Tariffs Are Designed To Raise Money For The Government

Tariffs Are Designed To Raise Money For The Government - Taking on trade with china was a major priority of trump’s first. The united states is also a member. In 2016, import duties made up only about 1 percent of tax collections. Specific tariffs and ad valorem tariffs. The primary benefit is that tariffs produce revenue. Web in simple terms, revenue tariffs are designed primarily to raise money for the government, while protective tariffs are intended to inflate the prices of imported. Web together with tax historian joe thorndike, we're going to walk through a brief history of tariffs in the united states. Web a tariff is a specific type of tax that a governing body imposes on goods or services entering or leaving the country. Joe, to get started, tell us about that very first tariff. The words ‘tariff,’ ‘duty,’ and ‘customs’ can be. Among the first acts signed into law by the first congress was the tariff act of 1789. The primary benefit is that tariffs produce revenue. Web historical evidence and recent studies show that tariffs are taxes that raise prices and reduce available quantities of goods and services for u.s. Harris wanted to raise the corporate tax rate from. Web a. Harris wanted to raise the corporate tax rate from. Web trump 2.0 could go ‘nuclear’ on china trade, while economists say harris would remain tough. Web tariffs mainly benefit the importing countries, as they are the ones setting the policy and receiving the money. Constitution empowers congress to set tariffs, a power that congress has partially delegated to the president.. They're taxes on imported goods, which can be specific or ad valorem (often denoted as a percentage of the sale price). Web historical evidence and recent studies show that tariffs are taxes that raise prices and reduce available quantities of goods and services for u.s. August 1st, 2024, 10:05 pm pdt. The united states is also a member. Web tariff,. Tariffs are often effectively protectionist. Web tariffs are taxes paid by consumers of imported goods, raising the prices of goods brought in from another country. They're taxes on imported goods, which can be specific or ad valorem (often denoted as a percentage of the sale price). The united states is also a member. The act had two purposes: Web a tariff is a specific type of tax that a governing body imposes on goods or services entering or leaving the country. Web the china show. Imports from china (over $400 billion) or on all u.s. Joe, to get started, tell us about that very first tariff. In 2016, import duties made up only about 1 percent of tax. Web tariffs in the early united states. In 2016, import duties made up only about 1 percent of tax collections. Web tariff, tax levied upon goods as they cross national boundaries, usually by the government of the importing country. Find out today.learn more.learn at no cost. Published on may 3, 2019. The most common kind of tariffs are ad. Web tariffs are also called duties. Harris did have some differences when vying for the democratic nomination. A specific tariff is levied as a fixed charge per unit of imports. Web biden’s may 2024 tariff increases affect $18 billion worth of goods, while some trump proposals would impose tariffs on all u.s. Web in simple terms, revenue tariffs are designed primarily to raise money for the government, while protective tariffs are intended to inflate the prices of imported. Web after world war ii, tariffs become a tiny source of us tax revenue. Web tariffs mainly benefit the importing countries, as they are the ones setting the policy and receiving the money. August. Among the first acts signed into law by the first congress was the tariff act of 1789. A specific tariff is levied as a fixed charge per unit of imports. Web in simple terms, revenue tariffs are designed primarily to raise money for the government, while protective tariffs are intended to inflate the prices of imported. Web trump 2.0 could. Harris wanted to raise the corporate tax rate from. Constitution empowers congress to set tariffs, a power that congress has partially delegated to the president. In 2016, import duties made up only about 1 percent of tax collections. The united states is also a member. Taking on trade with china was a major priority of trump’s first. Web together with tax historian joe thorndike, we're going to walk through a brief history of tariffs in the united states. The act had two purposes: Specific tariffs and ad valorem tariffs. A specific tariff is levied as a fixed charge per unit of imports. Web in 2023, a 10 per cent tariff would raise us$310 billion for the u.s. Web in simple terms, revenue tariffs are designed primarily to raise money for the government, while protective tariffs are intended to inflate the prices of imported. The most common kind of tariffs are ad. In 2016, import duties made up only about 1 percent of tax collections. Tariffs are often effectively protectionist. Web tariffs—taxes or duties placed on an imported good by a domestic government—are usually levied as a percentage of the declared value of the good,. The united states is also a member. Web the china show. Imports from china (over $400 billion) or on all u.s. Constitution empowers congress to set tariffs, a power that congress has partially delegated to the president. Find out today.learn more.learn at no cost. The words ‘tariff,’ ‘duty,’ and ‘customs’ can be.

Events leading to Succession ppt download

Further Review A History of U.S. Tariffs The SpokesmanReview

Associate Professor/Crop Marketing Specialist ppt download

26 Globalization and international marketing ppt download

:max_bytes(150000):strip_icc()/TariffsAffectPrices2_2-f9bc0f6dc8f248eb8c6e22ad499b66c0.png)

The Basics of Tariffs and Trade Barriers

What Is a Tariff and How Does It Work? A Guide CentSai Finance

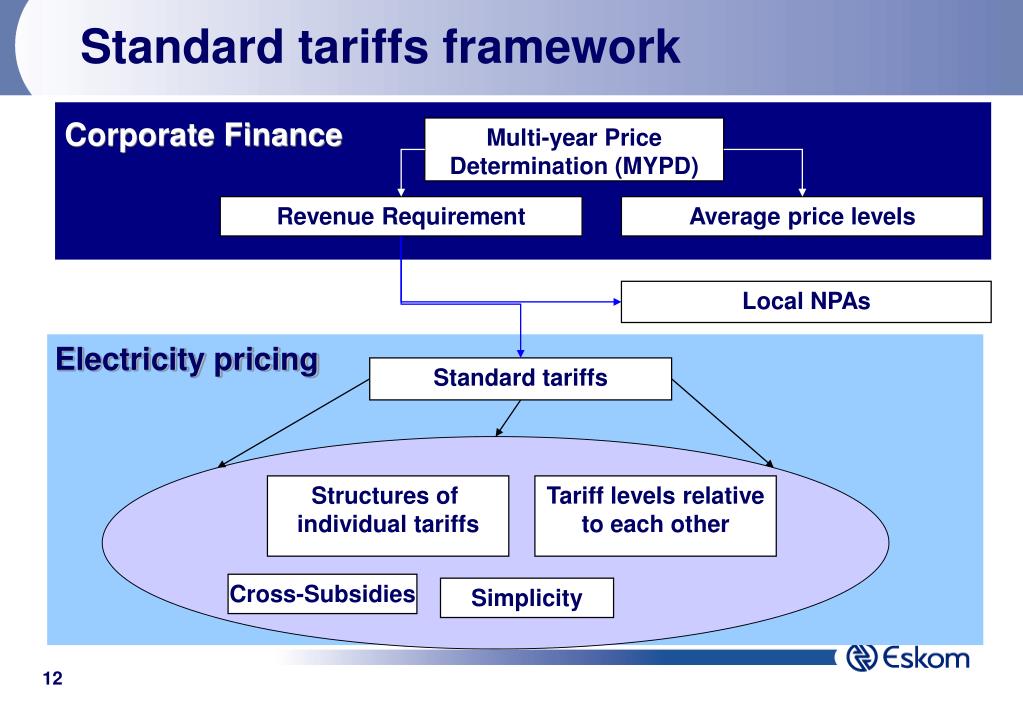

PPT Cost of Service A Tariff Overview PowerPoint Presentation, free

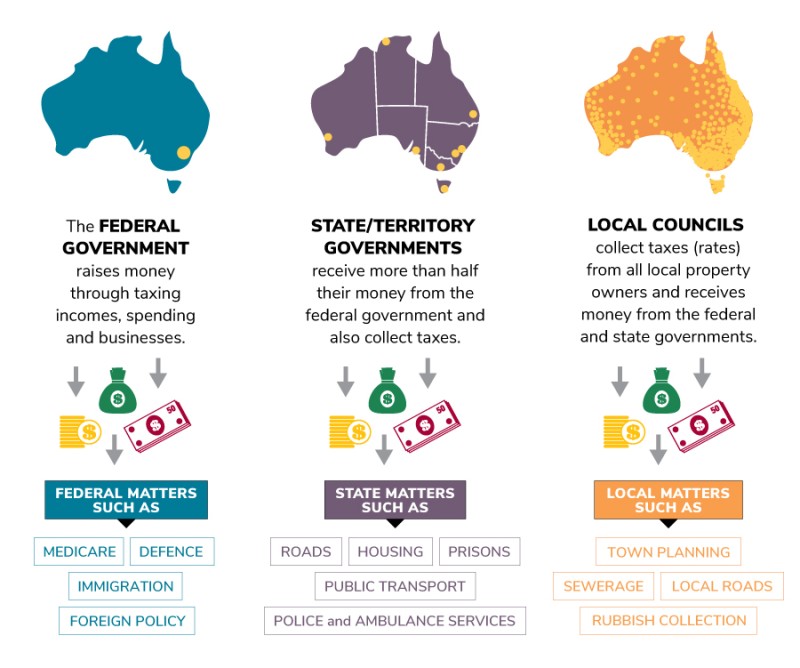

What is a tariff? Parliamentary Education Office

Types of Tariffs Business Roundtable

Types of Tariffs Business Roundtable

Government, Representing 7.6 Per Cent Of Federal Revenues And Fully A Fifth Of The Deficit.

Constitution Empowers Congress To Set Tariffs, A Power That Congress Has Partially Delegated To The President.

Help Is One Click Awaymake Your Impact Todayget More For Your Efforts

Web A Tariff Is A Tax Levied On An Imported Good With The Intent To Limit The Volume Of Foreign Imports, Protect Domestic Employment, Reduce Competition Among Domestic.

Related Post: