Quickbooks Owners Draw

Quickbooks Owners Draw - This article describes how to. Web to pay back your account using an owner's draw in quickbooks, follow these steps: This guide will walk you through what. Web learn how to pay an owner of a sole proprietor business in quickbooks online. Most types of businesses permit draws, but you should consider whether and when to take one. Then at the end of each year you should make a. Web in quickbooks desktop, properly setting up and recording owner’s draws ensures accurate financial tracking and reporting. Web the owner's draws are usually taken from your owner's equity account. Web an owner’s draw is when an owner of a sole proprietorship, partnership or limited liability company (llc) takes money from their business for personal use. If you change the expense account to the. Web when recording an owner's draw in quickbooks online, you'll need to create an equity account. When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures, the money is treated as a draw on the owner's equity in the business. Web when making a direct deposit. Web owner’s draw in quickbooks: Web in quickbooks desktop, properly setting up and recording owner’s draws ensures accurate financial tracking and reporting. Web the owner's draws are usually taken from your owner's equity account. This guide will walk you through what. Web an owner’s draw account is a type of equity account in which quickbooks desktop tracks withdrawals of assets. Web to pay back your account using an owner's draw in quickbooks, follow these steps: This guide will walk you through what. Web how to record owner draws into quickbooks. Web an owner’s draw account is a type of equity account in which quickbooks desktop tracks withdrawals of assets from the company to pay an owner. It is necessary to. Web when making a direct deposit payment to an owner, you'll need to set up an owner or partner as a vendor, as suggested by my colleagues above. Most types of businesses permit draws, but you should consider whether and when to take one. This transaction impacts the owner’s equity. The draw acct should be zeroed out to owners capital. Web when recording an owner's draw in quickbooks online, you'll need to create an equity account. Quickbooks online is a leader in accounting software, thanks to its strong feature set, scalability and ability to accommodate small businesses with more. Web owner’s draw in quickbooks: Web the owner’s draw is the distribution of funds from your equity account. This leads to. Web an owner’s draw account is a type of equity account in which quickbooks desktop tracks withdrawals of assets from the company to pay an owner. When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures, the money is treated as a draw on the owner's. Web the most common way to take an owner’s draw is by writing a check that transfers cash from your business account to your personal account. If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. When the owner of a business takes money out of the business bank account to. Also, you cannot deduct the. Web in quickbooks desktop, properly setting up and recording owner’s draws ensures accurate financial tracking and reporting. If you change the expense account to the. Web owner’s draw in quickbooks: Web to pay back your account using an owner's draw in quickbooks, follow these steps: Web an owner's draw is money taken out of a business for personal use. However, owners can’t simply draw as much as they want; Also, you cannot deduct the. This article describes how to. The draw acct should be zeroed out to owners capital (sole pro.) or retained earnings (corp) at the end of each accounting. Web the owner’s draw is the distribution of funds from your equity account. Web how to record owner draws into quickbooks. Pay for business expenses with personal. Web owner’s draw in quickbooks: When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures, the money is treated. Also, you cannot deduct the. This article describes how to. This leads to a reduction in your total share in the business. This guide will walk you through what. Web when making a direct deposit payment to an owner, you'll need to set up an owner or partner as a vendor, as suggested by my colleagues above. Web owner’s draw in quickbooks: Web when recording an owner's draw in quickbooks online, you'll need to create an equity account. Web how to record owner draws into quickbooks. Web an owner's draw is money taken out of a business for personal use. Web owner’s draw in quickbooks refers to the distribution of funds or assets from a business to its owners for personal use or investments. Web in quickbooks desktop, properly setting up and recording owner’s draws ensures accurate financial tracking and reporting. Pay for business expenses with personal. Web the owner’s draw is the distribution of funds from your equity account. It is necessary to make a record for the transactions of the owner’s withdrawal for the financial reasons of the company. Web am i entering owner's draw correctly? However, owners can’t simply draw as much as they want;

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

how to take an owner's draw in quickbooks Masako Arndt

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

how to take an owner's draw in quickbooks Masako Arndt

how to take an owner's draw in quickbooks Masako Arndt

Owners draw QuickBooks Desktop Setup, Record & Pay Online

Owners Draw Quickbooks Desktop DRAWING IDEAS

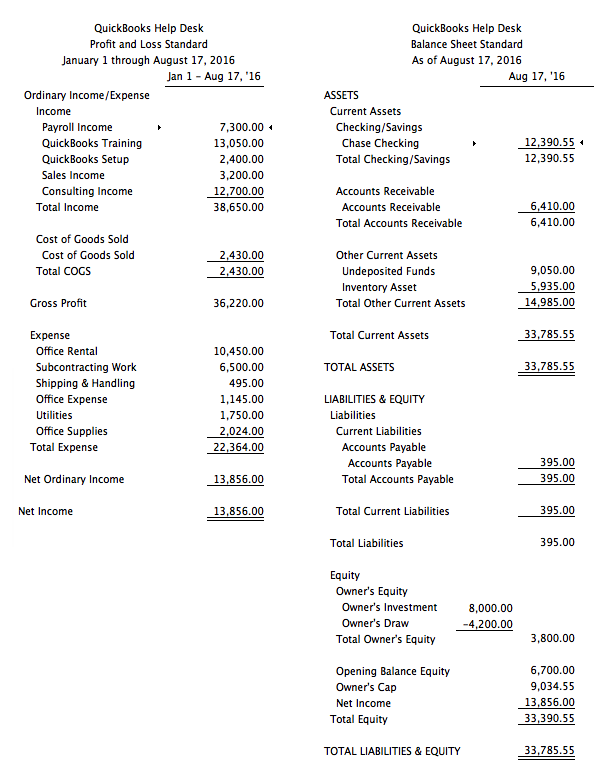

Owner Draw Report Quickbooks

Then At The End Of Each Year You Should Make A.

Quickbooks Online Is A Leader In Accounting Software, Thanks To Its Strong Feature Set, Scalability And Ability To Accommodate Small Businesses With More.

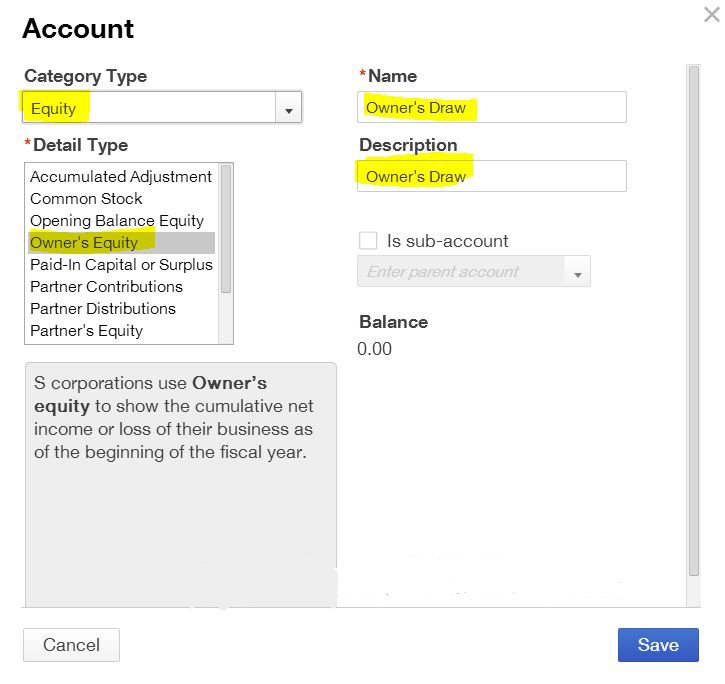

Web To Properly Record An Owner’s Draw In Quickbooks, It Is Essential To Create A Dedicated Owner’s Equity Account To Track The Withdrawal And Maintain Accurate Financial Records.

Most Types Of Businesses Permit Draws, But You Should Consider Whether And When To Take One.

Related Post: