Sector Rotation Chart

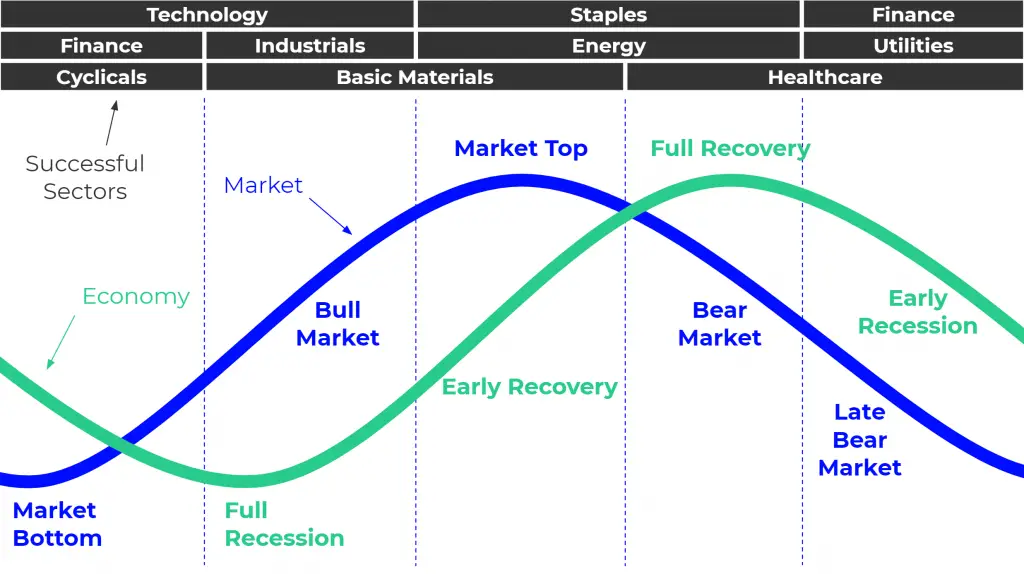

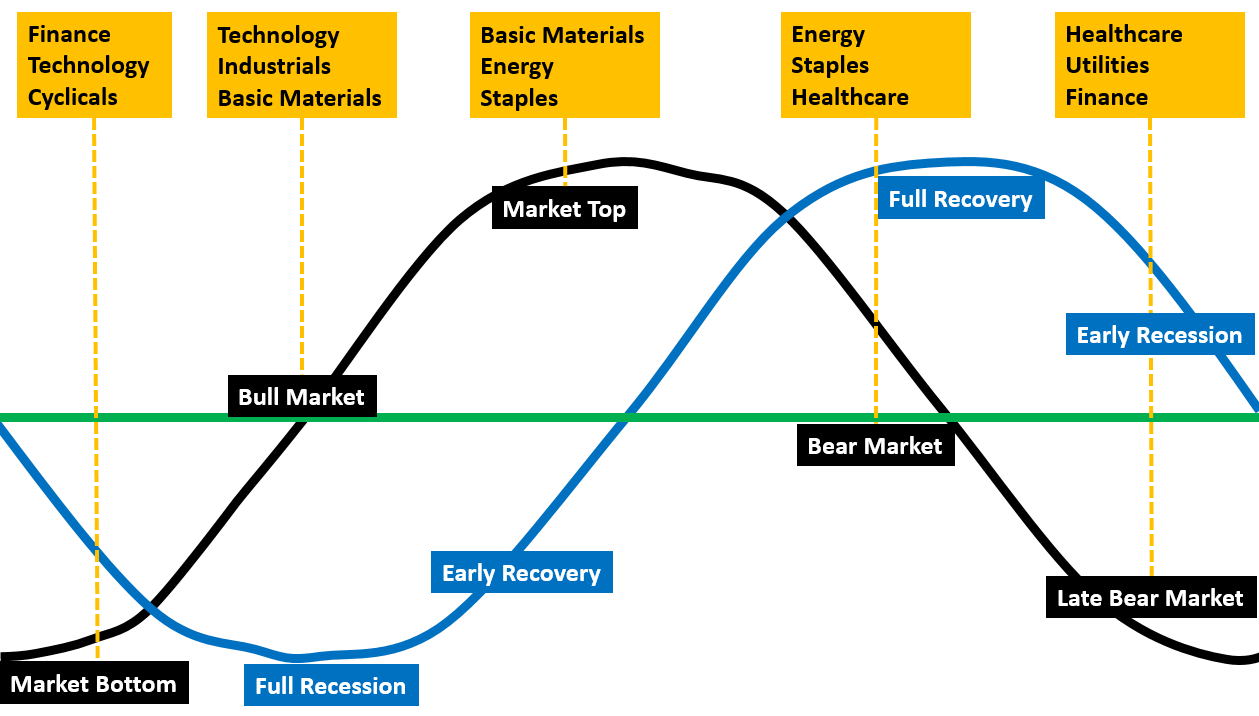

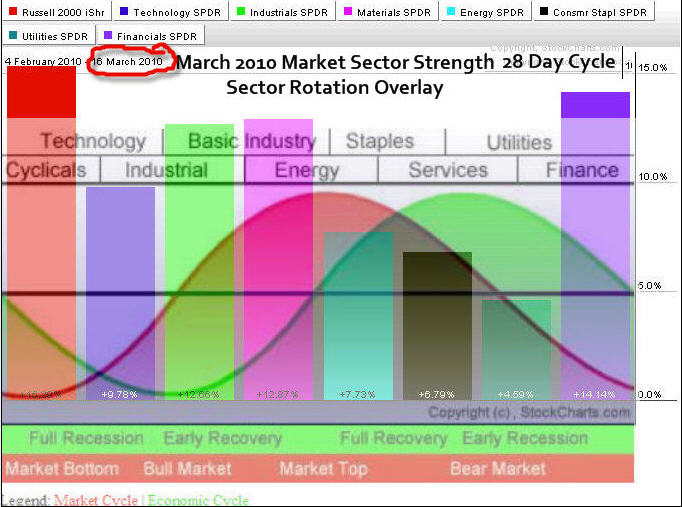

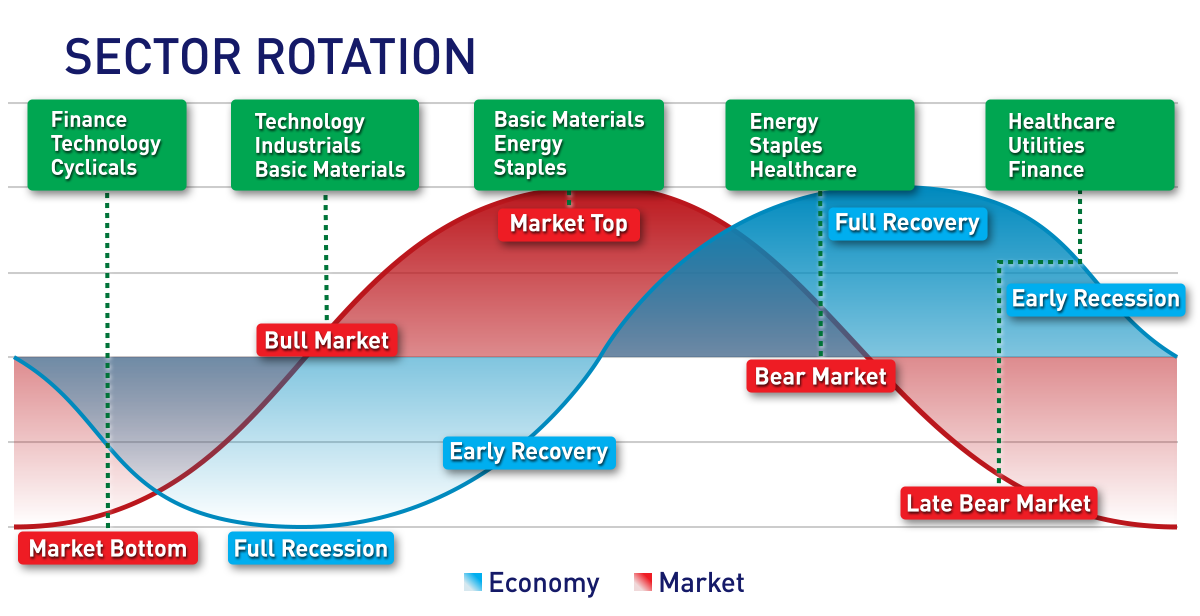

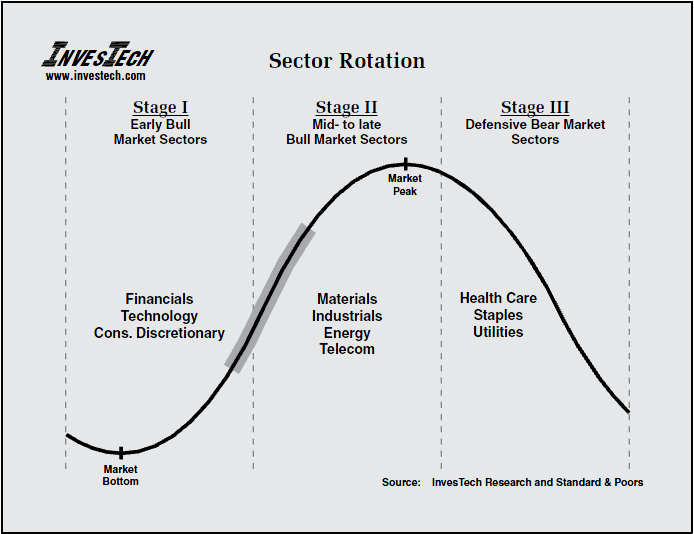

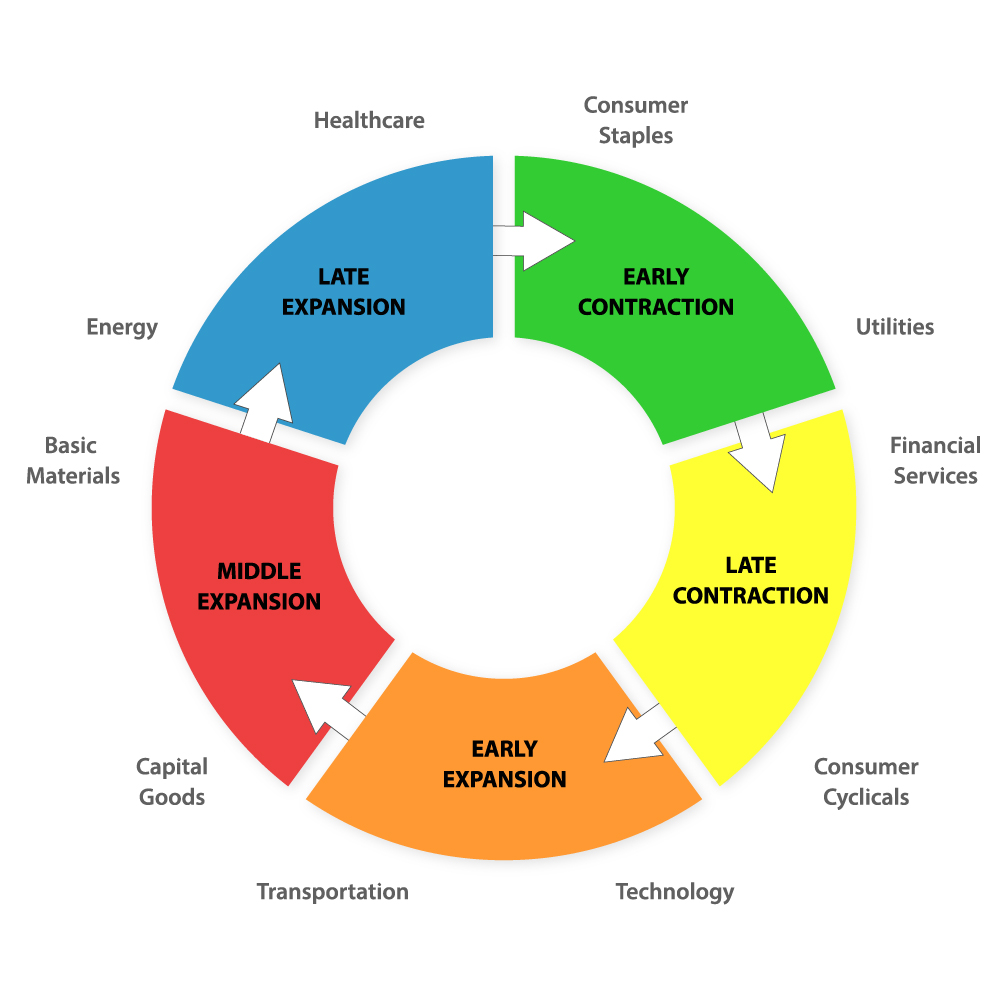

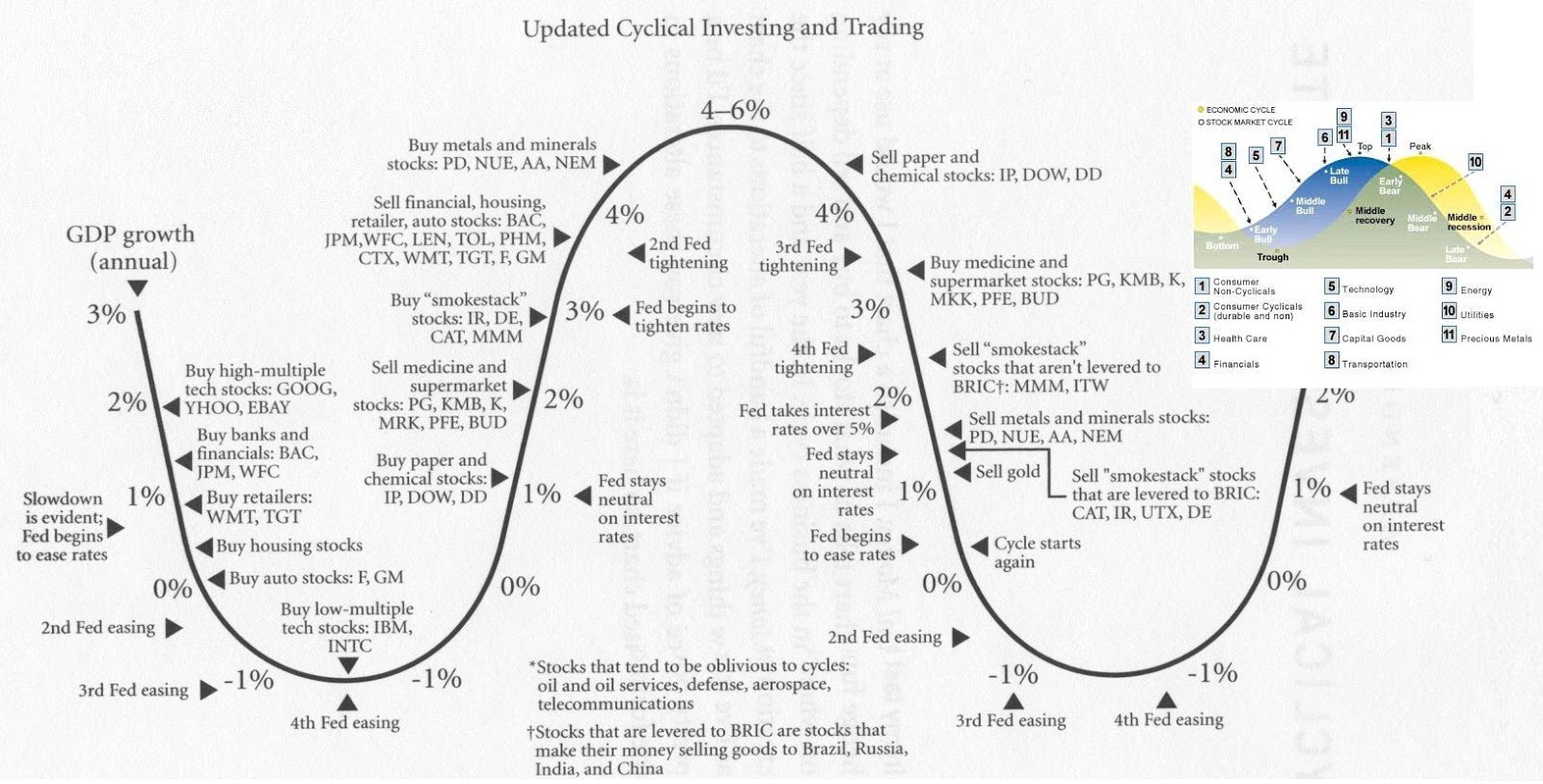

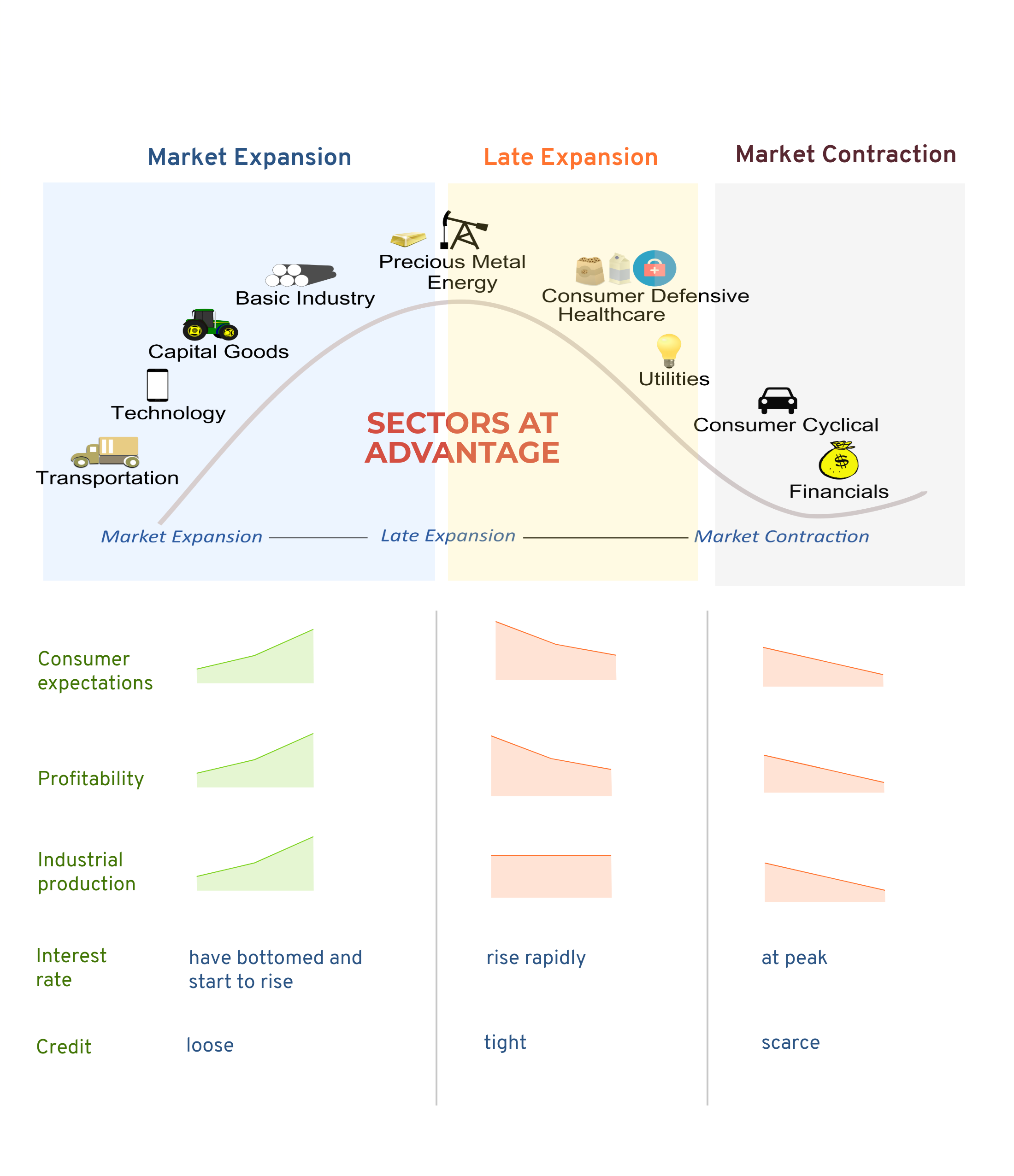

Sector Rotation Chart - I have then copied these colored labels to the sectors at the top of the sector rotation model. Growth stocks, which are more sensitive to interest rates. Web see chart below: These indicators include price momentum, economic data, and market sentiment, each providing insights for strategic investment decisions. In this week's episode of sector spotlight, i reviewed the current position of markets (sector rotation) in combination with the theoretical framework provided by the sector rotation model (sam stovall). Investors can use it to. Got a question about investing or financial chart analysis? All assets automatically update with the latest data, making for effortless creation of communication collateral. I have shaded them according to my view of what is bullish (green=outperform), neutral (blue=in line with market) or bearish (red=underperform). With an understanding of how certain sectors have typically performed during each phase of the business cycle, you may be able to position your portfolio optimally. Web stock screens tied to the great rotation: All assets automatically update with the latest data, making for effortless creation of communication collateral. Magnificent seven are imploding, while small caps are on a tear. Web investors utilize sector rotation indicators to identify the stages of economic cycles. Our main interest here is with sectors which are plotted along the top. Web beat the street with sector rotation strategy. Web sector rotation analysis attempts to link current strengths and weaknesses in the stock market with the general business cycle based on the relative performance of the eleven s&p sector spdr etfs. Web chart 1 is a visual representation of how that happens. Web see chart below: Investors can use it to. But industrial stocks are still. Web the sector rotation model (srm) helps you earn outsized returns by staying in tune with the best performing areas of the market. I have then copied these colored labels to the sectors at the top of the sector rotation model. True rotations can be seen as securities move from one quadrant to the other. Here, you can learn everything about investing and financial chart analysis. The red line plots the stock market while the green line tracks the economy. Web investors are fleeing big tech for value stocks—sector must ‘blow out’ earnings to stop that, says analyst. Web december 09, 2021 at 11:04 am. We shared details of this rotation in our commentary last. Growth stocks, which are more sensitive to interest rates. Percentage of large cap stocks over their moving averages, short to long term. Welcome to chartschool, stockcharts.com 's extensive educational resource for investors of all levels. Web jul 30, 2024, 6:11 am pdt. Web chart 1 is a visual representation of how that happens. Starting in a full recession, then moving into an early recovery which evolves into a full recovery, and then dives back into an early recession and later a fuller recession again. Web see chart below: Here, you can learn everything about investing and financial chart analysis. Web rrg ® charts show you the relative strength and momentum for a group. Welcome to chartschool, stockcharts.com 's extensive educational resource for investors of all levels. Got a question about investing or financial chart analysis? Web see chart below: Web the relative rotation graph (rrg) is a sophisticated tool in technical analysis to help investors decide which sectors, individual stocks, and other assets to pursue. We shared details of this rotation in our. Web see chart below: Web the sector rotation model uses the theoretical sequence of an economy moving through the various stages. But industrial stocks are still. Web investors utilize sector rotation indicators to identify the stages of economic cycles. Web sector rotation analysis attempts to link current strengths and weaknesses in the stock market with the general business cycle based. The red line plots the stock market while the green line tracks the economy. Web the relative rotation graph above shows the current rotations for all eleven sectors. All assets automatically update with the latest data, making for effortless creation of communication collateral. Web the sector rotation model uses the theoretical sequence of an economy moving through the various stages.. The red line plots the stock market while the green line tracks the economy. Web rrg ® charts show you the relative strength and momentum for a group of stocks. Web stockcharts.com's comprehensive collection of financial analysis articles and explanations. Investors can use it to. Web year to date performance. Investors can use it to. Many institutional investors saw this rotation out of tech into. Web chart 1 is a visual representation of how that happens. Index level as of jul 29, 2024 914.38. Web sector rotation is the movement of money in the stock market from one industry to another as investors anticipate the next stage of the economic cycle. Web the sector rotation model (srm) helps you earn outsized returns by staying in tune with the best performing areas of the market. Web investors utilize sector rotation indicators to identify the stages of economic cycles. Web stockcharts.com's comprehensive collection of financial analysis articles and explanations. Stock screener for investors and traders, financial visualizations. Here, you can learn everything about investing and financial chart analysis. I have then copied these colored labels to the sectors at the top of the sector rotation model. Stocks with strong relative strength and momentum appear in the green leading quadrant. The red line plots the stock market while the green line tracks the economy. Web december 09, 2021 at 11:04 am. With an understanding of how certain sectors have typically performed during each phase of the business cycle, you may be able to position your portfolio optimally. You can see that basic industry (materials) and energy are late cycle leaders.

Sector Rotation PatternsWizard

Stock Market Sector Rotation Strategy and How to Profit using it.

Stock and Commodity ETF Trading Sector Rotation The Market Oracle

Use the Correlation Between the Economy & Stock Market to Your Advantage

Sector Rotation and the Stock Market Cycle The Big Picture

Sector Rotation Strategy Can it Outperform The Market?

5/24 MWL Recap Sector Rotation Chart Breakouts! Turning Point

Trading Correlation Manager Seasonal And Sector Rotation. The Distant

Sector Rotation Guides iSquare Intelligence

Mind in Focus . World

Starting In A Full Recession, Then Moving Into An Early Recovery Which Evolves Into A Full Recovery, And Then Dives Back Into An Early Recession And Later A Fuller Recession Again.

Percentage Of Large Cap Stocks Over Their Moving Averages, Short To Long Term.

Web Beat The Street With Sector Rotation Strategy.

Web See Chart Below:

Related Post: