Travel Logbook Template

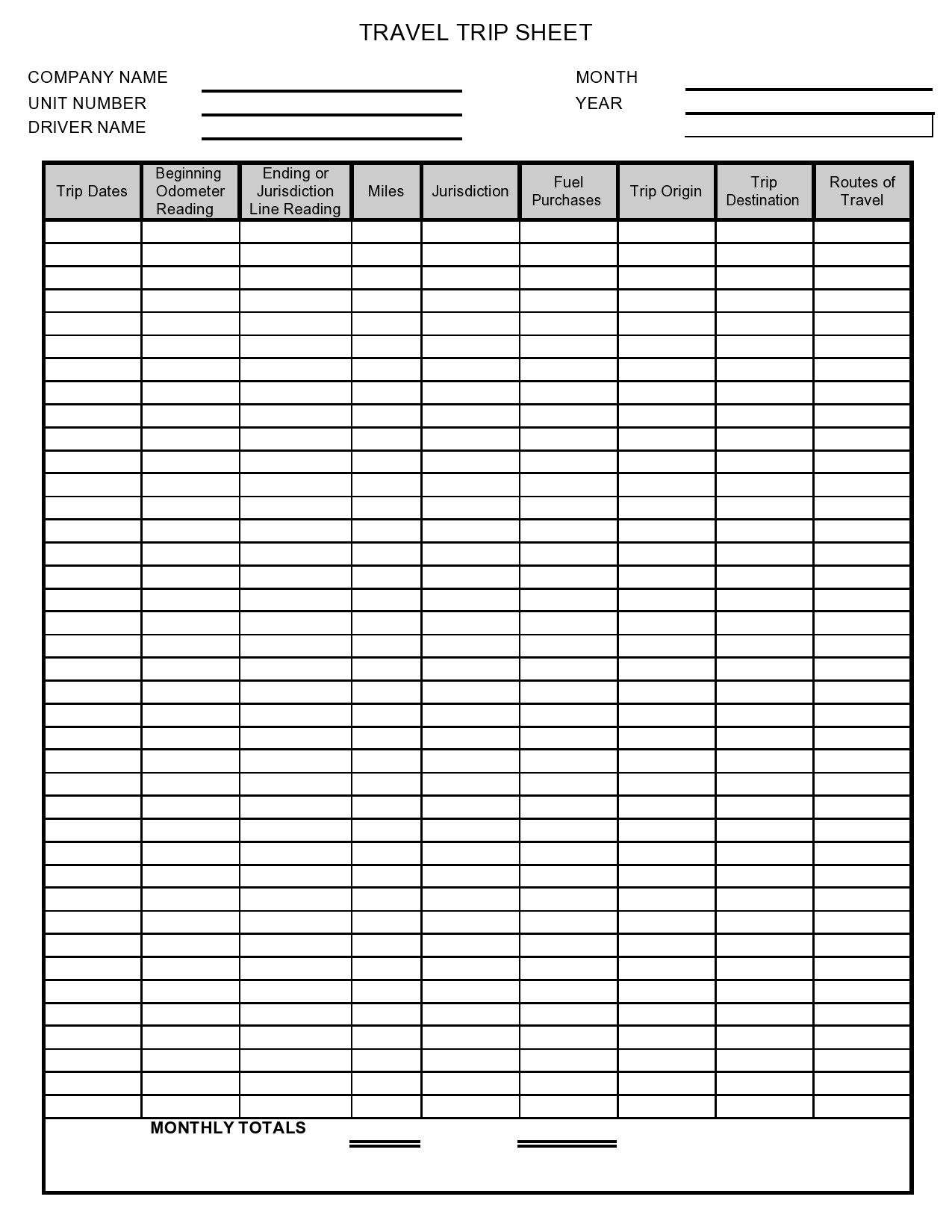

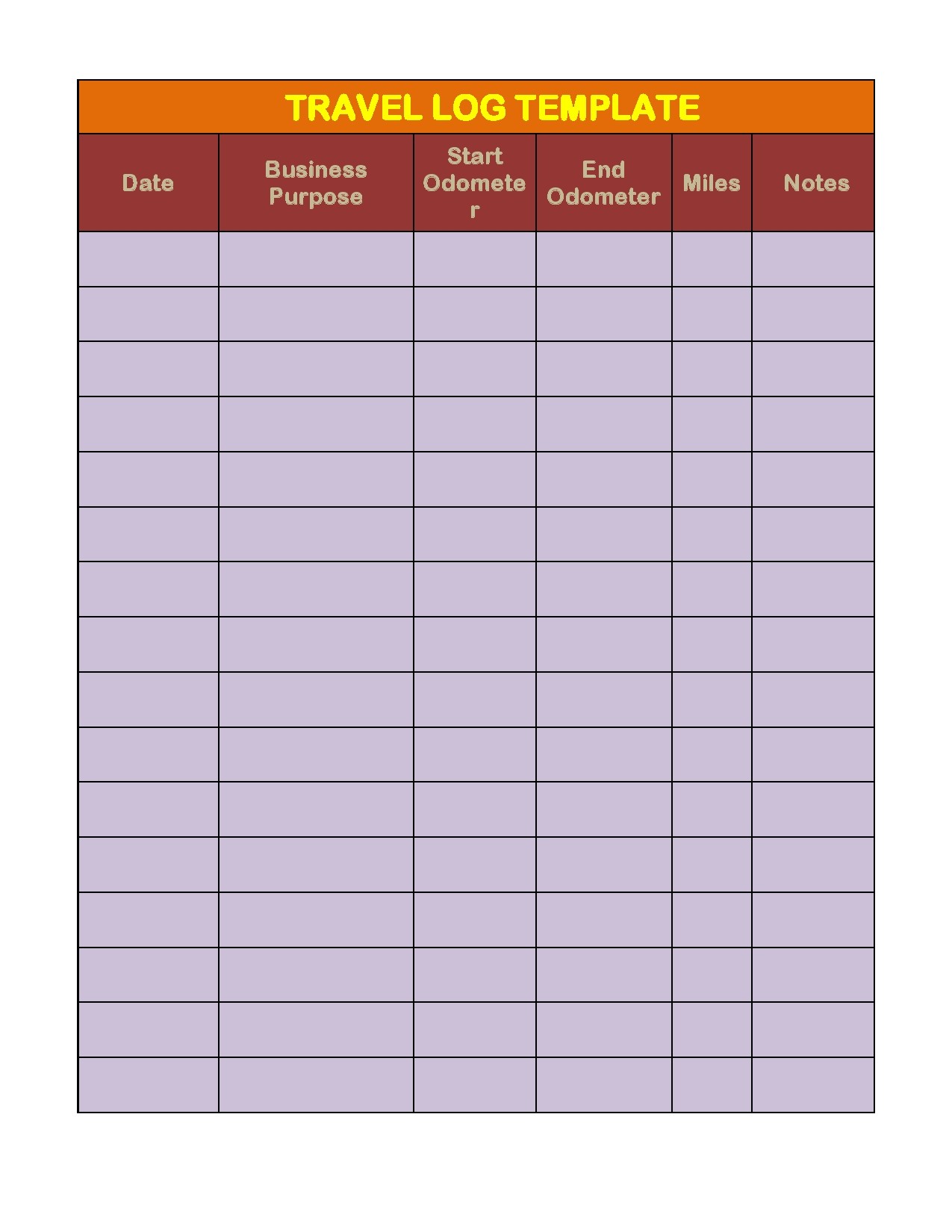

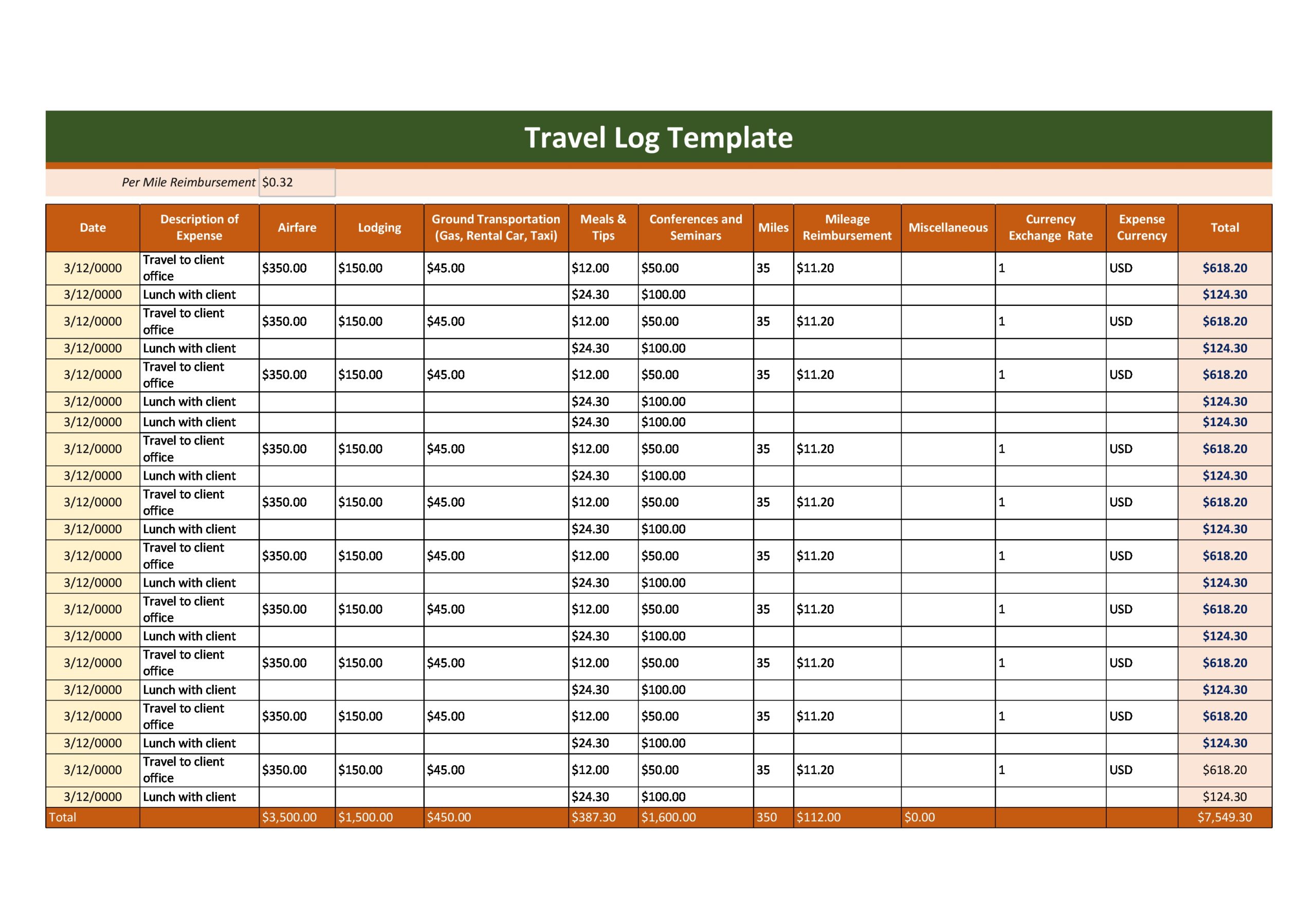

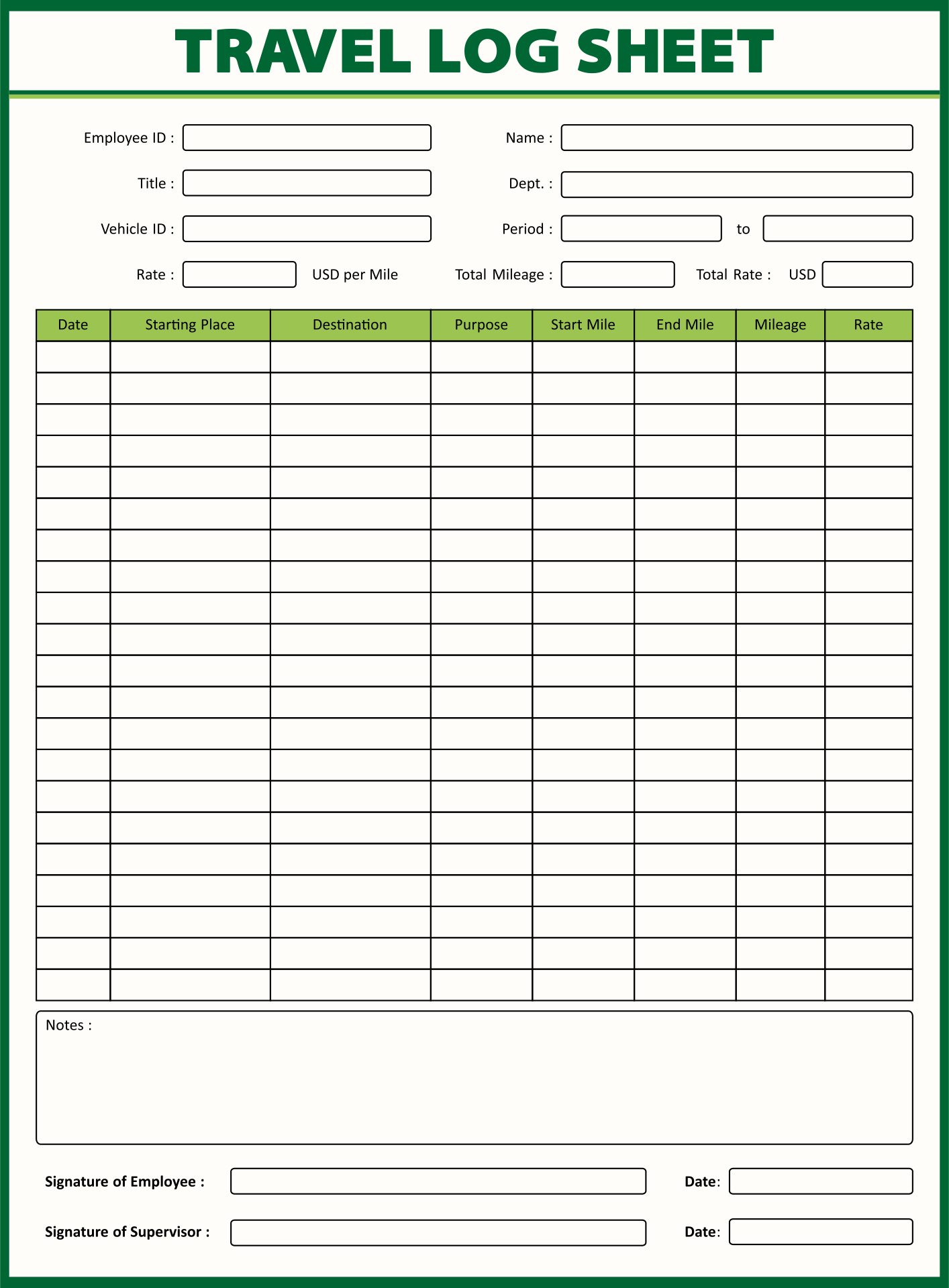

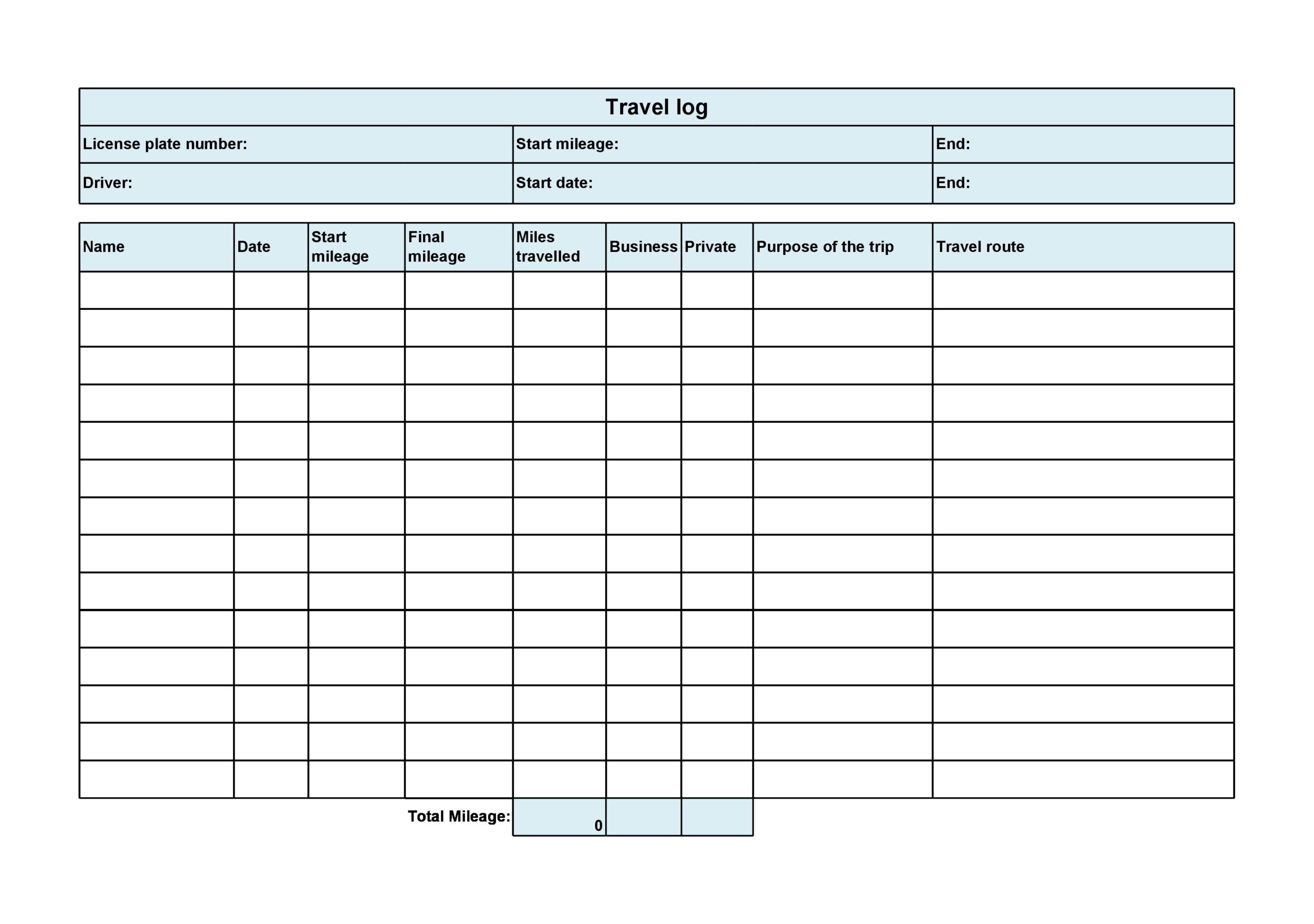

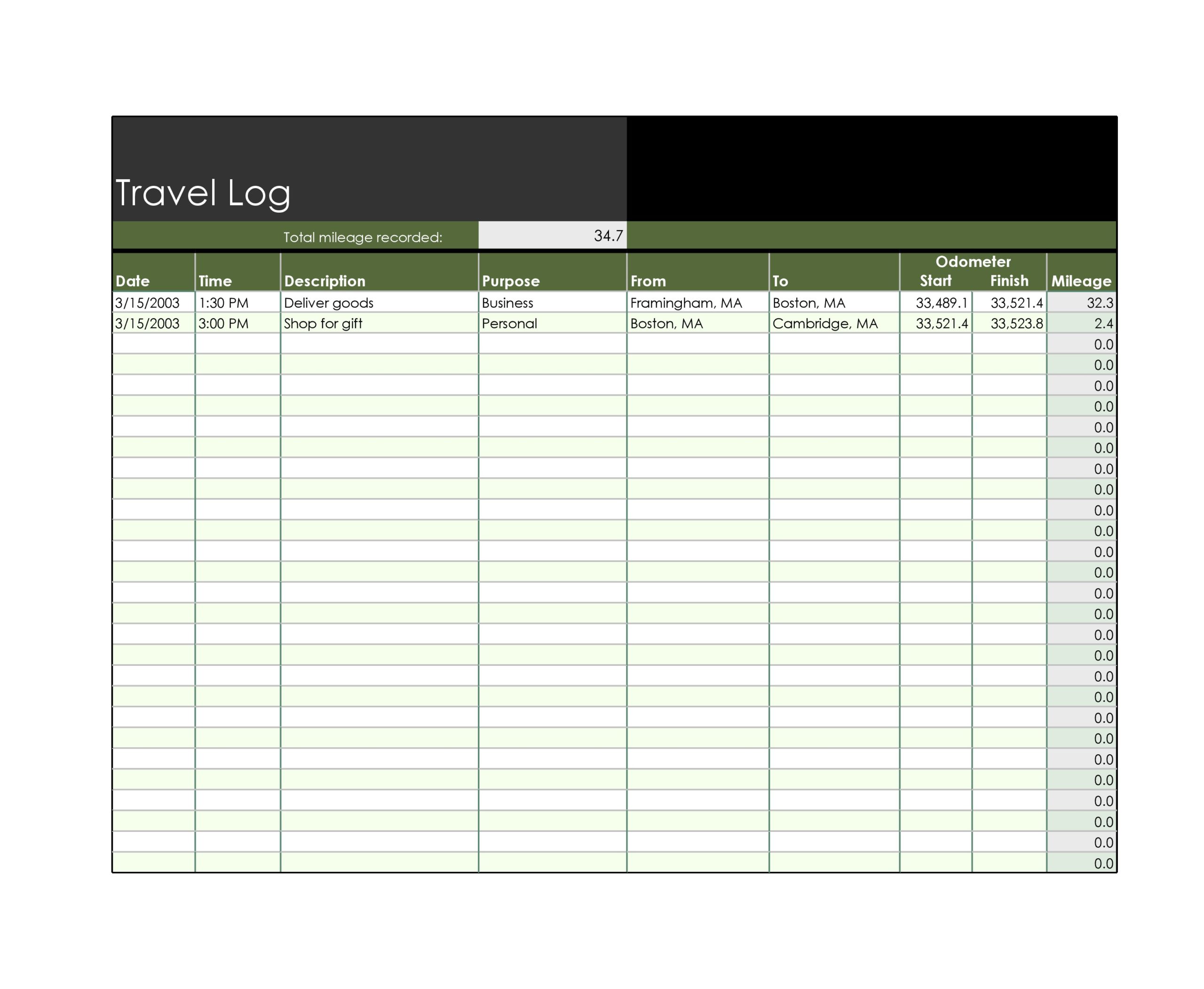

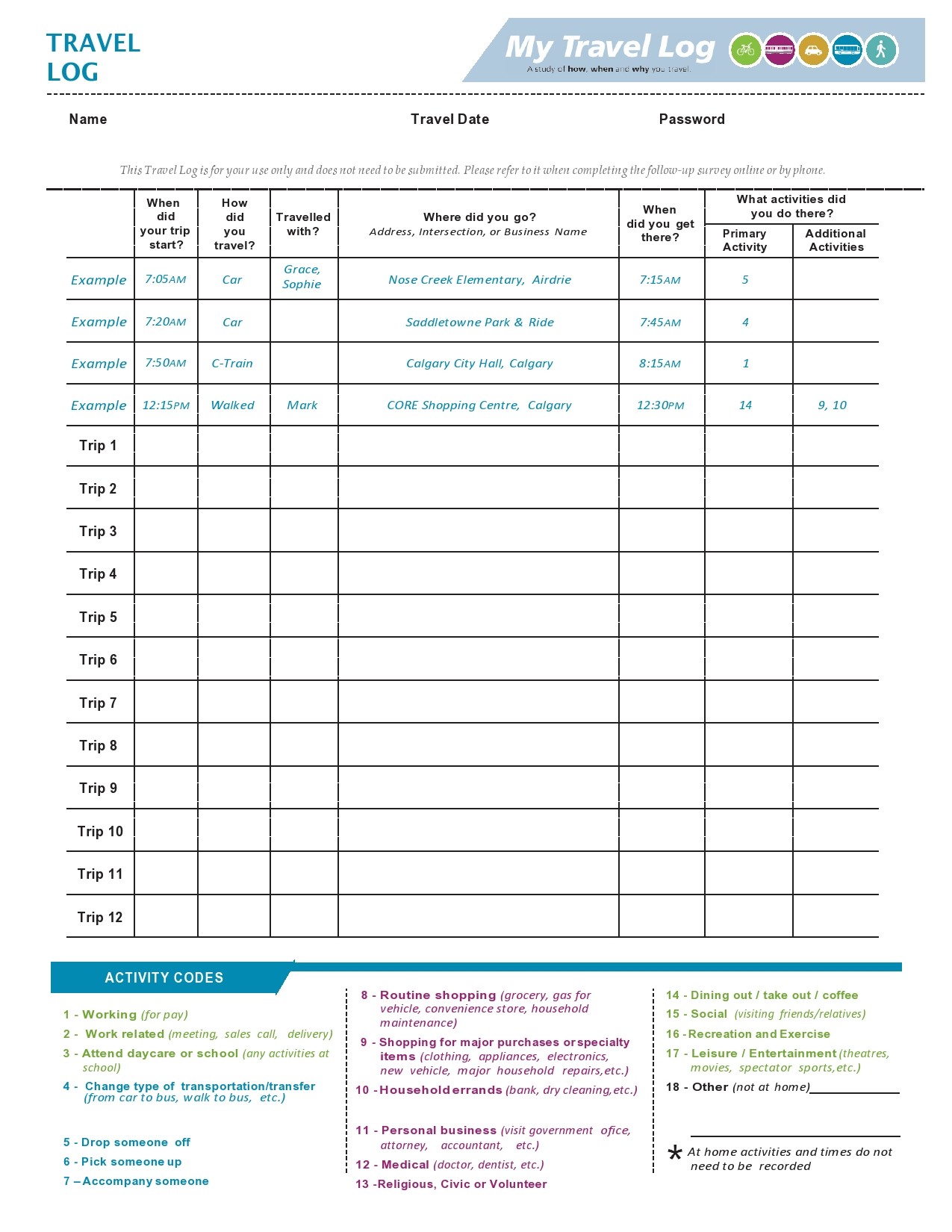

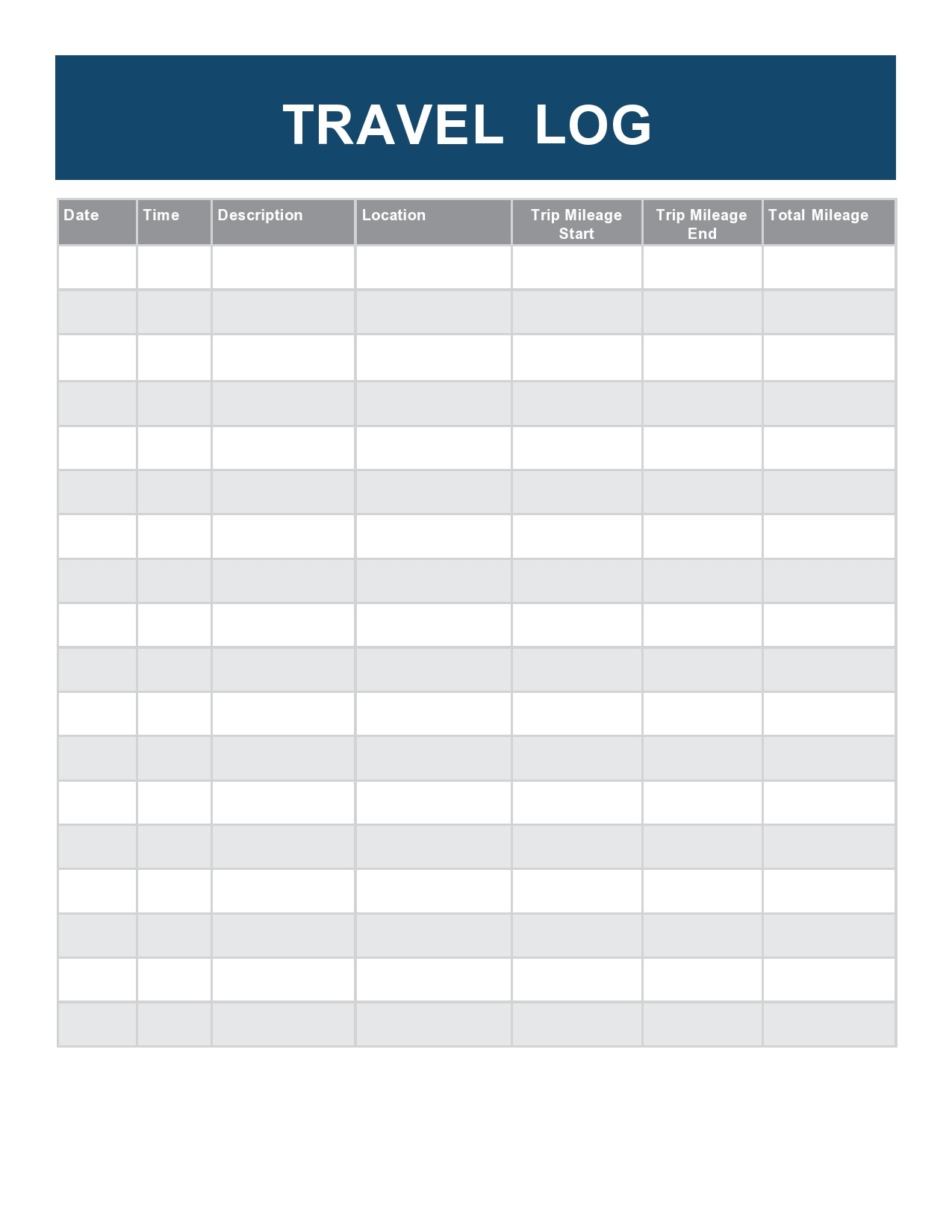

Travel Logbook Template - Business travel log template 01. It is used as a supporting document to claim deductions or reimbursements on your tax returns. It is important to note that travel between your home and place of work cannot be claimed and is regarded as private travel. You may include pictures, notes, and things that you enjoyed in the course of your trip. The logbook is available for use by taxpayers who wish to claim a deduction for the use of a private motor vehicle for business purposes. This means you will be mindful of things you do, smell, taste, touch, hear and see while on your trip. Web travel logs help companies in preparing a sheet of traveling expense incurred by them in a specific period. Traveling expands your world and introduces you to new perspectives and cultures. You must be able to show which are business miles and which are strictly personal. Web individuals traveling around the world on various trips use a travel log template to save them time and help them keep track of their budget, memorialize their experiences, and include both narrative and photos. It must record starting and ending dates and odometer readings of travel; Web by utilizing our travel log templates, you can capture important details, reflect on your experiences, and create a personal keepsake of your journeys. A travel log helps you to be mindful and focus on your trip. You record all the memorable experiences from a trip ten miles. Web get the free 2024 vehicle log book template in excel, pdf, and sheets format. Get your hands on this free car logbook template to easily keep track of every business trip you take. A mileage log is a useful tool because it keeps a record of the distance that a person has traveled using that particular vehicle. It must. Free travel log template 02. Web the income tax act no.58 of 1962 allows taxpayers who receive a travel allowance to claim a deduction for the use of their private vehicles for business purposes. You must be able to show which are business miles and which are strictly personal. It is used as a supporting document to claim deductions or. Web the vehicle log book requires the following set of information. You record all the memorable experiences from a trip ten miles away to a voyage on the other side of the world in your travel log. This means you will be mindful of things you do, smell, taste, touch, hear and see while on your trip. Web 21+ free. Web you may make use of the sars elogbook, simply download the: Web a travel log helps you remember all of the experiences you had during your travels. The travel log is the best tool to treasure those beautiful memories. Web travel logbook (having the following content): 1 march 2018) and closing odometer reading (s) (e.g. It is important to note that travel between your home and place of work cannot be claimed and is regarded as private travel. Web the vehicle log book requires the following set of information. Web the ba book is a lot smaller and more basic, but it has room for 51 flights. This log helps them keep track of various. Sars has released its 2022 template of the electronic travel logbook. Using a restaurant manager log book improves operational efficiency and communication. Travel log template for excel. Web download our free printable mileage log templates, forms and samples! It must record starting and ending dates and odometer readings of travel; Access and customize a free template to suit your restaurant’s specific needs. 1 march 2018) and closing odometer reading (s) (e.g. Using a restaurant manager log book improves operational efficiency and communication. Web the irs requires this mileage log template to ensure that individuals and businesses have accurate details of their travel expenses, such as fuel costs, vehicle maintenance, and. Web keeping an accurate travel log is essential for business professionals, freelancers, and anyone looking to track their mileage for tax purposes. Web a person using the travel log can keep a record of all the memories and discoveries he has made while traveling. A mileage log is a useful tool because it keeps a record of the distance that. Using a restaurant manager log book improves operational efficiency and communication. Attractive cities and breathtaking scenes make it difficult to take in all the good feelings at once. 1 march 2018) and closing odometer reading (s) (e.g. Web a travel log template is a blank journal that captures images, texts, mementos, and experiences of your journey. Web a travel log. The total business kilometers traveled and their percentage 1 march 2018) and closing odometer reading (s) (e.g. Free travel log template 02. Web 21+ free mileage log templates (for irs mileage tracking) whether you choose to claim your business auto expenses by submitting your total gas receipts or by claiming the irs standard mileage rate, you will need to keep track of your mileage. Given below are different travel logs: Traveling expands your world and introduces you to new perspectives and cultures. Web travel logs help companies in preparing a sheet of traveling expense incurred by them in a specific period. A travel log helps you to be mindful and focus on your trip. A mileage log is a useful tool because it keeps a record of the distance that a person has traveled using that particular vehicle. Web by utilizing our travel log templates, you can capture important details, reflect on your experiences, and create a personal keepsake of your journeys. Compliant with ato rules for your business km records. Web the income tax act no.58 of 1962 allows taxpayers who receive a travel allowance to claim a deduction for the use of their private vehicles for business purposes. You may include pictures, notes, and things that you enjoyed in the course of your trip. Using a restaurant manager log book improves operational efficiency and communication. Web you may make use of the sars elogbook, simply download the: The travel log is the best tool to treasure those beautiful memories.

42 Useful Travel Log Templates (100 Free) ᐅ TemplateLab

42 Useful Travel Log Templates (100 Free) ᐅ TemplateLab

42 Useful Travel Log Templates (100 Free) ᐅ TemplateLab

Travel Logs 10 Free PDF Printables Printablee

42 Useful Travel Log Templates (100 Free) ᐅ TemplateLab

42 Useful Travel Log Templates (100 Free) ᐅ TemplateLab

42 Useful Travel Log Templates (100 Free) ᐅ TemplateLab

![Free Printable Travel Log Templates [PDF, Excel, Word]](https://www.typecalendar.com/wp-content/uploads/2022/05/Travel-Log-1086x1536.jpg)

Free Printable Travel Log Templates [PDF, Excel, Word]

42 Useful Travel Log Templates (100 Free) ᐅ TemplateLab

42 Useful Travel Log Templates (100 Free) ᐅ TemplateLab

Web Download Our Free Printable Mileage Log Templates, Forms And Samples!

Web Keeping An Accurate Travel Log Is Essential For Business Professionals, Freelancers, And Anyone Looking To Track Their Mileage For Tax Purposes.

This Log Helps Them Keep Track Of Various Factors Such As The Fuel Consumed By Their Vehicle When They Travel From Point A To Point B.

You Must Be Able To Show Which Are Business Miles And Which Are Strictly Personal.

Related Post: