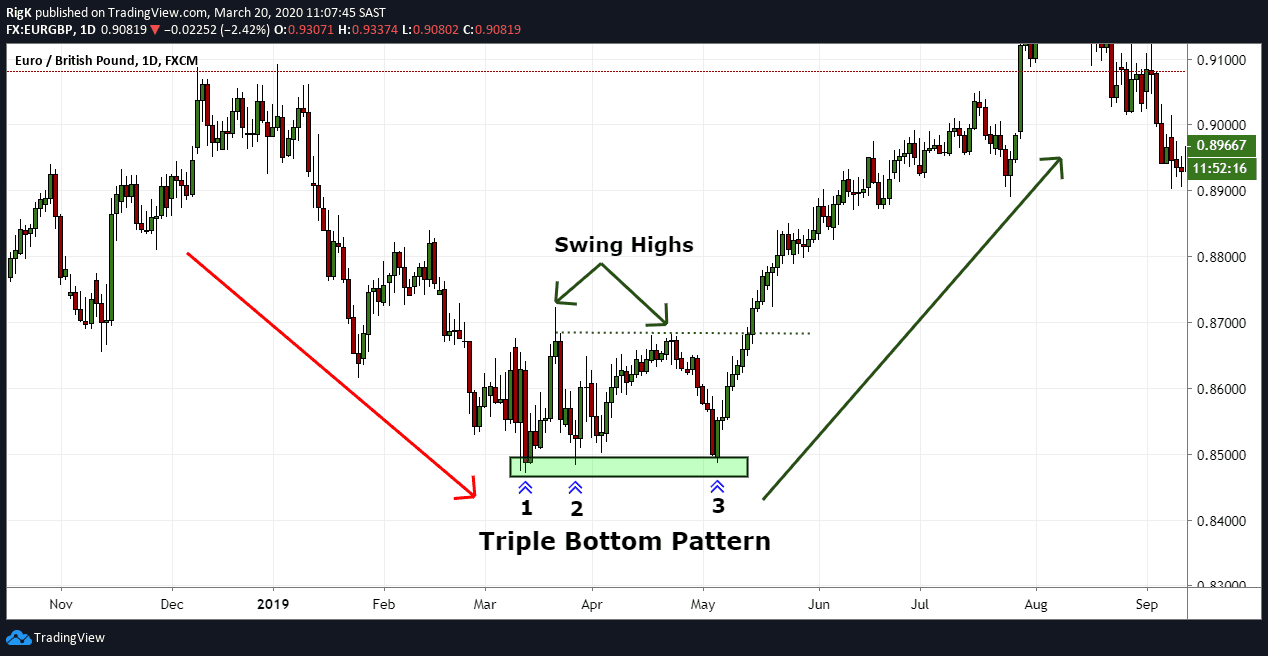

Triple Bottom Chart

Triple Bottom Chart - In this article, we will focus on. The pattern appears on a price chart as three. The pattern appears on a price chart as three. Web triple bottom chart patterns are easy to identify and, if seen, can be readily used as an aspect of technical analysis to develop a trading strategy. Web this is why in this training guide you’ll learn: Much like its twin, the triple top pattern, it. The chart pattern is categorized as a bullish reversal pattern. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web a triple bottom is a chart pattern that consists of three equal lows followed by a break above resistance. In this article, we will focus on. Web triple bottom chart patterns are easy to identify and, if seen, can be readily used as an aspect of technical analysis to develop a trading strategy. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. The. Web the triple bottom is a bullish reversal chart pattern that could be an indication that sellers (bears) are losing control of a downtrend and that buyers (bulls). Web triple top and triple bottom patterns are the types of reversal chart patterns. Web a triple bottom is a chart pattern that consists of three equal lows followed by a break. This candlestick pattern suggests an impending change in the trend. The pattern appears on a price chart as three. Web this is why in this training guide you’ll learn: Web the triple bottom chart pattern is a technical analysis trading strategy in which the trader attempts to identify a reversal point in the market. Web the official site of major. Web the triple bottom is a bullish reversal chart pattern that could be an indication that sellers (bears) are losing control of a downtrend and that buyers (bulls). The triple bottom chart pattern is. The pattern appears on a price chart as three. The chart pattern is categorized as a bullish reversal pattern. In this article, we will focus on. In this article, we will focus on. The triple bottom chart pattern is. Web this is why in this training guide you’ll learn: It consists of 3 swing low levels in the. Web a triple bottom pattern is a specific chart formation that becomes apparent when a security’s price tests the support level three times, each time bouncing back. The chart pattern is categorized as a bullish reversal pattern. It appears rarely, but it always warrants consideration, as it is. Web this is why in this training guide you’ll learn: Web a triple bottom pattern is a bullish reversal chart pattern that is formed at the end of a downtrend. Web the triple bottom chart pattern is a powerful. Web the official site of major league baseball Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. It consists of 3 swing low levels in the. Web a triple bottom is a chart pattern used for technical analysis, which shows the buyers are taking control of the price action from the sellers.. Web this is why in this training guide you’ll learn: Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web triple bottom is a reversal pattern formed by three consecutive lows that are at the same level (a slight difference in price values is. Web this article delves into the application of classic chart patterns in financial markets, emphasizing their significance as technical analysis tools for uncovering price movement. It consists of 3 swing low levels in the. The triple bottom chart pattern is. Web the triple bottom is a bullish reversal chart pattern that could be an indication that sellers (bears) are losing. Web a triple bottom is a bullish reversal chart pattern found at the end of a bearish trend and signals a shift in momentum. The triple bottom chart pattern is. Web this article delves into the application of classic chart patterns in financial markets, emphasizing their significance as technical analysis tools for uncovering price movement. Web the triple bottom trading. The pattern appears on a price chart as three. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web triple bottom is a reversal pattern formed by three consecutive lows that are at the same level (a slight difference in price values is allowed) and two intermediate highs between. How not to approach triple bottoms (and what you should do. Web a triple bottom is a bullish reversal chart pattern found at the end of a bearish trend and signals a shift in momentum. Web a triple bottom is a chart pattern used for technical analysis, which shows the buyers are taking control of the price action from the sellers. Web continuation patterns signal that an asset’s price will keep rising while reversals are signs that the asset will start a new trend. Web in technical analysis, a triple bottom is a bullish reversal chart pattern that forms on the price charts of financial markets. The chart pattern is categorized as a bullish reversal pattern. The triple bottom chart pattern is. Web this is why in this training guide you’ll learn: Web the triple bottom chart pattern is a powerful indicator in technical analysis, often signaling the reversal of a bearish trend. It appears rarely, but it always warrants consideration, as it is. Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. Web the triple bottom is a bullish reversal chart pattern that could be an indication that sellers (bears) are losing control of a downtrend and that buyers (bulls). Web a triple bottom pattern is a specific chart formation that becomes apparent when a security’s price tests the support level three times, each time bouncing back.

The Triple Bottom Candlestick Pattern ThinkMarkets AU

Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Bottom_Definition_Jun_2020-01-38534512050d4a0a8e7cefc9ebb3509f.jpg)

What Is a Triple Bottom Chart in Technical Analysis?

How To Trade Triple Bottom Chart Pattern TradingAxe

Chart Pattern Triple Bottom — TradingView

The Triple Bottom Pattern is a bullish chart pattern. It occurs

The Complete Guide to Triple Bottom Trading Pattern Pro Trading School

Triple Bottom Pattern Explanation and Examples

Triple Bottom Chart Pattern Trading charts, Stock trading strategies

How To Trade Triple Bottom Chart Pattern TradingAxe

The Pattern Appears On A Price Chart As Three.

In This Article, We Will Focus On.

Web Triple Top And Triple Bottom Patterns Are The Types Of Reversal Chart Patterns.

This Candlestick Pattern Suggests An Impending Change In The Trend.

Related Post: