Snowball Debt Template

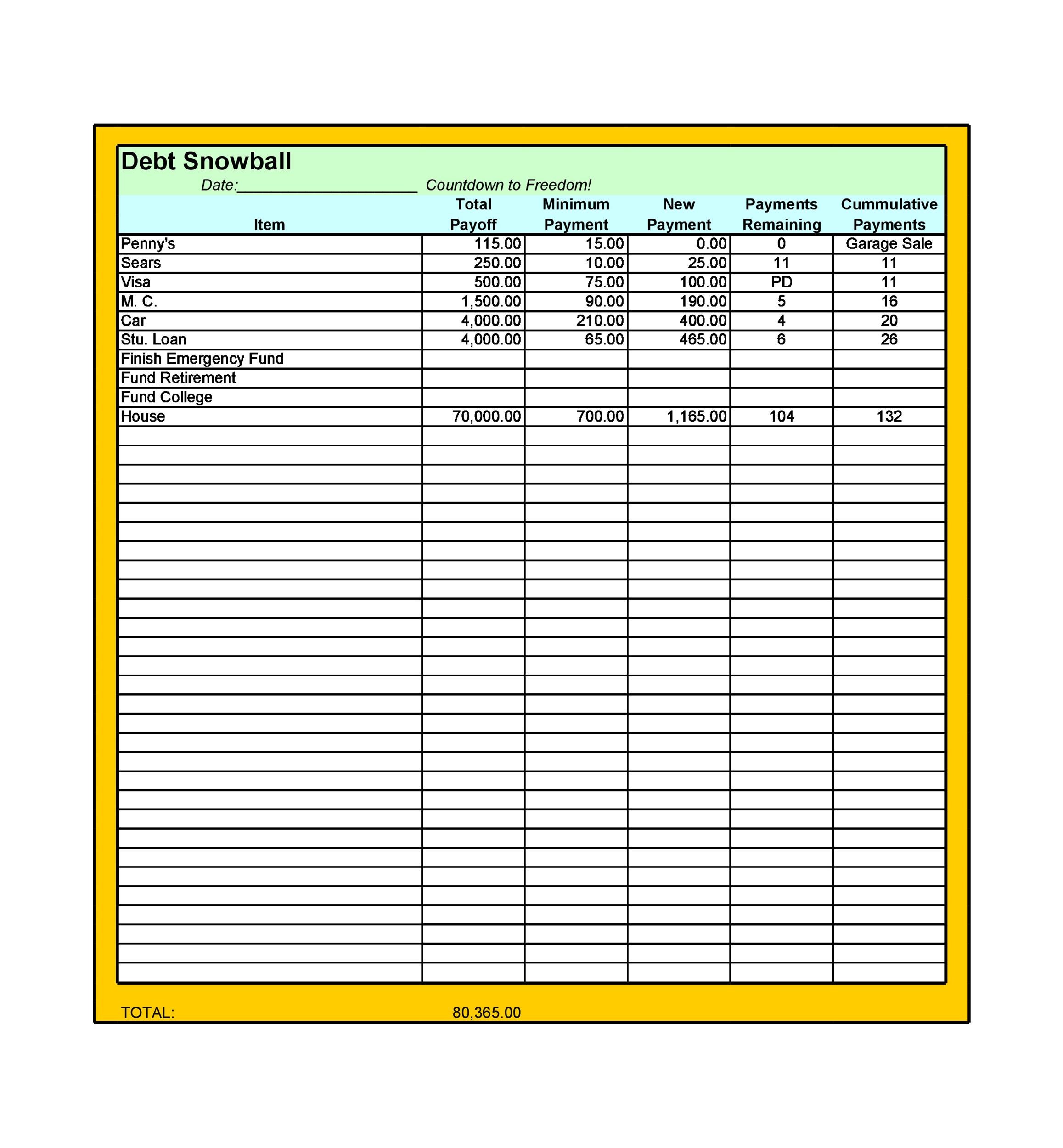

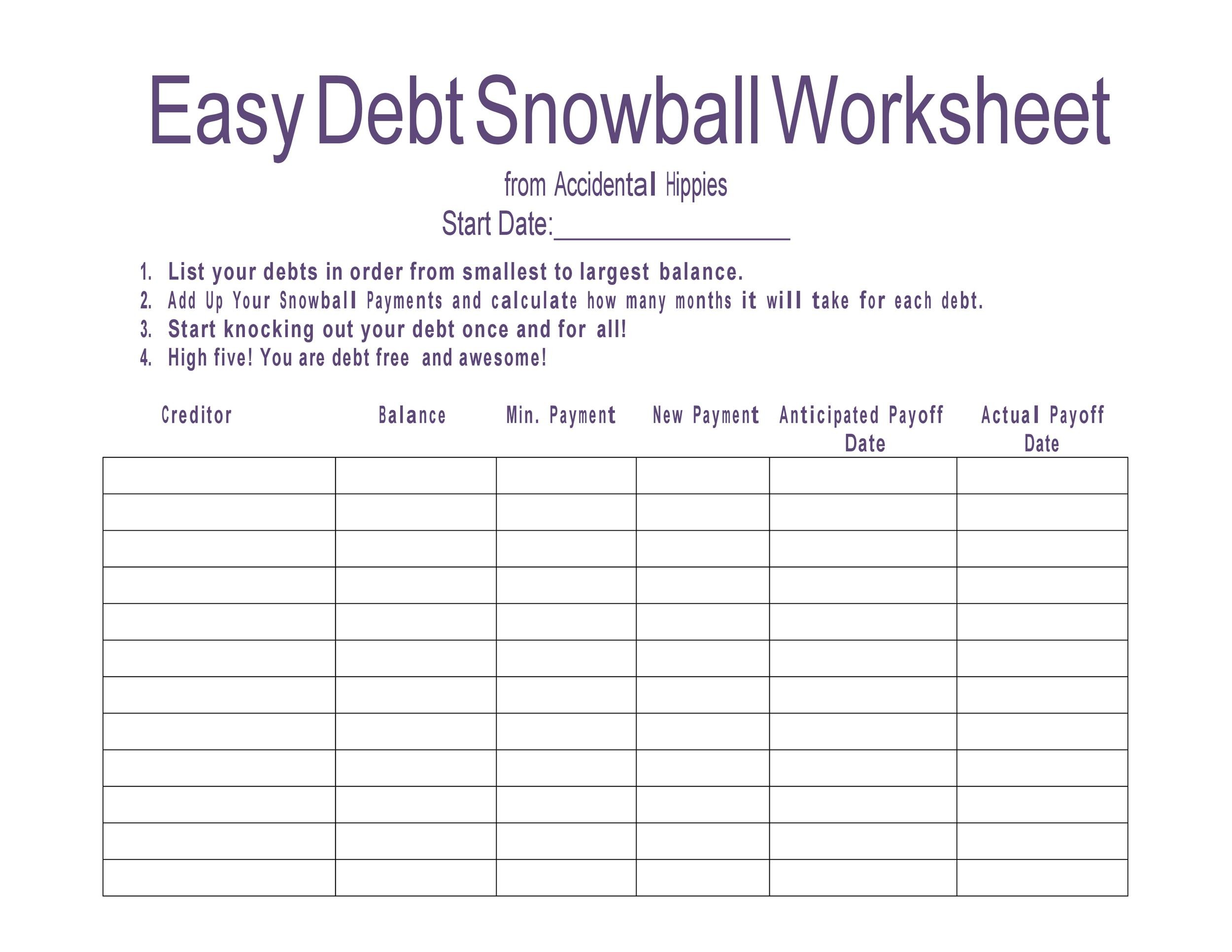

Snowball Debt Template - Web the vertex42 debt snowball spreadsheet includes a snowball calculator and a payment schedule feature so you can design several debt payoff scenarios. Just like an actual snowball rolling down a hill, the idea is the amount you pay towards each debt accumulates over time, and your debt is paid off faster. Web grab this free debt snowball spreadsheet/calculator to get your debt paid off once and for all! Web want to set up your debt snowball spreadsheet in just a few minutes? Web if you have multiple credit card balances, the debt snowball method helps you prioritize paying off your debt by smallest amount. Web find the best free printable debt snowball worksheet or spreadsheet in google docs for your needs so you can get out of debt fast. With the spreadsheet, you can input your debts, interest rates, and minimum payments, then it will calculate the snowball method for you. Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. The debt snowball follows these exact steps to help you pay off your debt: Web in this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. Our debt snowball calculator makes the process easy. Web in this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. Web a debt snowball spreadsheet is a tool used in this popular method for paying off debt. List your debts from smallest to largest regardless of. It lists all debt in ascending order by balance owed and includes the minimum payments due. Web the vertex42 debt snowball spreadsheet includes a snowball calculator and a payment schedule feature so you can design several debt payoff scenarios. Web the debt snowball plan has helped thousands of people find freedom from debt. Web want to set up your debt. With the spreadsheet, you can input your debts, interest rates, and minimum payments, then it will calculate the snowball method for you. Web the vertex42 debt snowball spreadsheet includes a snowball calculator and a payment schedule feature so you can design several debt payoff scenarios. Web the debt snowball plan has helped thousands of people find freedom from debt. All. With the spreadsheet, you can input your debts, interest rates, and minimum payments, then it will calculate the snowball method for you. Web in this article, let us discuss the top 5 free debt snowball spreadsheet google sheets templates. Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up. You need to work out how much you can put towards this first debt while covering the minimum payments. Web if you have multiple credit card balances, the debt snowball method helps you prioritize paying off your debt by smallest amount. Web our snowball debt spreadsheet makes it easy for you to track your debt and create a personalized plan. Web find the best free printable debt snowball worksheet or spreadsheet in google docs for your needs so you can get out of debt fast. Web the vertex42 debt snowball spreadsheet includes a snowball calculator and a payment schedule feature so you can design several debt payoff scenarios. Web download this free debt snowball worksheet that will tell you exactly. Repeat until each debt is paid in full. All pages are 100% free. Pay as much as possible on your smallest debt. Simply fill out the form with all your debts, enter a monthly dollar amount you can add to your payoff plan, and click the “calculate debt snowball” button. There’s a basic spreadsheet that lets you list up to. There’s a basic spreadsheet that lets you list up to ten debts you can get for free. Web in this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. Web our snowball debt spreadsheet makes it easy for you to track your debt and create a. Web download this free debt snowball worksheet that will tell you exactly how many months until you are debt free once you fill it out. Web the debt snowball worksheet from template lab for excel is a simplified template that can be used to work out successive payments due, starting from the smallest amount owed to the largest amount outstanding. For beginners, we will also provide you with a simple, free debt tracker spreadsheet template to use. Web the debt snowball plan has helped thousands of people find freedom from debt. Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. List your debts from smallest to largest regardless of interest rate. There’s. Web by customizing your debt snowball spreadsheet in these ways, you create a personalized and actionable plan that charts a clear course for eliminating your debts, one by one. Simply fill out the form with all your debts, enter a monthly dollar amount you can add to your payoff plan, and click the “calculate debt snowball” button. Web in order to keep track of the payments you’re making, you can use a debt snowball form or a debt payoff spreadsheet. Web our snowball debt spreadsheet makes it easy for you to track your debt and create a personalized plan to pay it off using the snowball method. List your debts from smallest to largest regardless of interest rate. Web a debt snowball spreadsheet is a tool used in this popular method for paying off debt. Our debt snowball calculator makes the process easy. Web with this snowball debt calculator spreadsheet, you can enter the rates (including teaser rates) and balances of all your debts, as well as change the order of your debt snowball plan to assess the best payoff times and least cumulative expenses. Web grab this free debt snowball spreadsheet/calculator to get your debt paid off once and for all! Web the debt snowball worksheet from template lab for excel is a simplified template that can be used to work out successive payments due, starting from the smallest amount owed to the largest amount outstanding with the goal of giving you a good idea as to when your debts will be paid off in full. The debt snowball follows these exact steps to help you pay off your debt: Web the debt snowball is a method for paying off your consumer debt (not your mortgage). You need to work out how much you can put towards this first debt while covering the minimum payments. With the spreadsheet, you can input your debts, interest rates, and minimum payments, then it will calculate the snowball method for you. You can use these forms to list down all your debts and add them to come up with the total. Web want to set up your debt snowball spreadsheet in just a few minutes?

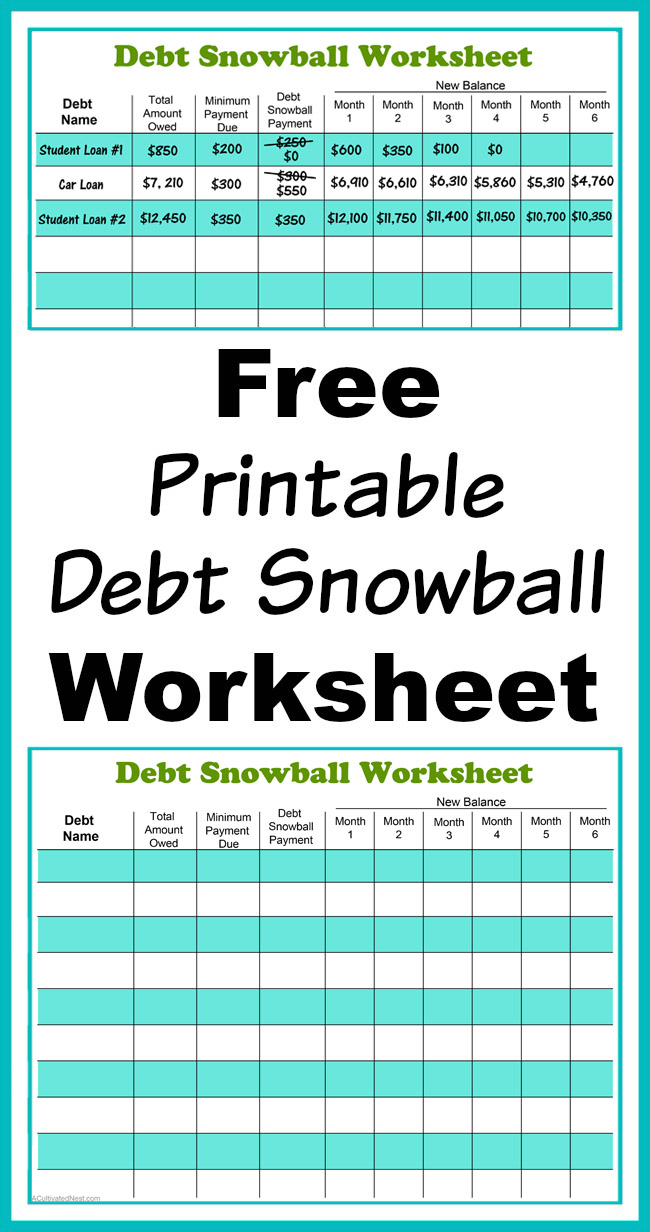

Printable Debt Snowball Tracker

38 Debt Snowball Spreadsheets, Forms & Calculators

![]()

Free Printable Debt Snowball Spreadsheet

38 Debt Snowball Spreadsheets, Forms & Calculators

Free Printable Debt Snowball Spreadsheet

Free Printable Debt Snowball Worksheet Pay Down Your Debt!

![]()

Debt Trackers & Debt Snowball Worksheets 35 Pages Printabulls

Debt Snowball Tracker Printable

38 Debt Snowball Spreadsheets, Forms & Calculators

Debt Snowball Tracker Printable Debt Payment Worksheet Debt Payoff

Available As Printable Pdf Or Google Docs Sheet.

There’s A Basic Spreadsheet That Lets You List Up To Ten Debts You Can Get For Free.

Just Like An Actual Snowball Rolling Down A Hill, The Idea Is The Amount You Pay Towards Each Debt Accumulates Over Time, And Your Debt Is Paid Off Faster.

Web If You Have Multiple Credit Card Balances, The Debt Snowball Method Helps You Prioritize Paying Off Your Debt By Smallest Amount.

Related Post: