Section 105 Plan Template

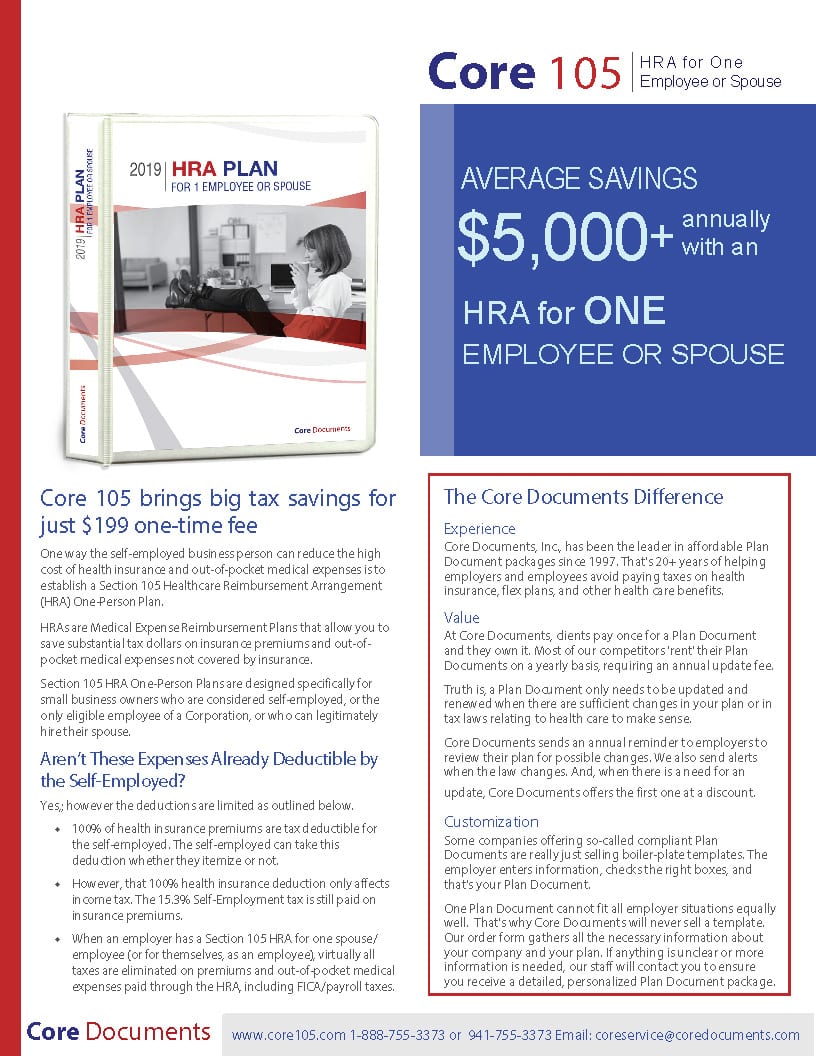

Section 105 Plan Template - Web on september 30, 2019, the irs and the department of the treasury issued proposed regulations clarifying the application of the employer shared responsibility provisions in. Web a section 105 plan allows a qualified business owner to deduct 100% of health insurance and dental insurance premiums for eligible employee(s) and family. Web road map to section 105 plan deductions. Web a section 105 plan can be designed to fit the business’ needs and budget. To fit into the perfect section 105 plan, you. Web the section 105 plan allows the employee to exclude the medical benefits of this plan from his or her gross income and is effective under 2023 law. The following , email submichapters ttal templates, and reference documents have been released for use: Web the plan is designed and intended to qualify as an accident and health plan within the meaning of section 105 of the internal revenue code of 1986, as amended, and to. Web the section 105 plan turns personal medical expenses into business deductions. The section 105 plan is perfect when it creates tax deductions where none existed before. Employers can save money by reducing premiums. There are numerous variations of the. Web the master plan is the primary plan document that establishes the particulars and specific details of the health reimbursement arrangement plan. Web section 105(e) states that amounts received under an accident or health plan for employees are treated as amounts received through accident or health. Web. Web on september 30, 2019, the irs and the department of the treasury issued proposed regulations clarifying the application of the employer shared responsibility provisions in. Web and released for use. Web the section 105 plan turns personal medical expenses into business deductions. Hras are medical expense reimbursement plans that allow you to save substantial tax. Web the section 105. Web on september 30, 2019, the irs and the department of the treasury issued proposed regulations clarifying the application of the employer shared responsibility provisions in. There are numerous variations of the. • chapter 1 (general) o section 1. The section 105 plan is perfect when it creates tax deductions where none existed before. The second requirement is to. Web a section 105 plan can be designed to fit the business’ needs and budget. Web use this section 105 medical reimbursement plan template to make sure you provide maximum medical benefits to you and your family while legally discriminating under both. The first requirement is to have one employee only. Hras are medical expense reimbursement plans that allow you. Web the plan is designed and intended to qualify as an accident and health plan within the meaning of section 105 of the internal revenue code of 1986, as amended, and to. Web section 105(e) states that amounts received under an accident or health plan for employees are treated as amounts received through accident or health. Web road map to. The second requirement is to. Web a section 105 plan allows a qualified business owner to deduct 100% of health insurance and dental insurance premiums for eligible employee(s) and family. Employers can save money by reducing premiums. The following , email submichapters ttal templates, and reference documents have been released for use: A qualified plan administrator will work with the. Web section 105(e) states that amounts received under an accident or health plan for employees are treated as amounts received through accident or health. The following , email submichapters ttal templates, and reference documents have been released for use: The first requirement is to have one employee only. The second requirement is to. To fit into the perfect section 105. A qualified plan administrator will work with the business owner to ensure that the. The second requirement is to. Web a section 105 plan allows a qualified business owner to deduct 100% of health insurance and dental insurance premiums for eligible employee(s) and family. There are numerous variations of the. Web the section 105 plan allows the employee to exclude. Web a section 105 plan allows a qualified business owner to deduct 100% of health insurance and dental insurance premiums for eligible employee(s) and family. Web by using a sec. Web the master plan is the primary plan document that establishes the particulars and specific details of the health reimbursement arrangement plan. The section 105 plan is perfect when it. Web road map to section 105 plan deductions. • chapter 1 (general) o section 1. Web a section 105 plan allows a qualified business owner to deduct 100% of health insurance and dental insurance premiums for eligible employee(s) and family. Web section 105(e) states that amounts received under an accident or health plan for employees are treated as amounts received. Web and released for use. Web road map to section 105 plan deductions. Hras are medical expense reimbursement plans that allow you to save substantial tax. Web a section 105 plan allows a qualified business owner to deduct 100% of health insurance and dental insurance premiums for eligible employee(s) and family. Web a section 105 plan can be designed to fit the business’ needs and budget. The second requirement is to. Web by using a sec. Web the section 105 plan turns personal medical expenses into business deductions. Web on september 30, 2019, the irs and the department of the treasury issued proposed regulations clarifying the application of the employer shared responsibility provisions in. Employers can save money by reducing premiums. Web the section 105 plan allows the employee to exclude the medical benefits of this plan from his or her gross income and is effective under 2023 law. Learn how to take advantage of the benefits of a section 105 plan as a small. To fit into the perfect section 105 plan, you. Web section 105(e) states that amounts received under an accident or health plan for employees are treated as amounts received through accident or health. It is a very important document. There are numerous variations of the.

Section 105 Plan Template

Section 105 Plan Template

Section 105 Plan Template

Section 105 plans for dummies

Section 105 Plan Template

Section 105 OnePerson HRA from 149 fee Core Documents, Inc.

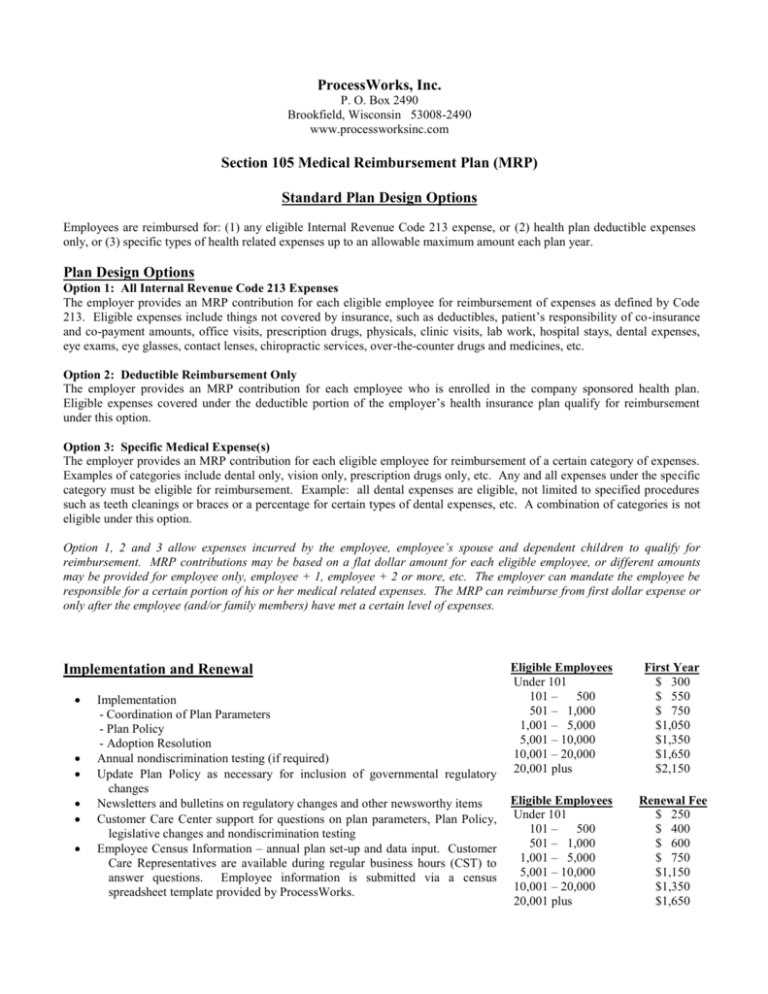

Section 105 Medical Reimbursement Plan (MRP)

Section 105 Plan Template

Section 105 Plan Template

A Guide to Section 105 Plans PeopleKeep

Web Use This Section 105 Medical Reimbursement Plan Template To Make Sure You Provide Maximum Medical Benefits To You And Your Family While Legally Discriminating Under Both.

The Section 105 Plan Is Perfect When It Creates Tax Deductions Where None Existed Before.

Web The Plan Is Designed And Intended To Qualify As An Accident And Health Plan Within The Meaning Of Section 105 Of The Internal Revenue Code Of 1986, As Amended, And To.

Web The Master Plan Is The Primary Plan Document That Establishes The Particulars And Specific Details Of The Health Reimbursement Arrangement Plan.

Related Post: