Restricted Funds Vs Designated Funds

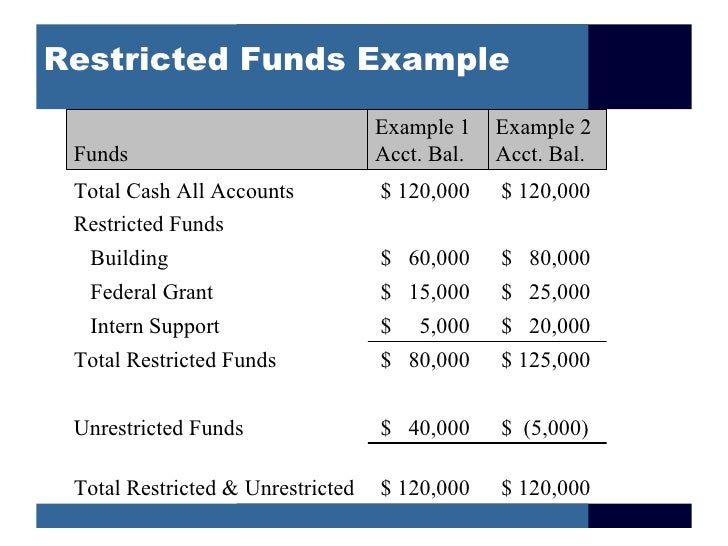

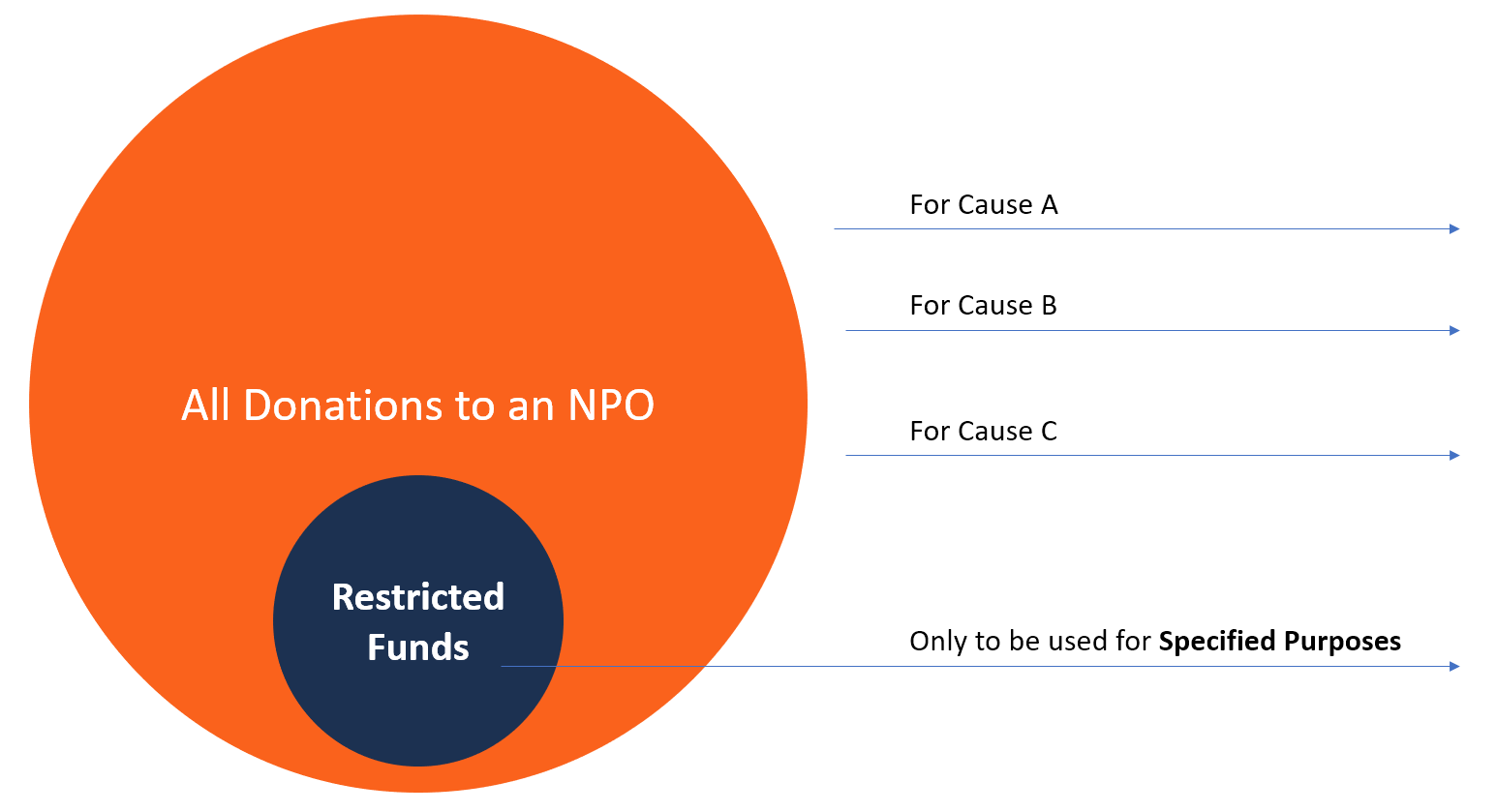

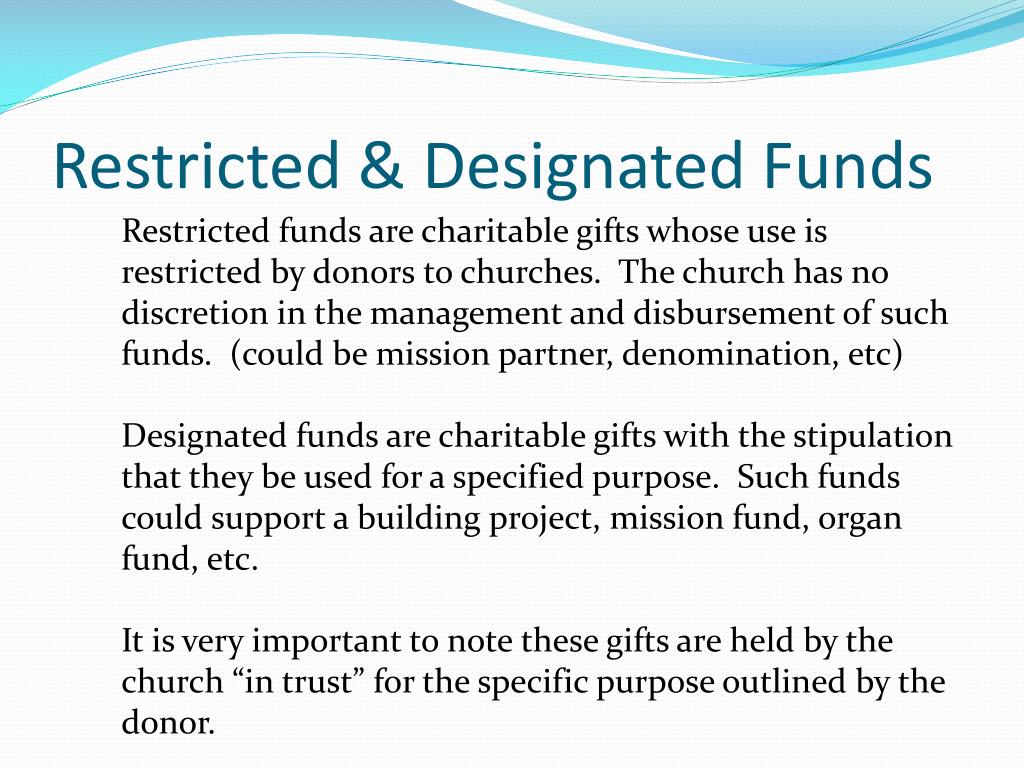

Restricted Funds Vs Designated Funds - Funds become designated when they are. The following provides policy, information, and guidance for receiving and disbursing restricted and designated funds. As a result, investors in bond funds. If the funds are permanently restricted, the. Web on the other hand, designated funds are a type of unrestricted fund, and they can legally be spent for any charitable purpose. The diocese and its parishes, missions,. Web donor designated funds are restricted gifts that allow donors to specify how their contributions are used, providing greater control and impact for charitable giving. They are permanently restricted to that purpose and cannot be used. The donor may or may not also restrict the use of income generated by the. Web bond funds, specifically bond etfs, benefit from economies of scale, allowing them to negotiate better prices on bond purchases. Web restricted funds are based on the donor stipulations of the initial gift, and designated funds are created from an internal transfer initiated by leadership. The diocese and its parishes, missions,. Web on the other hand, designated funds are a type of unrestricted fund, and they can legally be spent for any charitable purpose. Web restricted funds are monies received. Web in particular, there is a need to be able distinguish between unrestricted (including designated) funds and restricted funds. Web donor designated funds are restricted gifts that allow donors to specify how their contributions are used, providing greater control and impact for charitable giving. The following provides policy, information, and guidance for receiving and disbursing restricted and designated funds. Web. Web in particular, there is a need to be able distinguish between unrestricted (including designated) funds and restricted funds. Web we’ll cover the following points: Funds become designated when they are. These funds can only be used for specific purposes, such as a. And, from the donors perspective, in that regard, they are the same as well. These funds can only be used for specific purposes, such as a. Web donor designated funds are restricted gifts that allow donors to specify how their contributions are used, providing greater control and impact for charitable giving. Why are restricted funds important? Web on the other hand, designated funds are a type of unrestricted fund, and they can legally be. Exchange traded funds (etfs) have in recent years scored over mutual funds by garnering more investments and growing faster. Web restricted funds are where the restriction is defined by the donor. This trend is not solely. Web on the other hand, designated funds are a type of unrestricted fund, and they can legally be spent for any charitable purpose. If. Web in particular, there is a need to be able distinguish between unrestricted (including designated) funds and restricted funds. Web restricted funds are monies received by a nonprofit with conditions attached, dictated by the donor. Web contributions with donor restrictions are designated by the donor for specific projects or purposes other than general use. Funds become designated when they are.. Exchange traded funds (etfs) have in recent years scored over mutual funds by garnering more investments and growing faster. As a result, investors in bond funds. We compare it with unrestricted & designated funds, explain its examples, types, & importance. Web if the donor temporarily restricts how the funds can be utilized, the organization must use the funds for the. Funds become designated when they are. Web donor designated funds are restricted gifts that allow donors to specify how their contributions are used, providing greater control and impact for charitable giving. This trend is not solely. Web however, the difference between them is that designated funds are set aside for a specific end by the nonprofit itself, while restricted funds. Web the principal remains untouched, while the interest or dividends provide a steady stream of income for the designated cause. Web guide to what are restricted funds. They are permanently restricted to that purpose and cannot be used. Web bond funds, specifically bond etfs, benefit from economies of scale, allowing them to negotiate better prices on bond purchases. Why are. Web however, the difference between them is that designated funds are set aside for a specific end by the nonprofit itself, while restricted funds are restricted by the donor. Web contributions with donor restrictions are designated by the donor for specific projects or purposes other than general use. Web in particular, there is a need to be able distinguish between. As a result, investors in bond funds. Web restricted funds are where the restriction is defined by the donor. Web the principal remains untouched, while the interest or dividends provide a steady stream of income for the designated cause. If the funds are permanently restricted, the. Why are restricted funds important? Funds become designated when they are. They are permanently restricted to that purpose and cannot be used. Web we’ll cover the following points: The following provides policy, information, and guidance for receiving and disbursing restricted and designated funds. We compare it with unrestricted & designated funds, explain its examples, types, & importance. Web restricted funds are monies received by a nonprofit with conditions attached, dictated by the donor. Such funds typically are major gifts, bequests, and memorials. Web however, the difference between them is that designated funds are set aside for a specific end by the nonprofit itself, while restricted funds are restricted by the donor. Web restricted funds are monies set aside for a particular purpose as a result of designated giving. And, from the donors perspective, in that regard, they are the same as well. Web contributions with donor restrictions are designated by the donor for specific projects or purposes other than general use.

Managing Restricted Funds Propel Nonprofits

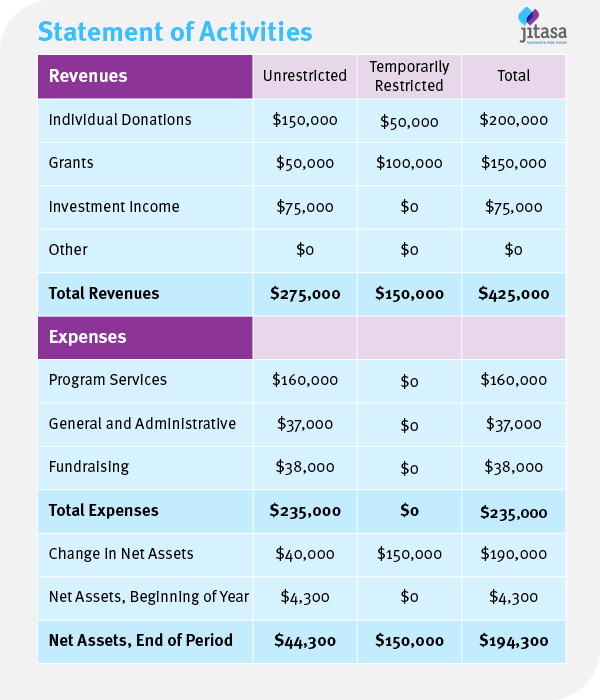

Restricted Funds What Are They? And Why Do They Matter? Jitasa Group

Managing Restricted Funds Propel Nonprofits

Designated Giving versus Restricted Giving what's the difference

PPT Operations 103 Finances Class 2 PowerPoint Presentation, free

Financial Management Slides

Restricted Funds Definitions, Types & Legal Obligations

Implementing ASU 201614 on the Presentation of NotforProfit

PPT Operations 103 Finances Class 2 PowerPoint Presentation, free

PPT Operations 103 Finances Class 2 PowerPoint Presentation, free

The Donor May Or May Not Also Restrict The Use Of Income Generated By The.

Web Restricted Funds Are Based On The Donor Stipulations Of The Initial Gift, And Designated Funds Are Created From An Internal Transfer Initiated By Leadership.

Restricted Funds Can Only Be Spent In.

These Funds Can Only Be Used For Specific Purposes, Such As A.

Related Post: