Sp 500 Seasonality Chart

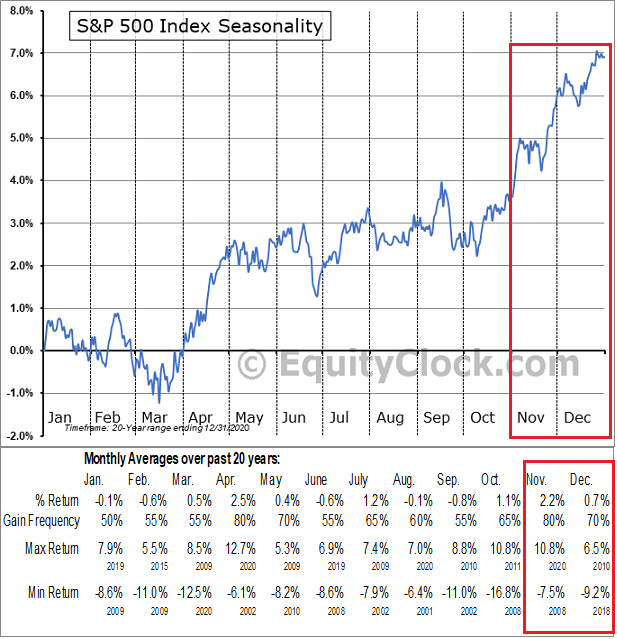

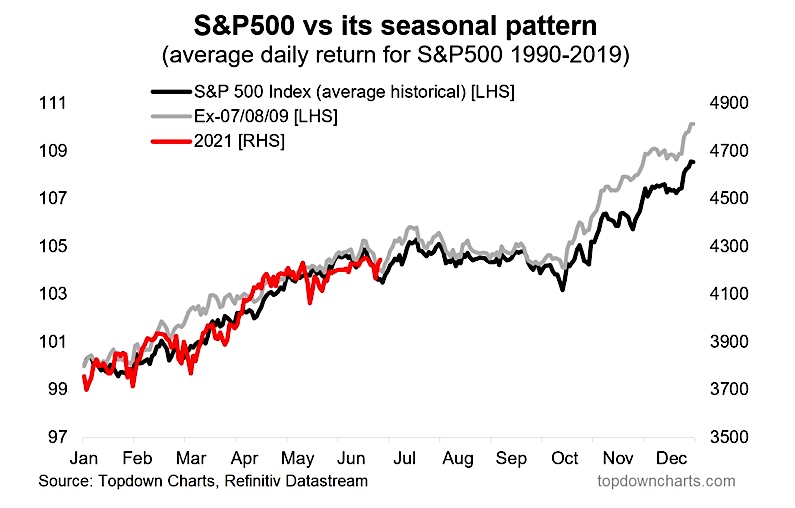

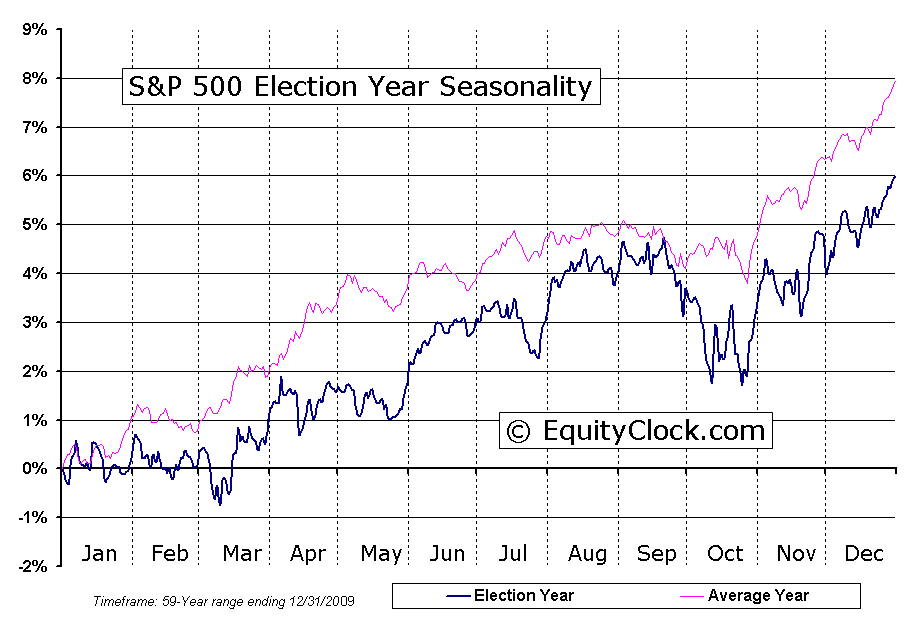

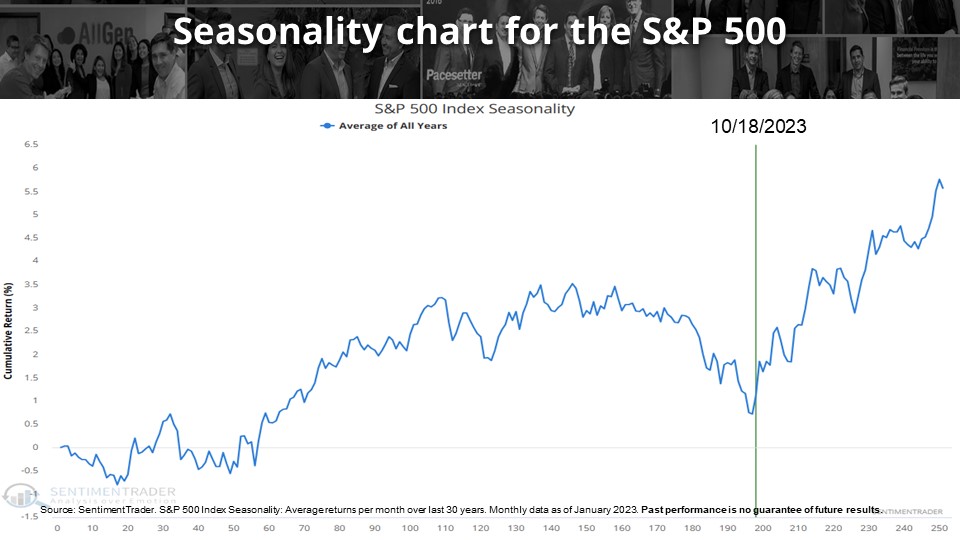

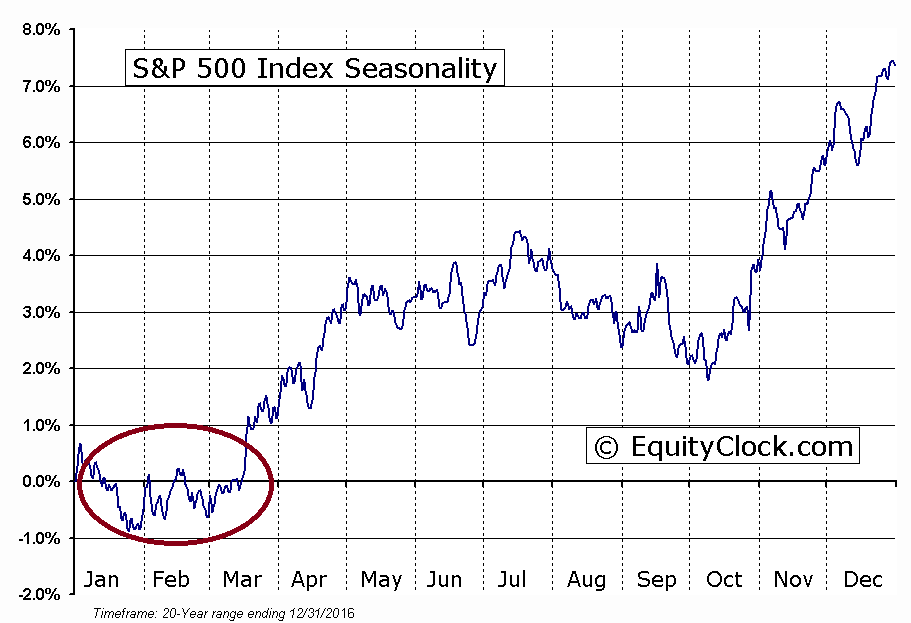

Sp 500 Seasonality Chart - The best presidential election year for the stock market was 1928 at 43.6 percent, and the worst year was. Web a seasonal chart of the s&p 500 shows when the index (or s&p futures) tends to move higher and lower, or peak or bottom, at certain points in the year. Web when a democrat was elected, the average yearly return for the s&p 500 was 7.6 percent. Reliability expressed by the number of profitable periods out of at least the past ten periods. Web interactive chart for s&p 500 (^gspc), analyze all the data with a huge range of indicators. For those less familiar with relative. Daily chart of the s&p 500 index. Technology companies report higher y/y net margins of 24.9% vs. Instead of looking at the last 20. Web determine how spdr s&p 500 etf trust (spy) performs during each month of the year. It’s completely free for 30 days. Web determine how spdr s&p 500 etf trust (spy) performs during each month of the year. Analysis has revealed that with a buy date of march 9 and a sell date of june 4, investors have benefited from a total return of 85.05% over the last 10 years. Technology companies report higher y/y net. To compare seasonality across stocks/etfs/crypto by calendar month visit seasonality summary. I highlight key price levels to monitor on the chart. Reliability expressed by the number of profitable periods out of at least the past ten periods. Web seasonal performance for [spx] s&p 500 index. This isn't an unusual seasonality pattern. The above chart represents the seasonality for s&p 500 futures (sp) continuous contract for the past 20 years. Web s&p 500 index (^gspc) seasonality. Web seasonal performance for [spx] s&p 500 index. January 1, 1990 to december 31, 2009. Reliability expressed by the number of profitable periods out of at least the past ten periods. This seasonality chart shows that 2012 was the best year for mrk, and 2010 was the worst. The best presidential election year for the stock market was 1928 at 43.6 percent, and the worst year was. Web seasonality chart of the russell 2000 vs. Web determine how spdr s&p 500 etf trust (spy) performs during each month of the year.. Web interactive chart for s&p 500 (^gspc), analyze all the data with a huge range of indicators. All information is supplied without guarantee. A seasonality chart comparing a stock against a benchmark is a line chart. Web seasonality chart of the russell 2000 vs. I highlight key price levels to monitor on the chart. Alternatively, view seasonality for a. The current month is updated on an hourly basis with today's latest value. Web the forecaster terminal enables better trading and investment decisions on s&p 500 with its 'seasonality' tab. Reliability expressed by the number of profitable periods out of at least the past ten periods. The s&p 500 (spx), or standard & poor's 500,. Web by john butters | july 26, 2024. Average return during the chosen period expressed as a percent. The current month is updated on an hourly basis with today's latest value. Web the net profit margin for the s&p 500 for q2 2024 is about 12.1%, above the net profit margin of a year ago. Analyze performance of s&p 500. Performance relative to a major equity index such as the s&p 500 index or the tsx composite index. Average return during the chosen period expressed as a percent. On the one hand, the percentage of s&p 500 companies reporting positive earnings surprises is above average levels. Web seasonality is measured in three ways: Web interactive chart of the s&p 500. Reliability expressed by the number of profitable periods out of at least the past ten periods. The s&p 500 (spx), or standard & poor's 500, is a notable stock market index that measures the performance of 500 large companies listed on u.s. Visit my new website www.seasonax.com for 20.000+ up to date seasonal charts! This isn't an unusual seasonality pattern.. Web determine how spdr s&p 500 etf trust (spy) performs during each month of the year. The best presidential election year for the stock market was 1928 at 43.6 percent, and the worst year was. Web the quarterly chart tells us that s&p 500 index tend to decline almost 0.5% in the middle of the month compared to april’s starting. The average sp500 curve was computed using closing daily values for years 2004 through 2023. The s&p 500 (spx), or standard & poor's 500, is a notable stock market index that measures the performance of 500 large companies listed on u.s. Web index performance for s&p 500 index (spx) including value, chart, profile & other market data. Web view data of the s&p 500, an index of the stocks of 500 leading companies in the us economy, which provides a gauge of the u.s. The best presidential election year for the stock market was 1928 at 43.6 percent, and the worst year was. For a different look, and to see how some actual years have played out, here are the yearly charts of the s&p 500 (spy) from 2014 to 2023. Web now you can pinpoint hundreds of high probability seasonal trades on s&p 500 stocks in very specific time windows with just a couple clicks. On the one hand, the percentage of s&p 500 companies reporting positive earnings surprises is above average levels. Web this chart visualizes the collective seasonality of all 11 sectors in the s&p 500. The above chart represents the seasonality for s&p 500 futures (sp) continuous contract for the past 20 years. Web the quarterly chart tells us that s&p 500 index tend to decline almost 0.5% in the middle of the month compared to april’s starting price. Daily chart of the s&p 500 index. Web a seasonal chart of the s&p 500 shows when the index (or s&p futures) tends to move higher and lower, or peak or bottom, at certain points in the year. This isn't an unusual seasonality pattern. I highlight key price levels to monitor on the chart. Use this simple tool to quickly find the best and worst holding periods, win rates by month, and seasonal trends to aid your trading research.

Weekly S&P 500 ChartStorm Seasonality; FAANG ExGrowth; Price Vs. Fair

S&p Seasonality Chart

S&p Seasonality Chart

S&P 500 Seasonality (S&P 500 계절성 전략)

TimePriceResearch S&P 500 vs Election Year Seasonal Chart

S&P 500 Seasonality Chart AllGen Financial Advisors, Inc.

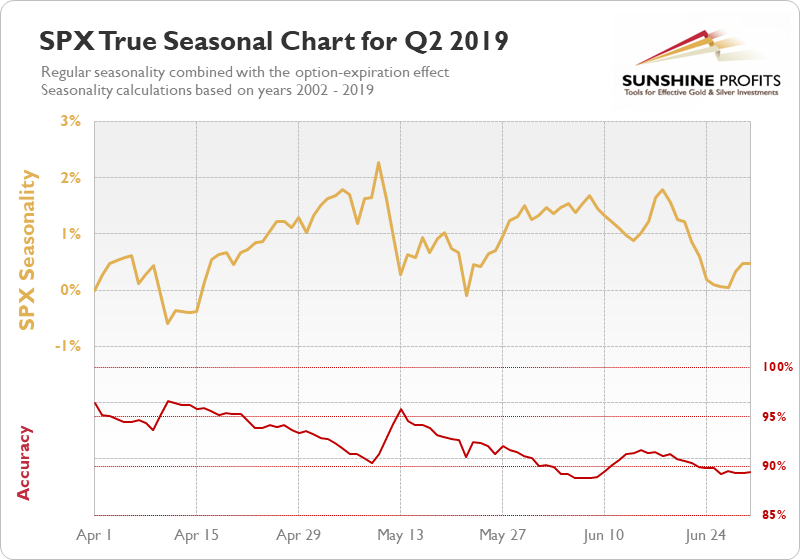

S&P 500 Seasonality So Much Better Sunshine Profits

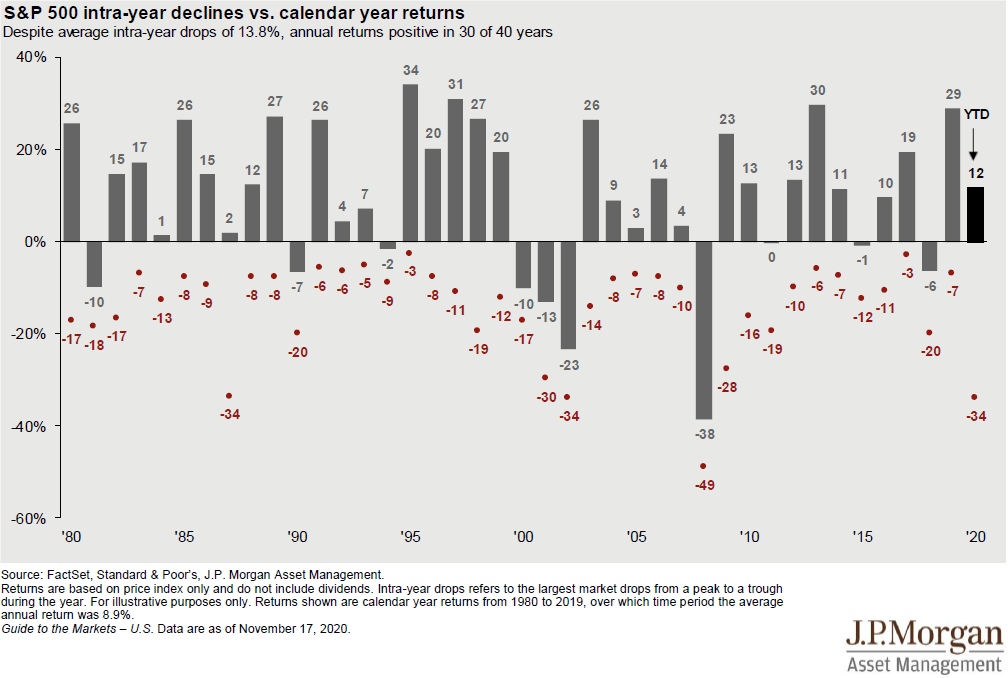

Weekly S&P 500 ChartStorm Seasonality, Statistics, And Earnings

s&p seasonals ValueTrend

S&P 500 Weekly Investing Outlook Seasonal Patterns Challenging See

Web Seasonality Chart Of The Russell 2000 Vs.

All Information Is Supplied Without Guarantee.

Analysis Has Revealed That With A Buy Date Of March 9 And A Sell Date Of June 4, Investors Have Benefited From A Total Return Of 85.05% Over The Last 10 Years.

March, April, May, June, July, August, October, November, December.

Related Post: