Triangle Trading Pattern

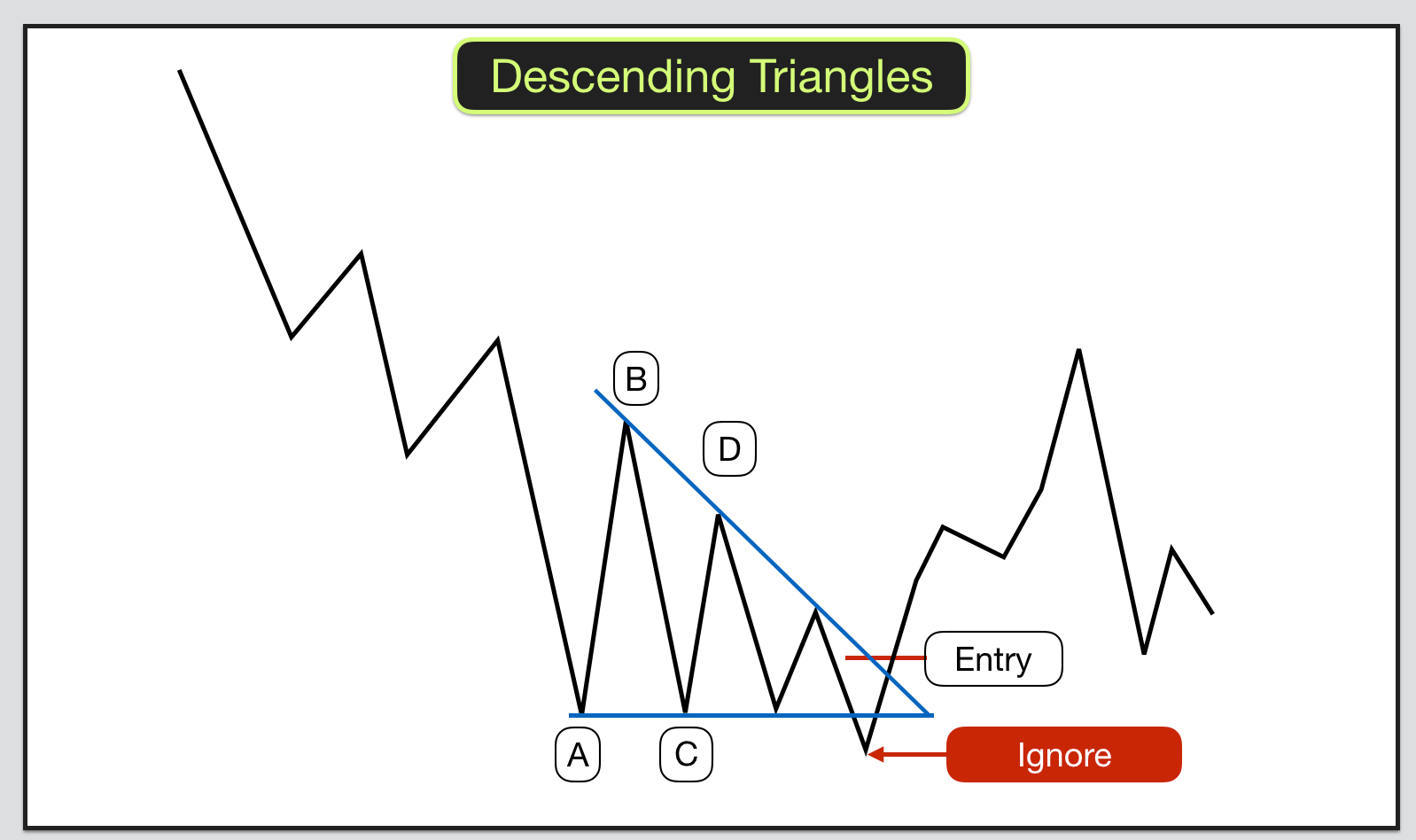

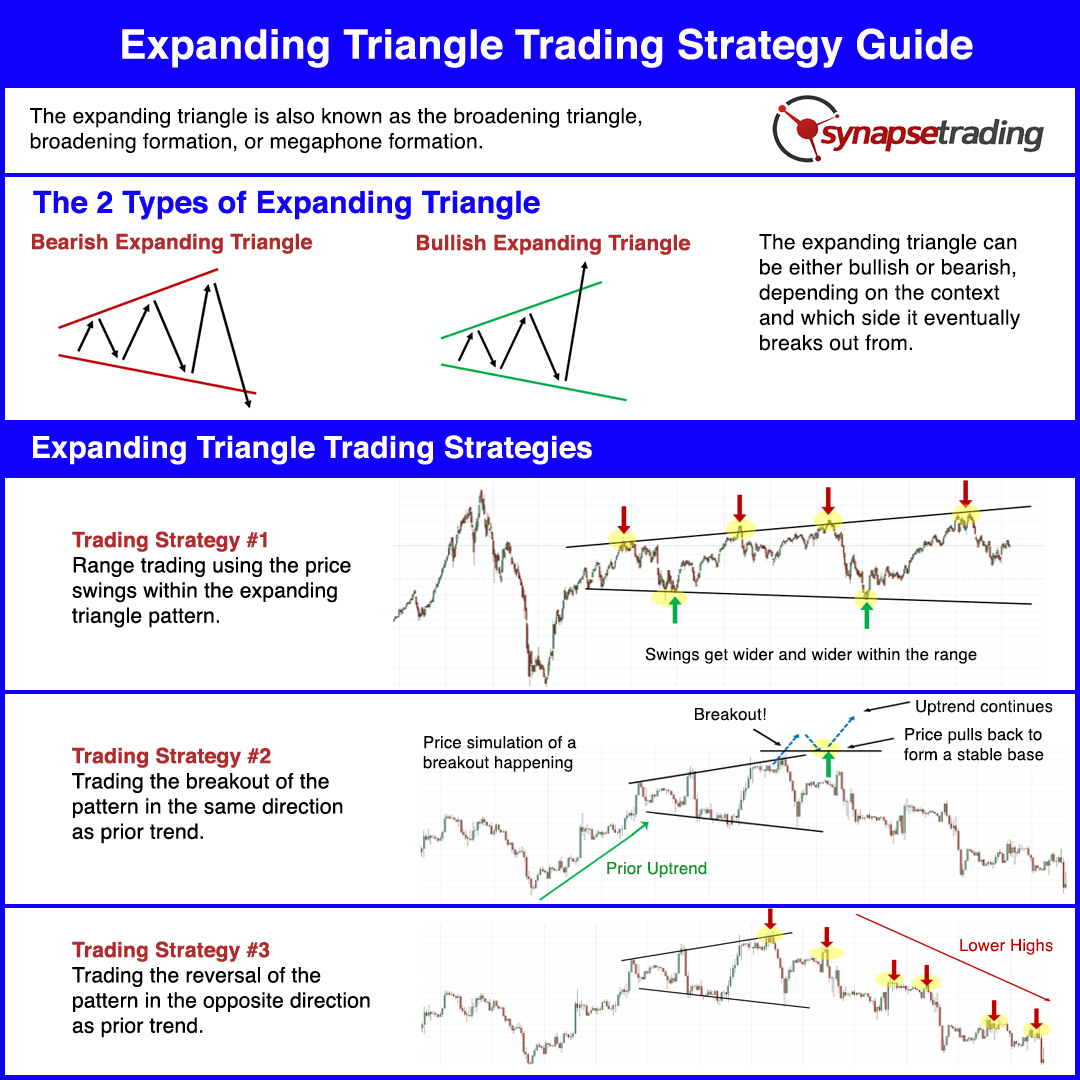

Triangle Trading Pattern - Web a triangle chart pattern forms when the trading range of a financial instrument, for example, a stock, narrows following a downtrend or an uptrend. Web triangle patterns are continuation patterns on a chart that indicate a pause in the market’s trend. Spotting chart patterns is a popular activity amongst traders of all. They can also assist a trader in spotting a market reversal. Web the triangle pattern’s success is enhanced by a spike in the market’s trading volume, according to thomas bulkowski’s book, “encyclopedia of chart patterns.”. We'll explore how these powerful triangle. Web the symmetrical triangle pattern is a technical analysis formation that typically indicates a period of consolidation before significant price movement. See examples of symmetrical, ascending,. There are three main types of triangles: Web triangle patterns are important because they help indicate the continuation of a bullish or bearish market. Web the most important trading triangles to know like the symmetrical triangle, ascending triangle, and descending triangle. See examples of symmetrical, ascending,. Web the triangle pattern is a specific figure formed on the price chart, typically identified when the tops and the bottoms of the price action are moving toward each other like the sides. They can be applied to. Web trading triangle patterns isn’t just about recognizing shapes; Web learn how to identify and trade forex triangle patterns, which are consolidation patterns that signal a continuation of the existing trend. Web this article delves into the application of classic chart patterns in financial markets, emphasizing their significance as technical analysis tools for uncovering price movement. Web the triangle pattern. Web the triangle pattern’s success is enhanced by a spike in the market’s trading volume, according to thomas bulkowski’s book, “encyclopedia of chart patterns.”. Web this article delves into the application of classic chart patterns in financial markets, emphasizing their significance as technical analysis tools for uncovering price movement. Web trading triangle patterns isn’t just about recognizing shapes; There are. Web what are triangle patterns? Web the triangle pattern is a specific figure formed on the price chart, typically identified when the tops and the bottoms of the price action are moving toward each other like the sides. Find out how to use breakout or. Web learn how to identify and trade three types of triangle patterns in stocks: It’s. Web learn how to identify and trade triangles, a type of chart pattern that indicates price consolidation and potential breakout. Web learn how to identify and use triangle patterns in technical analysis for trading. Find out how to use breakout or. Web learn how to identify and trade forex triangle patterns, which are consolidation patterns that signal a continuation of. Find out how to use breakout or. Web the most important trading triangles to know like the symmetrical triangle, ascending triangle, and descending triangle. Web the triangle pattern’s success is enhanced by a spike in the market’s trading volume, according to thomas bulkowski’s book, “encyclopedia of chart patterns.”. It’s about understanding the dynamics of price action, trend, and breakout within. We'll explore how these powerful triangle. They can also assist a trader in spotting a market reversal. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. Web learn how to identify and trade triangles, a type of chart pattern that indicates price. Web trading triangle patterns isn’t just about recognizing shapes; Web learn to identify the various triangle patterns that can appear on a chart and how you can use them in trading. It’s about understanding the dynamics of price action, trend, and breakout within those formations. Web learn how to identify and trade forex triangle patterns, which are consolidation patterns that. Web triangle patterns are important because they help indicate the continuation of a bullish or bearish market. Find out the differences between symmetrical, ascending and descending triangles,. Web trading a triangle chart pattern involves identifying the type of triangle pattern, determining the direction of the trend and then taking a trading position when a. We'll explore how these powerful triangle.. Web this guide will provide an overview of the different triangle chart pattern trading strategies. Web the most important trading triangles to know like the symmetrical triangle, ascending triangle, and descending triangle. Web triangle patterns are continuation patterns on a chart that indicate a pause in the market’s trend. Web a triangle chart pattern forms when the trading range of. Web this guide will provide an overview of the different triangle chart pattern trading strategies. Web learn to identify the various triangle patterns that can appear on a chart and how you can use them in trading. There are three main types of triangles: It’s about understanding the dynamics of price action, trend, and breakout within those formations. Web the triangle pattern’s success is enhanced by a spike in the market’s trading volume, according to thomas bulkowski’s book, “encyclopedia of chart patterns.”. Web a triangle chart pattern forms when the trading range of a financial instrument, for example, a stock, narrows following a downtrend or an uptrend. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. Web learn how to identify and use triangle patterns in technical analysis for trading. We'll explore how these powerful triangle. Find out the differences between symmetrical, ascending and descending triangles,. Web triangle patterns are important because they help indicate the continuation of a bullish or bearish market. See examples of symmetrical, ascending,. Web this article delves into the application of classic chart patterns in financial markets, emphasizing their significance as technical analysis tools for uncovering price movement. Web learn how to identify and trade three types of triangle patterns in stocks: Spotting chart patterns is a popular activity amongst traders of all. Find out how to use breakout or.

Triangle Pattern Characteristics And How To Trade Effectively How To

:max_bytes(150000):strip_icc()/Triangles_AShortStudyinContinuationPatterns1-bba0f7388b284f96b90ead2b090bf9a8.png)

The Ascending Triangle Pattern What It Is, How To Trade It

Trading triangles in chart patterns

Triangle Chart Patterns A Guide to Trading Options

3 Triangle Patterns Every Forex Trader Should Know

3 Triangle Patterns Every Forex Trader Should Know

Price Chart Patterns Archives Synapse Trading

Triangle Chart Patterns Complete Guide for Day Traders

3 Triangle Patterns Every Forex Trader Should Know

How to Trade Triangle Chart Patterns FX Access

We Will Explain How To Identify The Pattern, Its Characteristics, And.

Web Learn How To Identify And Trade Forex Triangle Patterns, Which Are Consolidation Patterns That Signal A Continuation Of The Existing Trend.

Web Learn How To Identify And Trade Triangles, A Type Of Chart Pattern That Indicates Price Consolidation And Potential Breakout.

Web Triangle Patterns Are Continuation Patterns On A Chart That Indicate A Pause In The Market’s Trend.

Related Post: