Red Green Candlestick Chart

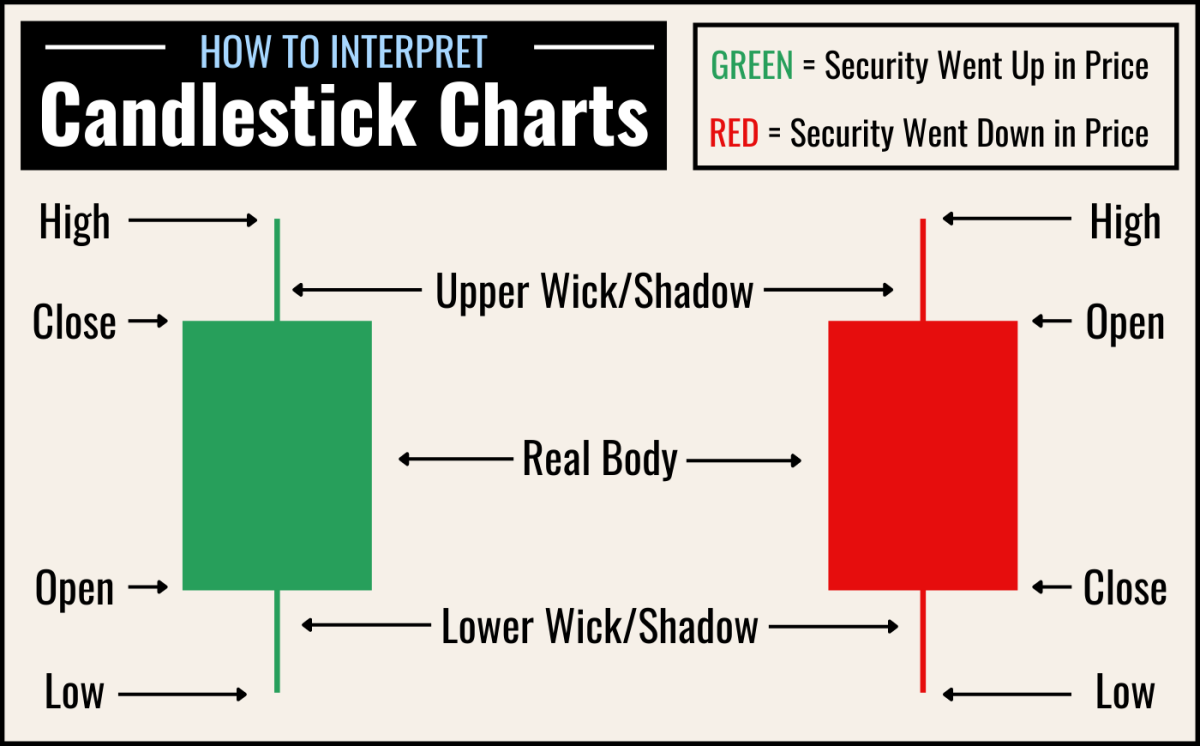

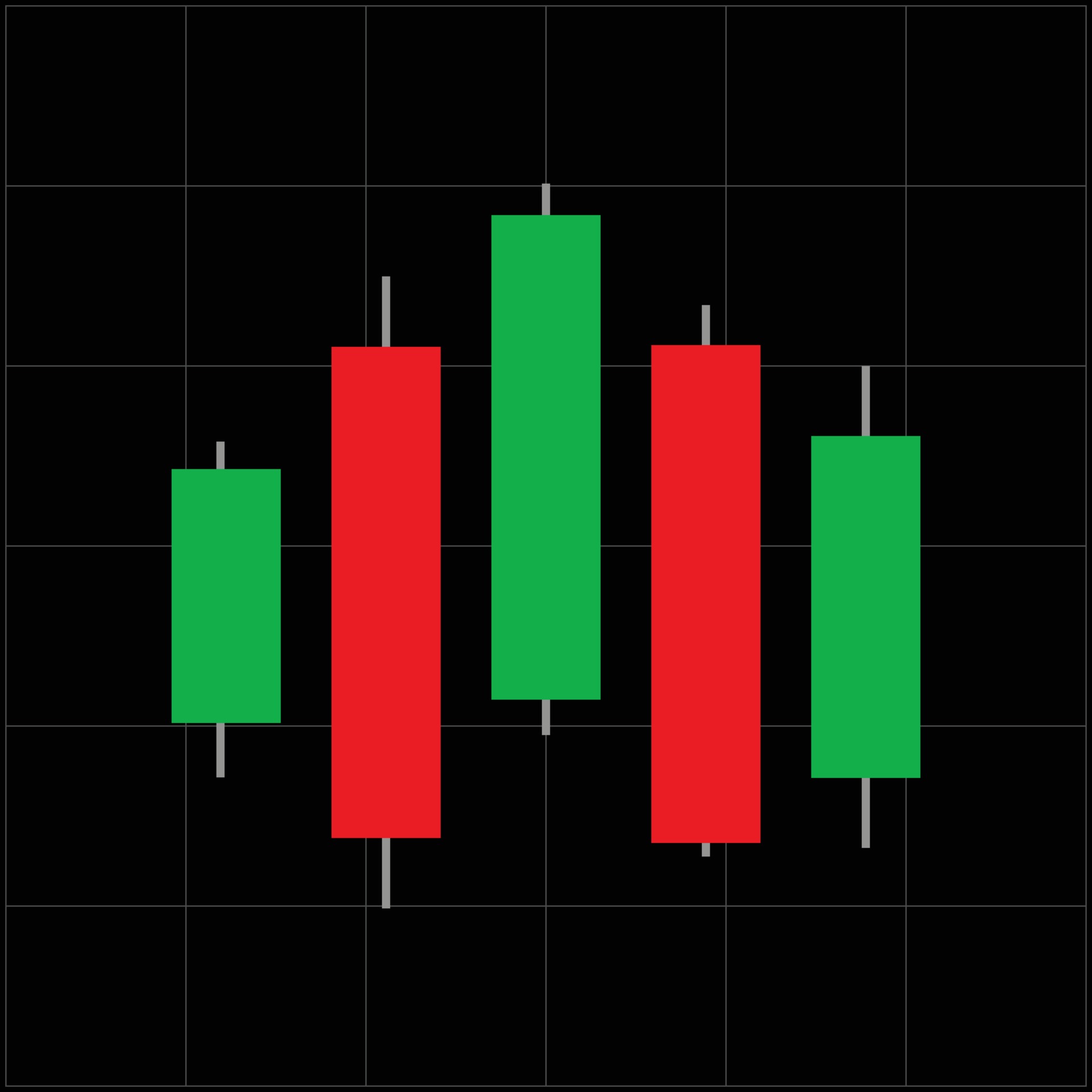

Red Green Candlestick Chart - Web it appears as black/red if the stock closed lower or white/green if the stock closed higher. Candlesticks resemble vertical rectangles with wicks at the top and bottom for presenting information about the price movement of a security. The color of each candlestick, typically green or red, conveys bullish or bearish. Generally, the longer the body of the candle, the more intense the trading. On the other hand, if the upper wick on a green candle is short, then it indicates that the stock closed near the high of the day. Web in this article, we will use red to represent price going up and green to represents price going down, to show you the structure of the candlestick chart and how to use candlestick patterns to determine the market momentum. Candlestick charts convey information about the opening, closing, high, and low prices for each time interval. Web if the upper wick on a red candle is short, then it indicates that the stock opened near the high of the day. Overtime, the candles create patterns that traders can use to predict price movements, trends, and reversals. Web recognize that the market price is going down if the candlestick is red. Web learn how to read and interpret candlestick charts for day trading. Bullish, bearish, reversal, continuation and indecision with examples and explanation. Web a red candlestick is a price chart indicating that the closing price of a security is below both the price at which it opened and that at which it previously closed. Web if the upper wick on. Web the chart is made up of red and green candles where each candle gives information about opening, closing and range of trading prices within a particular time frame. Web learn about all the trading candlestick patterns that exist: Web it appears as black/red if the stock closed lower or white/green if the stock closed higher. Candlesticks resemble vertical rectangles. Web the chart is made up of red and green candles where each candle gives information about opening, closing and range of trading prices within a particular time frame. You can use many different chart timeframes or periods to plot. A candlestick need not have either a body or a wick. The color of the candlestick is usually red if. Web a candlestick chart is a charting technique used in the stock market to visualize price movements and trends of a security, such as a stock, over a specific time period. Web candlesticks are price chart units that show the high, low, opening, and closing prices of a stock or security within a specified time period. You can use many. Web it appears as black/red if the stock closed lower or white/green if the stock closed higher. Overtime, the candles create patterns that traders can use to predict price movements, trends, and reversals. Web a candlestick chart is a charting technique used in the stock market to visualize price movements and trends of a security, such as a stock, over. Web recognize that the market price is going down if the candlestick is red. Web candlesticks are price chart units that show the high, low, opening, and closing prices of a stock or security within a specified time period. Candlestick charts display the high, low, open, and closing prices of a security for a. These charts are highly valued for. For example, if the trader set the time frame to five minutes, a new candlestick will be created every five minutes. Web candlestick patterns highlight trend weakness and reversal signals that may not be apparent on a normal bar chart. Web candlestick charts are now the de facto charting style on most trading platforms so knowing how to read candlestick. On the other hand, if the upper wick on a green candle is short, then it indicates that the stock closed near the high of the day. Web the chart is made up of red and green candles where each candle gives information about opening, closing and range of trading prices within a particular time frame. You can use many. Overtime, the candles create patterns that traders can use to predict price movements, trends, and reversals. Web in this article, we will use red to represent price going up and green to represents price going down, to show you the structure of the candlestick chart and how to use candlestick patterns to determine the market momentum. Web if the upper. Candlesticks where the price closed higher than the open are colored green (or white) in the area between the open and close. Web in this article, we will use red to represent price going up and green to represents price going down, to show you the structure of the candlestick chart and how to use candlestick patterns to determine the. Web those red/green or white/black bars known as candles in a candlestick chart represent price fluctuations that occur throughout the time period. Web candlesticks are price chart units that show the high, low, opening, and closing prices of a stock or security within a specified time period. Web learn about stock candlestick patterns, their types and components, how to read a candle chart, and what should you look for in a candlestick chart. Web in this article, we will use red to represent price going up and green to represents price going down, to show you the structure of the candlestick chart and how to use candlestick patterns to determine the market momentum. For example, if the trader set the time frame to five minutes, a new candlestick will be created every five minutes. Web candlesticks are formed on a chart as follows: Web learn how to read and interpret candlestick charts for day trading. Overtime, the candles create patterns that traders can use to predict price movements, trends, and reversals. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its. Bullish, bearish, reversal, continuation and indecision with examples and explanation. These charts are highly valued for their ability to provide a wide range of information in a clear and comprehensive manner. Web learn about all the trading candlestick patterns that exist: Candlesticks where the price closed higher than the open are colored green (or white) in the area between the open and close. Web red candles show that the current close price is less than the previous close price. Web a green candlestick indicates that a security increased in price over the course of the trading period, while a red candlestick indicates that a security decreased in price over the course of a. Candlestick charts display the high, low, open, and closing prices of a security for a.

Red and green candlestick chart with marked buy and sell positions

What Is a Candlestick Chart & How Do You Read One? TheStreet

binary options. Green and red candles. Trade. Candlestick chart with an

Trading Candlestick Pattern In Red And Green Colors, Candlesticks

Red green candlestick chart stock Cut Out Stock Images & Pictures Alamy

An illustration of a three dimensional redgreen candlestick chart on a

Candle Stick Pattern Chart With Buy Sale Indicator In Red Green Colors

Forex Trade Chart Green and Red Candle Sticks on a Black Background

Forex concept Candlestick chart red green in financial market for

An Illustration of a Three Dimensional Redgreen Candlestick Chart on a

Web Candlestick Patterns Highlight Trend Weakness And Reversal Signals That May Not Be Apparent On A Normal Bar Chart.

A Candlestick Need Not Have Either A Body Or A Wick.

You Can Use Many Different Chart Timeframes Or Periods To Plot.

On The Other Hand, If The Upper Wick On A Green Candle Is Short, Then It Indicates That The Stock Closed Near The High Of The Day.

Related Post: