Triple Top Stock Chart Pattern

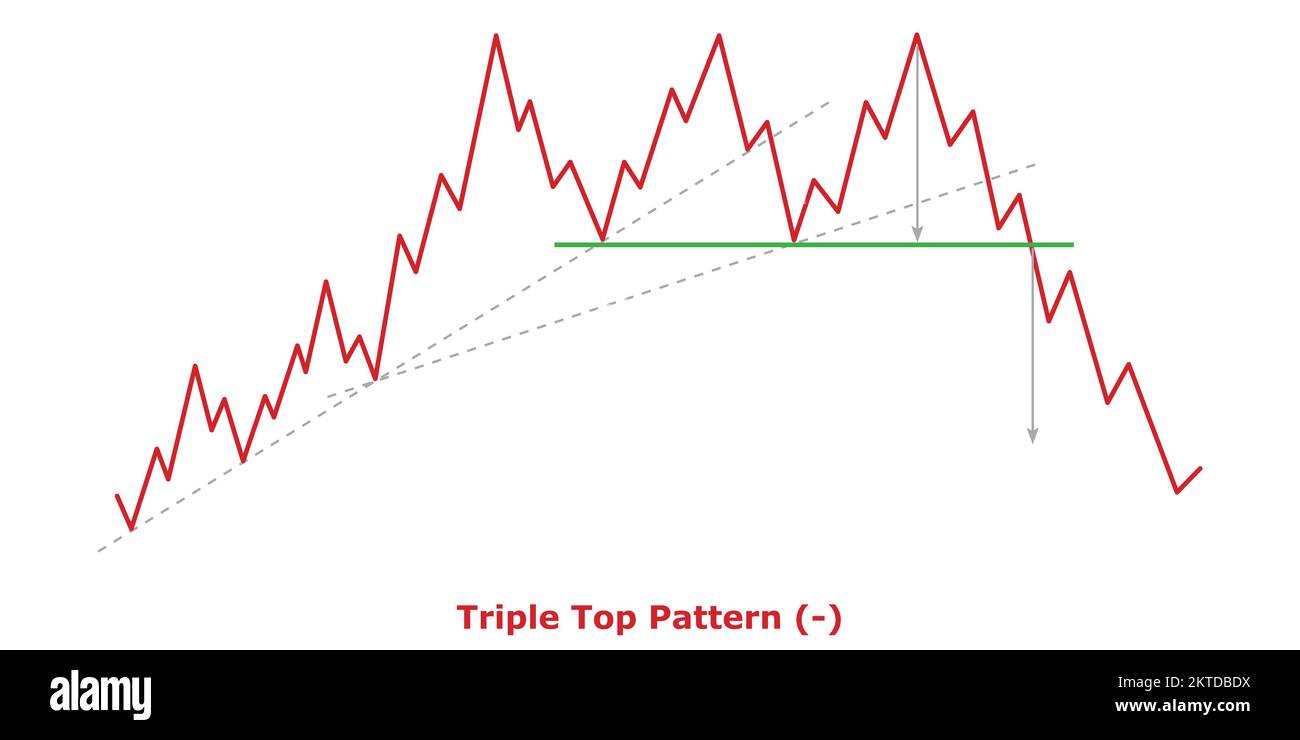

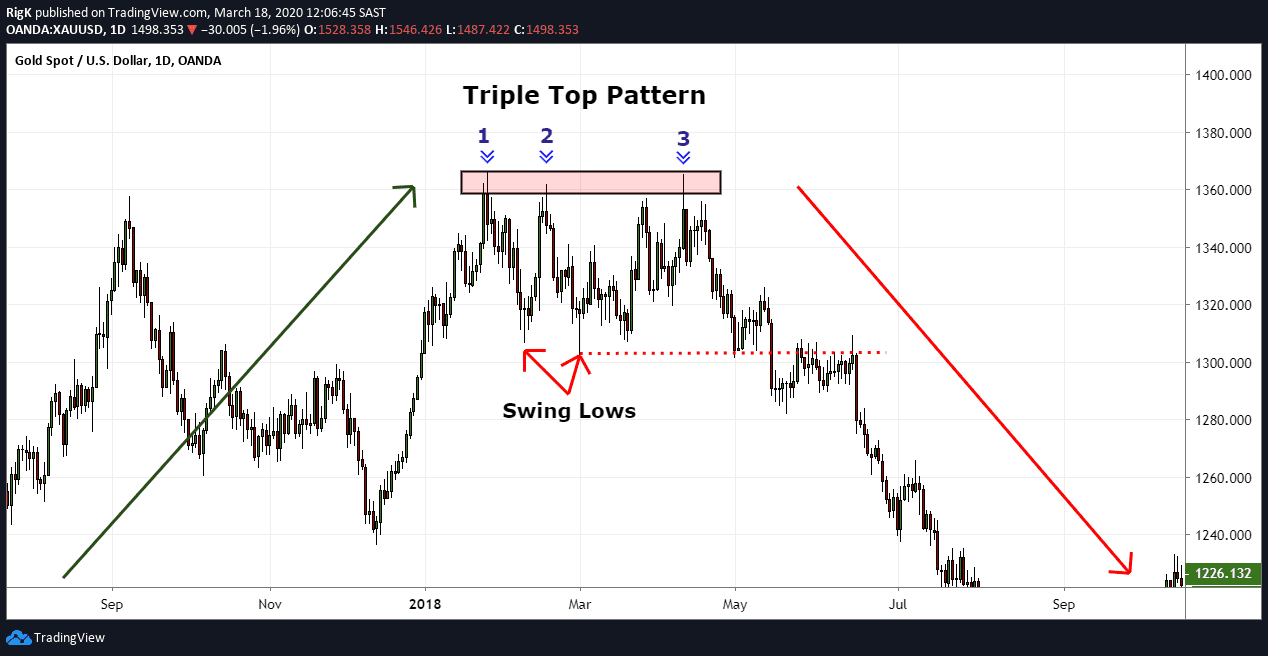

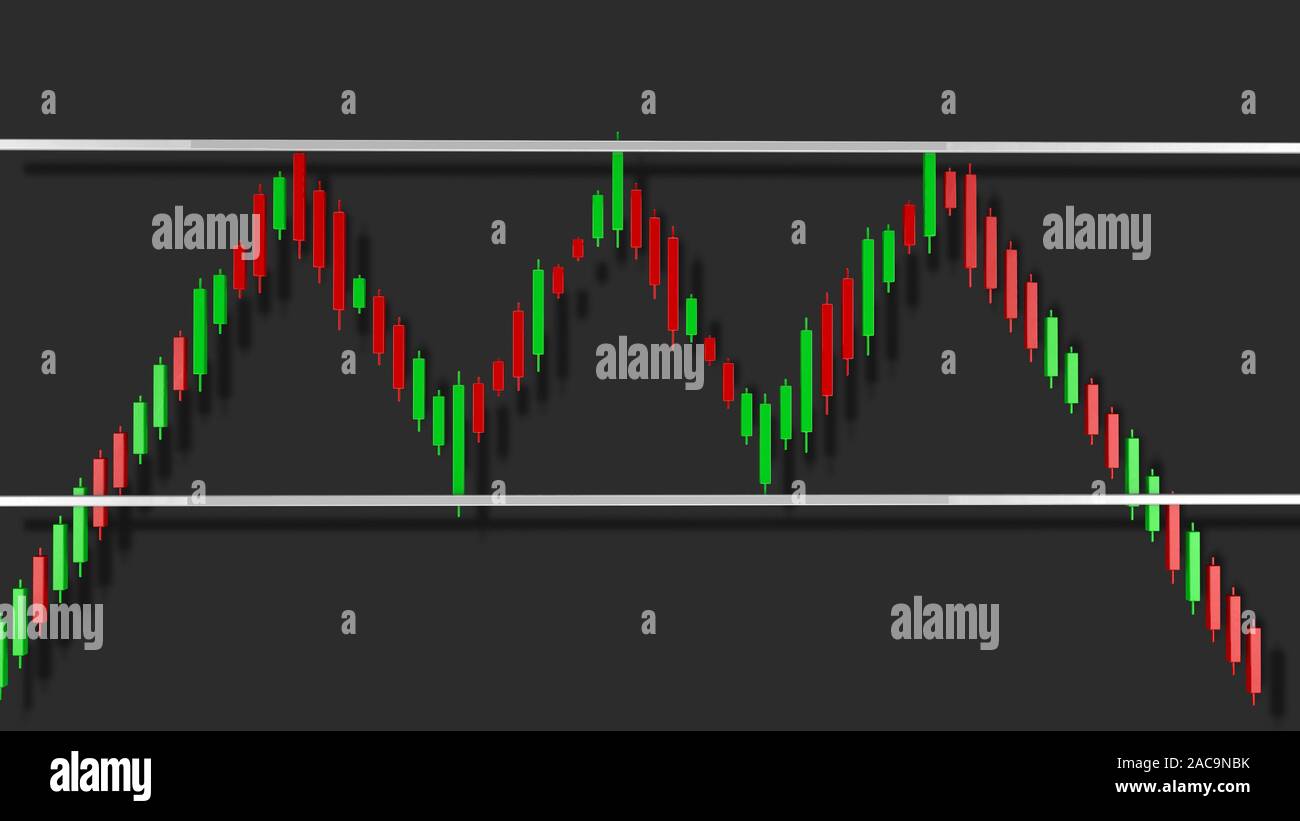

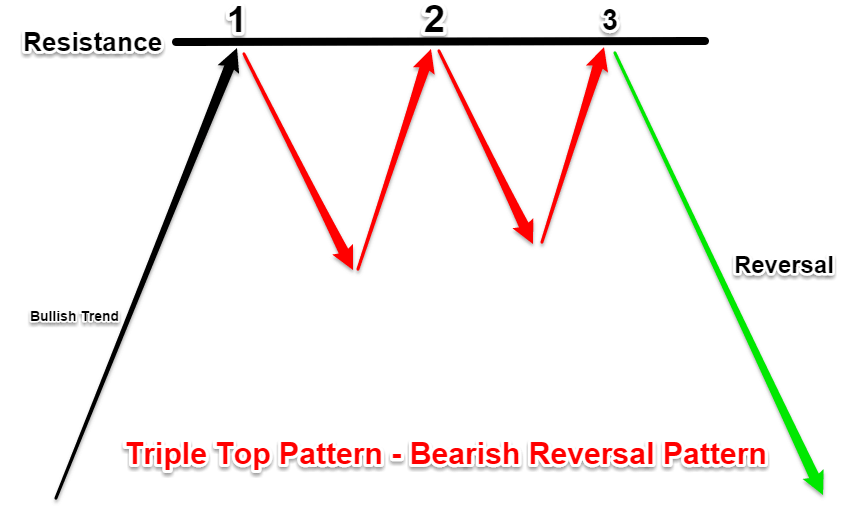

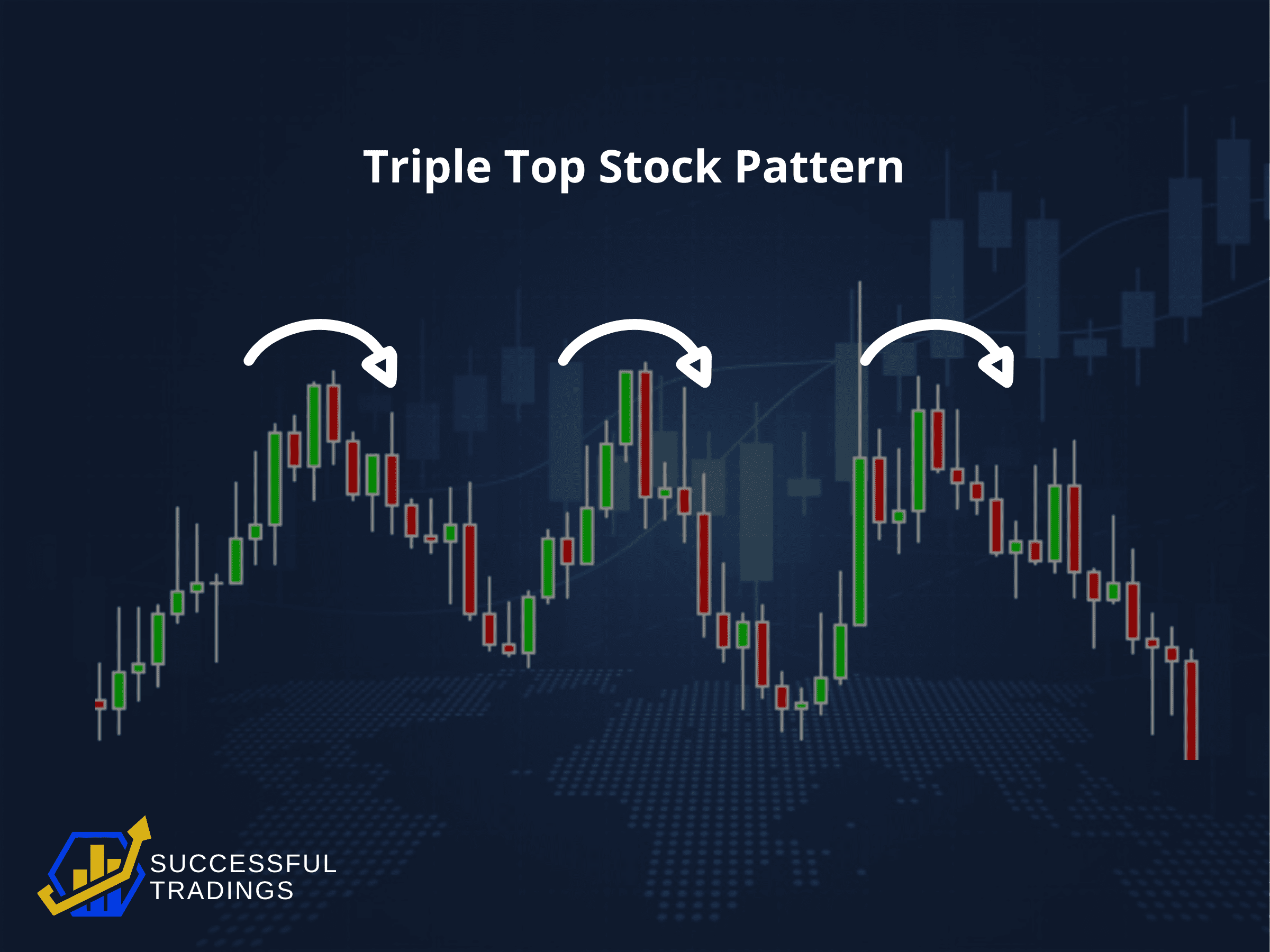

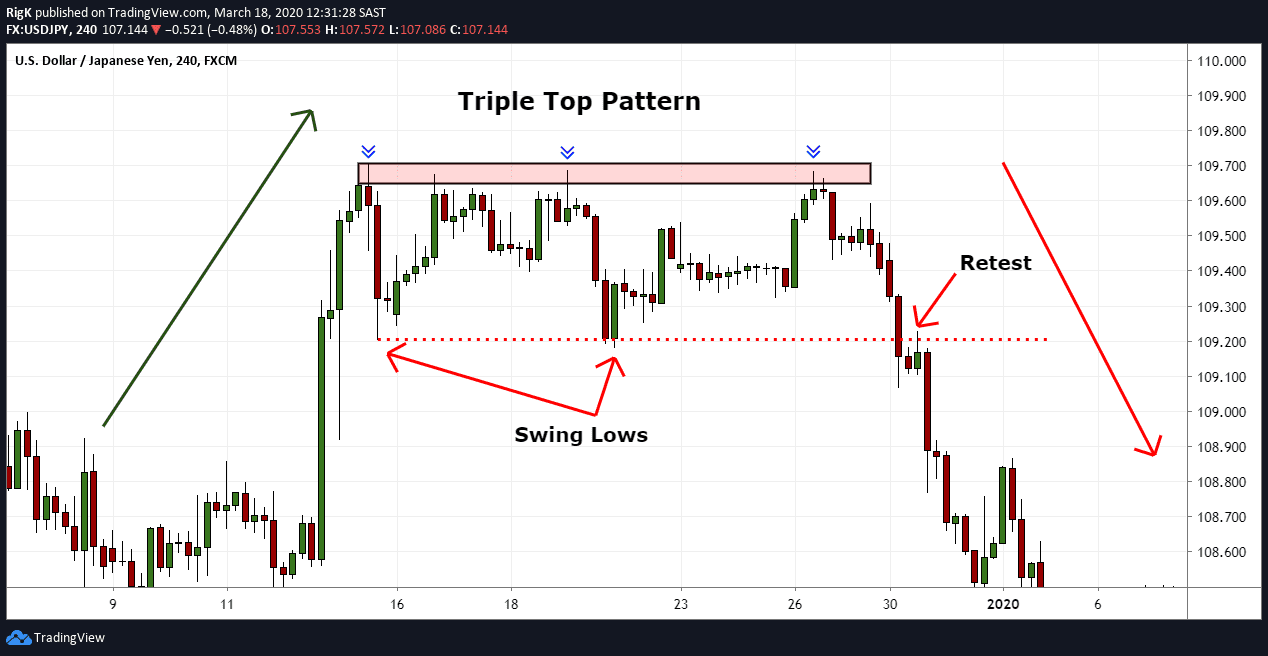

Triple Top Stock Chart Pattern - When demand outweighs supply over a period of time prices. Web these patterns are bearish reversal patterns found on stock charts. It is straightforward and it is defined by three clear. Web the triple top chart pattern is a key formation in technical analysis, known for signaling potential reversals in bullish trends. But the stock has moved higher and may continue to do so. It suggests a potential shift in market sentiments from bullish to bearish. Because it presents itself in the form of. Web put simply, the triple top stock pattern indicates a potential shift from an uptrend to a downtrend, signaling that bullish momentum may be ending. Treasury yield curve first inverted in october 2022 is about to do something it hasn't. In most cases, this is one of the most bearish chart patterns. In most cases, this is one of the most bearish chart patterns. The stock has formed a. Web triple top offers one of the bets methods to have a look at the major resistance level for a stock. Web triple tops chart pattern. Trade stocks and etfsimprove how you investcompare rates, find deals The stock has formed a. Web using chart patterns to trade penny stocks can be a highly effective strategy for maximizing profits. Web the method we've used to track the probability of recession in the u.s. Triple top patterns are similar looking to. Web the triple top pattern is a bearish reversal pattern that occurs at the end of an. Triple tops are similar to double tops and comprise three peaks of similar height. The boeing company (nyse:ba) reported earnings that were well short of estimates. The stock has formed a. Web a triple top pattern is a very reliable stock chart pattern used in stock market technical analysis charts. The formation shows the 3 major high's of the stock. The stock has formed a. In classical chart patterns, the head and shoulders top is a highly recognizable and widely accepted bearish reversal. Web a triple top or triple bottom pattern is a chart feature which traders of an asset, such as bitcoin (btc), ethereum (eth) or other cryptoassets, can use to catch major trend. Trade stocks and etfsimprove how. Entry 1 at the third. Web head and shoulders pattern: Web using chart patterns to trade penny stocks can be a highly effective strategy for maximizing profits. Web the triple top pattern is a bearish reversal that forms after a long uptrend. Nvidia's chart shows the stock has cleared a 92.22 buy point. An a++ triple top reversal is composed of three rounded tops. In this pattern, the price reaches a high point. Web triple top offers one of the bets methods to have a look at the major resistance level for a stock. Because it presents itself in the form of. Web the triple top pattern is a bearish reversal that forms. Web chart patterns are a good way of telling when to buy or sell a stock. Web the triple top pattern is a bearish reversal that forms after a long uptrend. An a++ triple top reversal is composed of three rounded tops. It suggests a potential shift in market sentiments from bullish to bearish. Web these patterns are bearish reversal. Web head and shoulders pattern: It is straightforward and it is defined by three clear. Treasury yield curve first inverted in october 2022 is about to do something it hasn't. But the stock has moved higher and may continue to do so. This pattern is typical in stock trading, forex. Treasury yield curve first inverted in october 2022 is about to do something it hasn't. An a++ triple top reversal is composed of three rounded tops. Web triple top is a reversal pattern formed by three consecutive highs that are at the same level (a slight difference in price values is allowed) and two intermediate lows between. Web chart patterns. It suggests a potential shift in market sentiments from bullish to bearish. Web triple top is a reversal pattern formed by three consecutive highs that are at the same level (a slight difference in price values is allowed) and two intermediate lows between. This pattern is typical in stock trading, forex. Entry 1 at the third. Web chart patterns are. This pattern is typical in stock trading, forex. It is considered a bearish. Web triple top offers one of the bets methods to have a look at the major resistance level for a stock. The boeing company (nyse:ba) reported earnings that were well short of estimates. Generally speaking price charts are nothing more than a series of swing highs and swing lows. Web a triple top pattern is a very reliable stock chart pattern used in stock market technical analysis charts. Triple top patterns are similar looking to. But the stock has moved higher and may continue to do so. In most cases, this is one of the most bearish chart patterns. Because it presents itself in the form of. The stock is already extended, according to ibd. Mastering this pattern can significantly improve your. Web head and shoulders pattern: Treasury yield curve first inverted in october 2022 is about to do something it hasn't. Web the method we've used to track the probability of recession in the u.s. Web triple top is a reversal pattern formed by three consecutive highs that are at the same level (a slight difference in price values is allowed) and two intermediate lows between.

Triple Top Pattern Bearish () Green & Red Bearish Reversal Chart

Triple Top Pattern Explained Stock Chart Patterns

Triple Top Pattern A Guide by Experienced Traders

Triple Top Stock Chart Pattern 3D Illustration Stock Photo Alamy

The Complete Guide to Triple Top Chart Pattern

Trading the Triple Top Stock Chart Pattern India Dictionary

Triple Top Stock Chart Pattern 3D Illustration Stock Photo Alamy

Triple Top Stock Pattern Explained In Simple Terms

Triple Top Pattern A Guide by Experienced Traders

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)

Triple Top What It Is, How It Works, and Examples

Web The Triple Top Chart Pattern Is A Key Formation In Technical Analysis, Known For Signaling Potential Reversals In Bullish Trends.

Nvidia's Chart Shows The Stock Has Cleared A 92.22 Buy Point.

It Suggests A Potential Shift In Market Sentiments From Bullish To Bearish.

An A++ Triple Top Reversal Is Composed Of Three Rounded Tops.

Related Post: