Reg Cc Funds Availability Chart 2024

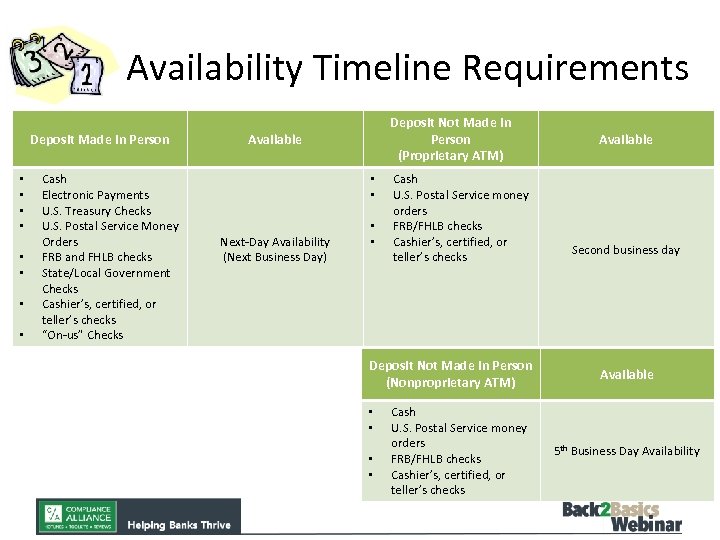

Reg Cc Funds Availability Chart 2024 - Web find downloadable files for efta, efaa and regulation d compliance. Web regulation cc sets forth the requirements for funds availability and check collection for credit unions. Use the pull down menu to. Web the federal reserve board and consumer financial protection bureau have issued amendments to adjust for inflation certain dollar amounts in regulation cc, with an. Web download an excel spreadsheet to calculate when funds must be made available under reg cc for different hold types and holidays. Learn the key dates, deadlines, and steps to. Web this final rule adjusts the dollar amounts under the expedited funds availability act for inflation, effective july 1, 2025. Web this part is issued by the board of governors of the federal reserve system (board) to implement the expedited funds availability act (12 u.s.c. I see from the bol daily compliance briefing that the fdic exam manual has been updated. Web the board of governors of the federal reserve system (board) and the consumer financial protection bureau (bureau) (collectively, agencies) are amending regulation. Web regulation cc's required notices on deposit slips and receipts; Web the agencies announced the new thresholds for regulation cc, which affect the availability of customer funds for check deposits, will take effect july 1, 2025. Web this part is issued by the board of governors of the federal reserve system (board) to implement the expedited funds availability act (12. When the deposited item is. Web regulation cc's required notices on deposit slips and receipts; Use the pull down menu to. Web find downloadable files for efta, efaa and regulation d compliance. Web what changed on reg cc exams. Web this part is issued by the board of governors of the federal reserve system (board) to implement the expedited funds availability act (12 u.s.c. Whether a credit union may allow all funds to be available for immediate withdrawal as soon as deposited; I see from the bol daily compliance briefing that the fdic exam manual has been updated. Web. Web the agencies announced the new thresholds for regulation cc, which affect the availability of customer funds for check deposits, will take effect july 1, 2025. Web find downloadable files for efta, efaa and regulation d compliance. Web what changed on reg cc exams. Web it is a quick reference guide to what reg cc allows or requires for funds. Web the board of governors of the federal reserve system (board) and the consumer financial protection bureau (cfpb) are amending regulation cc, which implements. It provides availability timelines for different types of deposits including cash, electronic payments,. Web what changed on reg cc exams. Web regulation cc sets forth the requirements for funds availability and check collection for credit unions.. The file for reg cc 2024 contains the funds availability chart for 2024 and the expiration dates for reg cc. Treasury checks deposited into a proprietary atm receive. This tool consists of an excel spreadsheet designed to allow a user to calculate when funds must be made available under reg cc. Learn the key dates, deadlines, and steps to. Web. This tool consists of an excel spreadsheet designed to allow a user to calculate when funds must be made available under reg cc. Web the agencies announced the new thresholds for regulation cc, which affect the availability of customer funds for check deposits, will take effect july 1, 2025. Whether a credit union may allow all funds to be available. Web the agencies announced the new thresholds for regulation cc, which affect the availability of customer funds for check deposits, will take effect july 1, 2025. When the deposited item is. Web regulation cc's required notices on deposit slips and receipts; Web the board of governors of the federal reserve system (board) and the consumer financial protection bureau (cfpb) are. Learn the key dates, deadlines, and steps to. Web regulation cc funds availability calendar. Depository institutions can make funds available faster or in greater amounts than the. Web this document outlines funds availability requirements under regulation cc. Web this part is issued by the board of governors of the federal reserve system (board) to implement the expedited funds availability act. Web this guide highlights the following requirements of regulation cc: Web find downloadable files for efta, efaa and regulation d compliance. Web the efaa governs the availability of funds from consumer and business customers’ deposits in transaction accounts and promotes the expedited collection and return of. Web this document outlines funds availability requirements under regulation cc. Use the pull down. I see from the bol daily compliance briefing that the fdic exam manual has been updated. Making funds available for withdrawal within the times prescribed by the regulation; Web the agencies announced the new thresholds for regulation cc, which affect the availability of customer funds for check deposits, will take effect july 1, 2025. Web it is a quick reference guide to what reg cc allows or requires for funds availability. Web regulation cc's required notices on deposit slips and receipts; Web the federal reserve board and the consumer financial protection bureau today jointly adjusted for inflation dollar amounts relating to the availability of customer funds. Web what changed on reg cc exams. Treasury checks deposited into a proprietary atm receive. Generally, they are guaranteed funds, government checks, or cash, ach,. Web the federal reserve board and consumer financial protection bureau have issued amendments to adjust for inflation certain dollar amounts in regulation cc, with an. Web find downloadable files for efta, efaa and regulation d compliance. Web a guide to help you comply with the 2025 changes to regulation cc, which affects the availability of funds in your account. Web download an excel spreadsheet to calculate when funds must be made available under reg cc for different hold types and holidays. Web regulation cc sets forth the requirements for funds availability and check collection for credit unions. Whether a credit union may allow all funds to be available for immediate withdrawal as soon as deposited; Web you can hold, per reg.

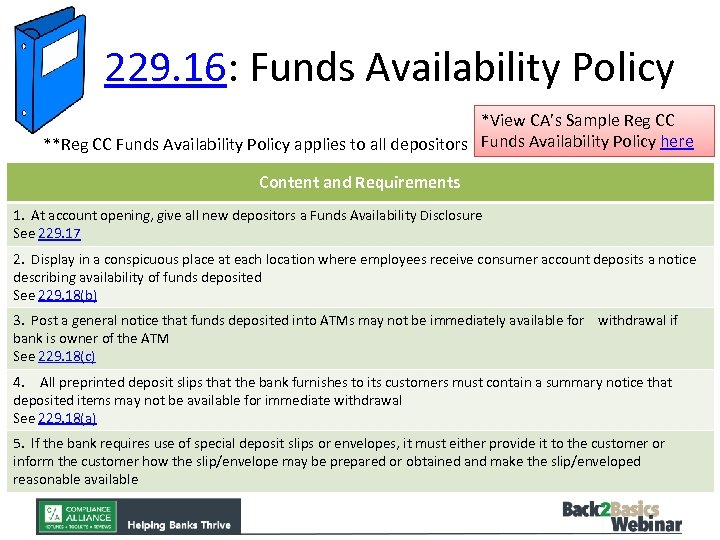

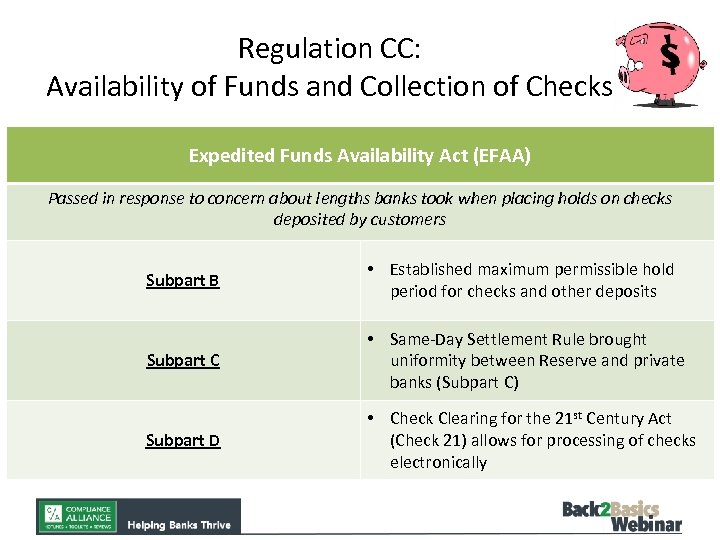

Regulation CC Funds Availability BY ELIZABETH MADLEM ASSOCIATE

Regulation Cc Hold Chart

Regulation CC Funds Availability BY ELIZABETH MADLEM ASSOCIATE

Regulation Cc Funds Availability Chart 2024 Daune Eolande

Regulation CC Funds Availability BY ELIZABETH MADLEM ASSOCIATE

Regulation CC Funds Availability Reference Guide Compliance Alliance

:max_bytes(150000):strip_icc()/checking-account-hold-315305-v2-5b73414c46e0fb002c12a554.png)

Regulation Cc Funds Availability Applies To

Regulation cc check holds serreblackberry

Reg Cc Hold Chart 2024 Abbey

Latest Regulation Regulation Cc Funds Availability Applies To

Web This Part Is Issued By The Board Of Governors Of The Federal Reserve System (Board) To Implement The Expedited Funds Availability Act (12 U.s.c.

Web This Document Outlines Funds Availability Requirements Under Regulation Cc.

Web This Final Rule Adjusts The Dollar Amounts Under The Expedited Funds Availability Act For Inflation, Effective July 1, 2025.

When The Deposited Item Is.

Related Post: