Rounded Bottom Pattern

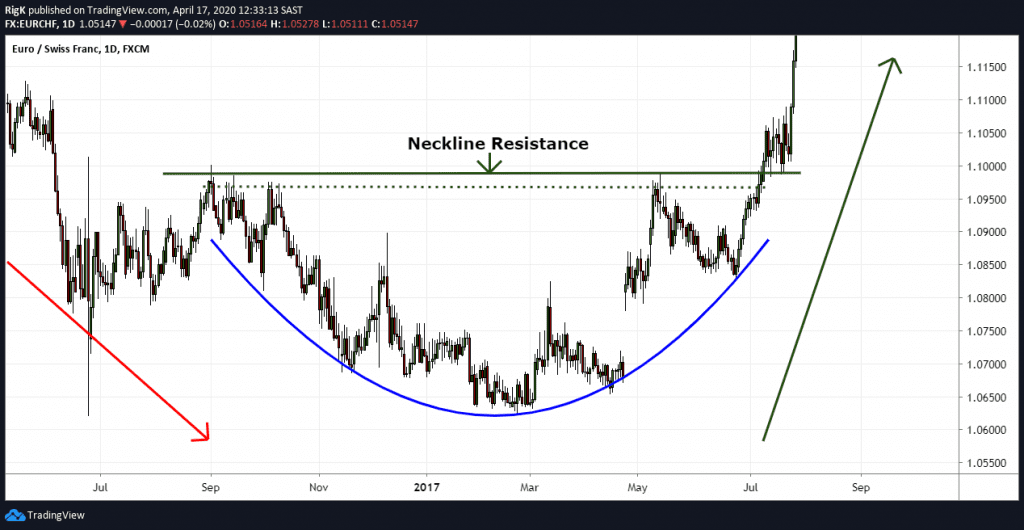

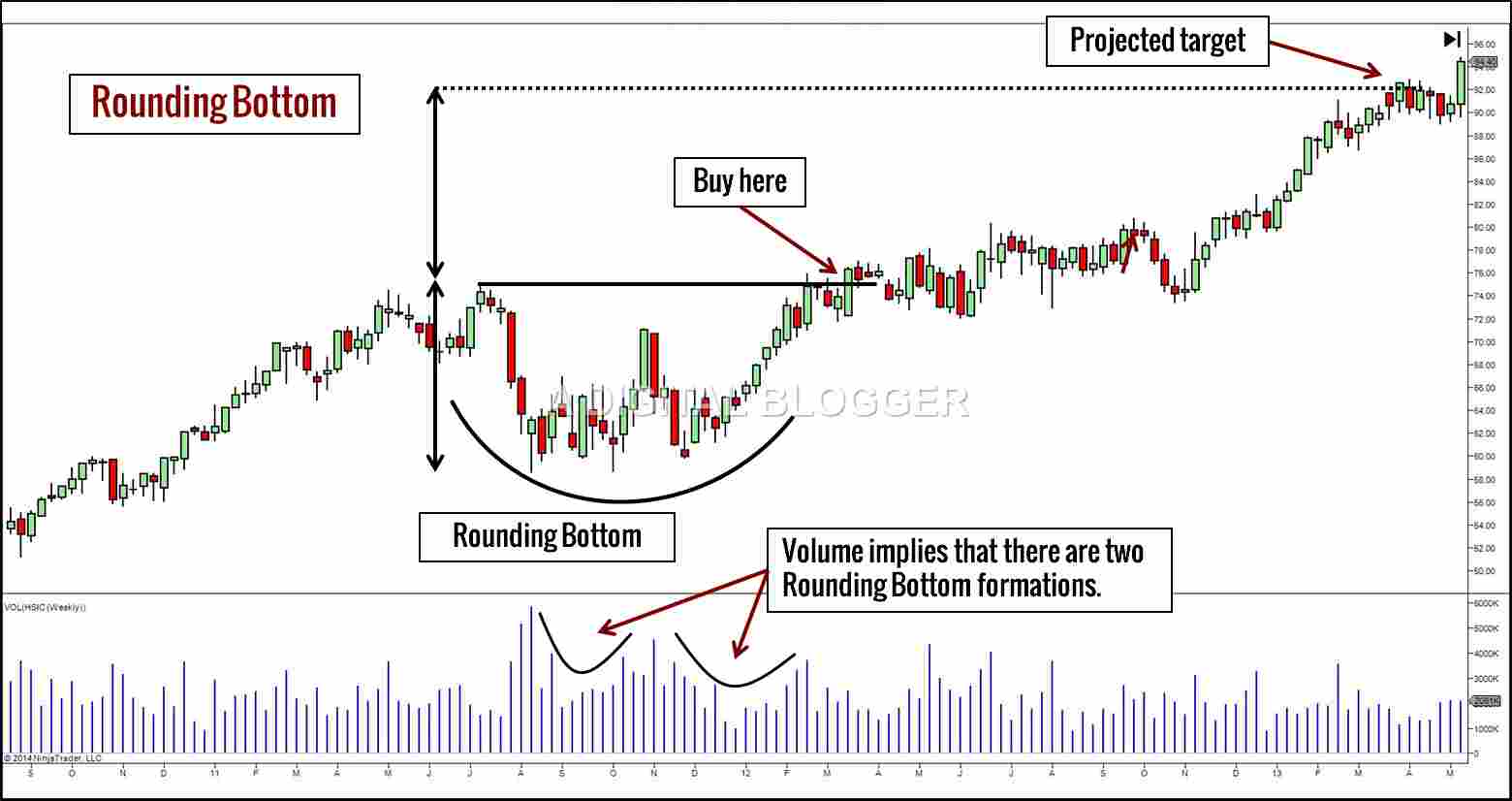

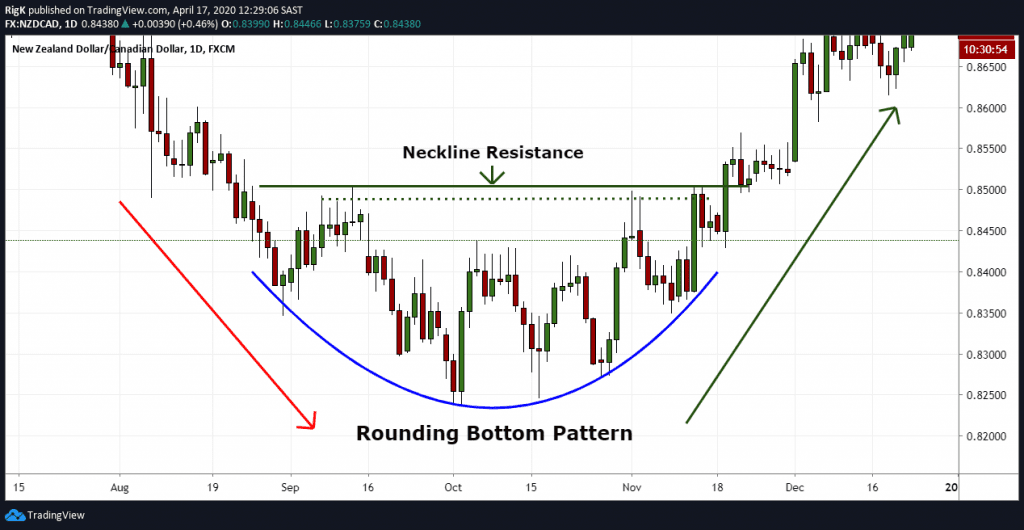

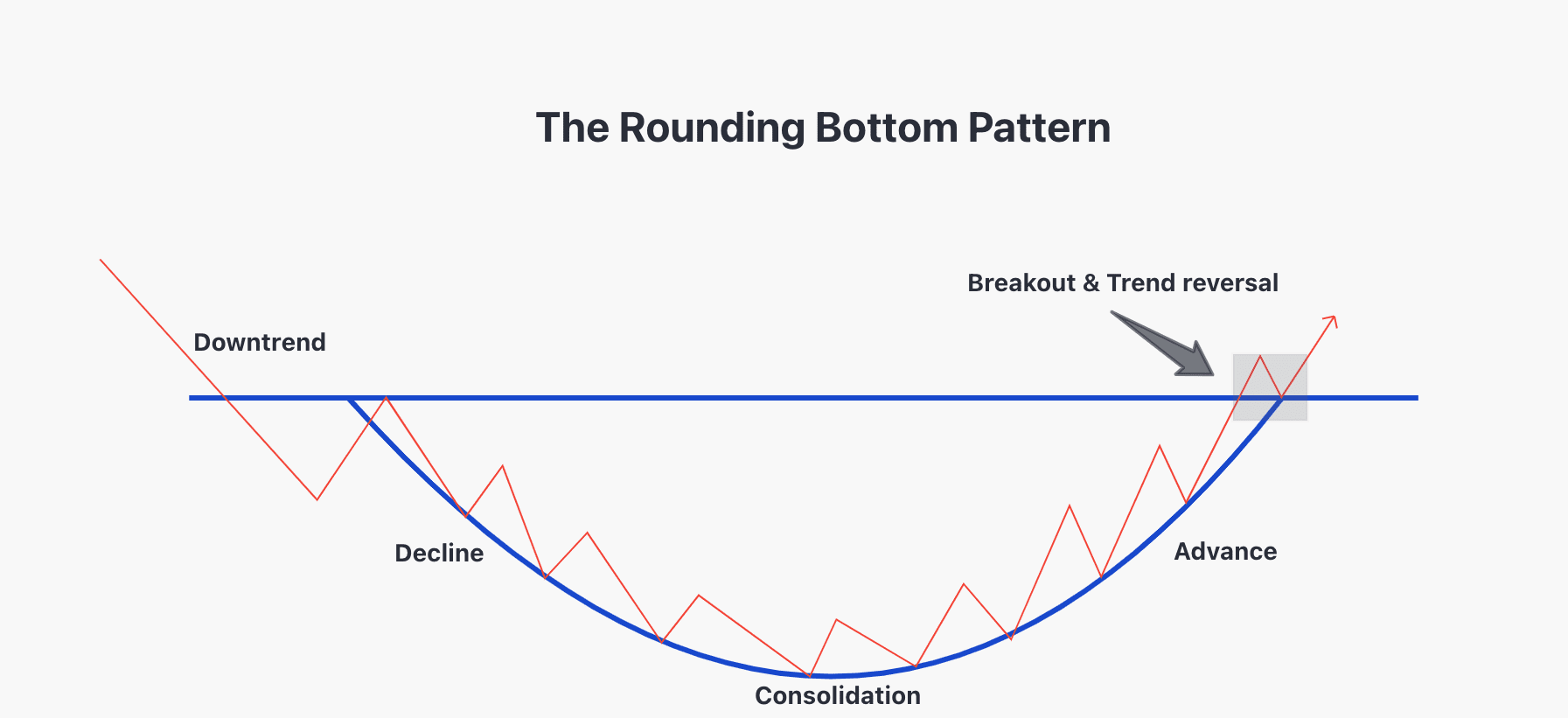

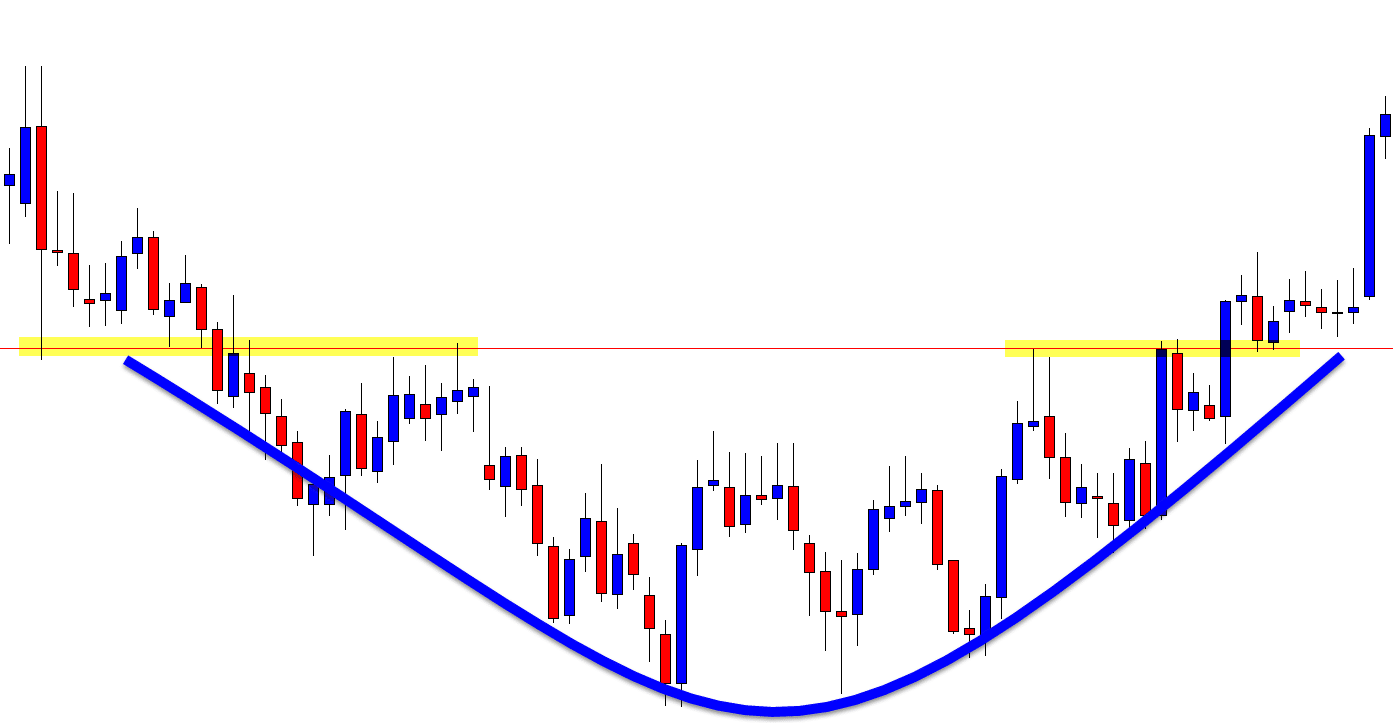

Rounded Bottom Pattern - Rounding bottoms are found at. Often, it’s more of a pausing pattern, allowing the stock to consolidate before it builds enough energy to move up in price. The strongest confirmation of the pattern comes from the volume indicator. Rounding bottoms are situated at the close of an elongated downward trend. E) put a stop loss in the middle of the pattern. It is also referred to as a saucer bottom. Web check out all the details on how to use and interpret the rounded bottom pattern in crypto trading. Web a rounding bottom is a chart pattern used in technical analysis. Web rounded bottom breakout pattern. Web a rounding bottom is a chart pattern that's used in technical analysis. B) draw the neck line. This pattern is indicated by: Web unlike the sharp and angular patterns commonly seen, the rounded bottom reveals a more gentle and curved transition in prices, indicative of a gradual change in market sentiment. Web the rounding bottom chart pattern, also known as the saucer bottom pattern, is a trend reversal pattern used in technical. Learn how to spot opportunities to buy low and sell high and take advantage of the bullish momentum. It is also referred to as a saucer bottom, and represents a long consolidation period that turns from a bearish bias to a bullish bias. C) confirm a rounded bottom breakout. The pattern signals that the existing downtrend is about to finish. The pattern signals that the existing downtrend is about to finish and the possibility of an uptrend to commence. Web a round bottom pattern, often referred to as a “saucer bottom,” is identified by a series of price movements on a chart that resemble a bowl or rounding shape. Web the rounding bottom, also called a saucer bottom is a. Web unlike the sharp and angular patterns commonly seen, the rounded bottom reveals a more gentle and curved transition in prices, indicative of a gradual change in market sentiment. Learn how to spot opportunities to buy low and sell high and take advantage of the bullish momentum. Web rounded bottom breakout pattern. Lower highs on the left, slightly higher peaks. Web a round bottom pattern, often referred to as a “saucer bottom,” is identified by a series of price movements on a chart that resemble a bowl or rounding shape. Lower highs on the left, slightly higher peaks in the middle, and then lower peaks again on the right. It would be advisable to wait for the successful breakout and. Web a rounded bottom or saucer pattern is not a common pattern, but is highly reliable as a reversal pattern with bullish implications. In other words, investor expectations and momentum (i.e., sentiment) gradually shift from bearish to bullish. Web a round bottom pattern, often referred to as a “saucer bottom,” is identified by a series of price movements on a. F) stay in the trade for a price move equal to the size of the rounding bottom. The formation starts with a slow decline in. Web a rounding bottom is a chart pattern that's used in technical analysis. Learn how to spot opportunities to buy low and sell high and take advantage of the bullish momentum. Web tata motors is. In other words, investor expectations and momentum (i.e., sentiment) gradually shift from bearish to bullish. Web to trade the rounded bottom, you should follow these steps: It is also referred to as a saucer bottom. Web unlike the sharp and angular patterns commonly seen, the rounded bottom reveals a more gentle and curved transition in prices, indicative of a gradual. E) put a stop loss in the middle of the pattern. Web the rounding bottom pattern consist of a rounded bottom u formation and a neckline resistance level in terms of structure. Web a rounding bottom regarding stock charts indicates a positive market reversal. It's identified by a series of price movements that graphically form the shape of a u.. Web the pattern is identified via the presence of a series of highs which follow an arc: In other words, investor expectations and momentum (i.e., sentiment) gradually shift from bearish to bullish. Both these patterns are designed to identify the end of a price trend, and technical traders use them frequently to supplement their hypothesis of an upcoming reversal in. It would be advisable to wait for the successful breakout and look to enter upon follow through. In other words, investor expectations and momentum (i.e., sentiment) gradually shift from bearish to bullish. Web the rounding bottom, also called a saucer bottom is a bullish reversal pattern within the field of technical analysis. D) enter a long trade on the breakout. Learn how to spot opportunities to buy low and sell high and take advantage of the bullish momentum. Web rounded bottom breakout pattern. E) put a stop loss in the middle of the pattern. The pattern is confirmed when the price breaks out above its moving average. F) stay in the trade for a price move equal to the size of the rounding bottom. Web a round bottom pattern, often referred to as a “saucer bottom,” is identified by a series of price movements on a chart that resemble a bowl or rounding shape. Web a rounding bottom is a chart pattern used in technical analysis and is identified by a series of price movements that graphically form the shape of a “u”. The formation starts with a slow decline in. Web a rounding bottom is a chart pattern used in technical analysis. Lower highs on the left, slightly higher peaks in the middle, and then lower peaks again on the right. Web a rounding bottom is a chart pattern that's used in technical analysis. In the image above you can see a great example of a rounding top chart pattern.

The Rounding Bottom Pattern Definition & Examples (2023)

Analyzing Chart Patterns Round Bottoms

Rounding Bottom Pattern Step By Step Guide to Use Rounding Bottom

How to Trade Rounding Top and Rounding Bottom Chart Patterns Forex

The Rounding Bottom Pattern Definition & Examples (2023)

Rounding bottom Basic characteristics & 2 examples!

Discover the Secrets of Technical Analysis The Ultimate Chart Patterns

How To Trade Chart Patterns A StepByStep Guide Pro Trading School

How to Find and Trade the Rounding Bottom Chart Pattern

Analyzing Chart Patterns Round Bottoms

Both These Patterns Are Designed To Identify The End Of A Price Trend, And Technical Traders Use Them Frequently To Supplement Their Hypothesis Of An Upcoming Reversal In Trend.

The Chart Pattern Represents A Long Consolidation Period That Turns From A Bearish To A Bullish Bias.

A Gradual Decline In Price, Followed By A Stabilization And A Subsequent Gradual Increase.

B) Draw The Neck Line.

Related Post: