Replacement Regulations Is Designed To Protect

Replacement Regulations Is Designed To Protect - A term life insurance policy matures: Market barriers include life insurance producer licensing regulations, replacement rules, group regulation, and other regulatory issues. Web where a replacement has occurred or is likely to occur, the insurer whose life insurance policy or annuity contract is to be replaced shall: Web the regulations are designed to help protect the interests of consumers by ensuring they have considered the consequences of replacing their existing policy with a new one. Web this guide is intended to help you comply with replacement regulations in general, and to assist you in making appropriate replacement recommendations. Many other situations are also covered in. (1) to regulate the activities of insurers and producers with respect to the replacement of existing life insurance and annuities. Web the model regulation establishes minimum requirements that must be included in each state’s replacement procedures that must be followed by the insurers and the producers. Web the purpose of this regulation is: Life insurance replacement regulation is designed to protect the interests of the: Market barriers include life insurance producer licensing regulations, replacement rules, group regulation, and other regulatory issues. Web this guide is intended to help you comply with replacement regulations in general, and to assist you in making appropriate replacement recommendations. Upon the insured's death during the term of the policy. Web the model regulation establishes minimum requirements that must be included. Web the regulations are designed to help protect the interests of consumers by ensuring they have considered the consequences of replacing their existing policy with a new one. Web a return of premium life insurance policy is: (2) to protect the interests of life insurance and. Web the replacement rule in life insurance is a regulatory requirement designed to protect. (2) to protect the interests of life insurance and. Life insurance replacement regulation is designed to protect the interests of the: Web a return of premium life insurance policy is: Web recent federal and state regulations have restricted employers' use of noncompete agreements, which in part are designed to protect trade secrets. Web this guide is intended to help you. Web the purpose of this regulation is: This 1998 model was developed to address findings. A term life insurance policy matures: Web regulations concerning replacement apply not only when existing coverage or contracts are canceled or terminated. (1) to regulate the activities of insurers and producers with respect to the replacement of existing life insurance and annuities. • (1) upon notice that its existing. Upon the insured's death during the term of the policy. This 1998 model was developed to address findings. (2) to protect the interests of life insurance and. Web the issue of replacement of life insurance policies long has been shrouded by hostile emotions against those engaging in such activity. Web recent federal and state regulations have restricted employers' use of noncompete agreements, which in part are designed to protect trade secrets. Web regulations concerning replacement apply not only when existing coverage or contracts are canceled or terminated. Of market conduct examinations and allegations made in litigation that. Web this guide is intended to help you comply with replacement regulations. Web this guide is intended to help you comply with replacement regulations in general, and to assist you in making appropriate replacement recommendations. Web the replacement rule in life insurance is a regulatory requirement designed to protect consumers from unethical practices and ensure that they understand. Web regulations concerning replacement apply not only when existing coverage or contracts are canceled. Web regulations concerning replacement apply not only when existing coverage or contracts are canceled or terminated. (2) to protect the interests of life insurance and. Market barriers include life insurance producer licensing regulations, replacement rules, group regulation, and other regulatory issues. Web a return of premium life insurance policy is: Web the model regulation establishes minimum requirements that must be. Web a return of premium life insurance policy is: Web the regulations are designed to help protect the interests of consumers by ensuring they have considered the consequences of replacing their existing policy with a new one. Of market conduct examinations and allegations made in litigation that. (2) to protect the interests of life insurance and. Web this guide is. Let it lapse, or forfeit, surrender or terminate it; Web recent federal and state regulations have restricted employers' use of noncompete agreements, which in part are designed to protect trade secrets. A term life insurance policy matures: Web the purpose of this regulation is: Of market conduct examinations and allegations made in litigation that. Web the regulations are designed to help protect the interests of consumers by ensuring they have considered the consequences of replacing their existing policy with a new one. Web this guide is intended to help you comply with replacement regulations in general, and to assist you in making appropriate replacement recommendations. Web regulation addressing the replacement of life insurance. (1) to regulate the activities of insurers and producers with respect to the replacement of existing life insurance and annuities. Web the purpose of this regulation is: Upon the insured's death during the term of the policy. Web the issue of replacement of life insurance policies long has been shrouded by hostile emotions against those engaging in such activity. Web if you are buying a new policy, under illinois law, you are replacing your current policy if you: Many other situations are also covered in. Of market conduct examinations and allegations made in litigation that. Web a return of premium life insurance policy is: A term life insurance policy matures: Web (1) to regulate the activities of insurers and producers with respect to the replacement of existing life insurance and annuities. Life insurance replacement regulation is designed to protect the interests of the: Web the replacement rule in life insurance is a regulatory requirement designed to protect consumers from unethical practices and ensure that they understand. (2) to protect the interests of life insurance and.

Building Construction and Fire Safety Code IAFF

What You Need To Know About Roof Replacement Building Regulations

12 Essential Tips for Electrical Panel Replacement

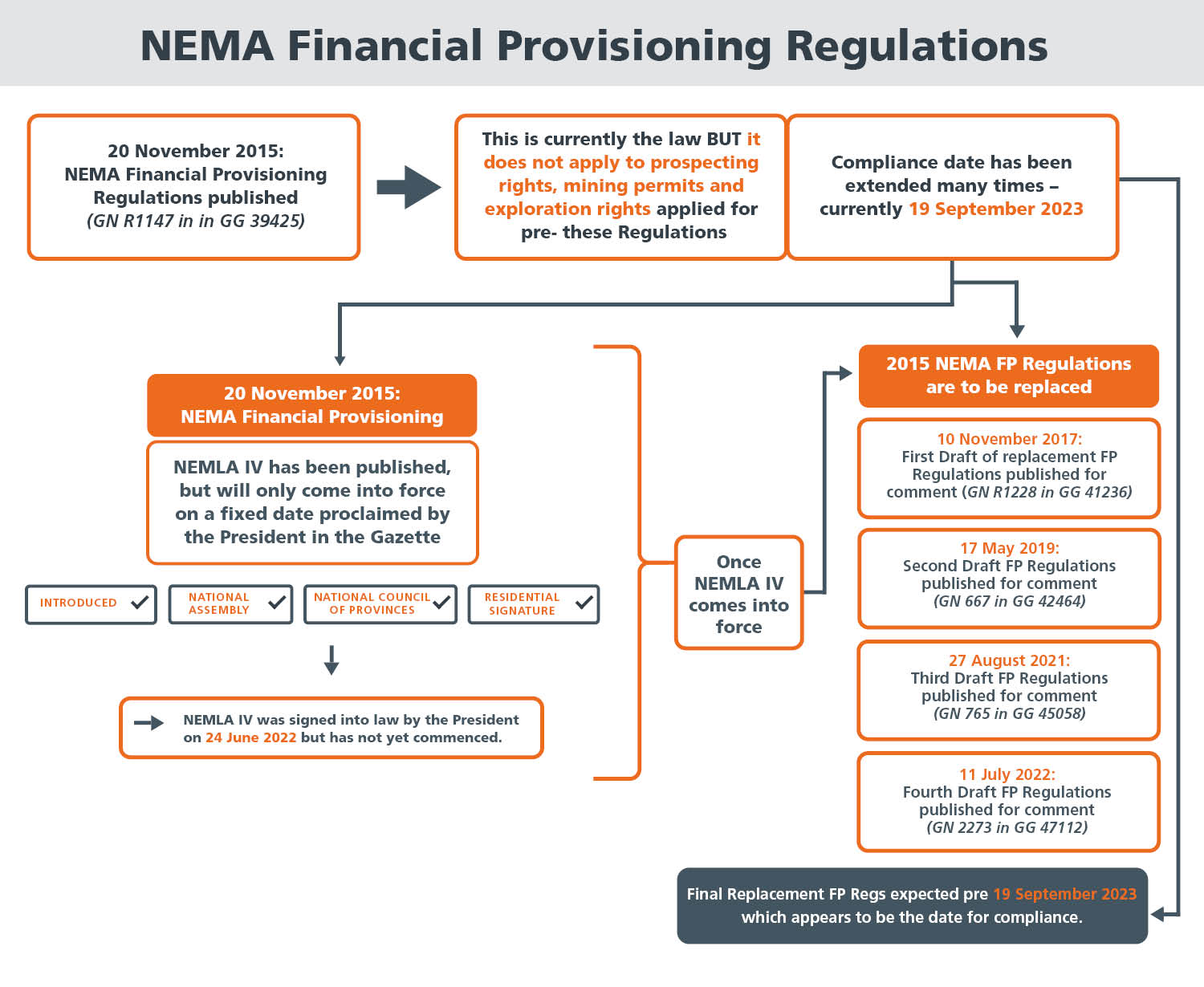

Final draft of the Replacement NEMA Financial Provisioning Regulations

South Carolina Labor Law Poster + 2021 Replacement Service SC Labor

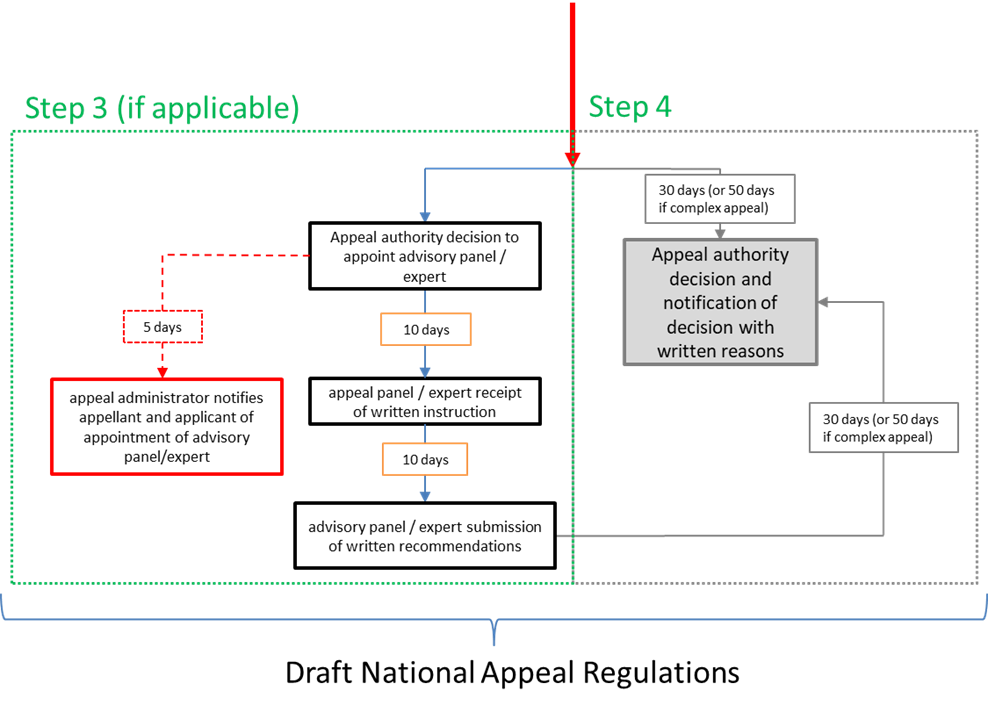

A stepbystep guide to the proposed draft NEMA National Appeal

Life Insurance Replacement Regulations Financial Report

Building Regulations for Replacing Windows and Doors in Your Home DIY

Navigating Window Replacement Regulations in South Wales A

Why Are Building Regulations Important For Your Roof Replacement?

Let It Lapse, Or Forfeit, Surrender Or Terminate It;

Market Barriers Include Life Insurance Producer Licensing Regulations, Replacement Rules, Group Regulation, And Other Regulatory Issues.

This 1998 Model Was Developed To Address Findings.

Web Recent Federal And State Regulations Have Restricted Employers' Use Of Noncompete Agreements, Which In Part Are Designed To Protect Trade Secrets.

Related Post: