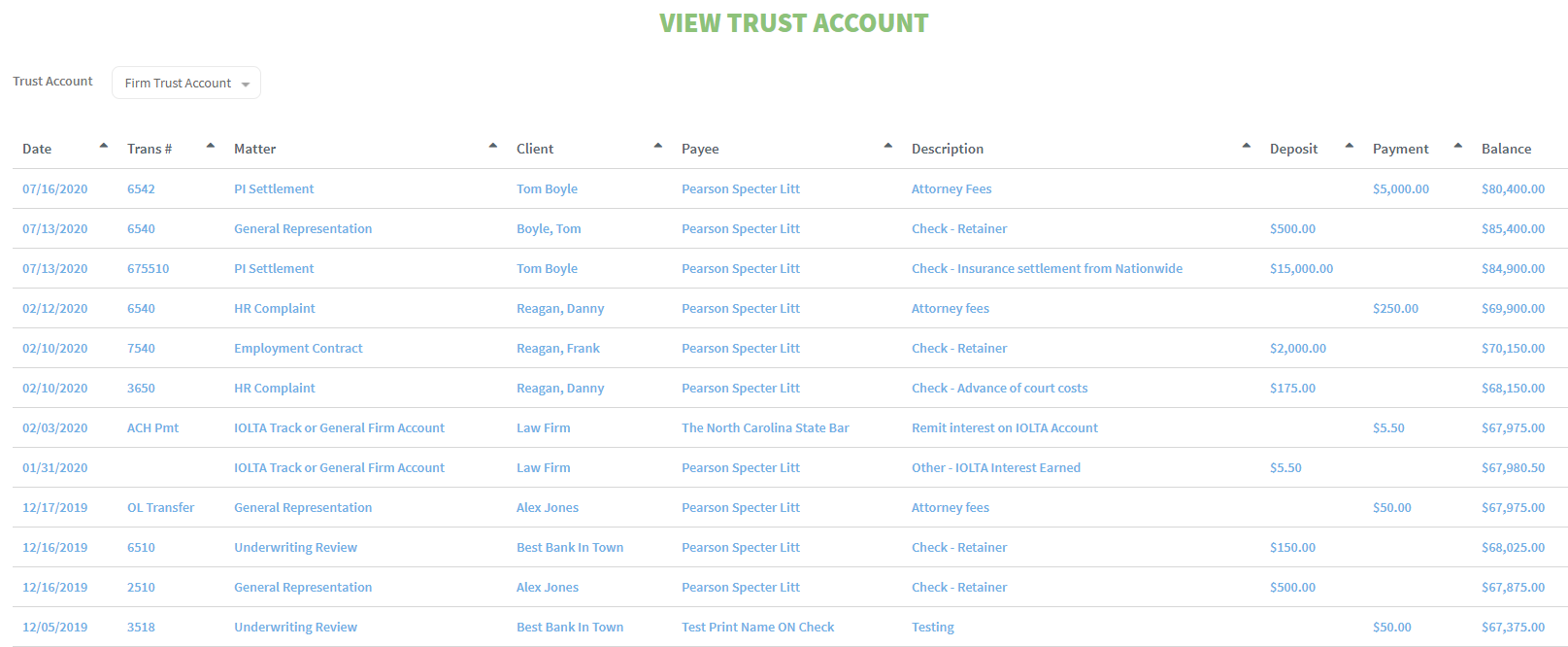

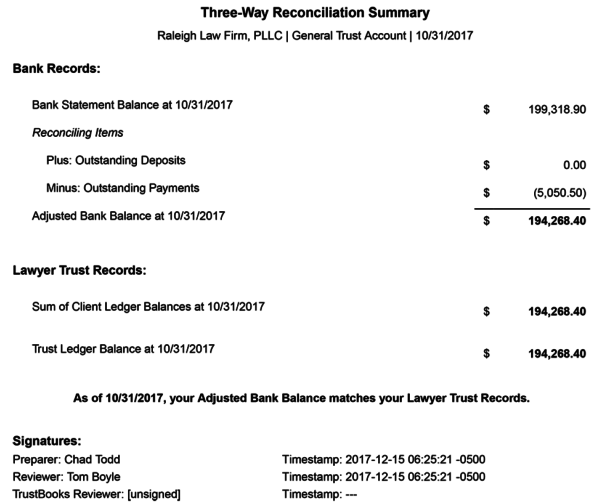

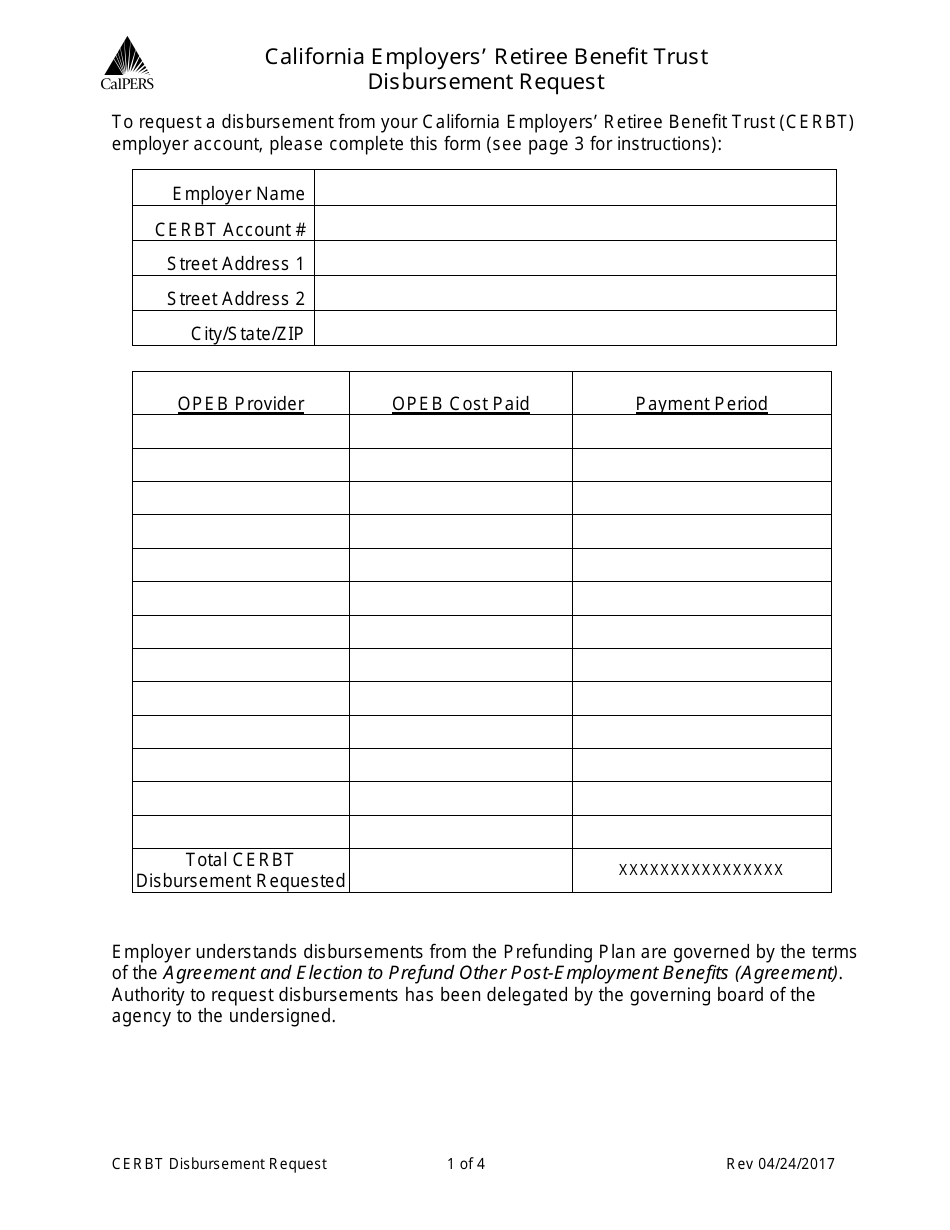

Trust Accounting Template California - In the golden state a trust accounting is needed yearly and is headed by the trustee. Web the practice guide for fiduciary (trust) accounting is designed to provide information on subjects covered for “best practice” guidelines, and is not the final. Below is a breakdown of each. Insight into the rules and best practices to keep you compliant. Under california probate code §16060, a trustee has a duty to. The formal requirements for a trust accounting can be. Download a sample fiduciary accounting prepared for a special needs trust. Web fiduciary accounting report samples. 100% money back guaranteeonline customers support Web sometimes trustees refuse to provide beneficiaries with financial information. 1) to check the status of trust assets; Web the following templates and guides for client trust accounting were created by the state bar to assist attorneys with bookkeeping and client trust account reconciliation. Web trust accountings start with the charges—those are the list of things that come into the trustee’s possession (what the trustee is charged with possessing). A. Onesource trust & estate administration provides software and services for fiduciary tax, court accounting, estate. Under california probate code §16060, a trustee has a duty to. Web the following two sample trust account review (tar) reports are being provided solely as a guideline to assist threshold brokers and their accountants in complying with business. At this year’s annual meeting, one. Information on the client trust account protection program. Web a trust accounting should meet the california probate code requirements, but preparing a trust accounting can be tedious and very complicated. Web the following templates and guides for client trust accounting were created by the state bar to assist attorneys with bookkeeping and client trust account reconciliation. Web the most basic. Web explore the comprehensive and compliant trust accounting template california for seamless management of trust transactions, audits, and beneficiary updates. 1) to check the status of trust assets; Web understanding how to do a trust accounting in california is only part of the battle. Web the following two sample trust account review (tar) reports are being provided solely as a. At this year’s annual meeting, one of our members asked if asb would provide some spreadsheets for trust. Web understanding how to do a trust accounting in california is only part of the battle. Below is a breakdown of each. Free1 price all apps includedconsulte nuestras tarifaseasy to use Web the following templates and guides for client trust accounting were. And 2) to determine if the trustee is acting within his or her discretion or has. Web the two primary reasons to compel an account are: Web the first step to understanding the trust rules and your responsibility is to review the seven key concepts in client trust accounting. 100% money back guaranteeonline customers support Web the practice guide for. Web a trust accounting should meet the california probate code requirements, but preparing a trust accounting can be tedious and very complicated. Web explore the comprehensive and compliant trust accounting template california for seamless management of trust transactions, audits, and beneficiary updates. Web providing accounting services to professional fiduciaries, probate attorneys & individuals since 2002. Free1 price all apps includedconsulte. Web learn how to administer a trust in california effectively with our comprehensive checklist, covering trustee responsibilities, asset management, and legal. What that accounting is and when it is required is. Web the following templates and guides for client trust accounting were created by the state bar to assist attorneys with bookkeeping and client trust account reconciliation. Web the first. Insight into the rules and best practices to keep you compliant. Ensuring that your accounting includes all the necessary information and. Web the following two sample trust account review (tar) reports are being provided solely as a guideline to assist threshold brokers and their accountants in complying with business. Web learn how to administer a trust in california effectively with. At this year’s annual meeting, one of our members asked if asb would provide some spreadsheets for trust. Web trust accountings start with the charges—those are the list of things that come into the trustee’s possession (what the trustee is charged with possessing). Web in california, a trustee is required to account to the beneficiaries as to the activities of. 100% money back guaranteeonline customers support Free1 price all apps includedconsulte nuestras tarifaseasy to use The formal requirements for a trust accounting can be. Under california probate code §16060, a trustee has a duty to. Web what is a waiver of trust accounting? In california, trustees have a legal responsibility to ensure they keep beneficiaries informed of activities relating to trust. Insight into the rules and best practices to keep you compliant. Web 2023 handbook on client trust accounting for california attorneys (pdf) client trust account school. Gain a complete understanding of the state bar of california trust rules. Form search engineedit on any devicecancel anytime And 2) to determine if the trustee is acting within his or her discretion or has. Web the following templates and guides for client trust accounting were created by the state bar to assist attorneys with bookkeeping and client trust account reconciliation. Web understanding how to do a trust accounting in california is only part of the battle. Web the following two sample trust account review (tar) reports are being provided solely as a guideline to assist threshold brokers and their accountants in complying with business. Web explore the comprehensive and compliant trust accounting template california for seamless management of trust transactions, audits, and beneficiary updates. Web in california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply.

Trust Accounting Template California

Trust Accounting Template California

Trust Accounting Template California

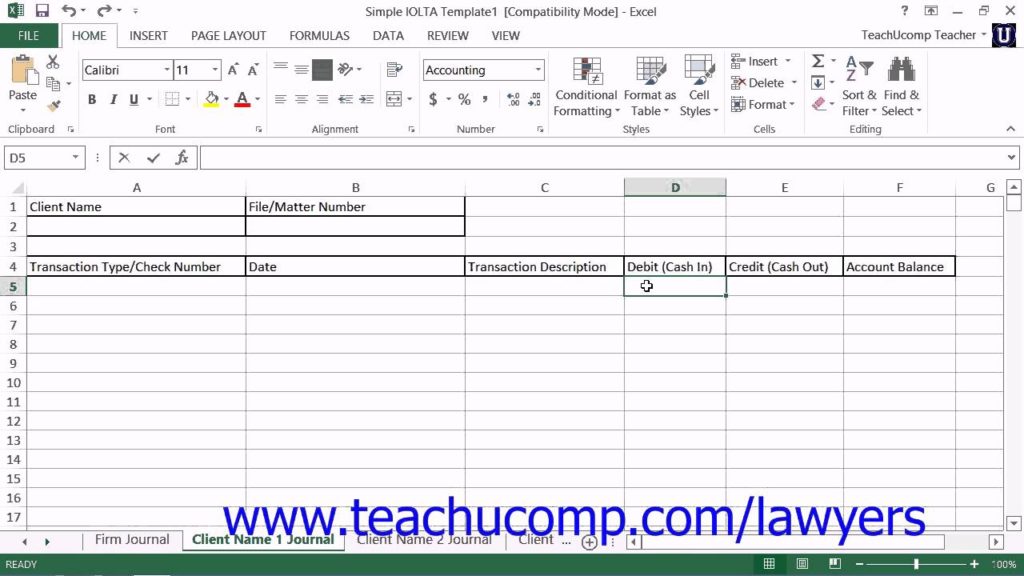

Trust Accounting Excel Template California

Trust Accounting Excel Template California

California Trust Accounting Software TrustBooks

Trust Accounting Template California

Trust Accounting Excel Template California

Trust Accounting Excel Template California

Trust Accounting Excel Template California

Web If Your Trust Is Governed By An Instrument Contained Within The Last Will Of The Trust’s Grantor, You May File Annual Accounts With The Probate Court.

In The Golden State A Trust Accounting Is Needed Yearly And Is Headed By The Trustee.

Web Trust Accountings Start With The Charges—Those Are The List Of Things That Come Into The Trustee’s Possession (What The Trustee Is Charged With Possessing).

1) To Check The Status Of Trust Assets;

Related Post: