Spinning Top Pattern

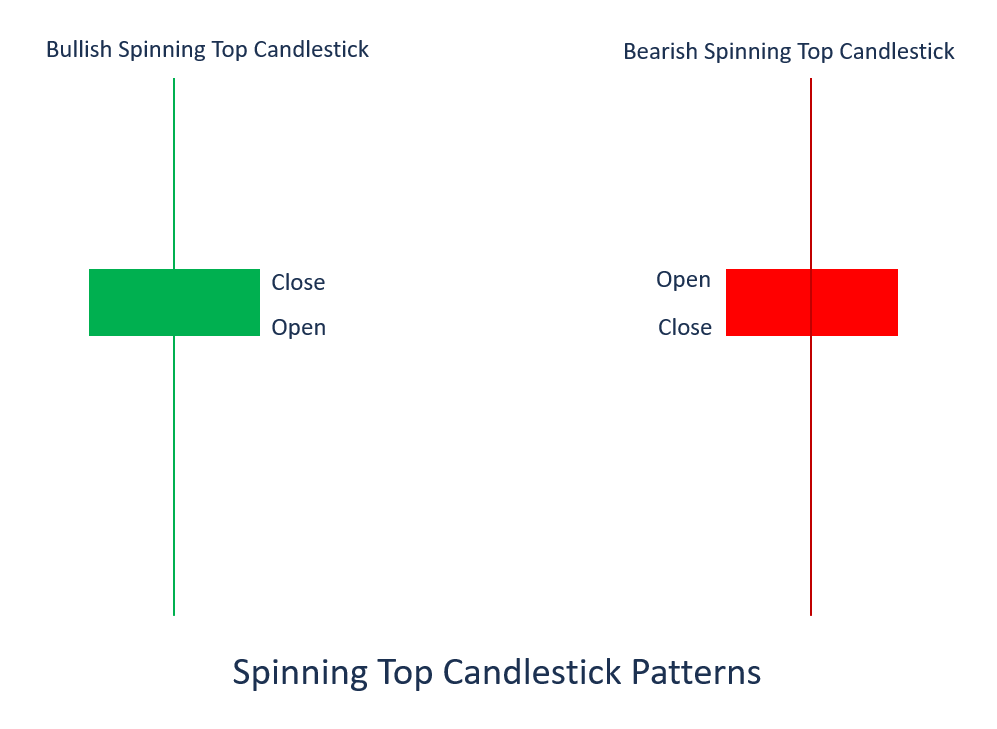

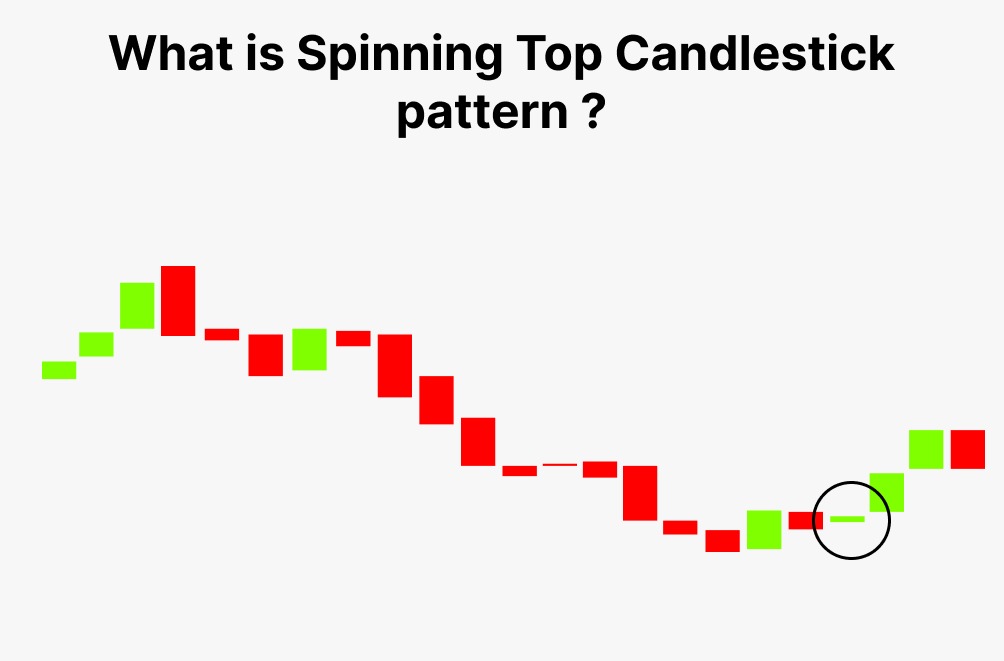

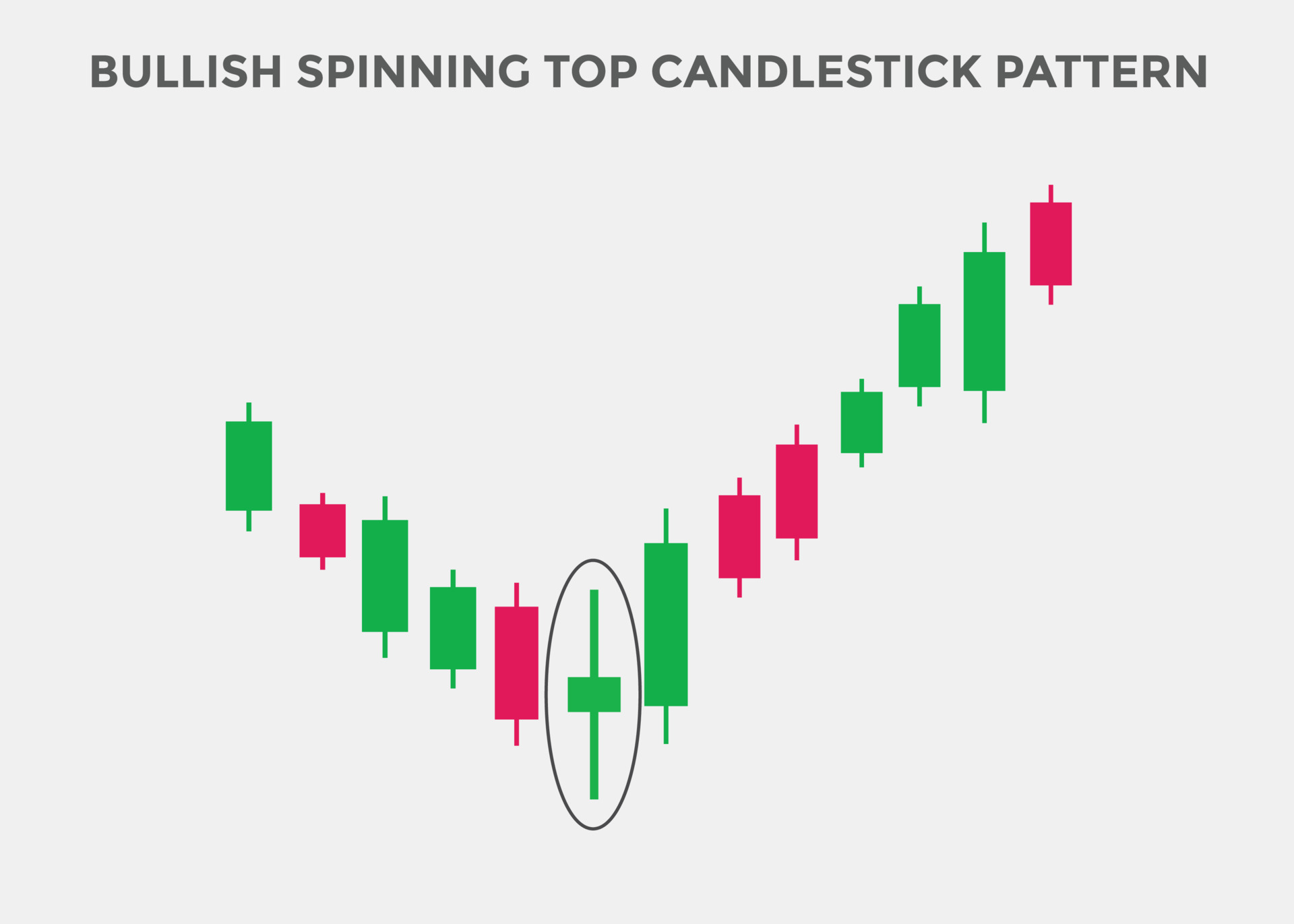

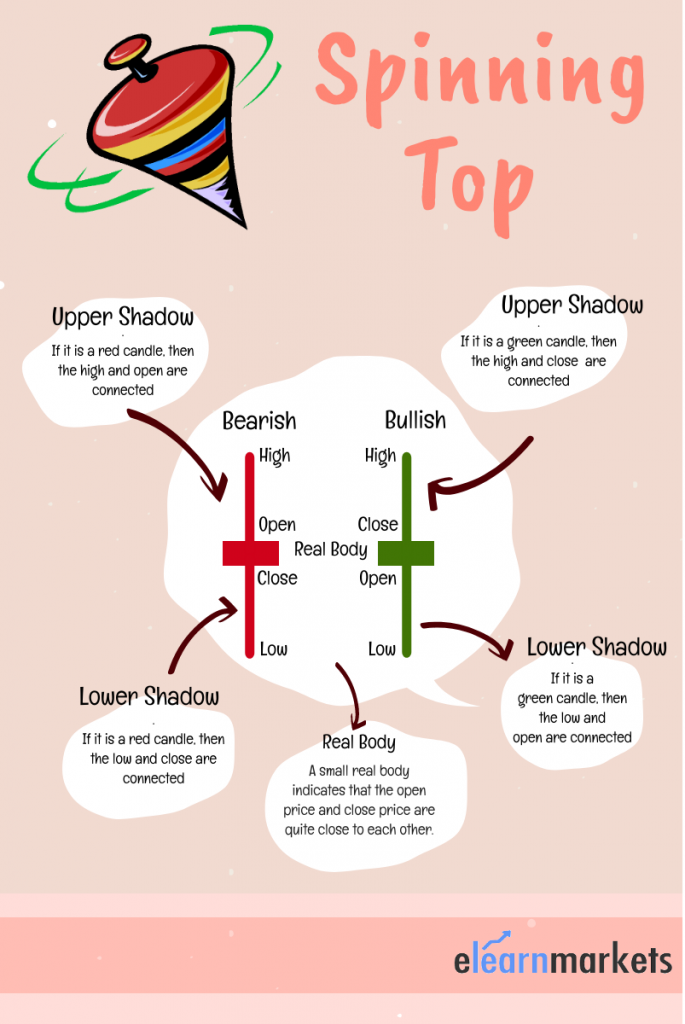

Spinning Top Pattern - Web a spinning top candlestick pattern forms when the price moves in one direction and then aggressively reverses in the opposite one. Web a spinning top candlestick is a chart pattern that forms over a single session. The pattern shows indecision as buyers and sellers both pushed the price on either sides. Web the bullish spinning top is an indecision pattern where it signals that the prevalent trend is starting to weaken or is about to reverse. Web a spinning top is a single candlestick pattern which represents indecision about the future price movement. Web a spinning top candlestick pattern is formed when the opening and closing prices of an asset are very close to each other, but there is significant movement in both directions throughout the trading session. Web identify the differences between doji candles and spinning tops on a candlestick chart, and learn how traders look at each for signals of trend changes. The pattern symbolizes a standoff between buyers and sellers, where neither party has managed to secure a decisive victory. Web a spinning top pattern involves a single candle indicating uncertainty in the market. With its distinctive long upper and lower wicks and small body, it visually portrays the tug of war between buyers and sellers during a. The pattern shows indecision as buyers and sellers both pushed the price on either sides. They emerge when bullish and bearish forces, speculating on price rise and decline, respectively, are evenly matched, resulting in a minimal net price change. In a downtrend, a spinning top may indicate that selling pressure is beginning to wane and a reversal could be imminent.. This creates a candlestick with a small real body and long upper and lower shadows or wicks. Web a spinning top candlestick is a chart pattern that forms over a single session. At the end of the candle's timeframe, both sides settle for a draw as the closing price appears near the opening price. Web a spinning top is a. The pattern shows indecision as buyers and sellers both pushed the price on either sides. Web a spinning top is a candlestick pattern with a short real body that's vertically centered between long upper and lower shadows. Web basically, we can conclude that a spinning top candlestick pattern symbolises exhaustion after a period of upsides and downsides in the market.. It is another common and effective candlestick reversal pattern used by traders to. The spinning top illustrates a scenario where neither the seller nor the buyer has gained. A small real body means that the open price and close price are close to each other. They emerge when bullish and bearish forces, speculating on price rise and decline, respectively, are. A small real body means that the open price and close price are close to each other. At the end of the candle's timeframe, both sides settle for a draw as the closing price appears near the opening price. It is another common and effective candlestick reversal pattern used by traders to. In a downtrend, a spinning top may indicate. The pattern symbolizes a standoff between buyers and sellers, where neither party has managed to secure a decisive victory. How to identify spinning top candlestick? They emerge when bullish and bearish forces, speculating on price rise and decline, respectively, are evenly matched, resulting in a minimal net price change. A spinning top is a fairly easy candlestick pattern to spot.. The spinning top candlestick is distinguished by its slender body, which is flanked by elongated upper and lower shadows. Web a candle you’ll find all over your charts, the spinning top is one of the most common candlesticks in forex. It is another common and effective candlestick reversal pattern used by traders to. Web a spinning top is a single. How to identify spinning top candlestick? Web spinning top candlestick is a pattern with a short body between an upper and a lower long wick. Web discover how to trade the spinning top candlestick pattern. It is another common and effective candlestick reversal pattern used by traders to. The spinning top illustrates a scenario where neither the seller nor the. This candlestick pattern has a short real body with long upper and lower shadows of almost equal lengths. Web a candle you’ll find all over your charts, the spinning top is one of the most common candlesticks in forex. The open and close is wider than a doji. It is another common and effective candlestick reversal pattern used by traders. In a downtrend, a spinning top may indicate that selling pressure is beginning to wane and a reversal could be imminent. The pattern symbolizes a standoff between buyers and sellers, where neither party has managed to secure a decisive victory. Web a spinning top candlestick pattern is formed when the opening and closing prices of an asset are very close. How to identify spinning top candlestick? A spinning top is a fairly easy candlestick pattern to spot. Web the spinning top pattern serves as a neutral signal, but its significance varies depending on the surrounding market conditions: Web spinning top candlestick is a pattern with a short body between an upper and a lower long wick. Web a spinning top candlestick pattern is formed when the opening and closing prices of an asset are very close to each other, but there is significant movement in both directions throughout the trading session. The spinning top illustrates a scenario where neither the seller nor the buyer has gained. Web the spinning top forex pattern consists of one candlestick that has a small green or red body that is centred between a long upper and lower wick. Web a spinning top candlestick is a chart pattern that forms over a single session. In a downtrend, a spinning top may indicate that selling pressure is beginning to wane and a reversal could be imminent. As to its appearance, a spinning top has a small body that closes in the middle of the candle’s range, with long wicks to both sides. The pattern shows indecision as buyers and sellers both pushed the price on either sides. The real body is small as it shows little difference between the open and close prices. Web read about the spinning top candlestick chart pattern, including what causes it to form and how to identify it. Web identify the differences between doji candles and spinning tops on a candlestick chart, and learn how traders look at each for signals of trend changes. The pattern symbolizes a standoff between buyers and sellers, where neither party has managed to secure a decisive victory. It is another common and effective candlestick reversal pattern used by traders to.

Spinning Top Candlestick Pattern Forex Trading

Spinning Top Candlestick Pattern Overview, Formation, How To Trade

Spinning Top Candlestick Pattern How to trade & Examples Finschool

Bullish Spinning top candlestick pattern. Spinning top Bullish

Spinning Top Candlestick How to trade with Spinning?

Trading with the Spinning Top Candlestick

What Is Spinning Top Candlestick Pattern ThinkMarkets EN

Understanding & Trading the Spinning Top Candlestick Pattern

Spinning Top Candlestick Patterns Cheat Sheet

How to Trade with the Spinning Top Candlestick IG International

It Results In Equal Opening And Closing Price Units.

Generally It Is A Small Bodied Candle With Long Wicks.

Web A Spinning Top Is A Candlestick Pattern That Indicates Uncertainty.

The Open And Close Is Wider Than A Doji.

Related Post: