Recoverable Draw Agreement

Recoverable Draw Agreement - Under a recoverable draw, the amount paid as “recoverable” (the difference between total pay and commissions. Web there are two main types of draws in a draw against commission plan: Recoupment of a portion of a draw against future commissions by the amount that the advance exceeded commissions earned. Web a recoverable draw is a loan from the company to the salesperson that is carried forward until the salesperson earns sufficient commissions and/or incentives to repay it or until. Web a recoverable draw is a type of advance payment made by a company to a commissioned employee. Web this payroll advance is called a “draw”. Recoverable draws (the difference between total pay and. Web a recoverable draw is a payout you make with an opportunity to gain back if an employee doesn't meet expected goals. Web a sample agreement for paying a recoverable draw to commission sales employees. Web prepare agreements with this in mind. Web a recoverable draw is a loan from the company to the salesperson that is carried forward until the salesperson earns sufficient commissions and/or incentives to repay it or until. Recoupment of a portion of a draw against future commissions by the amount that the advance exceeded commissions earned. Under a recoverable draw, the amount paid as “recoverable” (the difference. How advances on commission will be handled; Web a recoverable draw (also known as a draw against commission) is a set amount of money paid to the sales representative by the company at regular intervals. This is done so that the employee can cover for their basic. Web a recoverable draw is a loan from the company to the salesperson. This is done so that the employee can cover for their basic. This accrues as a debt that the sales. Web prepare agreements with this in mind. Employee understands and agrees that this draw is an advance against future commissions earned, a loan, which employee is. Recoverable draws are the most common and operate as described. Recoverable draws (the difference between total pay and. Under a recoverable draw, the amount paid as “recoverable” (the difference between total pay and commissions. Web a sample agreement for paying a recoverable draw to commission sales employees. Web recoverable draw against commission. Web a recoverable draw (also known as a draw against commission) is a set amount of money paid. A recoverable draw is an advance on future commission that a company pays to a sales rep. Web a recoverable draw is a loan from the company to the salesperson that is carried forward until the salesperson earns sufficient commissions and/or incentives to repay it or until. Web a sample agreement for paying a recoverable draw to commission sales employees.. This accrues as a debt that the sales. Web recoverable draw against commission. Web prepare agreements with this in mind. Ensure inside salespeople are compensated for their 10. A recoverable draw is owed back to you by the employee if they do not earn enough in commissions to cover the draw. Recoverable draws (the difference between total pay and. Employee understands and agrees that this draw is an advance against future commissions earned, a loan, which employee is. Web a sample agreement for paying a recoverable draw to commission sales employees. Web a recoverable draw is what most people may think of when considering a draw against commission. The executive ’s. Web this payroll advance is called a “draw”. Ensure inside salespeople are compensated for their 10. Recoupment of a portion of a draw against future commissions by the amount that the advance exceeded commissions earned. Recoverable draws are the most common and operate as described. The executive’s draw rate shall be subject to. Web a sample agreement for paying a recoverable draw to commission sales employees. Recoverable draws are the most common and operate as described. How advances on commission will be handled; Web prepare agreements with this in mind. The executive ’s annual recoverable draw rate shall be $300,000 per year (or $25,000 per month) (the “draw”). It often acts as a loan for earning sales. Web a recoverable draw is what most people may think of when considering a draw against commission. This is done so that the employee can cover for their basic. Web recoverable draw against commission. A recoverable draw is an advance on future commission that a company pays to a sales rep. Under a recoverable draw, the amount paid as “recoverable” (the difference between total pay and commissions. It often acts as a loan for earning sales. How advances on commission will be handled; Recoverable draws (the difference between total pay and. Recoverable draws are the most common and operate as described. Web there are two main types of draws in a draw against commission plan: Web a recoverable draw is a type of advance payment made by a company to a commissioned employee. Web a recoverable commission draw requires that an employee repay any portion of their draw that is greater than the total commissions they earned for the. Web a sample agreement for paying a recoverable draw to commission sales employees. Employee understands and agrees that this draw is an advance against future commissions earned, a loan, which employee is. A recoverable draw is owed back to you by the employee if they do not earn enough in commissions to cover the draw. Web a recoverable draw is what most people may think of when considering a draw against commission. This accrues as a debt that the sales. A recoverable draw is an advance on future commission that a company pays to a sales rep. The executive ’s annual recoverable draw rate shall be $300,000 per year (or $25,000 per month) (the “draw”). Web prepare agreements with this in mind.

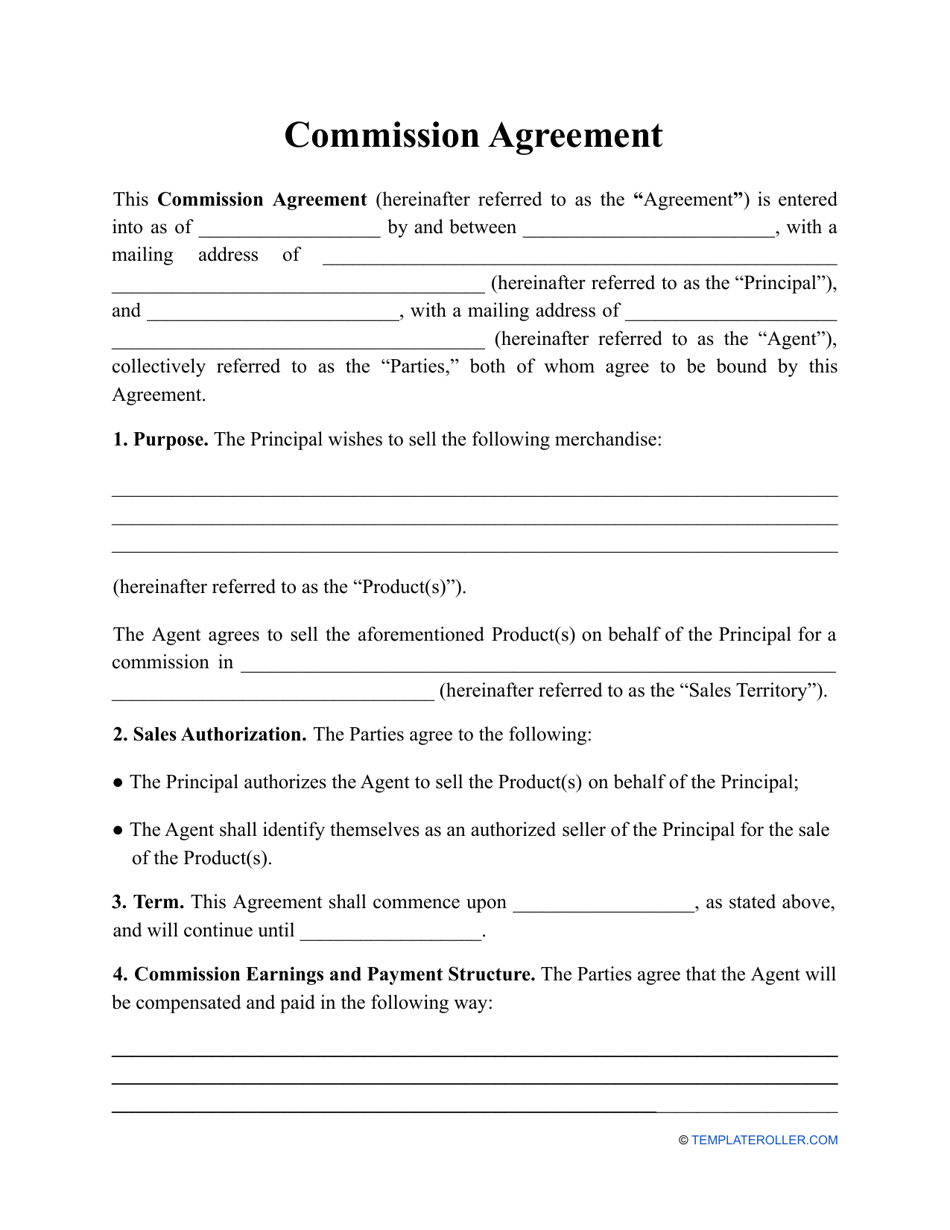

Pin on Free Agreement Templates

Non Recoverable Draw Offer Letter

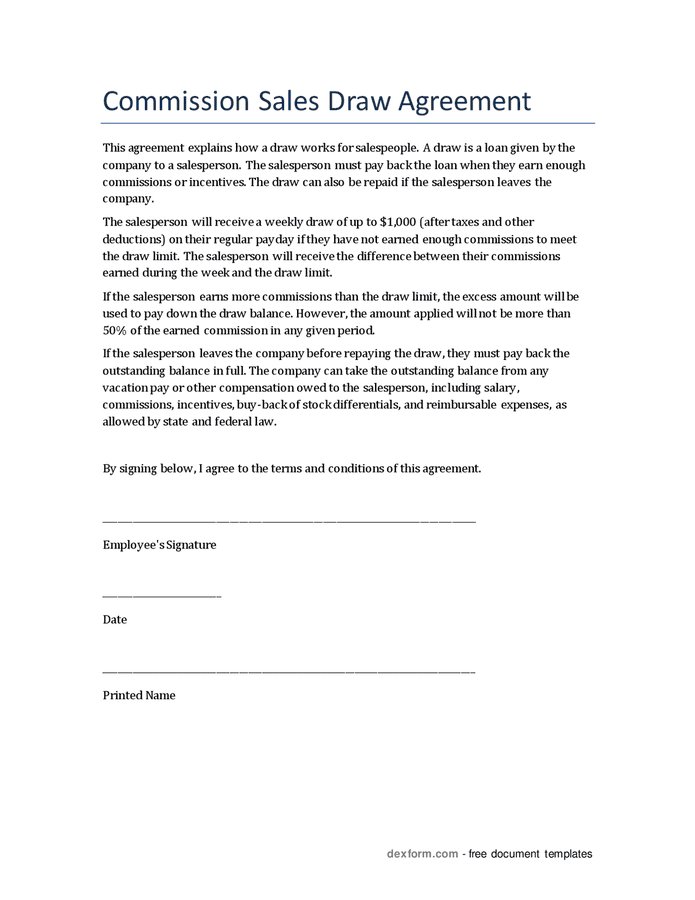

Commission sales draw agreement in Word and Pdf formats

Commission Draw Agreement Template

Recoverable Draw Spiff

Draw Against Commission Employment Agreement

Outside Sales Offer Letter with Recoverable Draw CleanTech Docs

How to Build Effective Sales Compensation Plans for Any Customer Facing

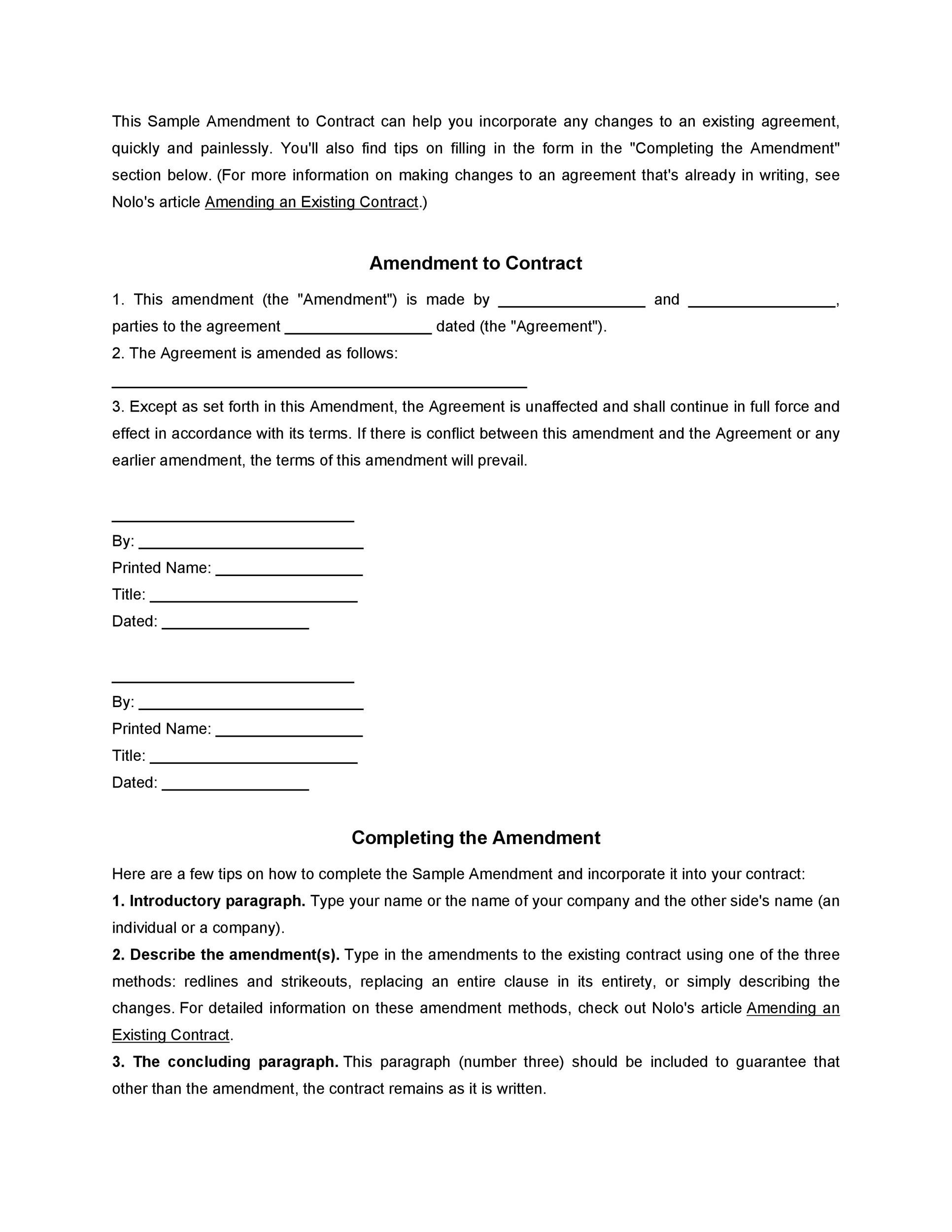

Sample Contract Amendment Template

What is a “Draw Against Commissions” in a Sales Rep Team?

The Executive’s Draw Rate Shall Be Subject To.

Web A Recoverable Draw (Also Known As A Draw Against Commission) Is A Set Amount Of Money Paid To The Sales Representative By The Company At Regular Intervals.

Ensure Inside Salespeople Are Compensated For Their 10.

Web A Recoverable Draw Is A Payout You Make With An Opportunity To Gain Back If An Employee Doesn't Meet Expected Goals.

Related Post: