Spin Top Pattern

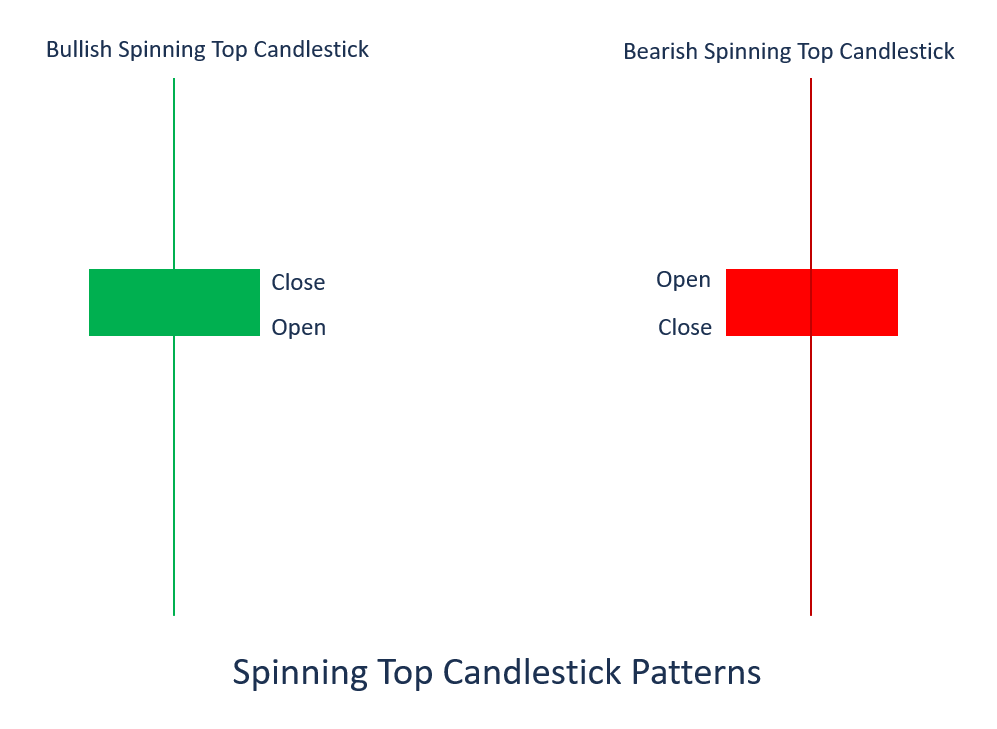

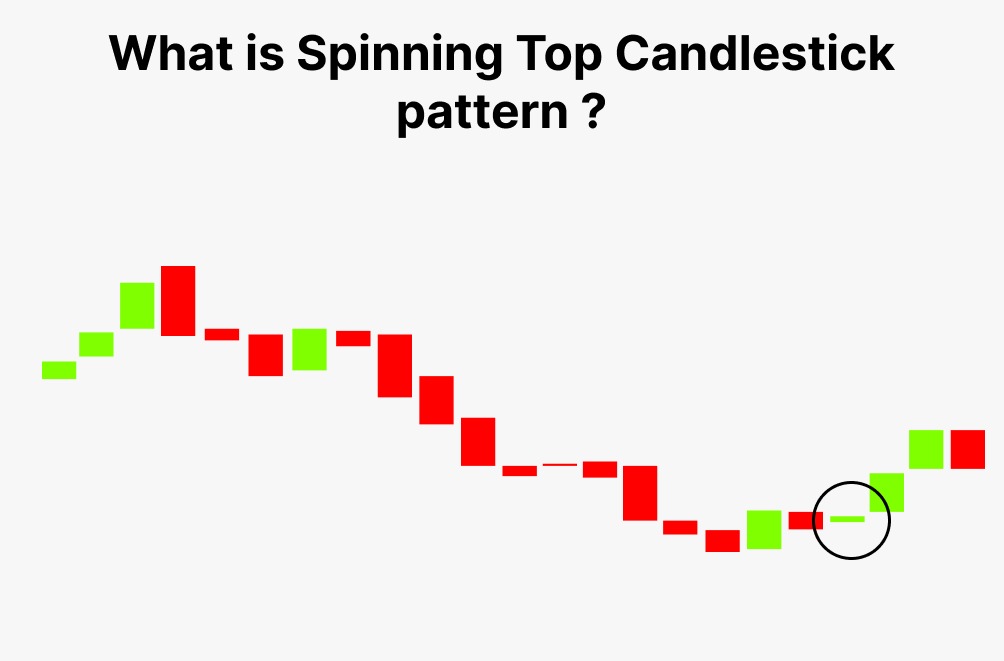

Spin Top Pattern - Before we dive into the details of the setups, i first want to ground you on the construct of a spinning top. Web a spinning top candlestick pattern is formed when the opening and closing prices of an asset are very close to each other, but there is significant movement in both directions throughout the trading session. The pattern shows indecision as buyers and sellers both pushed the price on either sides. The spinning top illustrates a scenario where neither the seller nor the buyer has gained. This candlestick pattern has a short real body with long upper and lower shadows of almost equal lengths. It happens when, after a strong uptrend, buyers start to lose some control over the market, indicating a downward movement may be near. A spinning top candle shows market uncertainty, no clear buyer/seller control, implying a. First, the bulls push price beyond the open, causing the candle to turn bullish. At the end of the candle's timeframe, both sides settle for a draw as the closing price appears near the opening price. Web spinning top candlestick is a pattern with a short body between an upper and a lower long wick. Web a spinning top candlestick can be defined as an asset price movement pattern where the candlestick has a short real body positioned between long upper and lower shadows. A spinning top candle shows market uncertainty, no clear buyer/seller control, implying a. This subtle shift is usually called a continuation pattern in trading terminology. Web a spinning top pattern can. It has a small body closing in the middle of the candle’s range, with long wicks on both sides. A small real body means that the open price and close price are close to each other. Web a spinning top candlestick pattern is formed when the opening and closing prices of an asset are very close to each other, but. First, the bulls push price beyond the open, causing the candle to turn bullish. At the end of the candle's timeframe, both sides settle for a draw as the closing price appears near the opening price. It results in equal opening and closing price units. The real body is small as it shows little difference between the open and close. First, the bulls push price beyond the open, causing the candle to turn bullish. Web a spinning top is a single candlestick pattern which represents indecision about the future price movement. The candlestick pattern signifies uncertainty over the asset’s future course. This subtle shift is usually called a continuation pattern in trading terminology. Web discover how to trade the spinning. Web a spinning top candlestick pattern have a small real body with upper and lower shadows of the almost same length. Understand what it means, mistakes to avoid, and strategies to ride massive trends. Web a spinning top is a single candlestick pattern that has a body in the middle of two longer wicks. Before we dive into the details. Web a spinning top is a single candlestick pattern that has a body in the middle of two longer wicks. In its simplicity and prevalence, the spinning top resembles the doji. This subtle shift is usually called a continuation pattern in trading terminology. A spinning top pattern involves a single candle indicating uncertainty in the market. A spinning top candle. Web a spinning top candlestick pattern have a small real body with upper and lower shadows of the almost same length. It is another common and effective candlestick reversal pattern used by traders to. The real body is small as it shows little difference between the open and close prices. First, the bulls push price beyond the open, causing the. Web spinning top candlestick is a pattern with a short body between an upper and a lower long wick. Understand what it means, mistakes to avoid, and strategies to ride massive trends. The spinning top illustrates a scenario where neither the seller nor the buyer has gained. You’ll also learn how to trade when you spot the spinning top pattern.. Web a spinning top is a single candlestick pattern which represents indecision about the future price movement. Spinning tops form when the bulls and bears battle for control of price, but neither side can overwhelm the other. The pattern shows indecision as buyers and sellers both pushed the price on either sides. Before we dive into the details of the. This creates a candlestick with a small real body and long upper and lower shadows or wicks. The bears, of course, don’t like this. Web spinning top candlestick is a pattern with a short body between an upper and a lower long wick. Web a spinning top candlestick pattern is formed when the opening and closing prices of an asset. Web a spinning top candlestick can be defined as an asset price movement pattern where the candlestick has a short real body positioned between long upper and lower shadows. The real body is small as it shows little difference between the open and close prices. Web in this article, i will discuss how to combine spinning tops with other candlestick formations and volume candles to pinpoint market reversals and continuation patterns. A small real body means that the open price and close price are close to each other. Web a spinning top pattern can occur after a robust buying or selling trend. Spinning tops form when the bulls and bears battle for control of price, but neither side can overwhelm the other. Web spinning top candlesticks can form a the the top or bottom of a pattern, signaling the end of a trend. It has a small body closing in the middle of the candle’s range, with long wicks on both sides. The candlestick pattern represents indecision about the. Web a spinning top is a single candlestick pattern that has a body in the middle of two longer wicks. Web the spinning top candlestick chart pattern develops when buyers and sellers reach an equilibrium, leading to minimal changes between opening and closing prices. In its simplicity and prevalence, the spinning top resembles the doji. It is another common and effective candlestick reversal pattern used by traders to. However, it’s easy to distinguish between the two because one has a body (the spinning top) and the other doesn’t (the doji). Web a candlestick pattern known as a spinning top features a short true body that is vertically positioned in the middle of extended upper and lower shadows. Spinning top candlestick pattern shows uncertainties around an underlying asset.

Spinning Tops Exploratorium

DIY Spinning Top Optical Illusion Toys — All for the Boys

Understanding & Trading the Spinning Top Candlestick Pattern

Spinning Top Candlestick Pattern Overview, Formation, How To Trade

What Does a Spinning Top Candlestick Pattern Mean? ThinkMarkets UK

LITE Spinning Tops

Buy online wooden spin top with patterns Shumee

Spinning Top Candlestick Pattern Forex Trading

Buy online wooden spin top with patterns Shumee

Spinning Top Candlestick Pattern How to trade & Examples Finschool

Web A Spinning Top Candlestick Pattern Have A Small Real Body With Upper And Lower Shadows Of The Almost Same Length.

Web A Spinning Top Candlestick Pattern Forms When The Price Moves In One Direction And Then Aggressively Reverses In The Opposite One.

While Closely Resembling A Doji, A Spinning Top Has Small Differences.

Web A White Spinning Top Is A Bullish Candlestick Chart Pattern That Indicates That The Closing Price Of A Security Or Other Financial Instrument Was Higher Than The Closing Price.

Related Post: