Shooting Star Stock Pattern

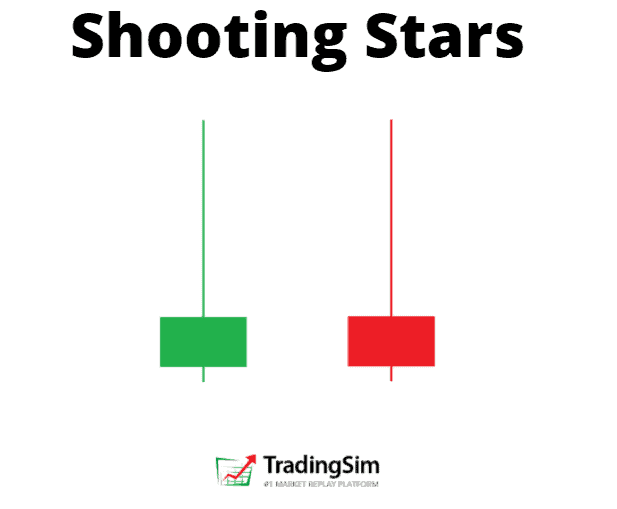

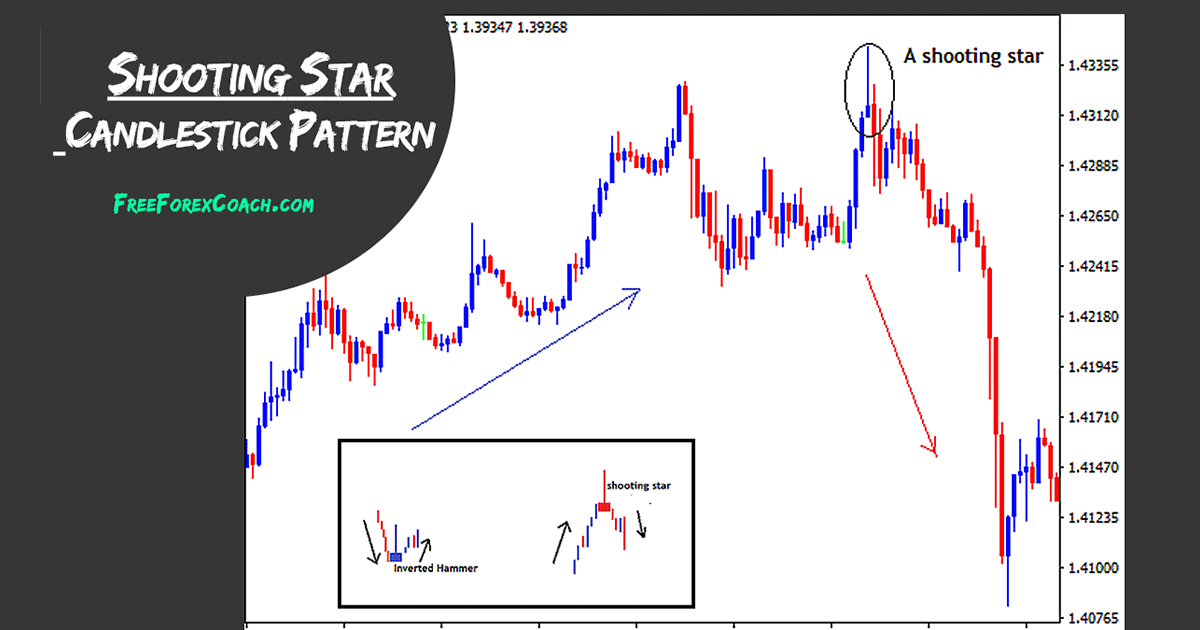

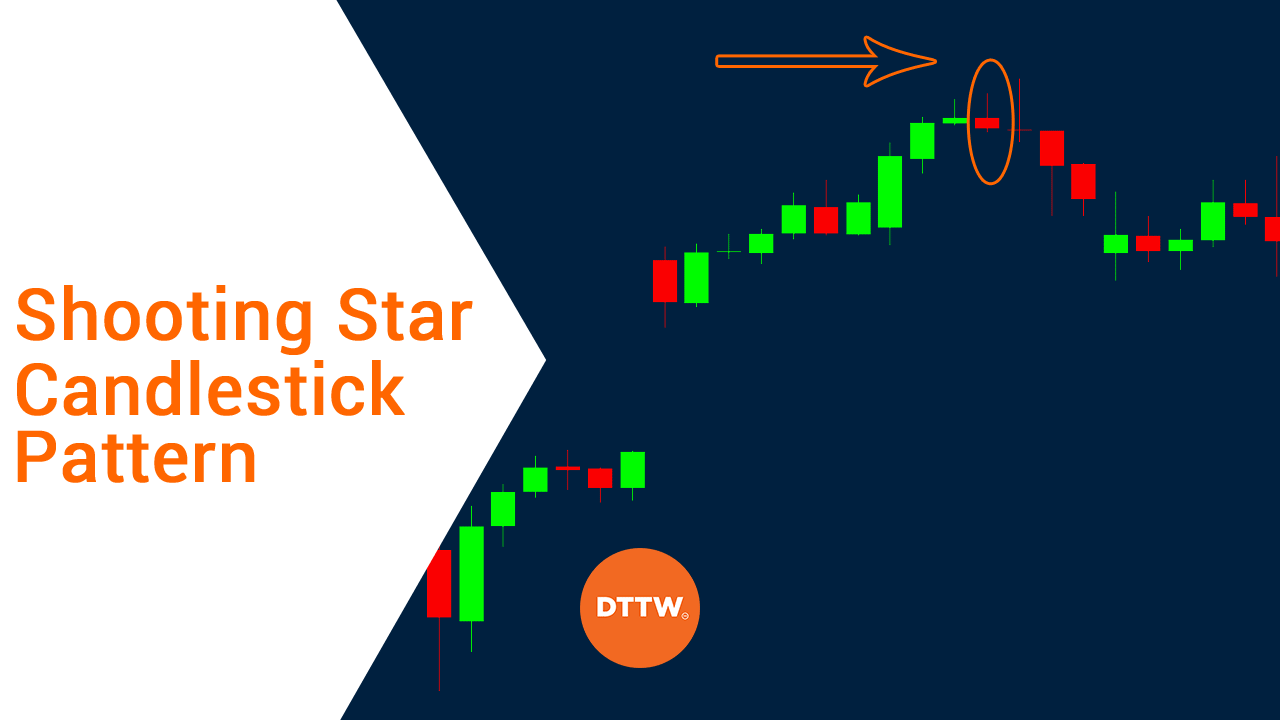

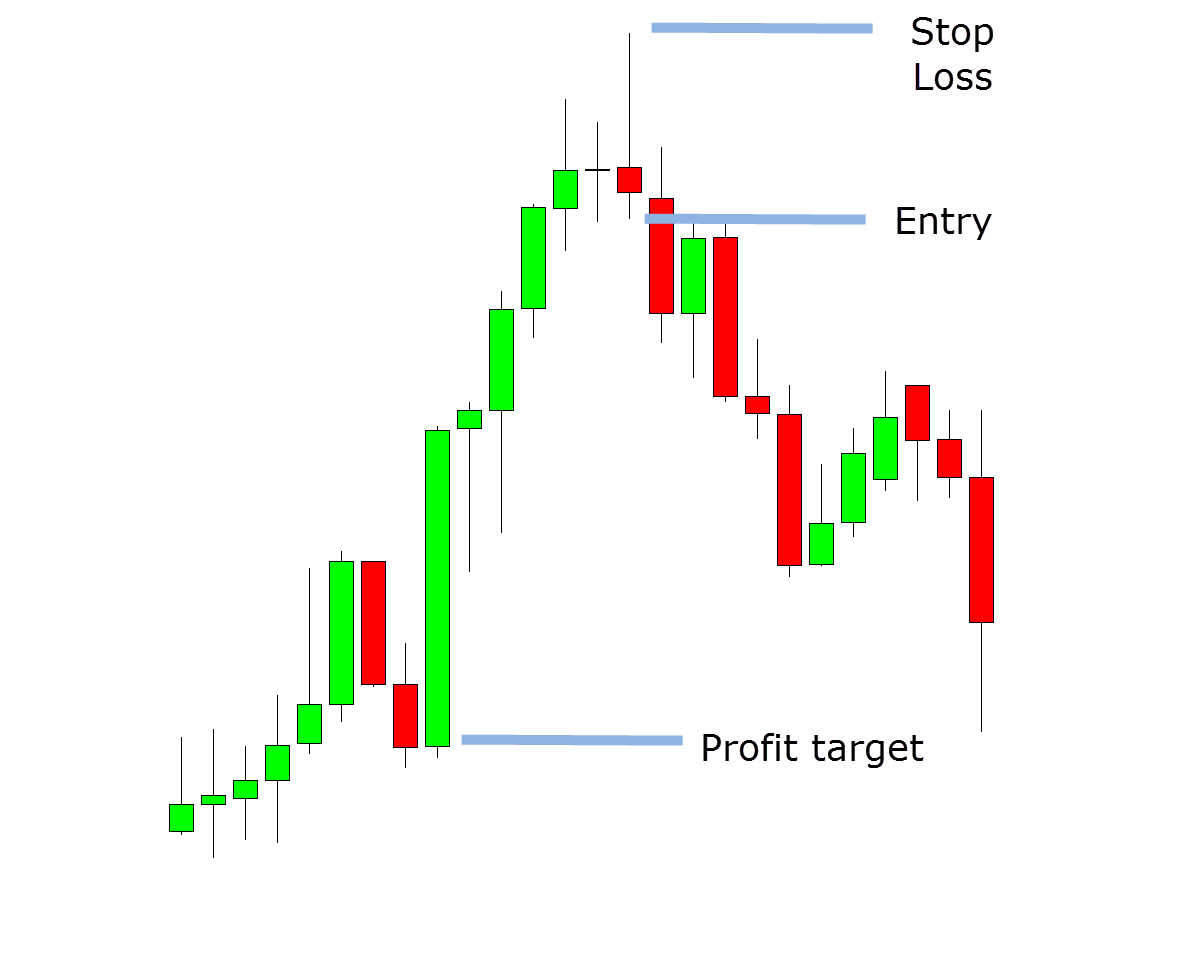

Shooting Star Stock Pattern - Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. It is a popular reversal candlestick pattern that occurs frequently in technical analysis and is simple and easy to identify. It has a bigger upper wick, mostly twice its body size. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. This pattern is the most effective when it forms after a series of rising bullish candlesticks. The shooting star is a powerful chart pattern that signals potential price reversals. It is a bearish candlestick pattern characterized by a long upper shadow and a small real body. Web in this article, we'll explore: Each bullish candlestick should create a higher high. You might be shocked that you’ll lose money if you trade this pattern. This pattern is characterized by a long upper shadow and a small real body near the low of the trading range, indicating potential weakness among the buyers. Each bullish candlestick should create a higher high. Web a shooting star pattern is a powerful bearish reversal candlestick pattern that occurs after an uptrend in trading. It has a bigger upper wick,. The shooting star is a powerful chart pattern that signals potential price reversals. You might be shocked that you’ll lose money if you trade this pattern. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. A shooting star occurs after an. This pattern is characterized by a long upper shadow and a small real body near the low of the trading range, indicating potential weakness among the buyers. Web the shooting star candlestick pattern is a bearish reversal pattern. Each bullish candlestick should create a higher high. This indicates a rejection of higher prices and suggests that a reversal might be. Web what is a shooting star pattern? Web the shooting star pattern reveals a significant price advance within a trading session, followed by selling pressure that brings the price back down near its open. Web shooting star patterns indicate that the price has peaked and a reversal is coming. This pattern is the most effective when it forms after a. It has a bigger upper wick, mostly twice its body size. This pattern is the most effective when it forms after a series of rising bullish candlesticks. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. The pattern forms when a security price opens, advances significantly, but then retreats during. This pattern is characterized by a long upper shadow and a small real body near the low of the trading range, indicating potential weakness among the buyers. Web shooting star patterns indicate that the price has peaked and a reversal is coming. When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. This indicates a. When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. This pattern is the most effective when it forms after a series of rising bullish candlesticks. The pattern forms when a security price opens, advances significantly, but then retreats during the period only to close near the open again. Web the shooting star candlestick pattern. It is a popular reversal candlestick pattern that occurs frequently in technical analysis and is simple and easy to identify. Web the shooting star candlestick pattern is a bearish reversal pattern. It is a bearish candlestick pattern characterized by a long upper shadow and a small real body. Web in this article, we'll explore: This indicates a rejection of higher. It is a popular reversal candlestick pattern that occurs frequently in technical analysis and is simple and easy to identify. A shooting star occurs after an advance and indicates the price could start falling. It has a bigger upper wick, mostly twice its body size. Web a shooting star pattern is a powerful bearish reversal candlestick pattern that occurs after. The formation is bearish because the price tried to rise significantly during the day, but. Web the shooting star pattern reveals a significant price advance within a trading session, followed by selling pressure that brings the price back down near its open. This indicates a rejection of higher prices and suggests that a reversal might be forthcoming. A shooting star. You might be shocked that you’ll lose money if you trade this pattern. The pattern forms when a security price opens, advances significantly, but then retreats during the period only to close near the open again. It is a popular reversal candlestick pattern that occurs frequently in technical analysis and is simple and easy to identify. Web the shooting star candlestick pattern is a bearish reversal pattern. This indicates a rejection of higher prices and suggests that a reversal might be forthcoming. Web in this article, we'll explore: Web a shooting star pattern is a powerful bearish reversal candlestick pattern that occurs after an uptrend in trading. This pattern is the most effective when it forms after a series of rising bullish candlesticks. When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. Web shooting star patterns indicate that the price has peaked and a reversal is coming. Web the shooting star pattern reveals a significant price advance within a trading session, followed by selling pressure that brings the price back down near its open. A shooting star occurs after an advance and indicates the price could start falling. It is a bearish candlestick pattern characterized by a long upper shadow and a small real body. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. It has a bigger upper wick, mostly twice its body size.

How To Trade Shooting Star Candlestick Patterns

Shooting Star Candlestick Pattern Profits from the Heavens TradingSim

How to Trade Shooting Star Candlestick in Forex Free Forex Coach

How to Spot & Trade with the Shooting Star Candlestick Pattern DTTW™

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

Shooting Star Candlestick Trading Strategy Guide

Shooting Star Chart Pattern

How to Trade the Shooting Star Pattern Warrior Trading

How To Trade Blog What Is Shooting Star Candlestick? How To Use It

Shooting Star Candlestick Pattern How to Identify and Trade

The Shooting Star Is A Powerful Chart Pattern That Signals Potential Price Reversals.

This Pattern Is Characterized By A Long Upper Shadow And A Small Real Body Near The Low Of The Trading Range, Indicating Potential Weakness Among The Buyers.

After An Uptrend, The Shooting Star Pattern Can Signal To Traders That The Uptrend Might Be Over And That Long Positions Could Potentially Be Reduced Or Completely Exited.

The Formation Is Bearish Because The Price Tried To Rise Significantly During The Day, But.

Related Post: