Simple Ira Rollover Chart

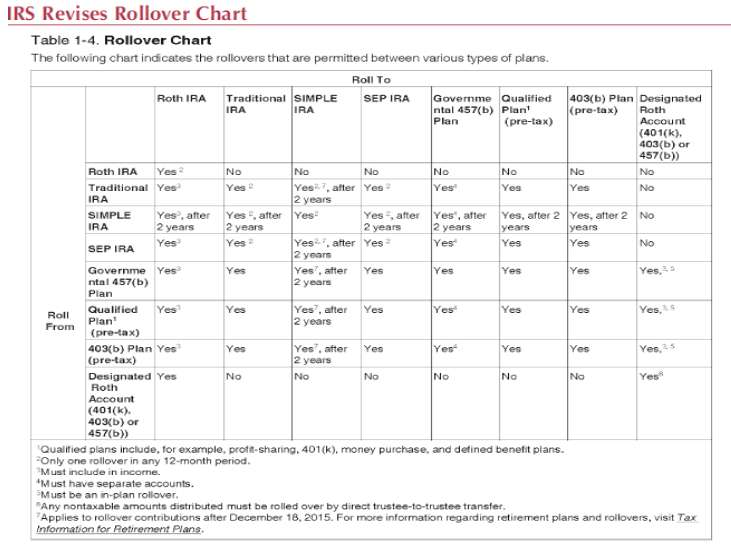

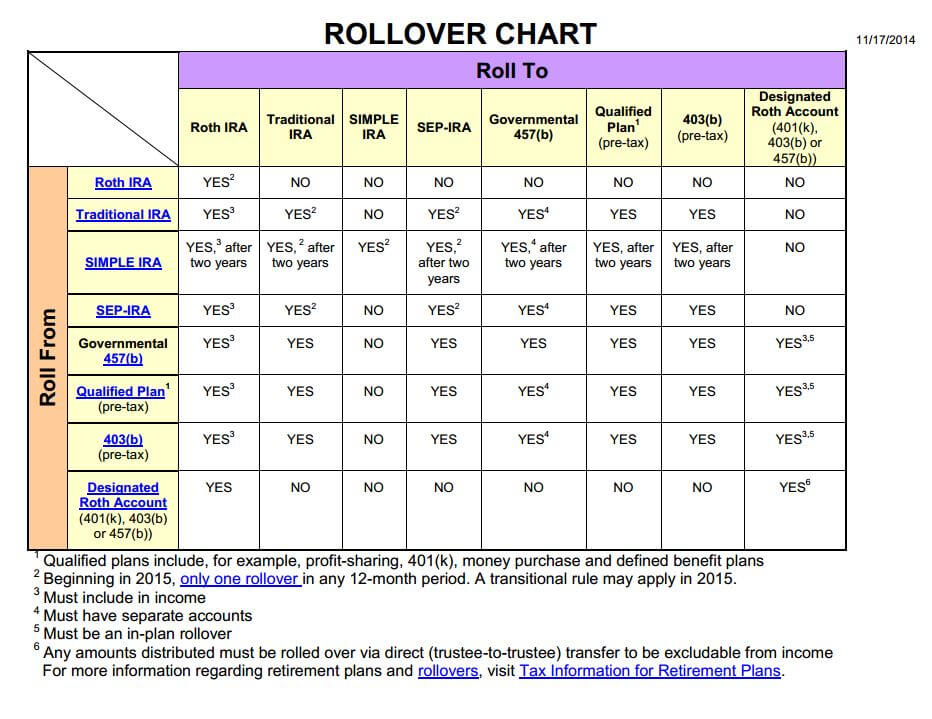

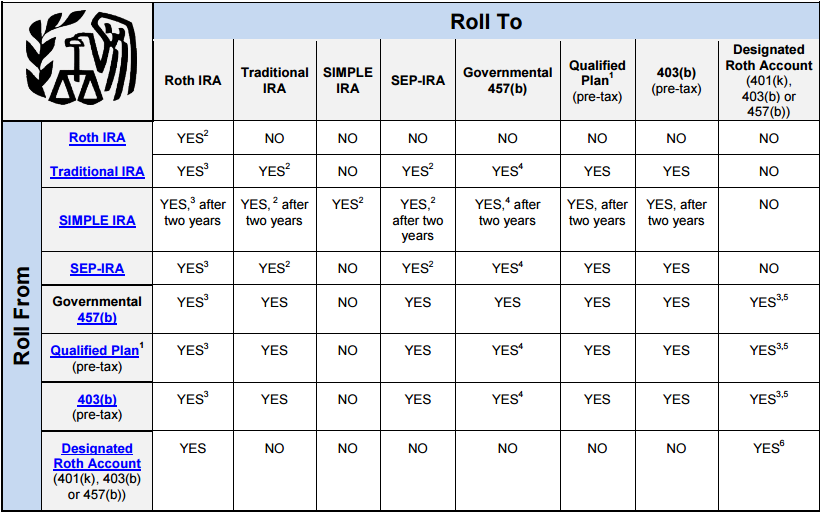

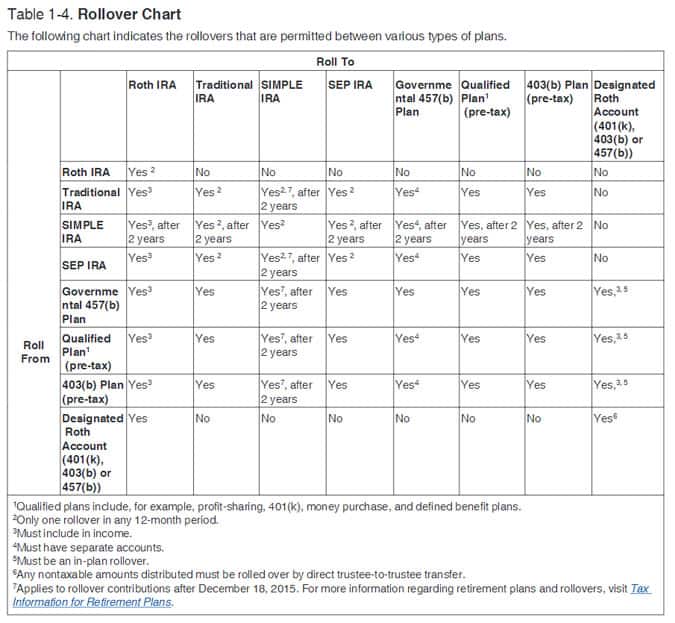

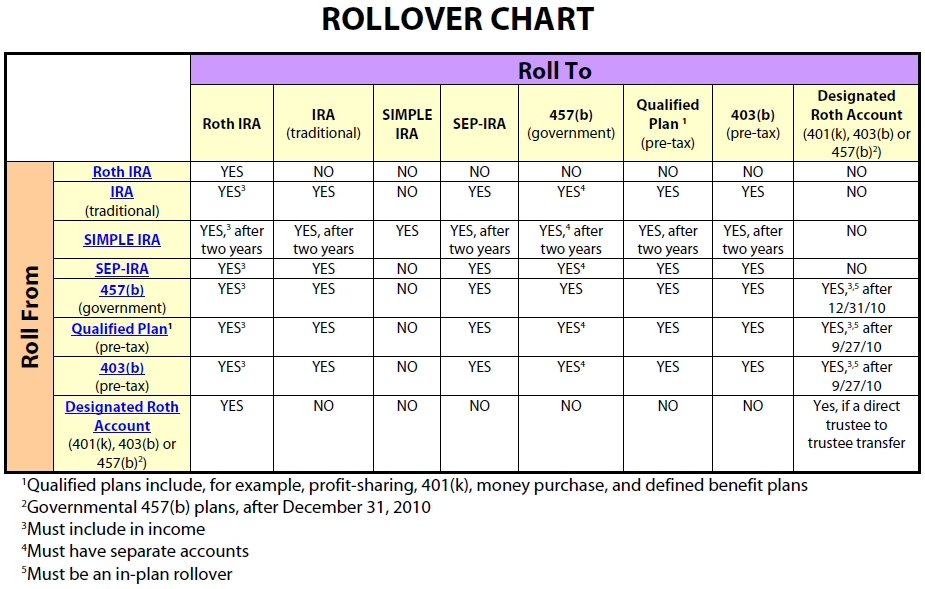

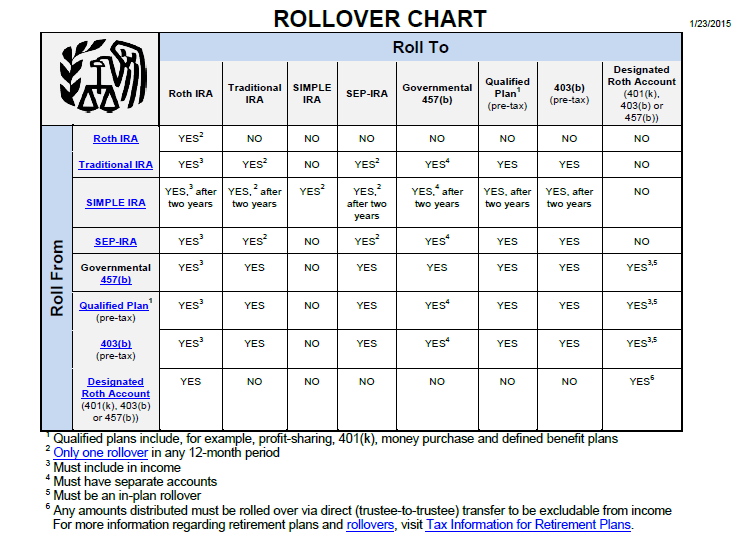

Simple Ira Rollover Chart - Many retirement plans that work well for large companies are not practical for small businesses, which often require plans with lower costs and fewer administrative responsibilities. The irs provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can roll them into (top row). You can rollover simple ira retirement funds into another simple ira tax and penalty free at any time. Simple ira plans combine employer and employee contributions for retirement savings. Web what is a simple ira? A simple ira, or savings incentive match plan for employees individual retirement arrangement, is a savings option for small firms with 100 or fewer employees. It is governed by many of the same regulations as traditional individual retirement accounts (iras) but with a higher contribution limit. Web simple ira rollovers. But just like with a 401(k), you have to ensure that you follow the proper process. Review a chart of allowable rollover transactions. You can rollover simple ira retirement funds into another simple ira tax and penalty free at any time. A simple ira, or savings incentive match plan for employees individual retirement arrangement, is a savings option for small firms with 100 or fewer employees. Many retirement plans that work well for large companies are not practical for small businesses, which often. Review a chart of allowable rollover transactions. You can rollover simple ira retirement funds into another simple ira tax and penalty free at any time. Web simple ira rollovers. Follow these steps to complete the transaction. The irs provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can. Web funds from a simple ira can be rolled over into another simple ira, a traditional ira, or another qualified plan, such as a 401(k). Web simple ira rollovers. Web what is a simple ira? Many retirement plans that work well for large companies are not practical for small businesses, which often require plans with lower costs and fewer administrative. Follow these steps to complete the transaction. You can rollover simple ira retirement funds into another simple ira tax and penalty free at any time. A simple ira, or savings incentive match plan for employees individual retirement arrangement, is a savings option for small firms with 100 or fewer employees. Simple ira plans combine employer and employee contributions for retirement. The irs provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can roll them into (top row). You can rollover simple ira retirement funds into another simple ira tax and penalty free at any time. Web funds from a simple ira can be rolled over into another simple. Web simple ira rollovers. Follow these steps to complete the transaction. Web find out how and when to roll over your retirement plan or ira to another retirement plan or ira. Many retirement plans that work well for large companies are not practical for small businesses, which often require plans with lower costs and fewer administrative responsibilities. It is governed. It is governed by many of the same regulations as traditional individual retirement accounts (iras) but with a higher contribution limit. Review a chart of allowable rollover transactions. Follow these steps to complete the transaction. Can be rolled to the following after two years: A simple ira, or savings incentive match plan for employees individual retirement arrangement, is a savings. Web what is a simple ira? Web find out how and when to roll over your retirement plan or ira to another retirement plan or ira. It is governed by many of the same regulations as traditional individual retirement accounts (iras) but with a higher contribution limit. Web funds from a simple ira can be rolled over into another simple. Simple ira plans combine employer and employee contributions for retirement savings. A simple ira, or savings incentive match plan for employees individual retirement arrangement, is a savings option for small firms with 100 or fewer employees. Web simple ira rollovers. Can be rolled to the following after two years: Follow these steps to complete the transaction. Follow these steps to complete the transaction. Web simple ira rollovers. Review a chart of allowable rollover transactions. A simple ira, or savings incentive match plan for employees individual retirement arrangement, is a savings option for small firms with 100 or fewer employees. Many retirement plans that work well for large companies are not practical for small businesses, which often. Can be rolled to the following after two years: Web if, however, your ultimate goal is to roll over your simple ira to a roth ira, you need to process a roth ira conversion. Web what is a simple ira? Web find out how and when to roll over your retirement plan or ira to another retirement plan or ira. Review a chart of allowable rollover transactions. Many retirement plans that work well for large companies are not practical for small businesses, which often require plans with lower costs and fewer administrative responsibilities. But just like with a 401(k), you have to ensure that you follow the proper process. You can rollover simple ira retirement funds into another simple ira tax and penalty free at any time. The irs provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can roll them into (top row). Web funds from a simple ira can be rolled over into another simple ira, a traditional ira, or another qualified plan, such as a 401(k). Web simple ira rollovers. Follow these steps to complete the transaction.

"The Pension Specialists" Blog New SIMPLEIRA Rollover and Transfer Rules

Learn the Rules of IRA Rollover & Transfer of Funds

Individual Retirement Accounts (IRAs) Prosperity Financial Group

Follow the Rules When Rolling Over Your EmployerSponsored Retirement

The Ultimate Guide To Easily Roll Over Your Retirement Plan Into An IRA

IRS issues updated Rollover Chart The Retirement Plan Blog

IRA Rollover Chart Rules Regarding Rollovers and Conversions AAII

How to Complete a SelfDirected IRA Rollover

IRA Rollover Chart Where Can You Roll Over Your Retirement Account

IRA Rollovers Simple and GREAT chart from the IRS

It Is Governed By Many Of The Same Regulations As Traditional Individual Retirement Accounts (Iras) But With A Higher Contribution Limit.

Simple Ira Plans Combine Employer And Employee Contributions For Retirement Savings.

A Simple Ira, Or Savings Incentive Match Plan For Employees Individual Retirement Arrangement, Is A Savings Option For Small Firms With 100 Or Fewer Employees.

Related Post: