Sp 500 Chart Remains Negative Despite Oversold Conditions

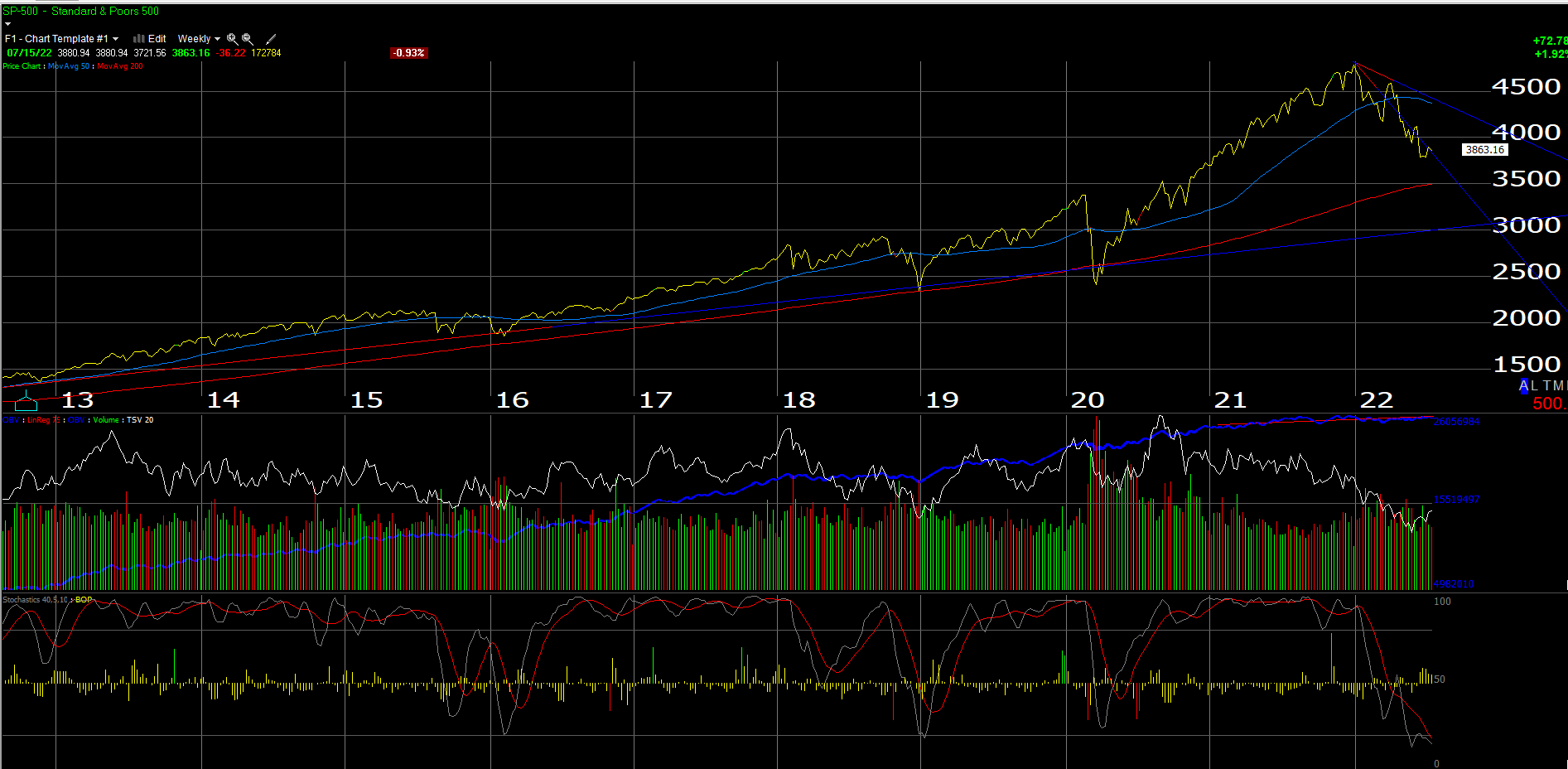

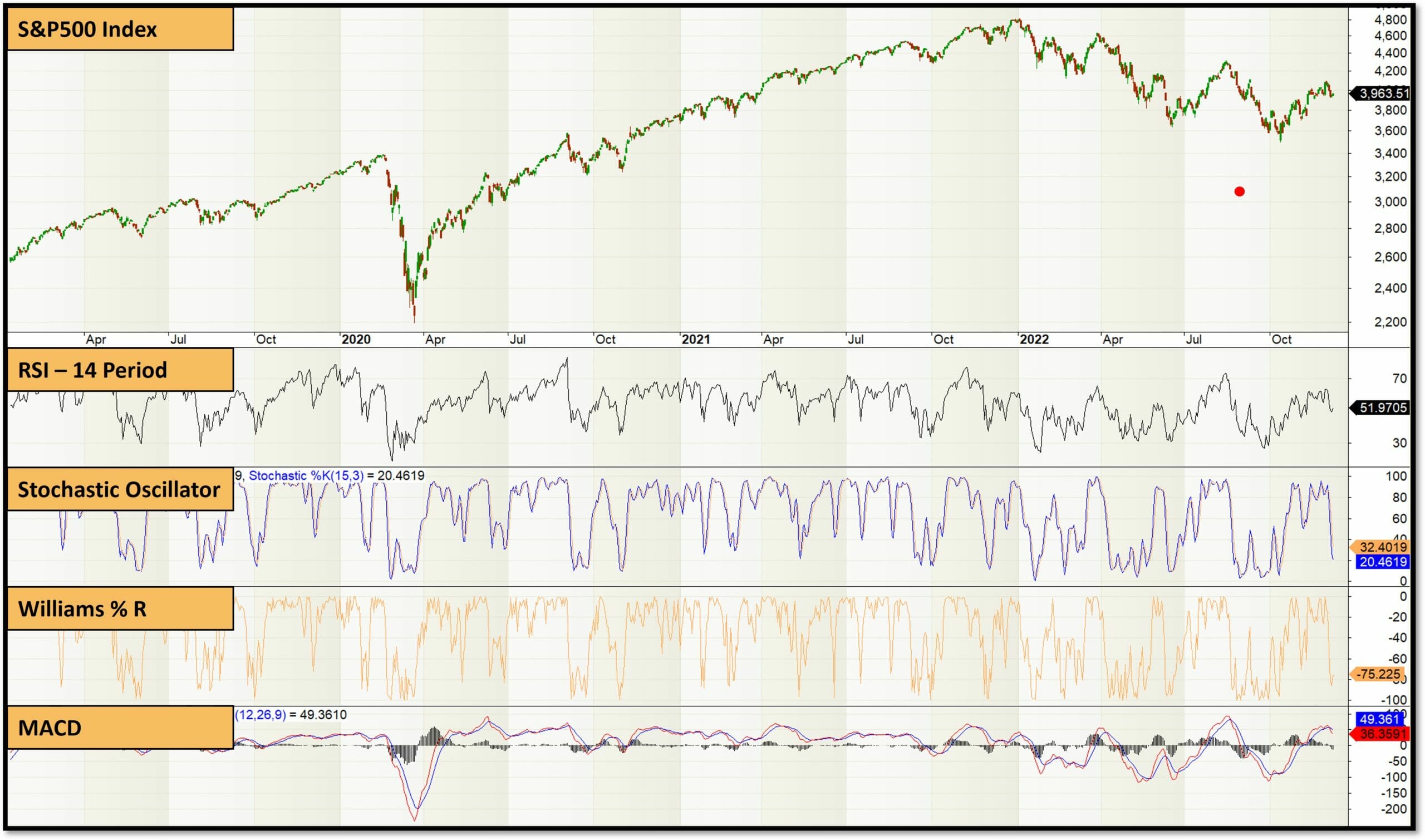

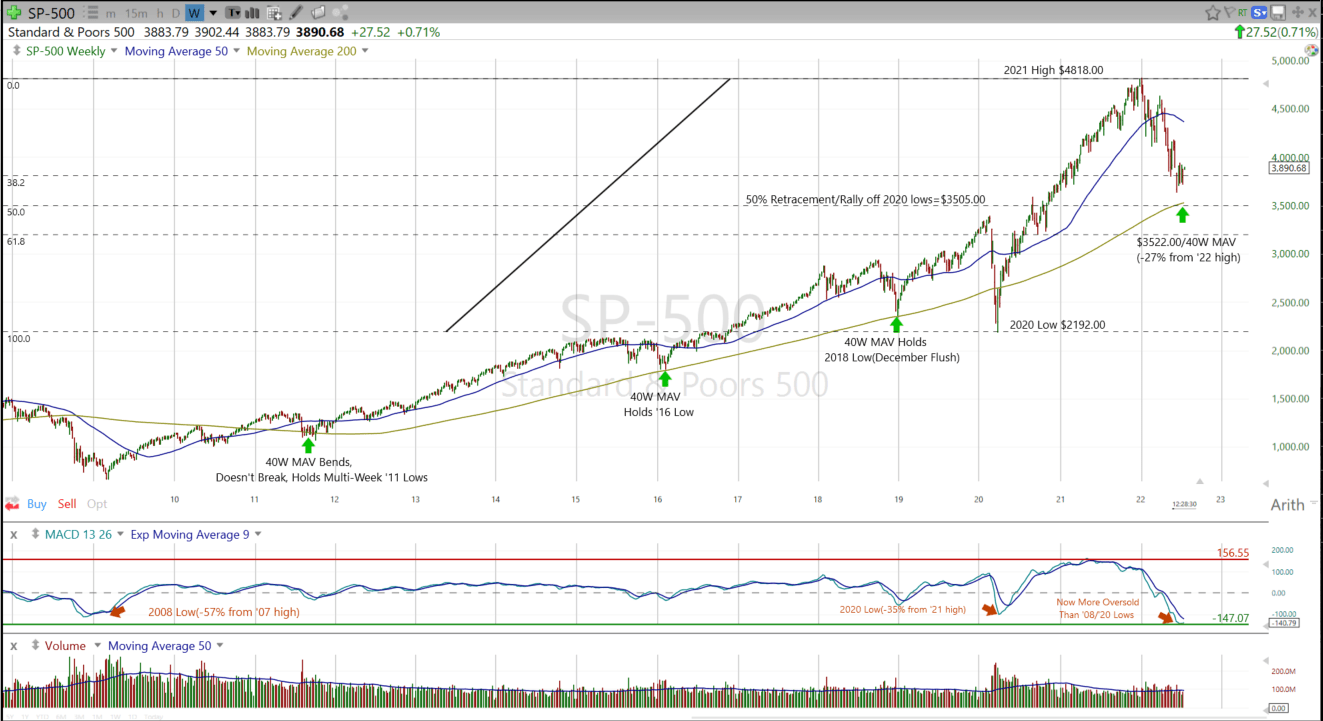

Sp 500 Chart Remains Negative Despite Oversold Conditions - I see no indication that gold will recover at this stage. The s&p 500 index has stalled out at its july high around 4600, and overbought readings from rsi indicate a likely pullback. This rally began in late october, initially spurred by a deeply. The ensuing rally has been strong, fueled. Web s&p 500 total returns by year since 1926. Web again, this is a negative indicator that is in an oversold condition. Therefore gains are likely to be limited with. Web the s&p 500 index has extended its gains, as we expected after last week’s breakout over resistance at 4170. The total returns of the s&p 500 index are listed by year. View daily, weekly or monthly format back to when s&p 500 stock was issued. Volatility measures, on the other hand, have. Web the s&p 500 index has extended its gains, as we expected after last week’s breakout over resistance at 4170. The s&p 500 index has stalled out at its july high around 4600, and overbought readings from rsi indicate a likely pullback. The etf hit a new all time high less than two. Web discover historical prices for ^gspc stock on yahoo finance. Web the above indicators are what we call “market internals,” and they have been fairly negative in line with the decline in spx. Web i think the outlook remains negative despite oversold conditions. Volatility measures, on the other hand, have. Web the s&p 500 spdr (spy) is down sharply this. Volatility measures, on the other hand, have. Stock market, as measured by the s&p 500 index spx, has continued to fall, even as oversold conditions abound and. The ensuing rally has been strong, fueled. The s&p 500 index has stalled out at its july high around 4600, and overbought readings from rsi indicate a likely pullback. The etf hit a. Web 99 rows interactive chart of the s&p 500 stock market index since 1927. Web s&p 500 total returns by year since 1926. Web the s&p 500's valuation is subjective and could rise instead of falling, with increasing growth opportunities and a more accessible monetary environment. Web the stock market, as measured by the s&p 500 index spx, bounced off. Web the spdr® s&p 500 etf trust (nysearca:spy) finished higher 240 days later 100% of the time, generating an average and median 29% and 27% return. Web discover historical prices for ^gspc stock on yahoo finance. Web again, this is a negative indicator that is in an oversold condition. Web 99 rows interactive chart of the s&p 500 stock market. Web the s&p 500 has now closed below 5,050 for two consecutive days (april 18 being the second day), and this officially eliminates our core bullish position. Web again, this is a negative indicator that is in an oversold condition. This rally began in late october, initially spurred by a deeply. I see no indication that gold will recover at. The total returns of the s&p 500 index are listed by year. The etf hit a new all time high less than two weeks ago and remains above its. View daily, weekly or monthly format back to when s&p 500 stock was issued. Web the stock market, as measured by the s&p 500 index spx, bounced off the lower trend. Web interactive chart for s&p 500 (^gspc), analyze all the data with a huge range of indicators. This rally began in late october, initially spurred by a deeply. Web s&p 500 total returns by year since 1926. Web the spdr® s&p 500 etf trust (nysearca:spy) finished higher 240 days later 100% of the time, generating an average and median 29%. This rally began in late october, initially spurred by a deeply. I see no indication that gold will recover at this stage. Web the s&p 500 spdr (spy) is down sharply this morning and over the last six days. Therefore gains are likely to be limited with. The s&p 500 index has stalled out at its july high around 4600,. I see no indication that gold will recover at this stage. The return generated by dividends. Web 99 rows interactive chart of the s&p 500 stock market index since 1927. Web the s&p 500 chart has a negative pattern now, after having broken down below previous support at 5,050. Web again, this is a negative indicator that is in an. The total returns of the s&p 500 index are listed by year. Web the stock market, as measured by the s&p 500 index spx, has decisively broken out to the upside. Web discover historical prices for ^gspc stock on yahoo finance. Web the spdr® s&p 500 etf trust (nysearca:spy) finished higher 240 days later 100% of the time, generating an average and median 29% and 27% return. The return generated by dividends. Therefore gains are likely to be limited with. The ensuing rally has been strong, fueled. Web 'oversold does not mean buy.' the u.s. Web the s&p 500's valuation is subjective and could rise instead of falling, with increasing growth opportunities and a more accessible monetary environment. Web the s&p 500 chart has a negative pattern now, after having broken down below previous support at 5,050. Web the s&p 500 spdr (spy) is down sharply this morning and over the last six days. Volatility measures, on the other hand, have. Total returns include two components: View daily, weekly or monthly format back to when s&p 500 stock was issued. Web the s&p 500 chart has a negative pattern now, after having broken down below previous support at 5,050. Web the s&p 500 index has extended its gains, as we expected after last week’s breakout over resistance at 4170.

S&P 500 Retains Negative Bias Despite BetterthanExpected ISM

Bitcoin’s (BTC) Correlation With S&P 500 Turns Negative for the First

S&P 500 Now As Oversold As 2008 Pretty Remarkable (Technical Analysis

Mastering the Relative Strength Index (RSI) A Trader’s Guide

SP 500 Chart Poplar Forest Funds

Oversold Bounces on S&P 500 and NASDAQ, Volatility Remains Unchanged

The Keystone Speculator™ SPX S&P 500 Daily Chart; Oversold; Positive

The Ultimate Guide to The Relative Strength Index SP500 with 14

Equities Remain In An Extreme Oversold Condition Seeking Alpha

S&P 500 Now As Oversold As 2008 Pretty Remarkable (Technical Analysis

Web The Stock Market, As Measured By The S&P 500 Index Spx, Bounced Off The Lower Trend Line Of The Bear Market Last Week.

Web 99 Rows Interactive Chart Of The S&P 500 Stock Market Index Since 1927.

The Etf Hit A New All Time High Less Than Two Weeks Ago And Remains Above Its.

I See No Indication That Gold Will Recover At This Stage.

Related Post: