Triangle Stock Pattern

Triangle Stock Pattern - Web ascending triangle trading chart patterns are some of the most widely used stock market patterns. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. Potential cup and handle formation. These patterns are created once the. These naturally occurring price actions. These patterns are typically reliable and have bullish implications. © 2024 millionaire media, llc. This is why our team of expert traders. Web the triangle pattern is a popular chart pattern that is often used by technical analysts to identify potential breakout opportunities. Web the descending triangle is a chart pattern used in technical analysis. Web the triangle pattern is a popular chart pattern that is often used by technical analysts to identify potential breakout opportunities. Rsi is bullish but not. Web whether bullish or bearish, a descending triangle pattern is a tried and tested approach that helps traders make more informed, consistent, and ultimately,. Web a symmetrical triangle also known as a coil is. Web the triangle pattern has three types: They are considered bullish chart patterns that reveal to a trader. © 2024 millionaire media, llc. However, traders should be aware that the. The target price level depends on the direction in which the price broke this pattern. Rsi is bullish but not. Potential cup and handle formation. Ascending triangles signal bullish trends and are traded. The ascending, descending, and symmetrical triangle patterns. Web the stock has formed a classic ‘ascending triangle' on the chart. These naturally occurring price actions. Find out how to use breakout or. These patterns are typically reliable and have bullish implications. These patterns are created once the. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. Find out how to use breakout or. However, traders should be aware that the. Web the triangle pattern is a popular chart pattern that is often used by technical analysts to identify potential breakout opportunities. Web a triangle pattern forms when the market is consolidating and slowly narrowing in a range. Ascending triangles signal bullish trends and are traded. The target price level depends on the direction in which the price broke this pattern. Web a triangle pattern forms when the market is consolidating and slowly narrowing in a range. Web roughly scans ascending triangle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap,. Web the descending triangle. These naturally occurring price actions. Web a triangle pattern is a chart pattern that denotes a pause in the prevailing trend and is represented by drawing trendlines along a converging price range. Web a triangle pattern forms when the market is consolidating and slowly narrowing in a range. Web what is a triangle pattern in trading? Find out how to. However, traders should be aware that the. Web whether bullish or bearish, a descending triangle pattern is a tried and tested approach that helps traders make more informed, consistent, and ultimately,. This is why our team of expert traders. Rsi is bullish but not. The resistance line intersects the. This is why our team of expert traders. Web learn how to identify and trade three types of triangle patterns in stocks: Web the stock has formed a classic ‘ascending triangle' on the chart. They are considered bullish chart patterns that reveal to a trader. However, traders should be aware that the. Web a triangle pattern forms when the market is consolidating and slowly narrowing in a range. The ascending, descending, and symmetrical triangle patterns. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. A triangle pattern often signals a trend continuation or reversal.. Web learn how to identify and trade three types of triangle patterns in stocks: © 2024 millionaire media, llc. Web what is a triangle pattern in trading? Web the triangle pattern is a popular chart pattern that is often used by technical analysts to identify potential breakout opportunities. Web ascending triangle trading chart patterns are some of the most widely used stock market patterns. These patterns are created once the. The resistance line intersects the. This is why our team of expert traders. Web a triangle pattern is a chart pattern that denotes a pause in the prevailing trend and is represented by drawing trendlines along a converging price range. Web an ascending triangle is a continuation pattern marking a trend with a specific entry point, profit target, and stop loss level. Web the stock has formed a classic ‘ascending triangle' on the chart. The target price level depends on the direction in which the price broke this pattern. The ascending, descending, and symmetrical triangle patterns. Rsi is bullish but not. Web triangle patterns are continuation patterns that fall into three types: Web a triangle chart pattern is formed when the upper and lower trendlines ultimately meet at the apex on the right side, which forms a corner.

How to Trade Triangle Chart Patterns FX Access

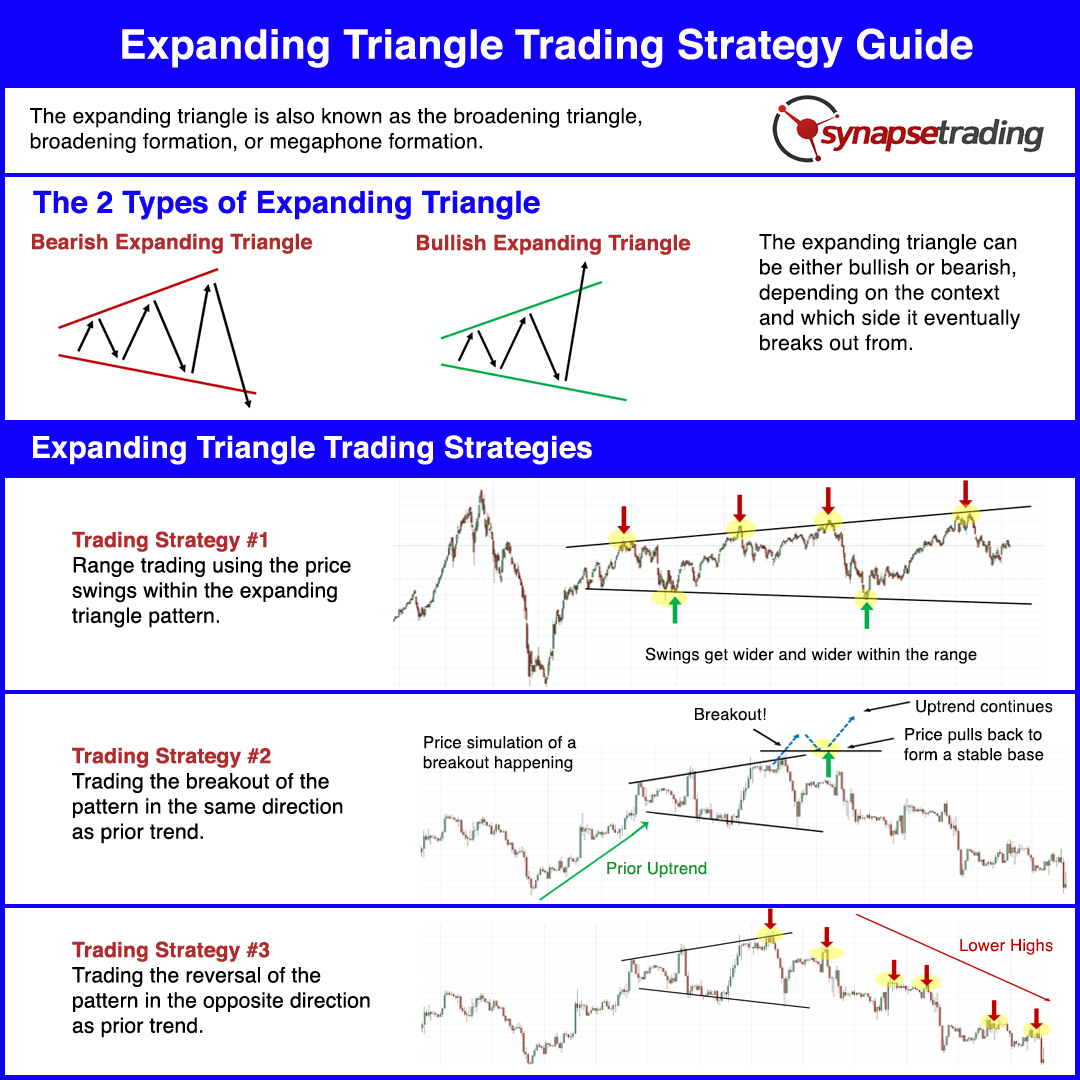

Price Chart Patterns Archives Synapse Trading

How To Trade Blog Triangle Pattern Characteristics And How To Trade

Symmetrical Triangle — Chart Patterns — Education — TradingView

3 Triangle Patterns Every Forex Trader Should Know

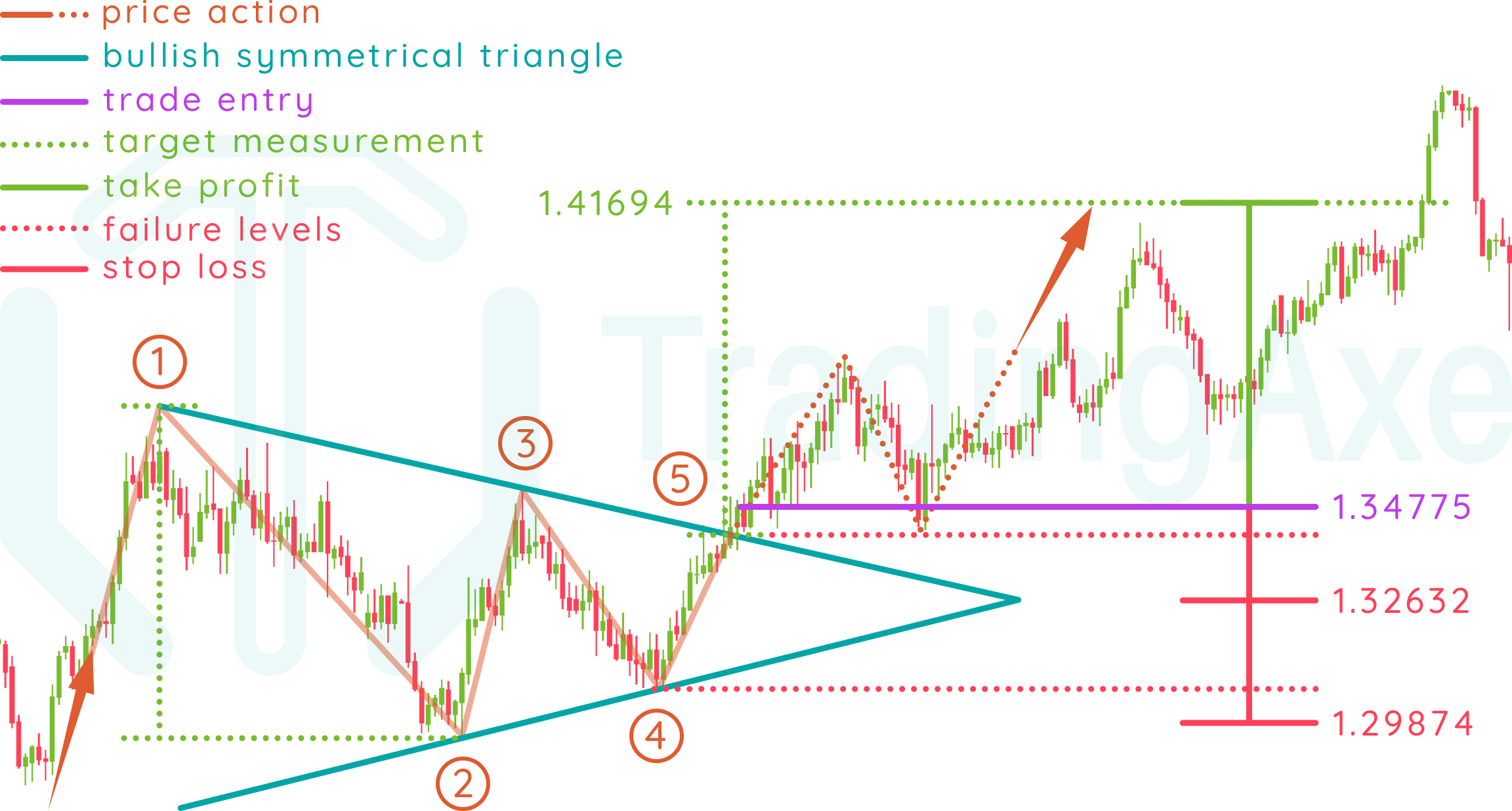

How To Trade Bullish Symmetrical Triangle Chart Pattern TradingAxe

triangle chart pattern Archives Synapse Trading

Triangle Chart Patterns A Guide to Trading Options

Triangle Chart Patterns Complete Guide for Day Traders

How To Trade Blog Triangle Pattern Characteristics And How To Trade

Web Roughly Scans Ascending Triangle Pattern Technical & Fundamental Stock Screener, Scan Stocks Based On Rsi, Pe, Macd, Breakouts, Divergence, Growth, Book Vlaue, Market Cap,.

These Naturally Occurring Price Actions.

Potential Cup And Handle Formation.

The Pattern Usually Forms At The End Of A Downtrend But Can Also Occur As A Consolidation In.

Related Post: