Rising Flag Pattern

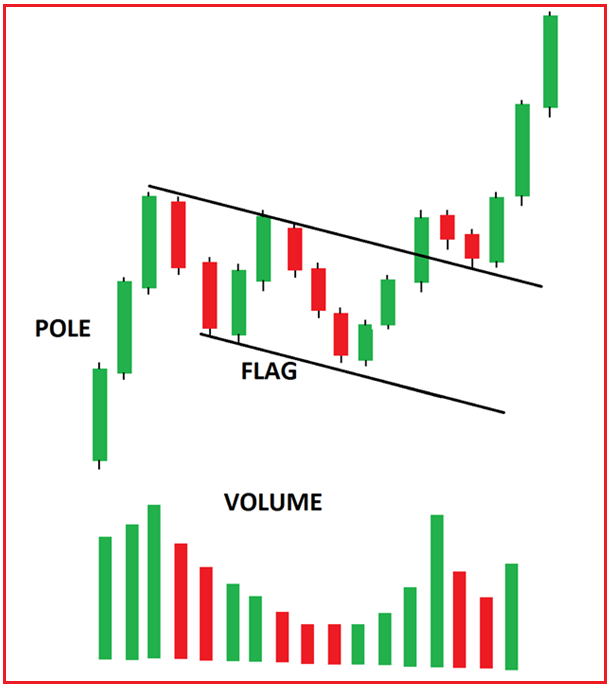

Rising Flag Pattern - Enter the trade immediately or wait for the price to. Web in this article, we will explore the definition and characteristics of flag chart patterns, delve into both bullish and bearish flag patterns, discuss potential trading strategies, and provide tips for successful flag trading. They represent a pattern of two parallel trendlines that meet at both the upper and lower points of an asset’s price, forming an approximate flag shape. This pattern resembles a flag with a mast and signifies a period of consolidation within a rising price trend. Web a flag chart pattern is a continuation pattern after a substantial price movement in a particular direction. Pole is the preceding uptrend where the flag represents the consolidation of the uptrend. It suggests that the underlying bullish trend will continue. It forms when rising prices experience a consolidation period, and the price moves within a narrow range defined by the. Web a correctly identified rising flag pattern indicates an upward trend, so prepare to buy the asset. After an uptrend it has a downward slope and after a downtrend, an upward slope. Web the rising range flag is an uptrend confirmation pattern that signals a continuous incline in currency pair prices. Web what is a bullish flag pattern? The shape of the pattern resembles a flag on a flagpole, hence the name “flag chart pattern.” How does bullish flag pattern? Web a flag pattern is a type of technical chart pattern that. Web what is a bullish flag pattern? Web a bull flag is an uptrend continuation chart pattern in the stock market or an individual stock that signals that a bullish trend is likely to persist. The flag is identified in short downtrends and provides traders with ideal entry price levels. Then, we explore the flag pattern indicators that show potential. Enter the trade immediately or wait for the price to. The flagpole is an initial impulsive move, the flag is a consolidation phase with parallel trend lines, and the breakout confirms the resumption of the primary trend. After the pattern forms, wait for a breakout indicating the bullish trend. Web what is the rising flag (bullish) pattern? Understanding the rising. It suggests that the underlying bullish trend will continue. The flag is identified in short downtrends and provides traders with ideal entry price levels. Web a bull flag is an uptrend continuation chart pattern in the stock market or an individual stock that signals that a bullish trend is likely to persist. Web in this article, we will explore the. Pole is the preceding uptrend where the flag represents the consolidation of the uptrend. It suggests that the underlying bullish trend will continue. Flags exist in both bullish and bearish form and each can be split into 3 distinct sections; Web a flag pattern is a word that you will come across in technical analysis while trading stocks. Flag patterns. It forms when rising prices experience a consolidation period, and the price moves within a narrow range defined by the. Discover the psychological aspects of pattern trading and enhance your skills in navigating the volatile stock market. After an uptrend it has a downward slope and after a downtrend, an upward slope. Web in the world of technical analysis, a. Once these patterns come to an end, the resulting move can often be strong and reach your target quickly, which is why it is so popular amongst technical traders. Web a flag chart pattern is a continuation pattern after a substantial price movement in a particular direction. Web the flag pattern is a powerful trend continuation chart pattern that appears. Pole is the preceding uptrend where the flag represents the consolidation of the uptrend. The bullish flag pattern is usually found in assets with a strong uptrend. After an uptrend it has a downward slope and after a downtrend, an upward slope. The shape of the pattern resembles a flag on a flagpole, hence the name “flag chart pattern.” How. The flagpole is an initial impulsive move, the flag is a consolidation phase with parallel trend lines, and the breakout confirms the resumption of the primary trend. Web unlock the secrets of the rising flag (bullish) pattern in stock trading. Discover the psychological aspects of pattern trading and enhance your skills in navigating the volatile stock market. We start by. Web a flag chart pattern is a continuation pattern after a substantial price movement in a particular direction. Flag patterns are accompanied by. Web what is the rising flag (bullish) pattern? Then, we explore the flag pattern indicators that show potential buy or sell signals. Web in the world of technical analysis, a flag pattern is a technical analysis pattern. Web in the world of technical analysis, a flag pattern is a technical analysis pattern that describes the price movement in a stock or other financial instrument. They are called bull flags because the pattern resembles a flag on a pole. Flags exist in both bullish and bearish form and each can be split into 3 distinct sections; Enter the trade immediately or wait for the price to. It forms when rising prices experience a consolidation period, and the price moves within a narrow range defined by the. We start by discussing what flag patterns are and how they are presented on a chart. The shape of the pattern resembles a flag on a flagpole, hence the name “flag chart pattern.” Traders and investors use bull flags to identify a potential entry into the next leg of an uptrend. Web the flag is a relatively rapid formation that appears as a small channel after a steep trend, which develops in the opposite direction: Web the rising range flag is an uptrend confirmation pattern that signals a continuous incline in currency pair prices. Pole is the preceding uptrend where the flag represents the consolidation of the uptrend. It is a bullish continuation pattern. How does bullish flag pattern? Once these patterns come to an end, the resulting move can often be strong and reach your target quickly, which is why it is so popular amongst technical traders. Web bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. Web what is a bullish flag pattern?

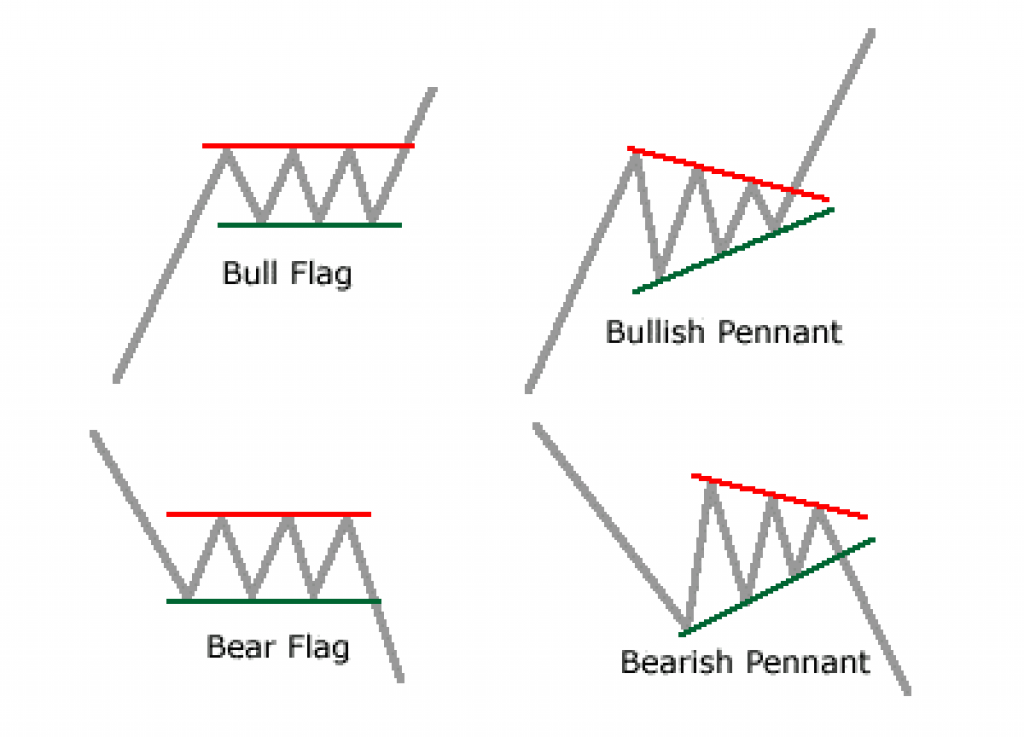

Types of Chart Patterns for Binary Options Trading

Flag Patterns Part I The Basics of Flag Pattern Unofficed

Flag Patterns Part I The Basics of Flag Pattern Unofficed

Technical analysis most common trading patterns CaptainAltcoin

Apa Itu Pola Bendera? Cara Memverifikasi Dan Memperdagangkannya

Flag Pattern Forex Trading

Flag Pattern Forex Trading

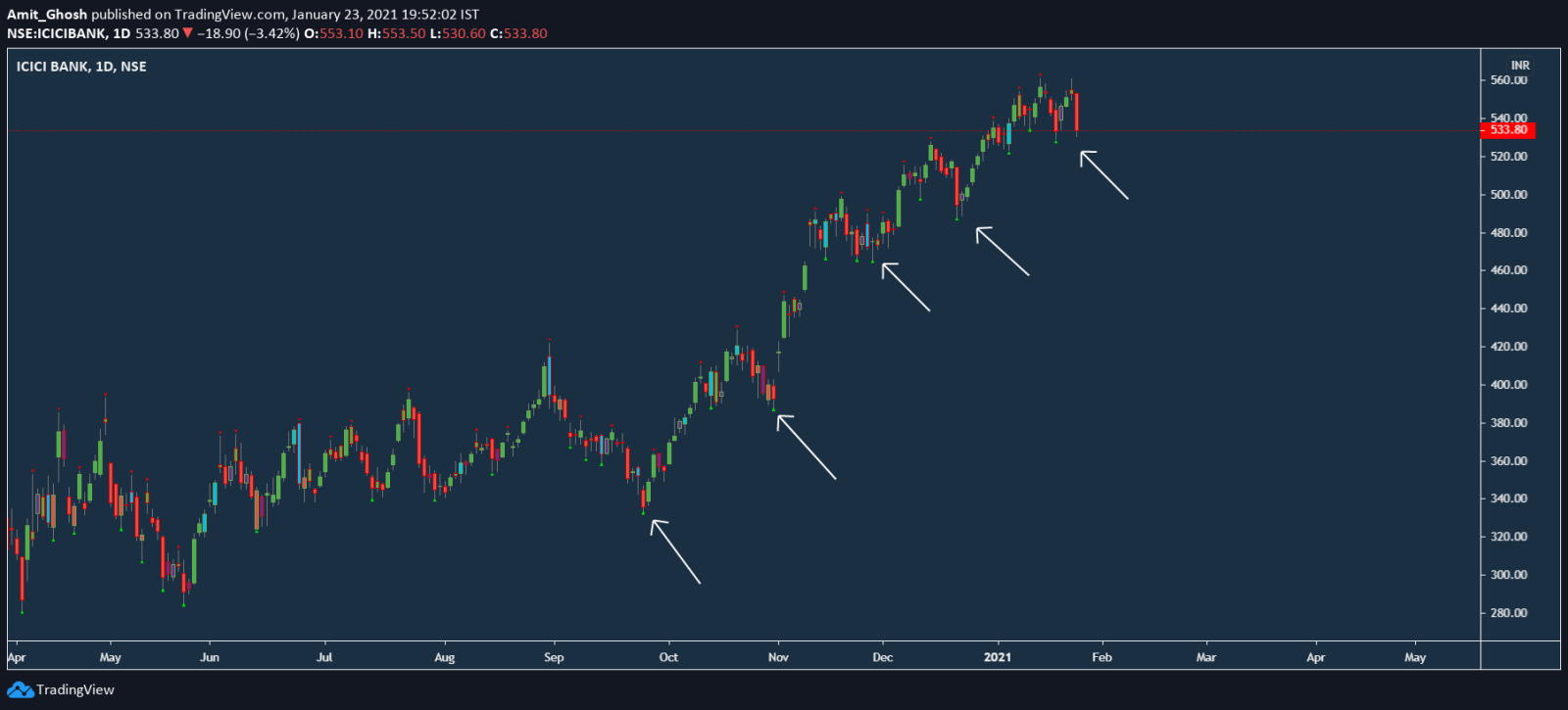

GE Rising Flag Pattern! for NYSEGE by SmartVest — TradingView

Page 2 Flag — Chart Patterns — Education — TradingView

Flag Patterns Part Ii How To Identify Bull Or Bear Flag Patterns Images

The Flagpole Is An Initial Impulsive Move, The Flag Is A Consolidation Phase With Parallel Trend Lines, And The Breakout Confirms The Resumption Of The Primary Trend.

Web What Is The Rising Flag (Bullish) Pattern?

Web This Technical Analysis Guide Teaches You About Flag Chart Patterns.

Web A Flag Chart Pattern Is A Continuation Pattern After A Substantial Price Movement In A Particular Direction.

Related Post: