Strongest Bullish Candlestick Pattern

Strongest Bullish Candlestick Pattern - Watching a candlestick pattern form can be time consuming and irritating. Web let’s look at a single candle pattern named the bullish closing marubozu. Bullish engulfing pattern comprises of two candles. For each pattern, we’ll cover: Bullish, bearish, reversal, continuation and indecision with examples and explanation. Web bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. These patterns typically are 70% or more reliable, depending on how strong the uptrend or reversal confirmation is. Web according to a top researcher of chart patterns, tim bukowsky, the inverse head and shoulders pattern is the strongest pattern with an 89% success rate. The first candle would be a small red candle while the second candle would be a big green candle. Web 📚 candlestick charts are used by traders to determine possible price movement based on past patterns; Web bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. It indicates a buying pressure, followed by a selling pressure that was not. You better be because you’re in for a treat! Web 📚 candlestick charts are used by traders to determine possible price movement based on past patterns; A. You better be because you’re in for a treat! This shows buying pressure stepped in and reversed the downtrend. However, this is the result he got from the specific data set he used. Bullish patterns are predicted when two or more candlesticks form patterns. These patterns may indicate either bullish or bearish trends, and so should be used in conjunction. Web in this article, we will cover 5 important bullish candlestick patterns. Web 8 strongest candlestick patterns. Some examples of bullish candles are the hammer, inverted hammer, and bullish engulfing patterns. We will focus on five bullish candlestick patterns that give the strongest reversal signal. Watching a candlestick pattern form can be time consuming and irritating. Web in this article, we will cover 5 important bullish candlestick patterns. Web bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. A close price very close to the high. In this post we’ll explain the most popular bullish candlestick patterns. Web there are a great many candlestick patterns that. Each of these patterns provides unique insights into market sentiment and can offer valuable signals for those looking to capitalize on emerging opportunities. Choose the best pattern with our ranking methods based on performance. Web learn about all the trading candlestick patterns that exist: A piercing pattern occurs when a bullish candle (second) closes above the middle of bearish candle. Choose the best pattern with our ranking methods based on performance. Web the bullish marubozu candlestick pattern is characterized by a long body with little to no shadows, indicating strong buying pressure, often signaling a continuation of an uptrend or a potential trend reversal. You better be because you’re in for a treat! Have a full understanding of how candlestick. Bullish, bearish, reversal, continuation and indecision with examples and explanation. What these patterns look like; Web candlestick patterns are key indicators on financial charts, offering insights into market sentiment and price movements. What are the criteria for confirming them; How to set entries and risk for each; Web their uniqueness lies in the ease with which they can be learned and integrated into multiple trading strategies. What are bullish candlestick patterns? Web how do you predict a bullish candle pattern? This shows buying pressure stepped in and reversed the downtrend. Bullish engulfing pattern comprises of two candles. What are the criteria for confirming them; Each of these patterns provides unique insights into market sentiment and can offer valuable signals for those looking to capitalize on emerging opportunities. Web their uniqueness lies in the ease with which they can be learned and integrated into multiple trading strategies. A candlestick must meet the following to be a valid bullish. Web therein lies the importance and functionality of bullish candlesticks and candlestick patterns. The most reliable japanese candlestick chart patterns — three bullish and five bearish patterns — are rated as strong. Bullish closing marubozu candlestick pattern. Web their uniqueness lies in the ease with which they can be learned and integrated into multiple trading strategies. You better be because. Web candlestick patterns are key indicators on financial charts, offering insights into market sentiment and price movements. These patterns typically are 70% or more reliable, depending on how strong the uptrend or reversal confirmation is. Here is a bullish example. That’s why in today’s guide… we will focus on practical implications on how you can use bullish candlestick patterns to create your own strategy whether you trade stocks, forex, or crypto. The only difference being that the upper wick is long, while the lower wick is short. A single candlestick pattern characterized by a long white body with no shadows, representing a strong bullish sentiment. These patterns may indicate either bullish or bearish trends, and so should be used in conjunction with other methods or signals. However, this is the result he got from the specific data set he used. Web this article will dissect the top six bullish candlestick patterns that traders can recognize. Web the bullish marubozu candlestick pattern is characterized by a long body with little to no shadows, indicating strong buying pressure, often signaling a continuation of an uptrend or a potential trend reversal. The most reliable japanese candlestick chart patterns — three bullish and five bearish patterns — are rated as strong. Web therein lies the importance and functionality of bullish candlesticks and candlestick patterns. You better be because you’re in for a treat! This shows buying pressure stepped in and reversed the downtrend. Bullish patterns are predicted when two or more candlesticks form patterns. In this post we’ll explain the most popular bullish candlestick patterns.

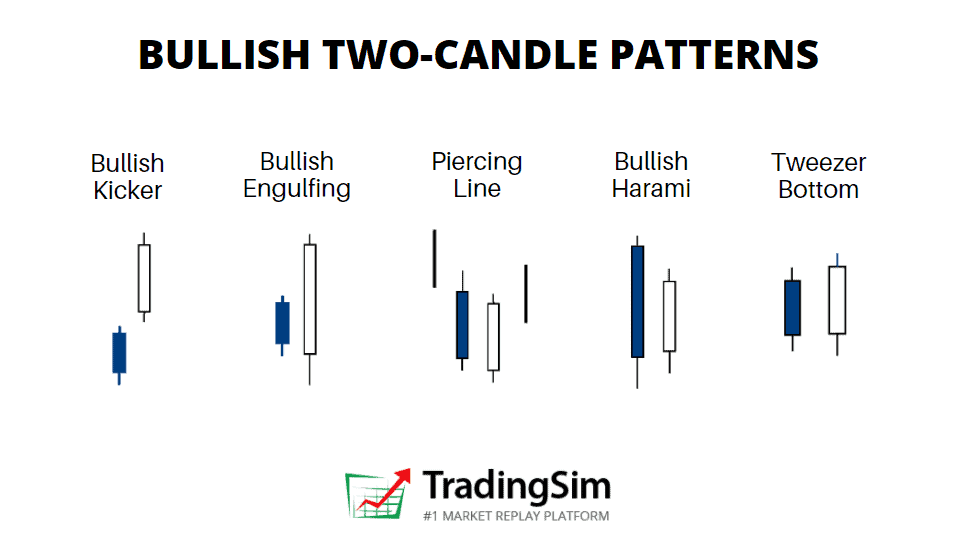

Using 7 Bullish Candlestick Patterns To Buy Stocks

6 Reliable Bullish Candlestick Pattern TradingSim

Bullish Candlestick Cheat Sheet Candle Stick Trading Pattern

Bullish Candlestick Patterns Pdf Candle Stick Trading Pattern

Using 5 Bullish Candlestick Patterns To Buy Stocks

Bullish Candlestick Patterns Pdf Candle Stick Trading Pattern

Master The 5 Bullish Candlestick Patterns For Buying Stocks

Candlestick Patterns The Definitive Guide (2021)

Bullish Candlestick Patterns Free PDF Download Advanced Forex

6 Reliable Bullish Candlestick Pattern TradingSim

Each Of These Patterns Provides Unique Insights Into Market Sentiment And Can Offer Valuable Signals For Those Looking To Capitalize On Emerging Opportunities.

What These Patterns Look Like;

Web There Are A Great Many Candlestick Patterns That Indicate An Opportunity To Buy.

Web A Candle Pattern Is Best Read By Analyzing Whether It’s Bullish, Bearish, Or Neutral (Indecision).

Related Post: