Shooting Star Candlestick Patterns

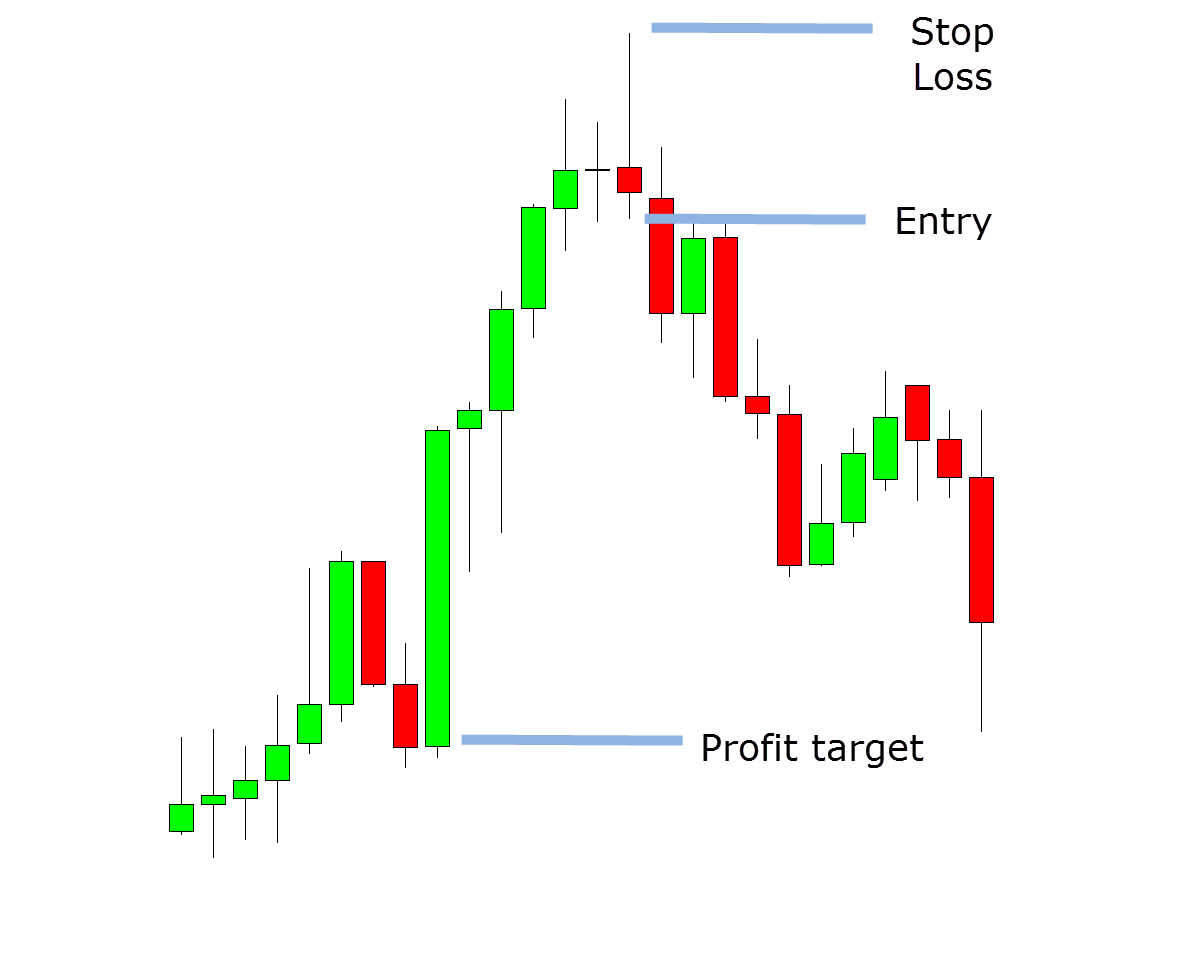

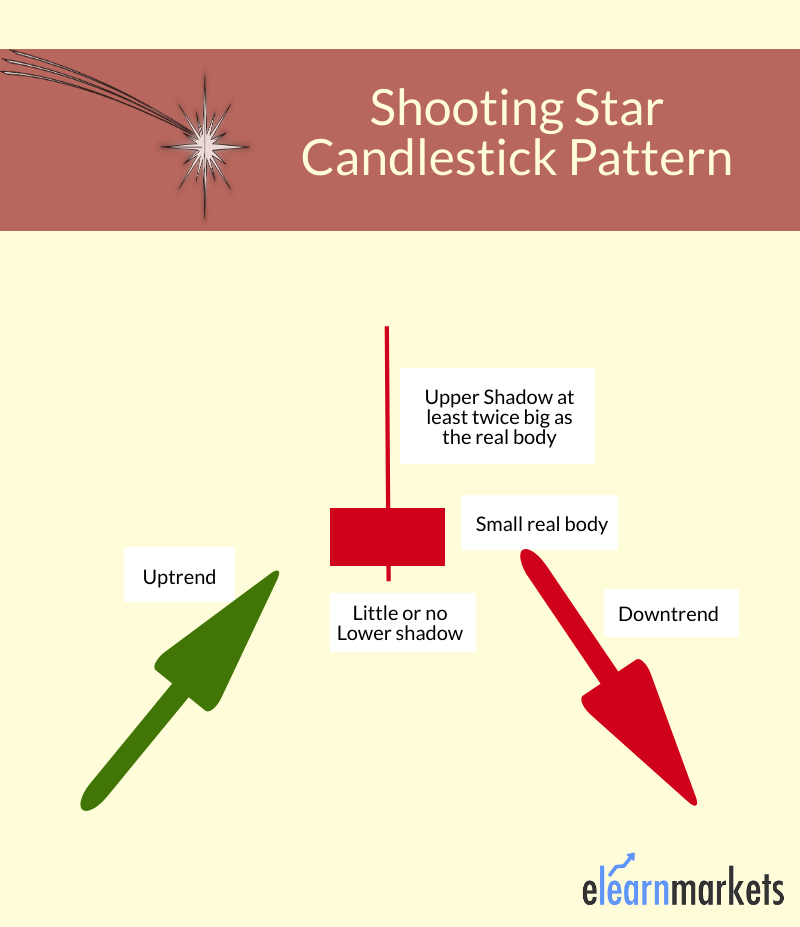

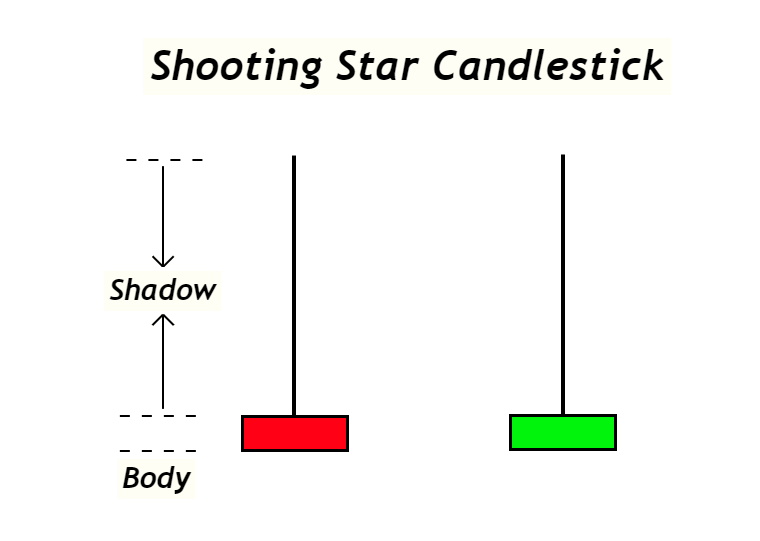

Shooting Star Candlestick Patterns - A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. Web a shooting star pattern is a bearish candlestick that can be identified with a long upper shadow and little to almost no lower shadow (candle wick). Also know as the bearish pin bar, the shooting star candlestick pattern is a bearish reversal formation that consists of just one. Web the shooting star is a single bearish candlestick pattern that is common in technical analysis. Web in this article, we'll explore: Said differently, a shooting star is a type of candlestick that forms when a security opens, advances significantly, but then closes the day near. It appears after an uptrend. Web the shooting star pattern is a bearish reversal pattern that consists of just one candlestick and forms after a price swing high. It is formed when a candlestick opens and moves up but. Crypto traders usually use the shooting star. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. This pattern is easy to understand and can be. Web the shooting star. The shooting star candlestick pattern, a crucial tool in a trader’s arsenal, is a significant reversal indicator predominantly found at. Also know as the bearish pin bar, the shooting star candlestick pattern is a bearish reversal formation that consists of just one. Web shooting star patterns occur after a stock uptrend, illustrating an upper shadow. Crypto traders usually use the. It is seen after an asset’s market. Web a shooting star candlestick is a price pattern that is formed when the price of security opens and first advances and then declines and falls to a price close to the opening. The shooting star candlestick pattern, a crucial tool in a trader’s arsenal, is a significant reversal indicator predominantly found at.. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. Said differently, a shooting star is a type of candlestick that forms when a security opens, advances significantly, but then closes the day near. Web a shooting star candlestick is a japanese candlestick. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. Web what is a shooting star candlestick pattern? It is seen after an asset’s market. Web in this article, we'll explore: It also has a small real. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. Web a shooting star candlestick is a pattern seen on price charts when an asset’s price initially rises after opening but then falls back near the opening price by the. Learn what. It also has a small real. Web the shooting star is a single bearish candlestick pattern that is common in technical analysis. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. Web shooting star candlestick pattern is among the most popular patterns traders use to identify a potential trend reversal.. Similar to a hammer pattern, the shooting star has a long. Web what is the shooting star candlestick pattern? Web shooting star candlestick pattern is among the most popular patterns traders use to identify a potential trend reversal. Said differently, a shooting star is a type of candlestick that forms when a security opens, advances significantly, but then closes the day. It appears after an uptrend. This pattern is the most effective when it forms after a series of rising bullish. Web the shooting star candlestick pattern is a single candle formation used by crypto traders to identify bearish reversals. It also has a small real. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically. Essentially the opposite of a hammer candlestick, the shooting star rises after opening but closes. It is formed when a candlestick opens and moves up but. Web a shooting star candlestick is a price pattern that is formed when the price of security opens and first advances and then declines and falls to a price close to the opening. Web. Web the shooting star candlestick pattern, also known as the pinbar (or bearish pinbar) by some, is one of the most popular candlestick patterns among price action. Web the shooting star is a reversal candlestick pattern commonly used by forex traders. Web shooting star patterns occur after a stock uptrend, illustrating an upper shadow. This pattern is the most effective when it forms after a series of rising bullish. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. Web a shooting star candlestick is a pattern seen on price charts when an asset’s price initially rises after opening but then falls back near the opening price by the. It also has a small real. Web in this article, we'll explore: Learn what it is, how it’s formed and how to trade it. Also know as the bearish pin bar, the shooting star candlestick pattern is a bearish reversal formation that consists of just one. Web what is a shooting star pattern in candlestick analysis? It is seen after an asset’s market. It is formed when a candlestick opens and moves up but. Web a shooting star candlestick is a price pattern that is formed when the price of security opens and first advances and then declines and falls to a price close to the opening. Web what is a shooting star candlestick pattern? Web what is the shooting star candlestick pattern?

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

Candlestick Patterns The Definitive Guide (2021)

Shooting Star Candlestick Pattern How to Identify and Trade

How To Trade Blog What Is Shooting Star Candlestick? How To Use It

Shooting Star Candlestick Pattern How to Identify and Trade

What Is Shooting Star Candlestick With Examples ELM

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

Shooting Star Candlestick Pattern Beginner's Guide LiteFinance

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

Essentially The Opposite Of A Hammer Candlestick, The Shooting Star Rises After Opening But Closes.

A Shooting Star Is A Bearish Candlestick With A Long Upper Shadow, Little Or No Lower Shadow, And A Small Real Body Near The Low Of The Day.

Web A Shooting Star Candlestick Pattern Is A Bearish Formation In Trading Charts That Typically Occurs At The End Of A Bullish Trend And Signals A Trend Reversal.

Web The Shooting Star Is A Single Bearish Candlestick Pattern That Is Common In Technical Analysis.

Related Post: