Texas Designation Of Homestead

Texas Designation Of Homestead - Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Web attorney general ken paxton today warned consumers to beware of businesses that are sending misleading letters to texans offering a “designation of homestead” if they pay a fee. Several homestead exemptions are available such as those for disabled veterans or residents age 65 or older. Web designation of homestead (tx) by practical law real estate. 1 of the tax year. The exemptions apply only to property that you own and occupy as your principal place of residence. If a homeowner files for and receive a tax exemption, they will receive a designation of homestead eventually for free. Web the designation of homestead under the texas property code is distinct from the homestead tax exemption under the texas tax code. A standard document that a property owner can record to make a voluntary designation of a homestead under texas law. This affidavit is for use when claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Homestead exemptions reduce the appraised value of your home and lower your property taxes. Web this article outlines unique protections available to an individual’s residence and personal property by what are broadly referred to as texas homestead laws. Web a general homestead exemption in texas can save you money on property taxes by lowering the taxable value of your home. (a) if a rural homestead of a family is part of one or more parcels containing a total of more than 200 acres, the head of the family and, if married, that person's spouse may voluntarily designate not more than 200 acres of the property as the homestead. Counties make the standard homestead tax exemption available for free to property. Web a general homestead exemption in texas can save you money on property taxes by lowering the taxable value of your home by up to $100,000 for school taxes. Web designation of homestead (tx) by practical law real estate. A standard document that a property owner can record to make a voluntary designation of a homestead under texas law. Counties. Web a homestead is generally the house and land used as the owner’s principal residence on jan. Counties make the standard homestead tax exemption available for free to property owners. A standard document that a property owner can record to make a voluntary designation of a homestead under texas law. 1 of the tax year. If a homeowner files for. Homestead exemptions reduce the appraised value of your home and lower your property taxes. Web the designation of homestead under the texas property code is distinct from the homestead tax exemption under the texas tax code. Web a general homestead exemption in texas can save you money on property taxes by lowering the taxable value of your home by up. If a homeowner files for and receive a tax exemption, they will receive a designation of homestead eventually for free. This affidavit is for use when claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Web voluntary designation of homestead. 1 of the tax year. Homestead exemptions reduce the appraised value of your. The exemptions apply only to property that you own and occupy as your principal place of residence. A standard document that a property owner can record to make a voluntary designation of a homestead under texas law. Web the designation of homestead under the texas property code is distinct from the homestead tax exemption under the texas tax code. (a). The exemptions apply only to property that you own and occupy as your principal place of residence. Web the designation of homestead under the texas property code is distinct from the homestead tax exemption under the texas tax code. Homestead exemptions reduce the appraised value of your home and lower your property taxes. 1 of the tax year. This affidavit. Web voluntary designation of homestead. This affidavit is for use when claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Counties make the standard homestead tax exemption available for free to property owners. Web designation of homestead (tx) by practical law real estate. Several homestead exemptions are available such as those for disabled. Senior homeowners, disabled homeowners, disabled veterans, and military or first responder spouses can claim additional exemptions. (a) if a rural homestead of a family is part of one or more parcels containing a total of more than 200 acres, the head of the family and, if married, that person's spouse may voluntarily designate not more than 200 acres of the. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. A standard document that a property owner can record to make a voluntary designation of a homestead under texas law. This affidavit is for use when claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. 1 of the tax year. Several homestead exemptions are available such as those for disabled veterans or residents age 65 or older. (a) if a rural homestead of a family is part of one or more parcels containing a total of more than 200 acres, the head of the family and, if married, that person's spouse may voluntarily designate not more than 200 acres of the property as the homestead. If a homeowner files for and receive a tax exemption, they will receive a designation of homestead eventually for free. Web the designation of homestead under the texas property code is distinct from the homestead tax exemption under the texas tax code. Counties make the standard homestead tax exemption available for free to property owners. Homestead exemptions reduce the appraised value of your home and lower your property taxes. Senior homeowners, disabled homeowners, disabled veterans, and military or first responder spouses can claim additional exemptions. Web a homestead is generally the house and land used as the owner’s principal residence on jan. The exemptions apply only to property that you own and occupy as your principal place of residence. Web attorney general ken paxton today warned consumers to beware of businesses that are sending misleading letters to texans offering a “designation of homestead” if they pay a fee.

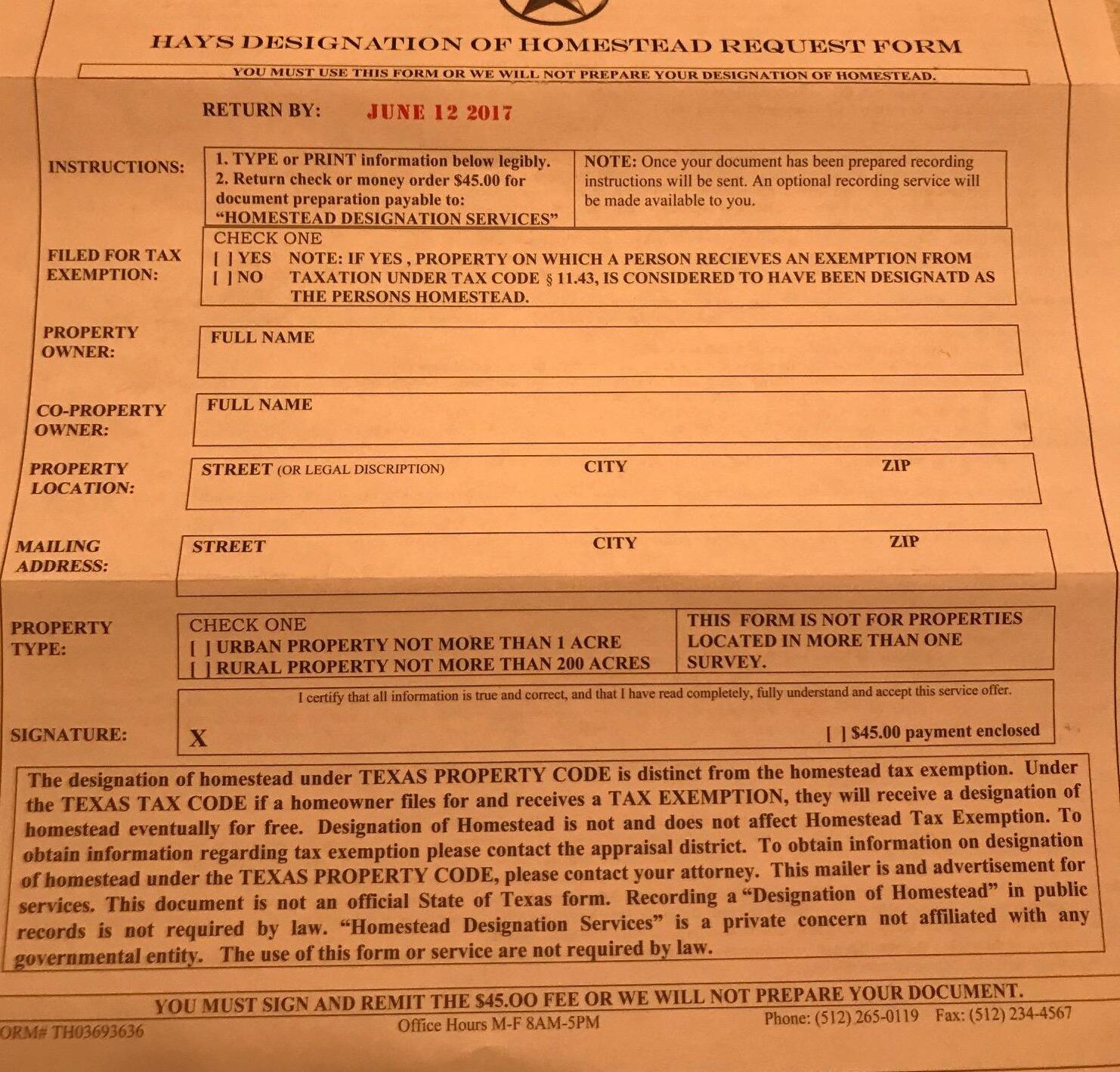

Homestead Designation Form Texas Awesome Home

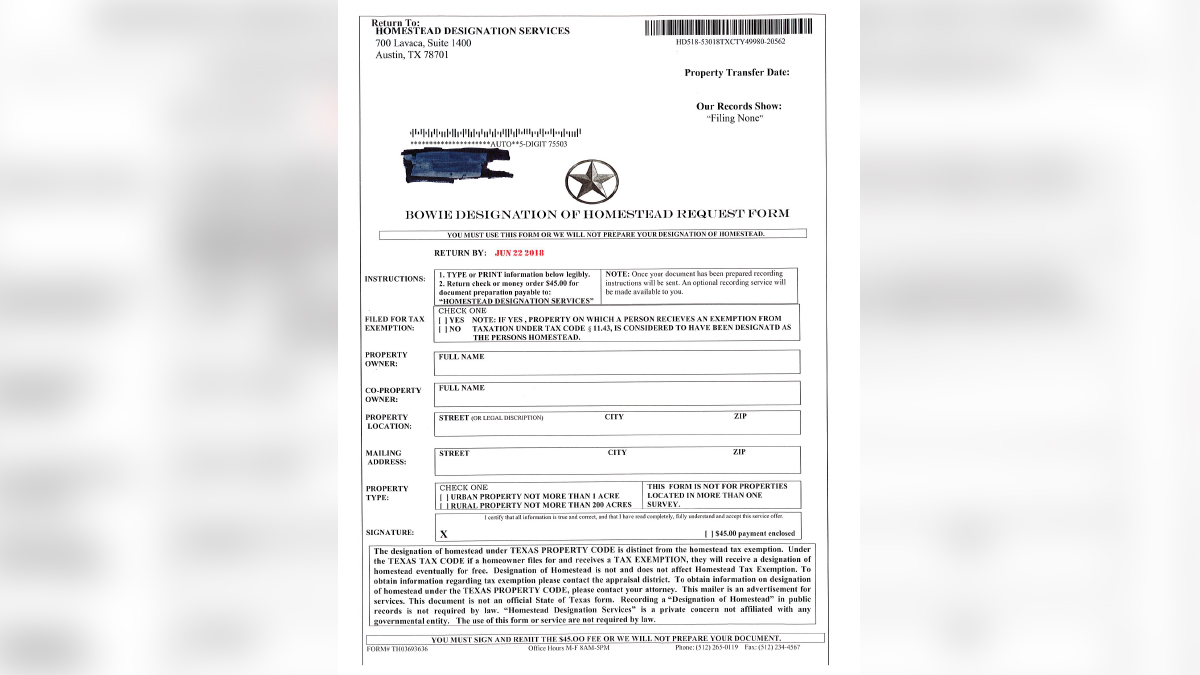

Designation Of Homestead Request Form Texas My Bios

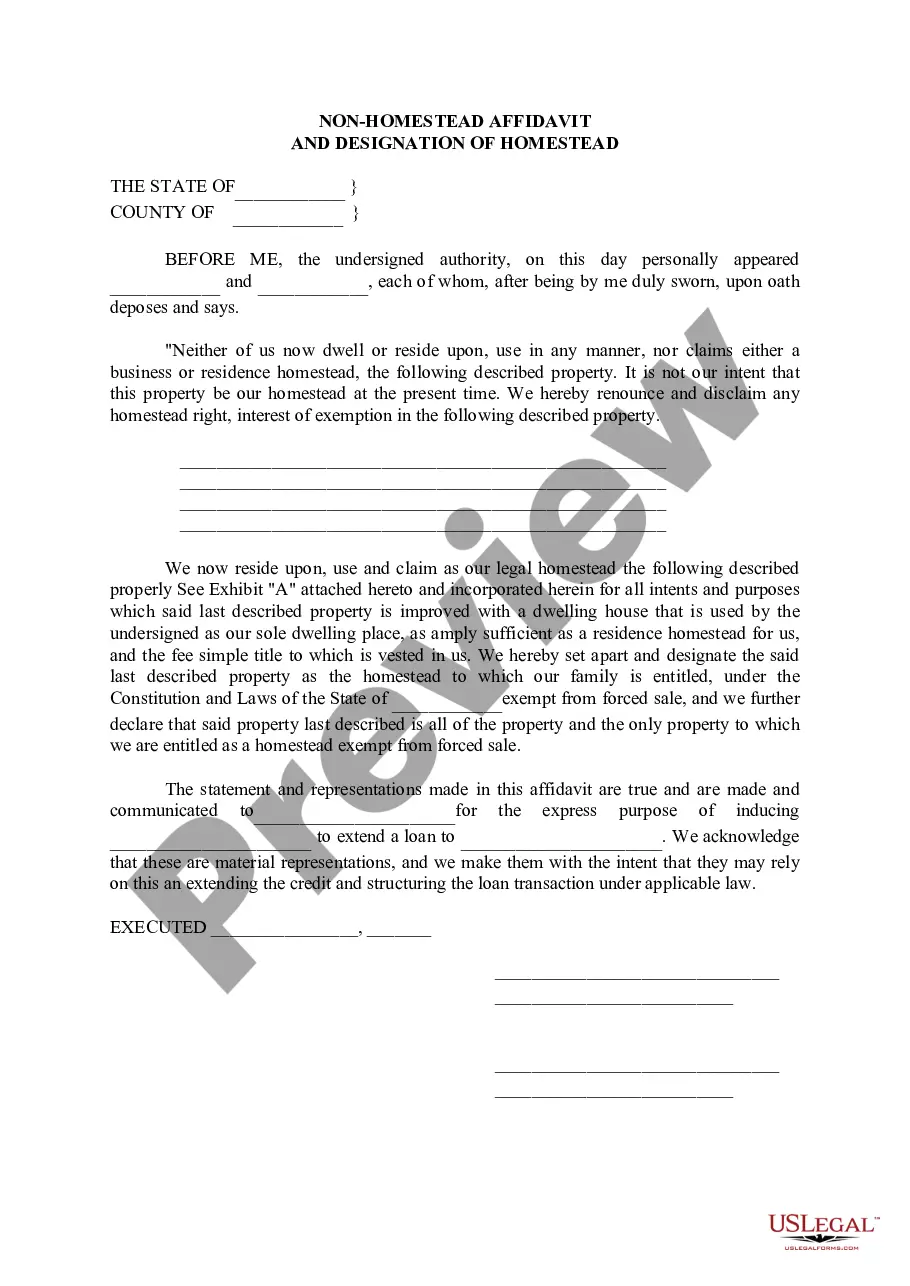

Texas Non Homestead Affidavit and Designation of Homestead Non

/cloudfront-us-east-1.images.arcpublishing.com/gray/XKIYHYWEZZA4HE5ELAFZICBYIU.png)

Designation Of Homestead Request Form Texas Bios Pics

![[Historic Marker Application Marnoch Homestead] Page 28 of 39 The](https://texashistory.unt.edu/iiif/ark:/67531/metapth491947/m1/28/full/full/0/default.jpg)

[Historic Marker Application Marnoch Homestead] Page 28 of 39 The

Homestead Exemptions Williamson County, TX

Designation Of Homestead Request Form Texas Awesome Home

Beware of ‘designation of homestead’ offers, Texas AG warns

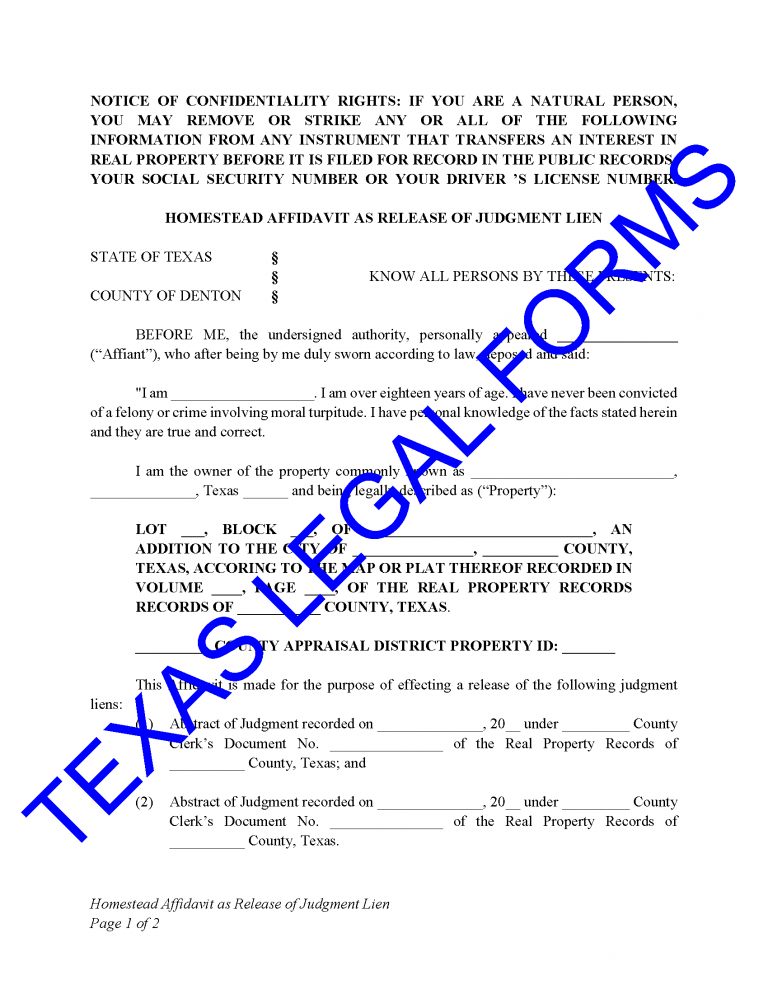

Homestead Affidavit Texas Legal Forms by David Goodhart, PLLC

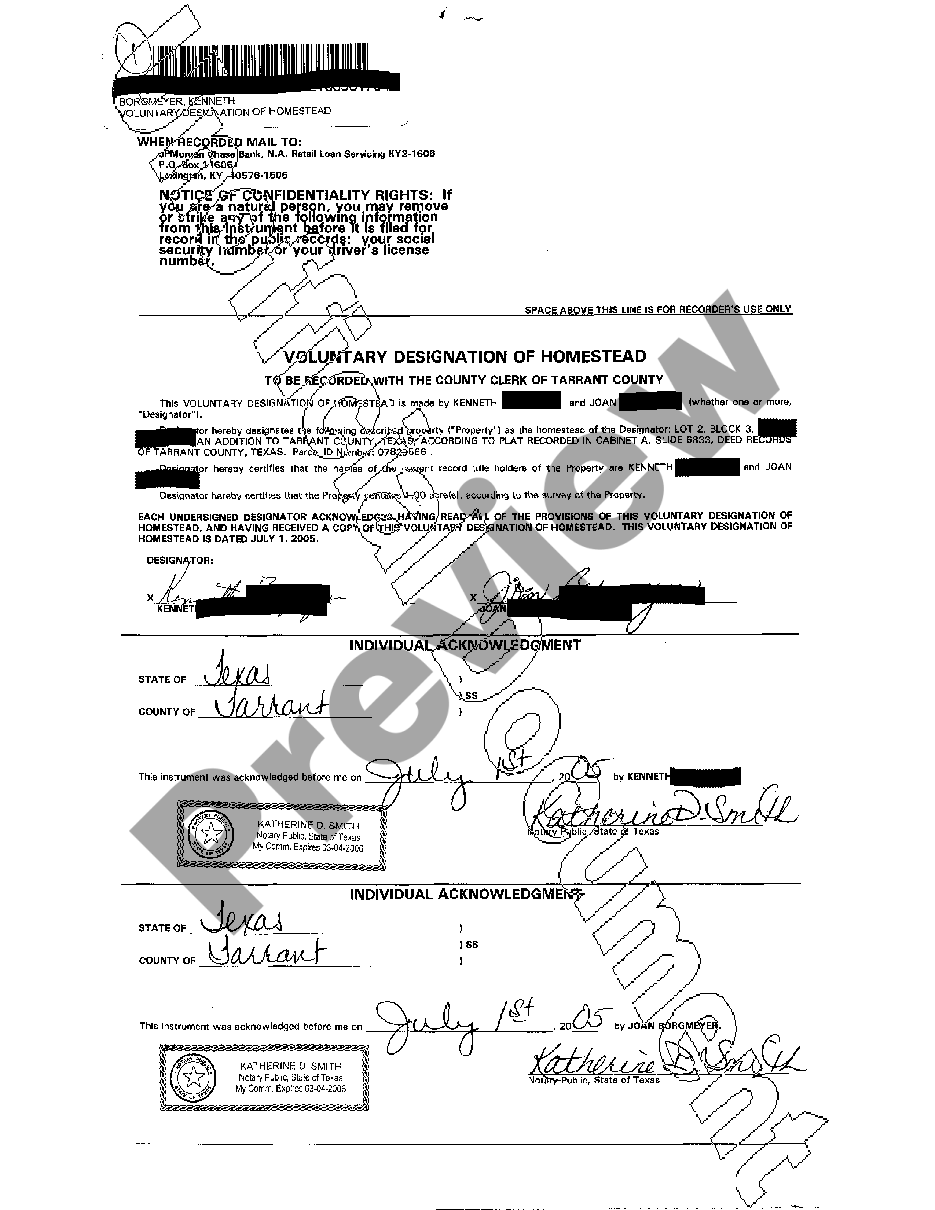

Austin Texas Voluntary Designation of Homestead Voluntary Designation

Web Designation Of Homestead (Tx) By Practical Law Real Estate.

Web A General Homestead Exemption In Texas Can Save You Money On Property Taxes By Lowering The Taxable Value Of Your Home By Up To $100,000 For School Taxes.

Web Voluntary Designation Of Homestead.

Web This Article Outlines Unique Protections Available To An Individual’s Residence And Personal Property By What Are Broadly Referred To As Texas Homestead Laws.

Related Post: