Reverse Hammer Pattern

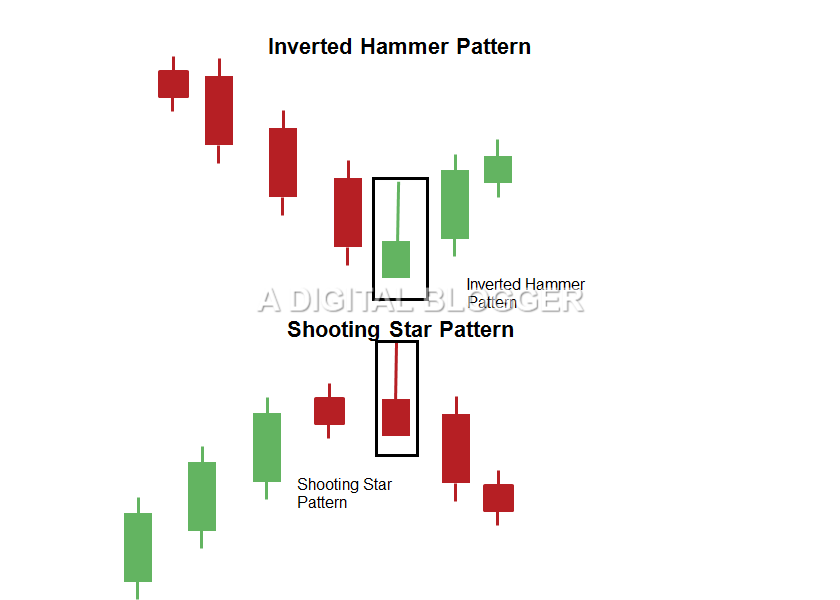

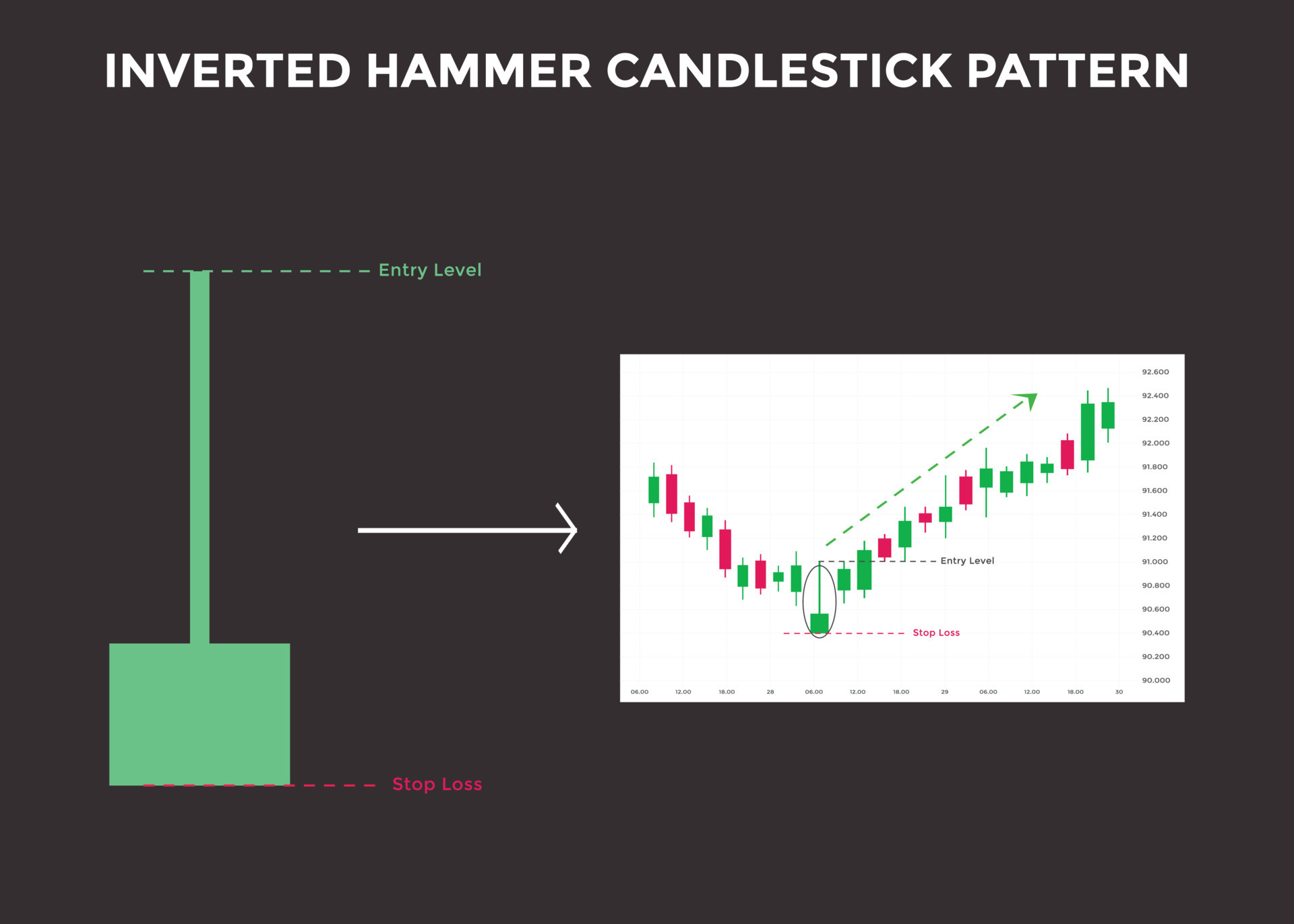

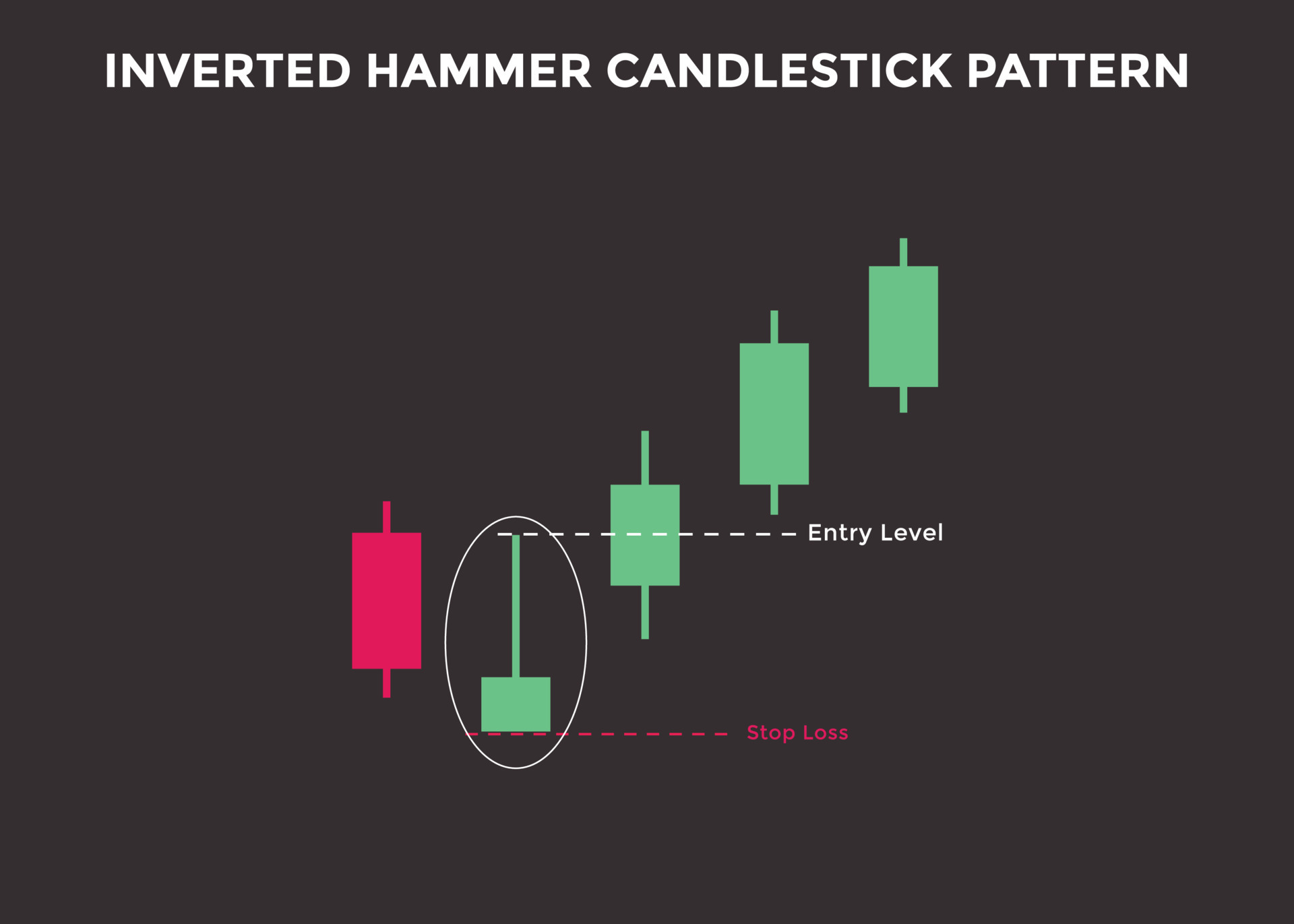

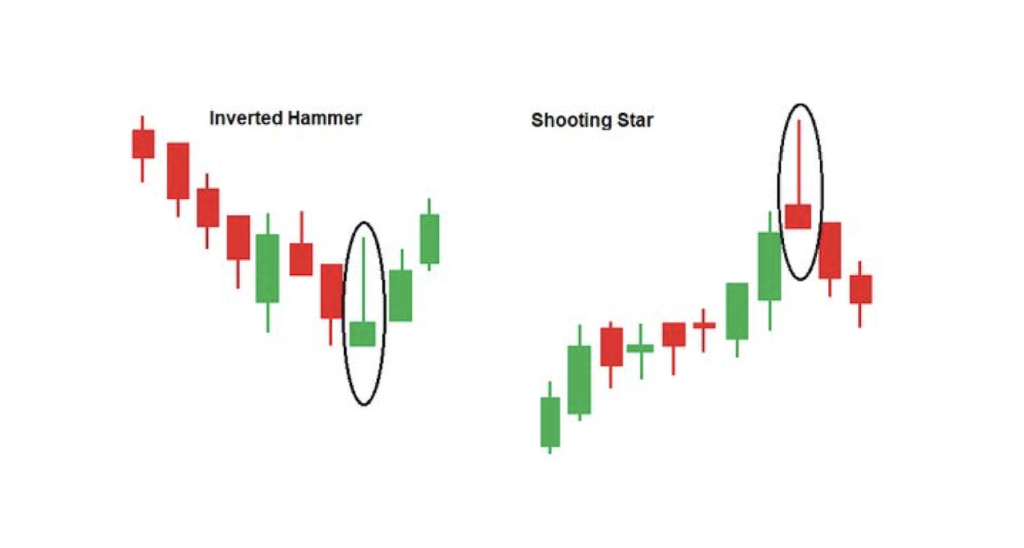

Reverse Hammer Pattern - Web the hammer candlestick is a bullish trading pattern that may indicate that a stock has reached its bottom and is positioned for trend reversal. Specifically, it indicates that sellers entered. It’s a bullish reversal pattern. We will dissect the hammer candle in great detail, and provide some practical tips for applying it in the forex market. It often appears at the bottom of a downtrend, signalling potential bullish reversal. To learn a little more about this common reversal pattern, please scroll down. Web the hammer candlestick pattern is a technical analysis tool used by traders to identify potential reversals in price trends. In the hammer pattern, the color of the body can either be red or green. Irrespective of the colour of the body, both examples in the photo above are hammers. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. Irrespective of the colour of the body, both examples in the photo above are hammers. Web the key to identifying a hammer versus an inverted hammer is the location of the long shadow. Web what is an inverted hammer pattern in candlestick analysis? A hammer’s long shadow extends from the bottom of the body, while an inverted hammer’s long shadow. Web shares of constellation energy corporation (ceg) have been struggling lately and have lost 7.5% over the past week. Web the inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. Web the inverted hammer candlestick pattern, also known as the inverted hammer. Web the inverted hammer is a japanese candlestick pattern. It’s a bullish reversal pattern. Web a hammer candlestick pattern is a bullish candlestick pattern that comprises a small body, little to no upper wick, and a large lower wick which is at least twice as large as the body of the pattern. This is a reversal pattern that appears at. It often signals a potential price reversal, where the current trend might be ending or transitioning into a new trend. It usually appears after a price decline and shows rejection from lower prices. This is a reversal pattern that appears at the end of a downtrend. Web the key to identifying a hammer versus an inverted hammer is the location. Web a hammer candlestick pattern is a bullish candlestick pattern that comprises a small body, little to no upper wick, and a large lower wick which is at least twice as large as the body of the pattern. It’s a bullish pattern because we expect to have a bull move after. Web the inverted hammer candlestick pattern, also known as. Specifically, it indicates that sellers entered. Web what is an inverted hammer pattern in candlestick analysis? That is why it is called a ‘bullish reversal’ candlestick pattern. For example, the move could go from a bearish to a bullish trend. Web the key to identifying a hammer versus an inverted hammer is the location of the long shadow. To learn a little more about this common reversal pattern, please scroll down. In particular, the inverted hammer can help to. Web bullish reversal patterns appear at the end of a downtrend and signal the price reversal to the upside. That is why it is called a ‘bullish reversal’ candlestick pattern. Web the inverted hammer pattern is regarded as a. A hammer’s long shadow extends from the bottom of the body, while an inverted hammer’s long shadow projects from the top. This coupled with an upward trend in earnings. For example, the move could go from a bearish to a bullish trend. That is why it is called a ‘bullish reversal’ candlestick pattern. This is a reversal candlestick pattern that. However, a hammer chart pattern was formed in its last trading session, which. We can most likely spot this candlestick on support levels where prices decline and show rejection from lower levels. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body.. A hammer’s long shadow extends from the bottom of the body, while an inverted hammer’s long shadow projects from the top. That is why it is called a ‘bullish reversal’ candlestick pattern. It’s a bullish pattern because we expect to have a bull move after. Web it’s a bullish reversal candlestick pattern, which indicates the end of a downtrend and. As the name implies, it has the appearance of an inverted hammer — a small body at the lower end and a long upper shadow. Web the key to identifying a hammer versus an inverted hammer is the location of the long shadow. Web a hammer candlestick pattern is a bullish candlestick pattern that comprises a small body, little to no upper wick, and a large lower wick which is at least twice as large as the body of the pattern. Specifically, it indicates that sellers entered. We can most likely spot this candlestick on support levels where prices decline and show rejection from lower levels. Web an inverted hammer candlestick is a pattern that appears on a chart when there is a buyer’s pressure to push the price of the stocks upwards. Web inverted hammer is a single candle which appears when a stock is in a downtrend. Web the inverted hammer candlestick pattern is a unique and essential pattern for traders to understand in the world of technical analysis. This is a reversal pattern that appears at the end of a downtrend. Since it exists at the bottom of a downtrend, it demonstrates trend reversal concerning an asset’s price. It often signals a potential price reversal, where the current trend might be ending or transitioning into a new trend. In the hammer pattern, the color of the body can either be red or green. Web the inverted hammer pattern is regarded as a significant indication or indicator indicating a market change during a trading day. It signals a potential reversal of price, indicating the initiation of a bullish trend. It directly indicates that bulls are starting to step in and are pushing the price up from the previous downtrend. It usually appears after a price decline and shows rejection from lower prices.

Inverted Hammer Candlestick How to Trade it ForexBoat Trading

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Inverted Hammer Pattern, Meaning, Uptrend, Formation, Reversal

Inverted Hammer Candlestick Pattern Quick Trading Guide

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

Inverted Hammer Candlestick Pattern (Bullish Reversal)

Inverted Hammer candlestick chart pattern. Candlestick chart Pattern

How to Use the Inverted Hammer Pattern Market Pulse

Inverted Hammer candlestick chart pattern. Candlestick chart Pattern

How to Read the Inverted Hammer Candlestick Pattern? (2022)

A Hammer’s Long Shadow Extends From The Bottom Of The Body, While An Inverted Hammer’s Long Shadow Projects From The Top.

The Candle Has A Long Lower Shadow, Which Should Be At Least Twice The Length Of The Real Body.

Irrespective Of The Colour Of The Body, Both Examples In The Photo Above Are Hammers.

Web It’s A Bullish Reversal Candlestick Pattern, Which Indicates The End Of A Downtrend And The Start Of A New Uptrend.

Related Post: