The Costs Provided By A Welldesigned Activitybased Costing System Are

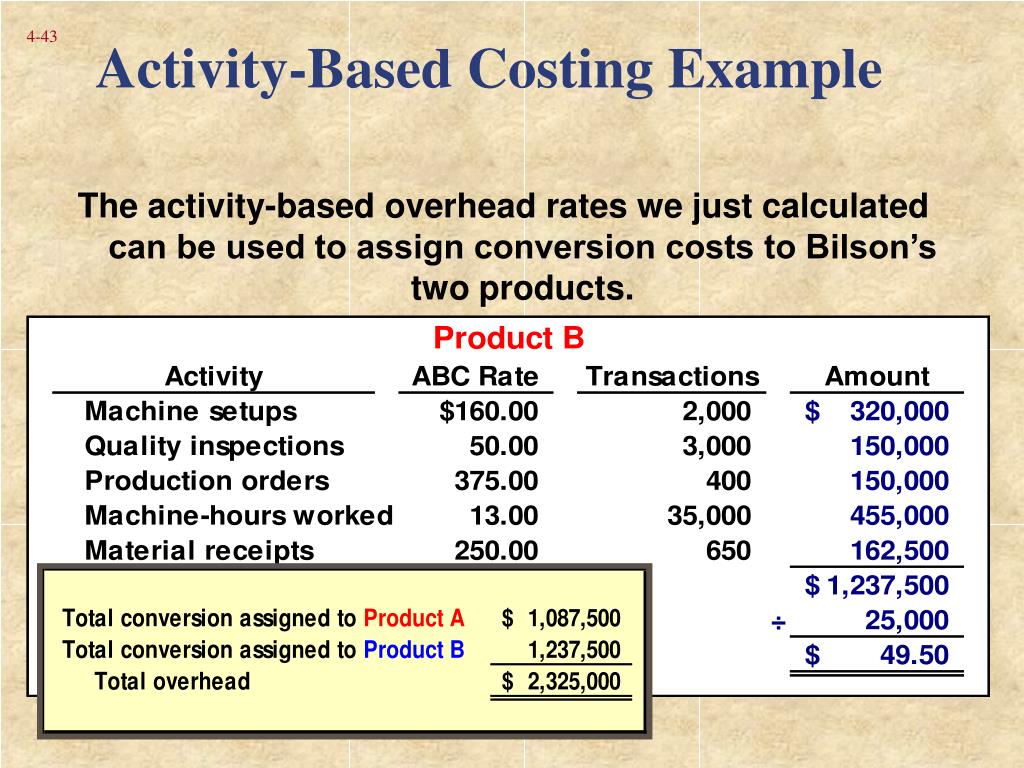

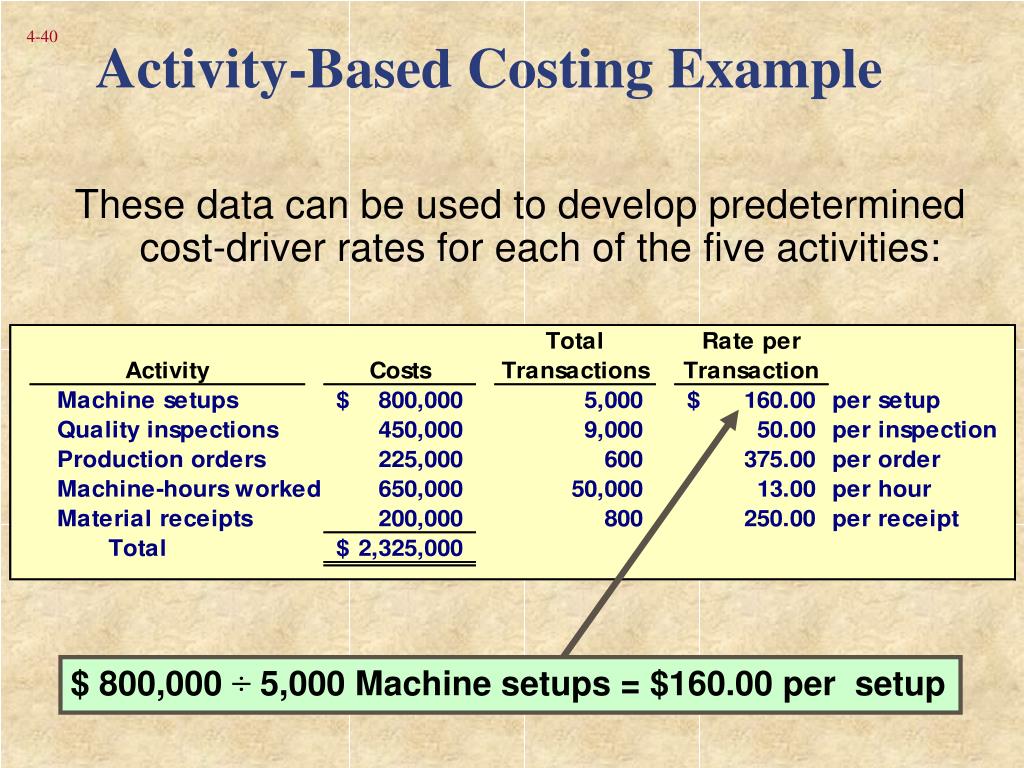

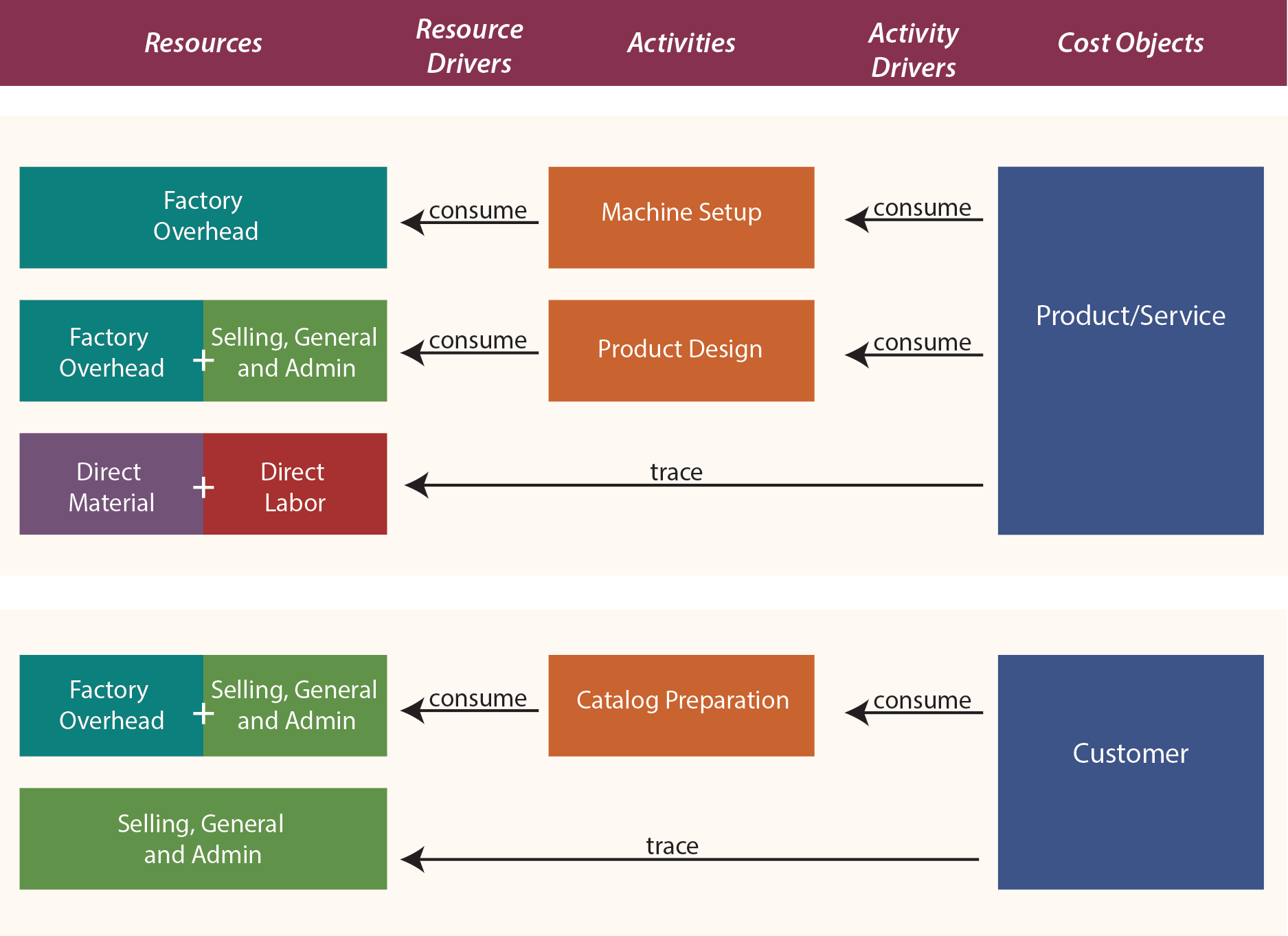

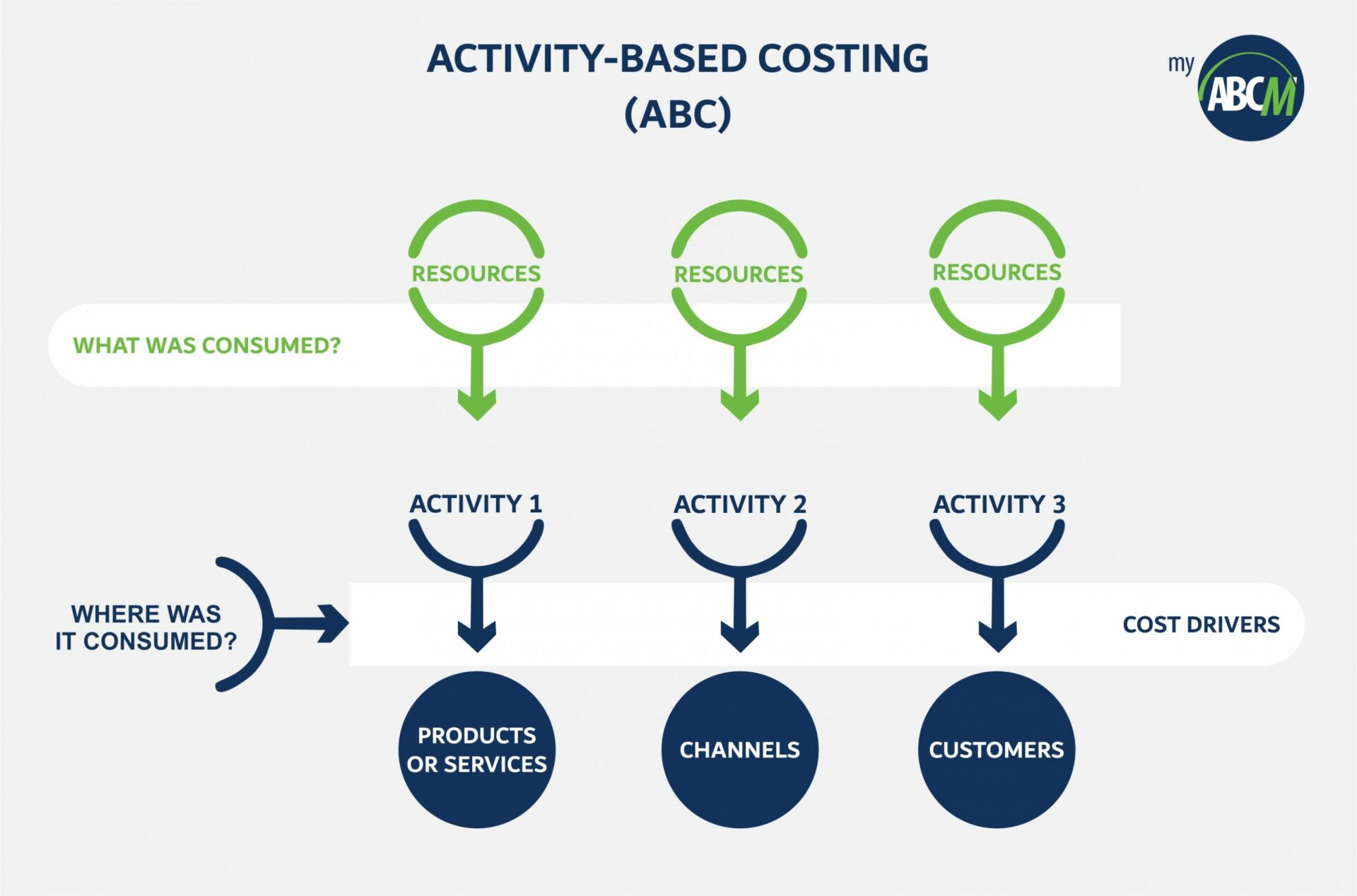

The Costs Provided By A Welldesigned Activitybased Costing System Are - Then each activity is studied to determine its relationship to products (or other relevant cost objects such as customers, projects,. It can be concluded, then, that the cost and. Activity based costing ( abc) offers a precise method for assigning overhead and indirect costs to products and services. In an abc system, costs are assigned more accurately to. Web study with quizlet and memorize flashcards containing terms like an incremental cost is, variable cost and relevant cost are not the same thing, fixed costs and sunk. This accounting method of costingrecognizes the relationship between costs, overhead activities, and manufactured products, assigning indirect costs to products less arbitrarily than traditional. Web accounting questions and answers. Web activity based costing recognizes that the special engineering, special testing, machine setups, and others are activities that cause costs—they cause the company to consume. Web hence, the abc system accurately allocates overhead cost to production by using the actual activity of a department using an overhead rate, which determines which primary. Web costs incurred are first attributed to activities; Web study with quizlet and memorize flashcards containing terms like an incremental cost is, variable cost and relevant cost are not the same thing, fixed costs and sunk. Web hence, the abc system accurately allocates overhead cost to production by using the actual activity of a department using an overhead rate, which determines which primary. This accounting method of costingrecognizes. Then each activity is studied to determine its relationship to products (or other relevant cost objects such as customers, projects,. In addition, this system provides information about the. Motivates abc by means of a simple example, a single and a diversified pen factory. Activity based costing ( abc) offers a precise method for assigning overhead and indirect costs to products. In addition, this system provides information about the. Web accounting questions and answers. Then each activity is studied to determine its relationship to products (or other relevant cost objects such as customers, projects,. Web costs incurred are first attributed to activities; Web hence, the abc system accurately allocates overhead cost to production by using the actual activity of a department. It can be concluded, then, that the cost and. This accounting method of costingrecognizes the relationship between costs, overhead activities, and manufactured products, assigning indirect costs to products less arbitrarily than traditional. Activity based costing ( abc) offers a precise method for assigning overhead and indirect costs to products and services. Web accounting questions and answers. Web hence, the abc. This accounting method of costingrecognizes the relationship between costs, overhead activities, and manufactured products, assigning indirect costs to products less arbitrarily than traditional. Web accounting questions and answers. Activity based costing ( abc) offers a precise method for assigning overhead and indirect costs to products and services. It can be concluded, then, that the cost and. Motivates abc by means. It can be concluded, then, that the cost and. Web costs incurred are first attributed to activities; Web hence, the abc system accurately allocates overhead cost to production by using the actual activity of a department using an overhead rate, which determines which primary. Then each activity is studied to determine its relationship to products (or other relevant cost objects. This accounting method of costingrecognizes the relationship between costs, overhead activities, and manufactured products, assigning indirect costs to products less arbitrarily than traditional. Web activity based costing recognizes that the special engineering, special testing, machine setups, and others are activities that cause costs—they cause the company to consume. It can be concluded, then, that the cost and. Motivates abc by. Web hence, the abc system accurately allocates overhead cost to production by using the actual activity of a department using an overhead rate, which determines which primary. Then each activity is studied to determine its relationship to products (or other relevant cost objects such as customers, projects,. This accounting method of costingrecognizes the relationship between costs, overhead activities, and manufactured. This accounting method of costingrecognizes the relationship between costs, overhead activities, and manufactured products, assigning indirect costs to products less arbitrarily than traditional. Motivates abc by means of a simple example, a single and a diversified pen factory. It can be concluded, then, that the cost and. Web activity based costing recognizes that the special engineering, special testing, machine setups,. Activity based costing ( abc) offers a precise method for assigning overhead and indirect costs to products and services. Then each activity is studied to determine its relationship to products (or other relevant cost objects such as customers, projects,. Motivates abc by means of a simple example, a single and a diversified pen factory. Web hence, the abc system accurately. It can be concluded, then, that the cost and. Web study with quizlet and memorize flashcards containing terms like an incremental cost is, variable cost and relevant cost are not the same thing, fixed costs and sunk. Web activity based costing recognizes that the special engineering, special testing, machine setups, and others are activities that cause costs—they cause the company to consume. Web accounting questions and answers. In addition, this system provides information about the. This accounting method of costingrecognizes the relationship between costs, overhead activities, and manufactured products, assigning indirect costs to products less arbitrarily than traditional. In an abc system, costs are assigned more accurately to. Web costs incurred are first attributed to activities; Motivates abc by means of a simple example, a single and a diversified pen factory.

ActivityBased Costing

Activity Based Costing/Management (ABC/ABM) System

PPT ActivityBased Costing Systems PowerPoint Presentation, free

![Activitybased costing system [5] Download Scientific Diagram](https://www.researchgate.net/publication/366939070/figure/fig1/AS:11431281111619857@1673098303568/Activity-based-costing-system-5.png)

Activitybased costing system [5] Download Scientific Diagram

PPT ActivityBased Costing Systems PowerPoint Presentation, free

PPT ActivityBased Costing Systems PowerPoint Presentation, free

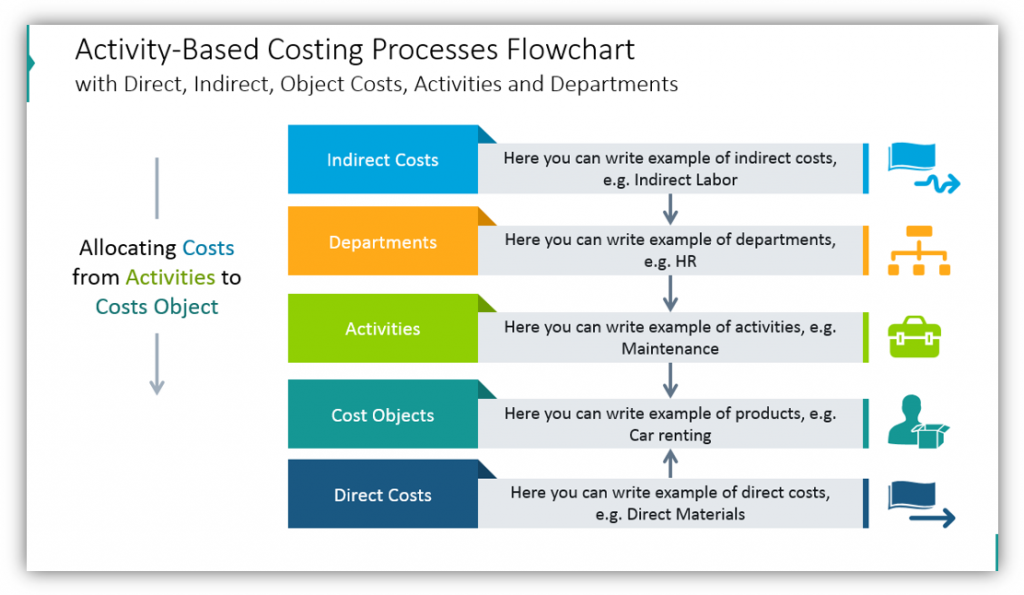

Explaining ActivityBased Costing Method in PowerPoint

ActivityBased Costing

ActivityBased Costing (ABC) Method And Advantages Defined, 49 OFF

What is Activity Based Costing

Web Hence, The Abc System Accurately Allocates Overhead Cost To Production By Using The Actual Activity Of A Department Using An Overhead Rate, Which Determines Which Primary.

Then Each Activity Is Studied To Determine Its Relationship To Products (Or Other Relevant Cost Objects Such As Customers, Projects,.

Activity Based Costing ( Abc) Offers A Precise Method For Assigning Overhead And Indirect Costs To Products And Services.

Related Post: