Snowball Budget Template

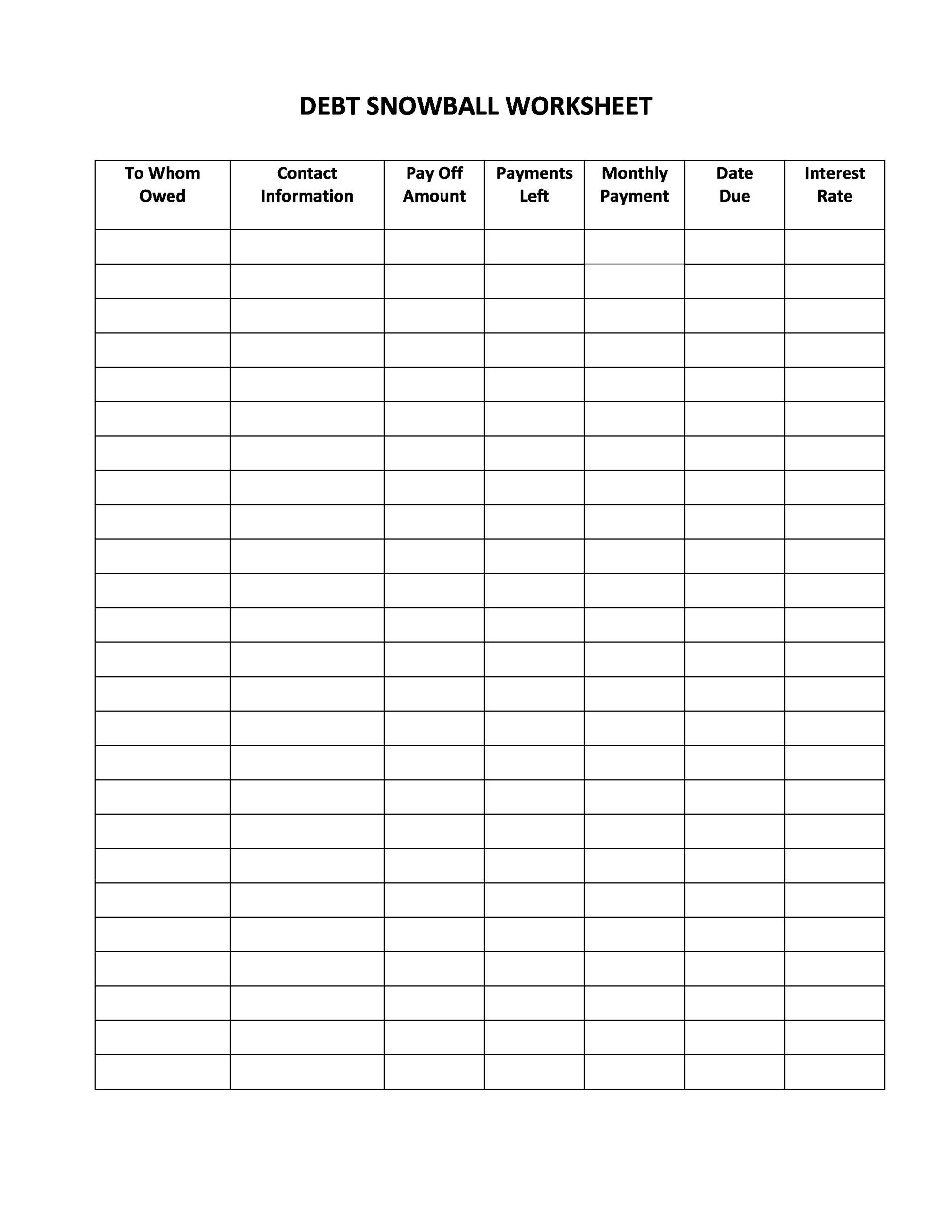

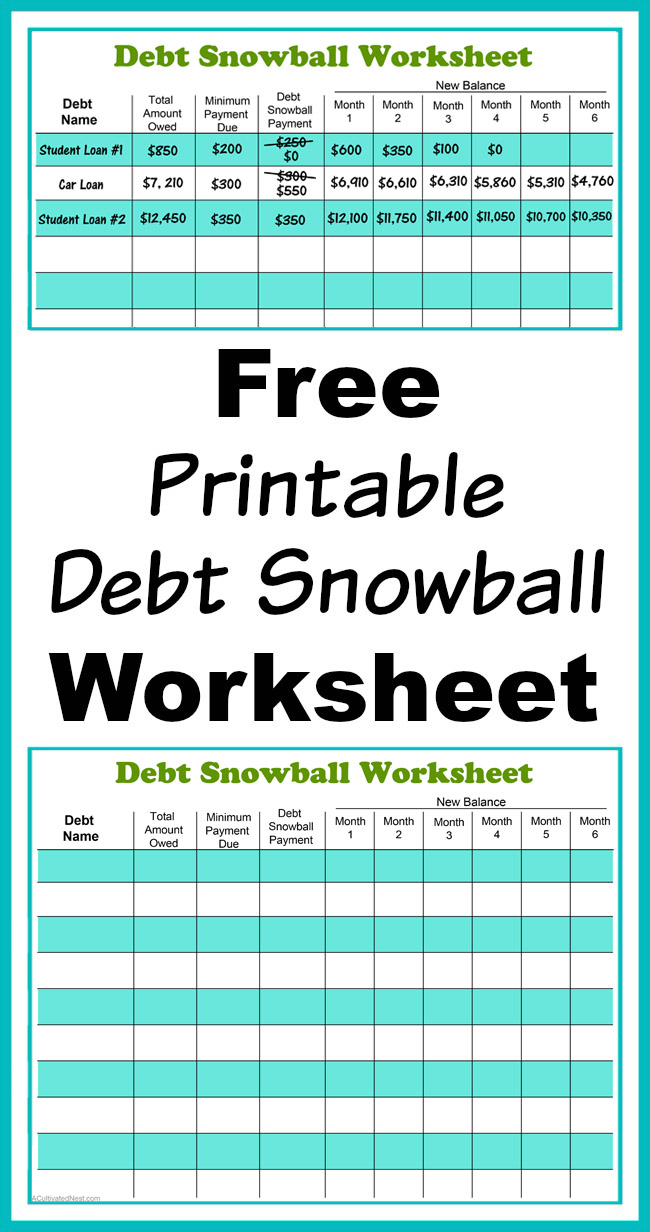

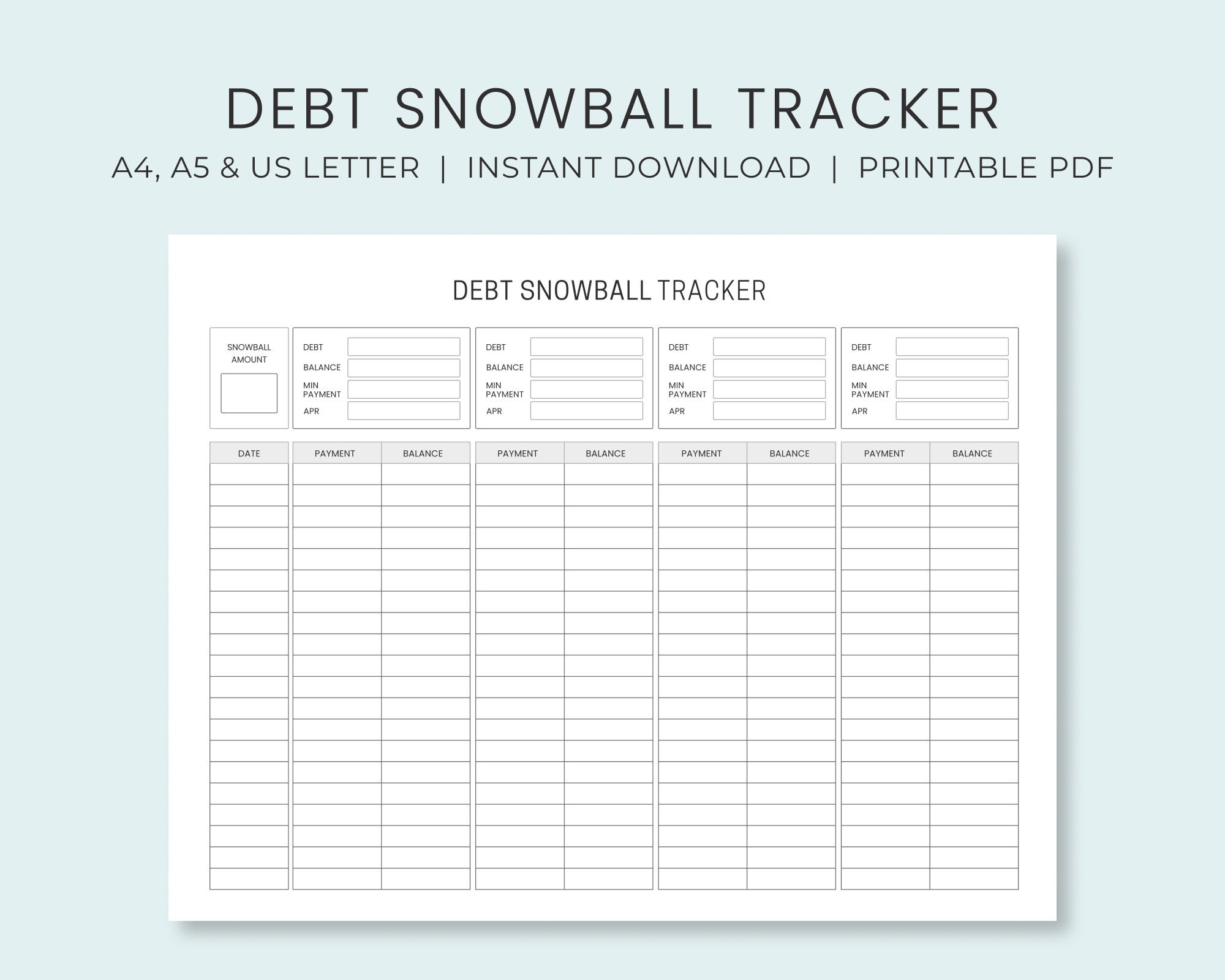

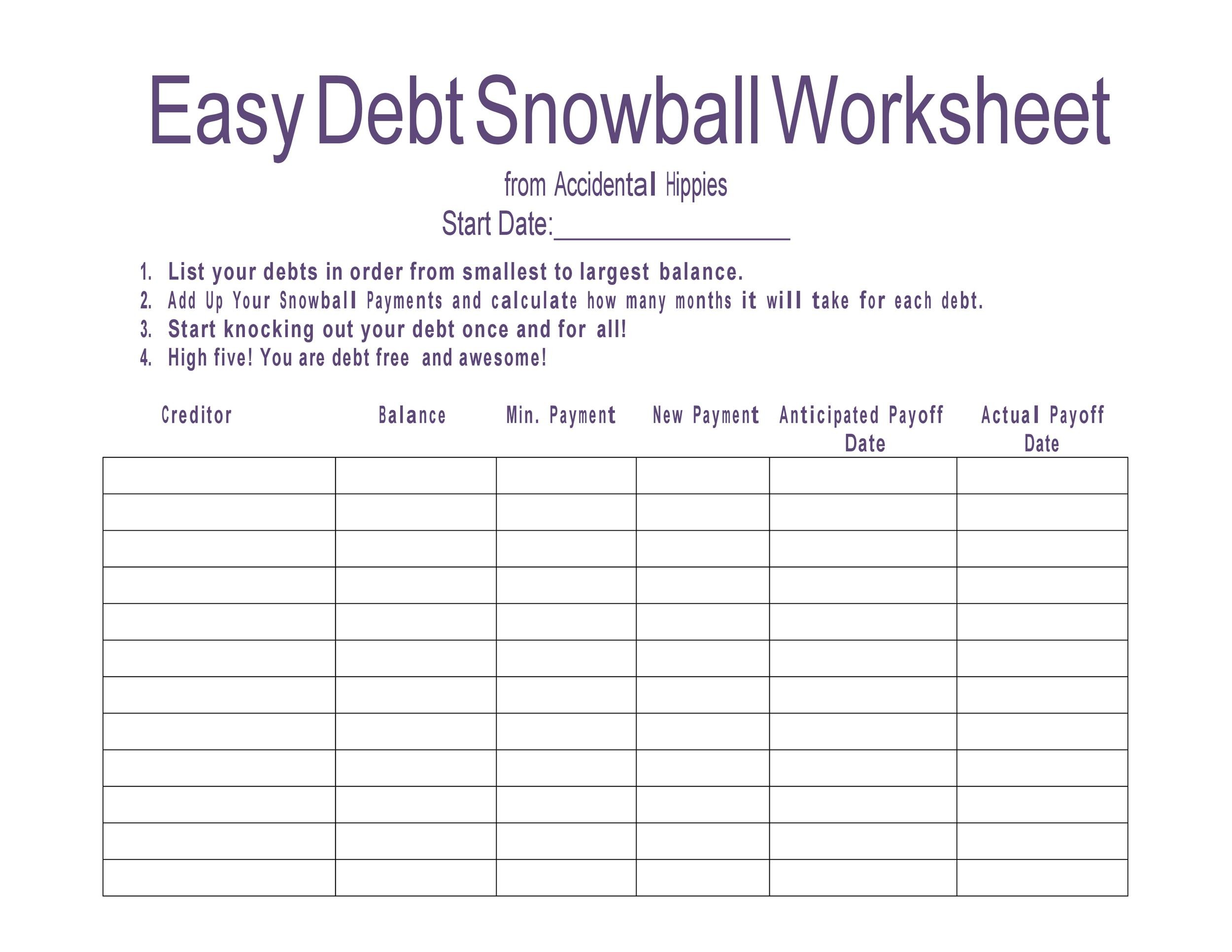

Snowball Budget Template - Web if you have multiple credit card balances, the debt snowball method helps you prioritize paying off your debt by smallest amount. It centers on the psychological win of clearing small balances. Web this free debt snowball worksheet can be used to help you track your progress with paying off your debt using the debt snowball method. You will use the debt snowball calculator to set up each credit card account, and then you will list each payment made to that account until the card is completely paid for. Web find the best free printable debt snowball worksheet or spreadsheet in google docs for your needs so you can get out of debt fast. List your debts from smallest to largest regardless of interest rate. This is the exact amount you have leftover at the end of the month. You’ll need a template to keep track of all your debts. Just like an actual snowball rolling down a hill, the idea is the amount you pay towards each debt accumulates over time, and your debt is paid off faster. Web grab this free debt snowball spreadsheet/calculator to get your debt paid off once and for all! Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt. On the left you write in the names of all your different debt sources, like “credit cardx”, “car loan”, “student loan #1”, “student loan #2” etc. This motivates you to keep going. If you. Web researchers say the snowball method is the best way to pay off debt — here's a simple spreadsheet that can make it work for you. Download the sheet here so you can use it to make calculations and check your progress. Make minimum payments on all your debts except the smallest. As you roll the payments on your cleared. Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Web the debt snowball method is a debt reduction strategy designed for you to pay off your debts efficiently. List your debts from smallest to largest. Web here’s how to use the debt snowball spreadsheet to. Tiller money offers several types of spreadsheets including a debt snowball spreadsheet. This is the amount you want to start putting. Web eliminate debt fast with a debt snowball spreadsheet. Web want to set up your debt snowball spreadsheet in just a few minutes? Web if you have multiple credit card balances, the debt snowball method helps you prioritize paying. Web grab this free debt snowball spreadsheet/calculator to get your debt paid off once and for all! Web find the best free printable debt snowball worksheet or spreadsheet in google docs for your needs so you can get out of debt fast. List your debts from smallest to largest regardless of interest rate. You will use the debt snowball calculator. Feb 17, 2017, 1:58 pm pst. Be sure to watch our debt free journey series on youtube where we cover topics that will help you succeed at eliminating your debt and most importantly not getting into debt again. Web researchers say the snowball method is the best way to pay off debt — here's a simple spreadsheet that can make. Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. As you roll the payments on your cleared debts into larger debts, your debt reduction will gain momentum—like a snowball rolling down a hill. This is the amount you want to start putting. With this spreadsheet. This is the exact amount you have leftover at the end of the month. Web in this article, we review the best free debt snowball templates for excel & google sheets to help you manage your finances more effectively. Make minimum payments on all debts except the smallest—throwing as much money as you can at that one. Web here’s how. Make minimum payments on all your debts except the smallest. Web if you have multiple credit card balances, the debt snowball method helps you prioritize paying off your debt by smallest amount. Web this free debt snowball worksheet can be used to help you track your progress with paying off your debt using the debt snowball method. Web the debt. It contains tables for each date, including the monthly payments, balances, and payment dates. Web want to set up your debt snowball spreadsheet in just a few minutes? As you roll the payments on your cleared debts into larger debts, your debt reduction will gain momentum—like a snowball rolling down a hill. Web eliminate debt fast with a debt snowball. Make minimum payments on all debts except the smallest—throwing as much money as you can at that one. As you roll the payments on your cleared debts into larger debts, your debt reduction will gain momentum—like a snowball rolling down a hill. Web this is a template that you can use if you want to pay off one credit card at a time. Web if you have multiple credit card balances, the debt snowball method helps you prioritize paying off your debt by smallest amount. Web below is an example of the debt snowball form in action and i will explain the 5 parts to this form so that you can get on the path to becoming debt free as soon as possible. Tiller money offers several types of spreadsheets including a debt snowball spreadsheet. Web in this method, you’ll use a debt snowball spreadsheet or a debt snowball form. List your debts from smallest to largest. Web for the debt trackers provided here, all you need to do is scroll through the images below and decide which one you think will be the most helpful and beneficial for your personal finance circumstances, click on the image, download the pdf file to your computer, and print! Web in this article, we review the best free debt snowball templates for excel & google sheets to help you manage your finances more effectively. Repeat until each debt is paid in full. Web grab this free debt snowball spreadsheet/calculator to get your debt paid off once and for all! List your debts from smallest to largest regardless of interest rate. Web here’s how to use the debt snowball spreadsheet to start paying down your debt today: Web here’s how the debt snowball works: With this spreadsheet you can customize the amount you want to pay on each debt to work with your personal budget.

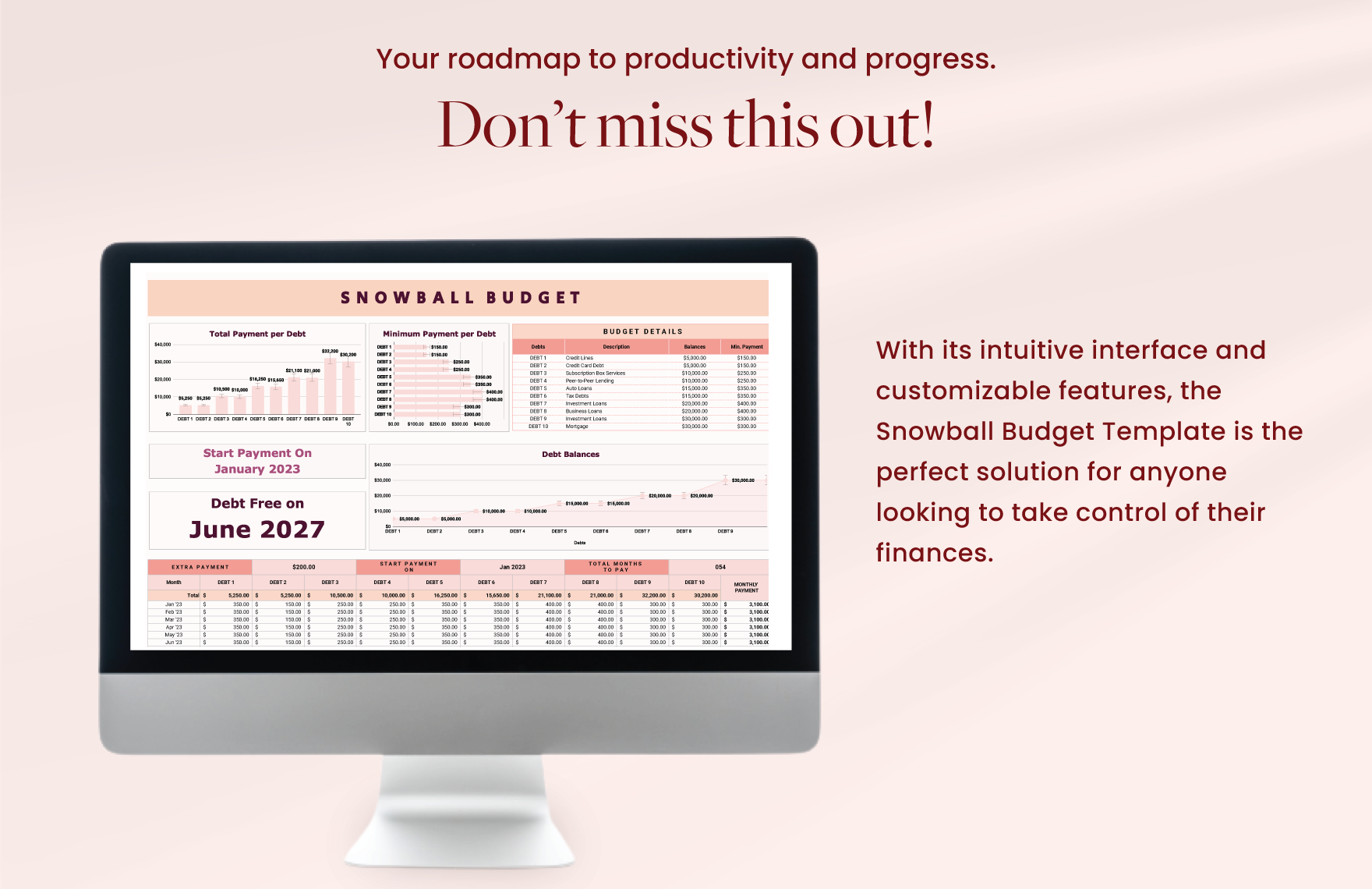

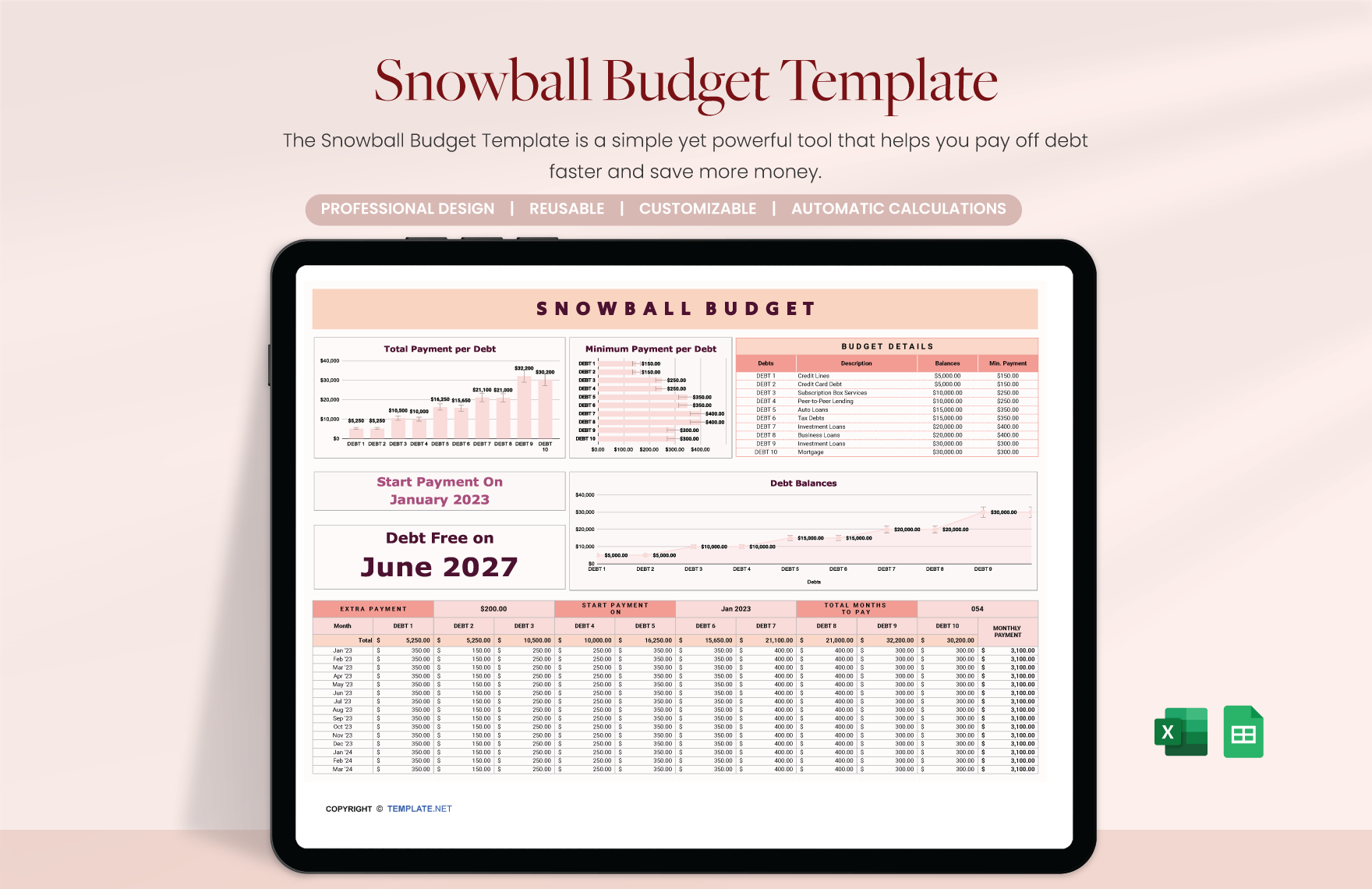

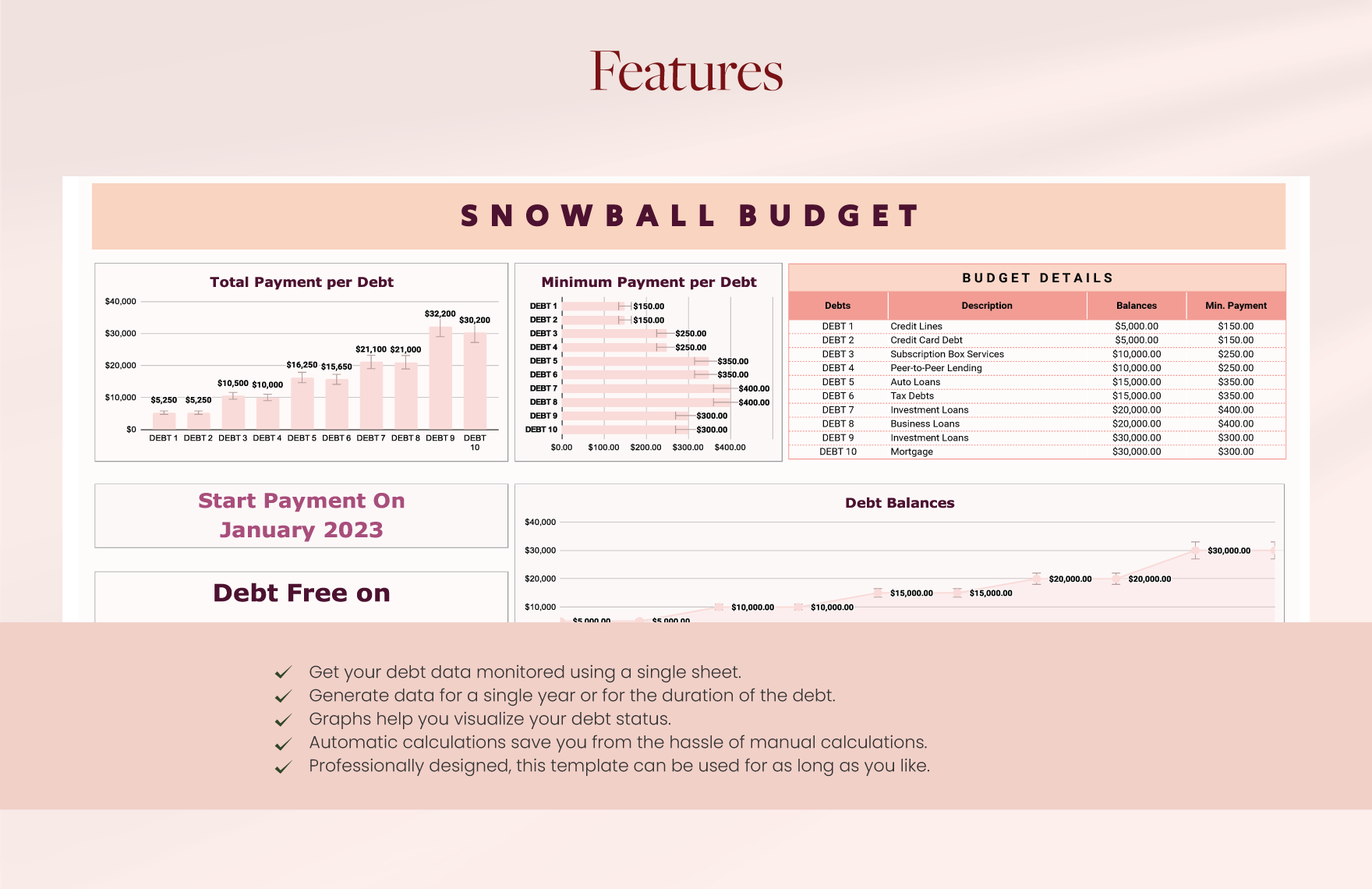

Can be used in Sheets and Excel Includes Graphs & Defined Calculations

Free Printable Debt Snowball WorksheetPaga il tuo debito! be settled

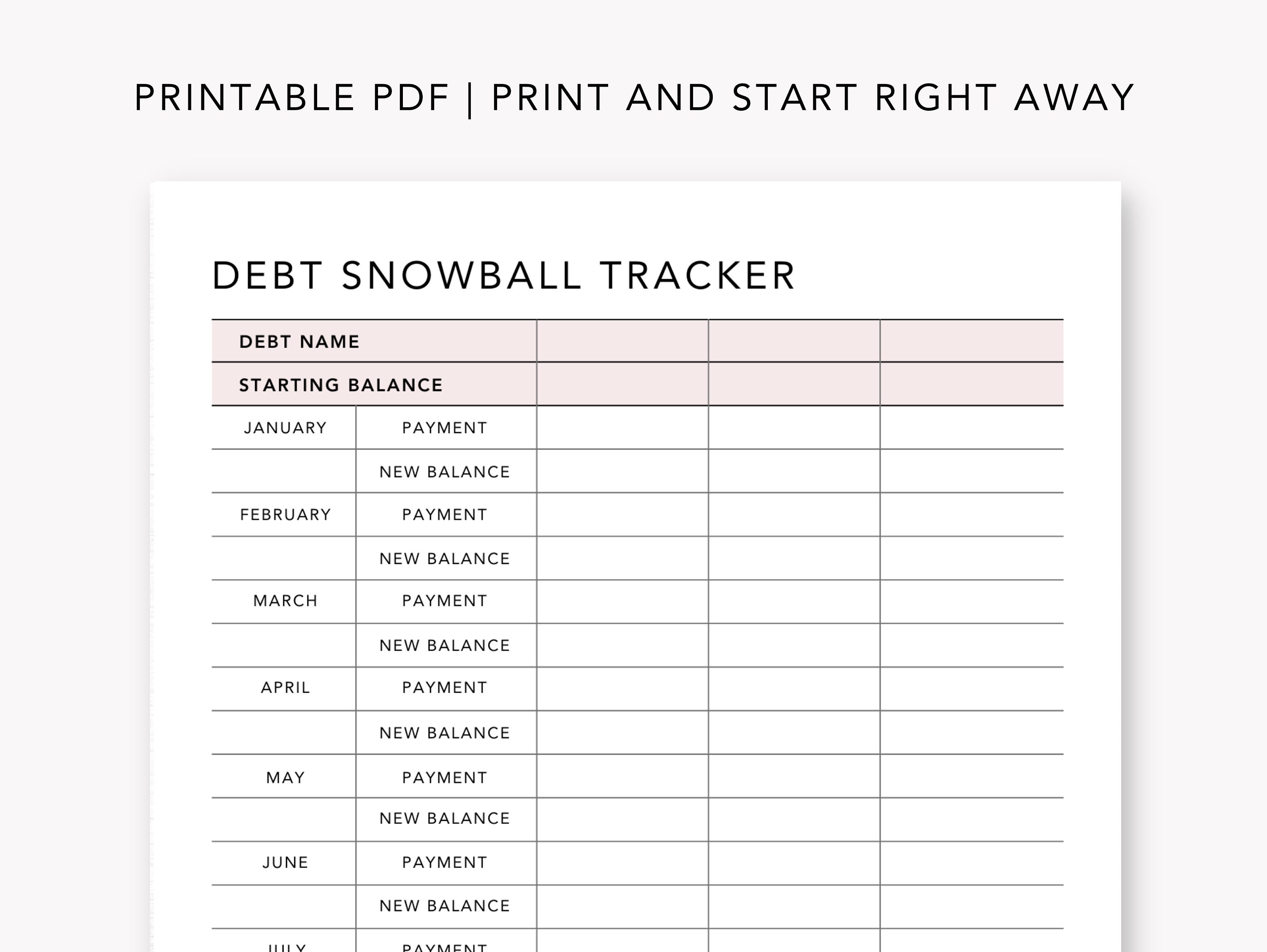

Debt Snowball Tracker Printable Debt Payment Worksheet Debt Payoff

Snowball Budget Template in Excel, Google Sheets Download

Snowball Budget Template in Excel, Google Sheets Download

Debt Snowball Tracker Budget Template Planner Inserts Etsy Canada

Debt Snowball Worksheet {Free Printable} Debt snowball worksheet

Snowball Budget Template in Excel, Google Sheets Download

Debt Snowball Tracker and Weekly Budget Planner Spreadsheet, Printable

Can be used in Sheets and Excel Includes Graphs & Defined Calculations

Feb 17, 2017, 1:58 Pm Pst.

This Debtbuster Worksheet Works Best If You Put The Smallest Debt At The Top Of The List And The Biggest Debt At The Bottom.

Web Want To Set Up Your Debt Snowball Spreadsheet In Just A Few Minutes?

It Centers On The Psychological Win Of Clearing Small Balances.

Related Post: