Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

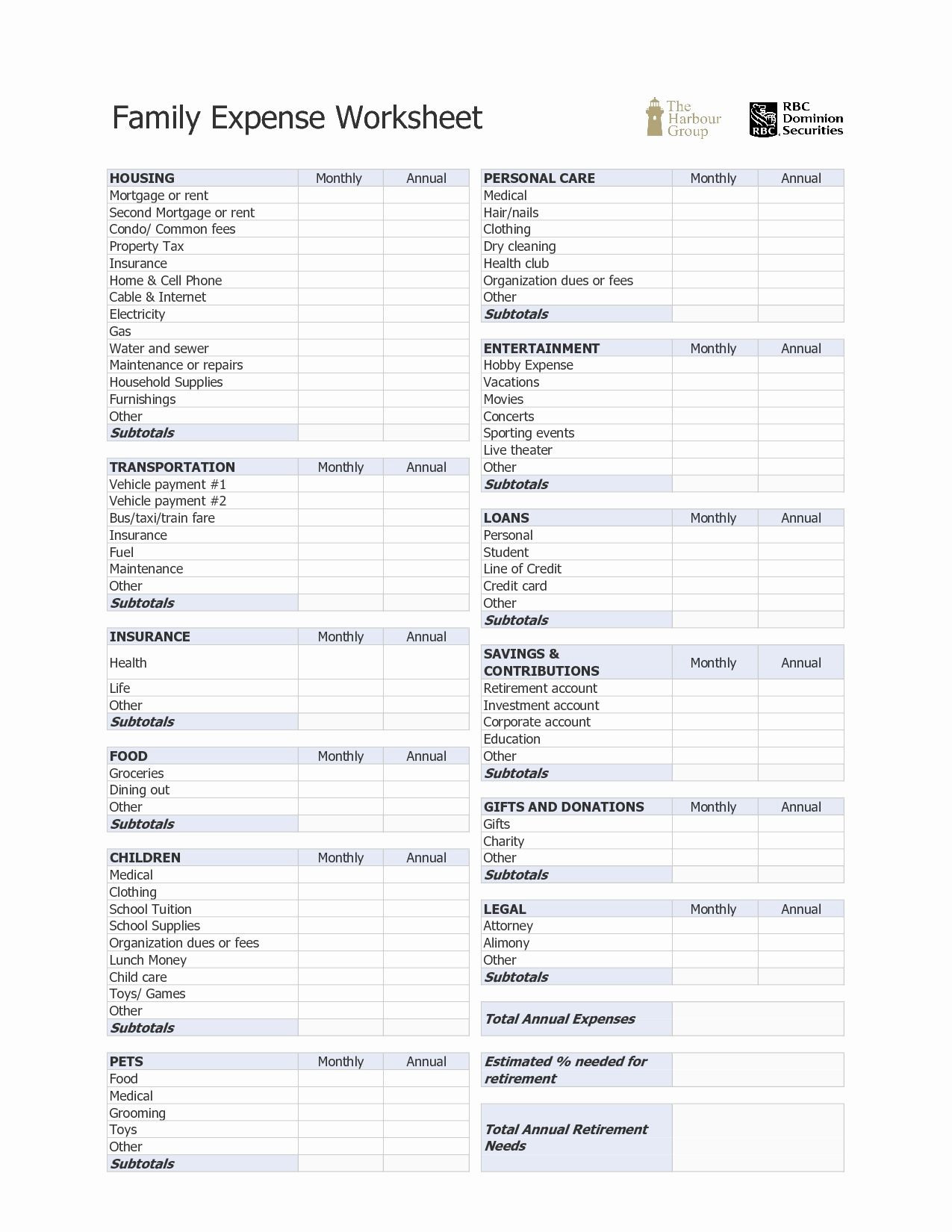

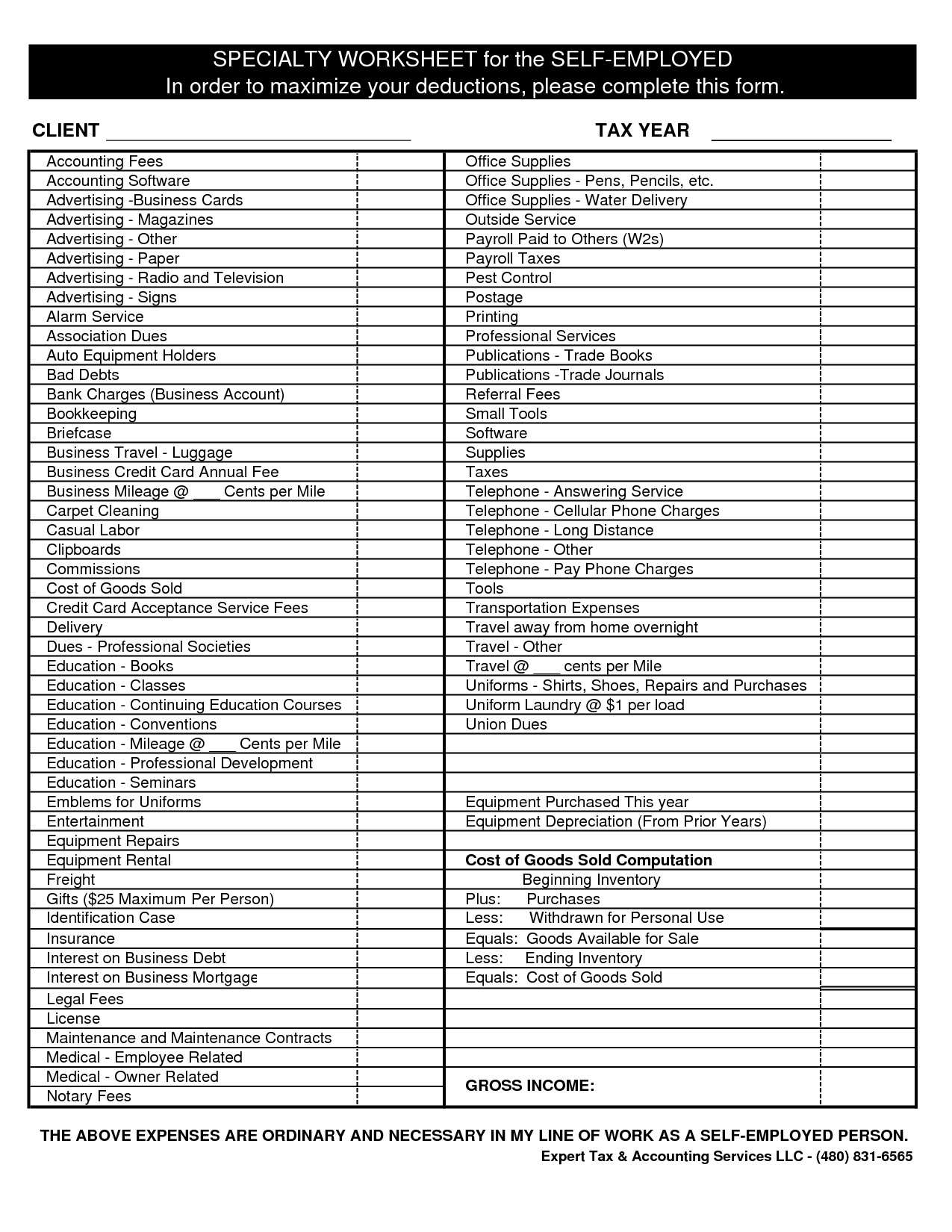

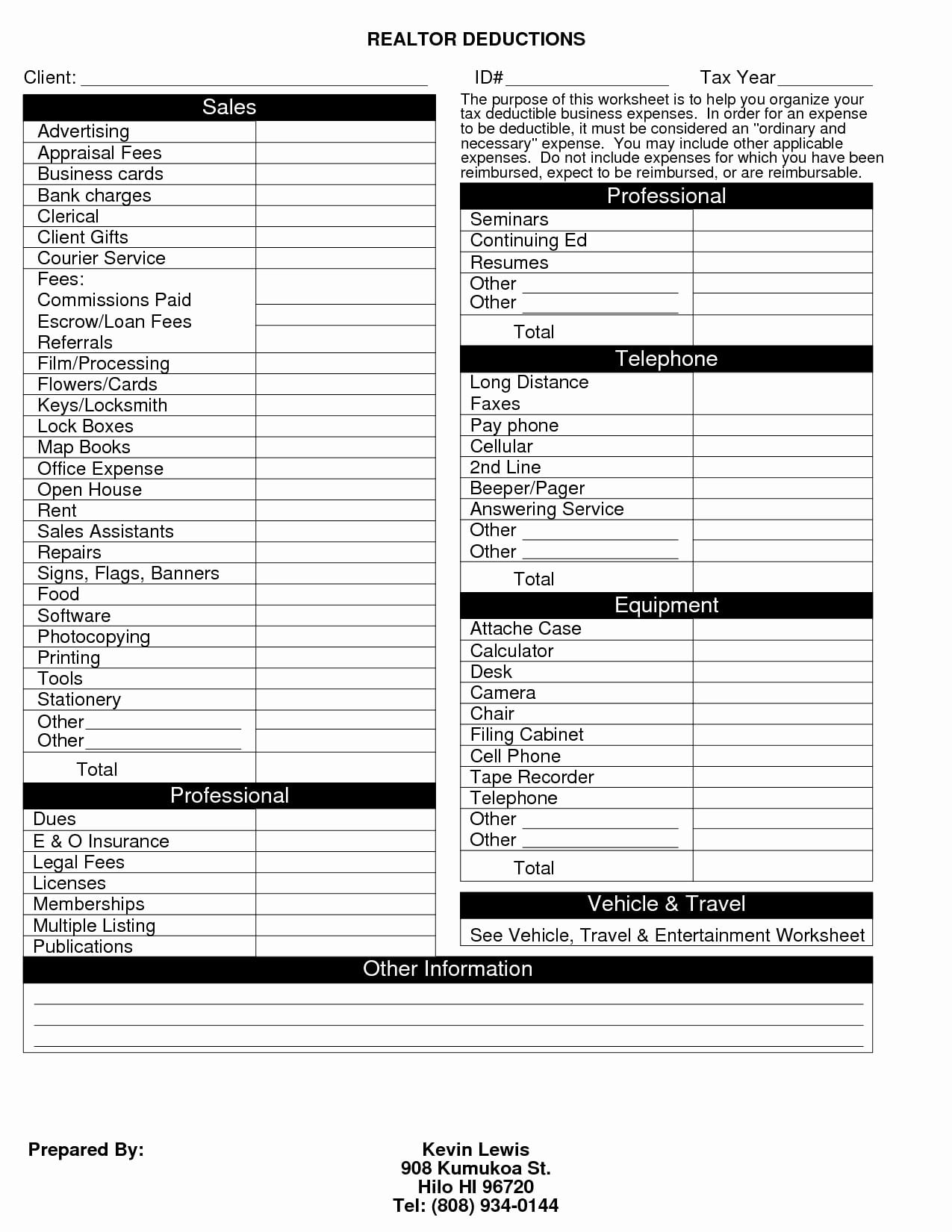

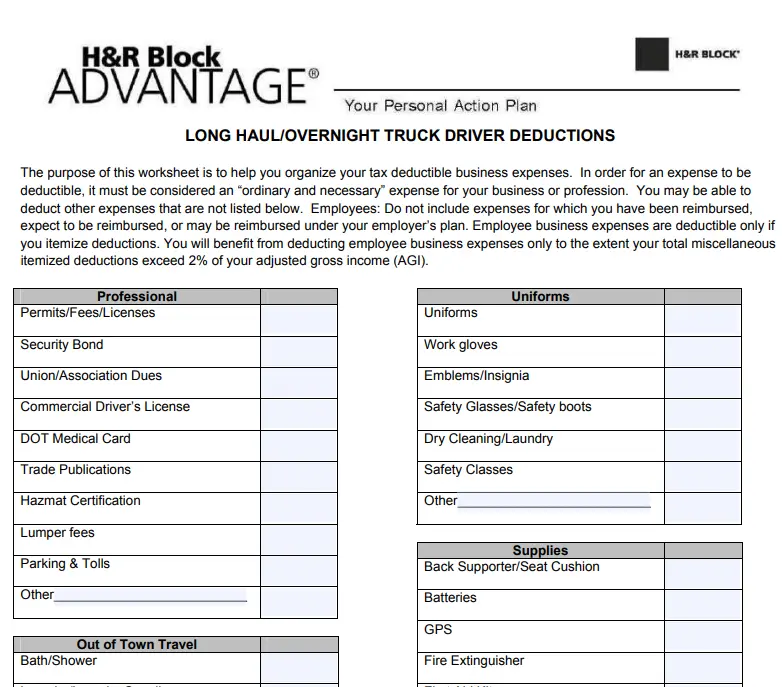

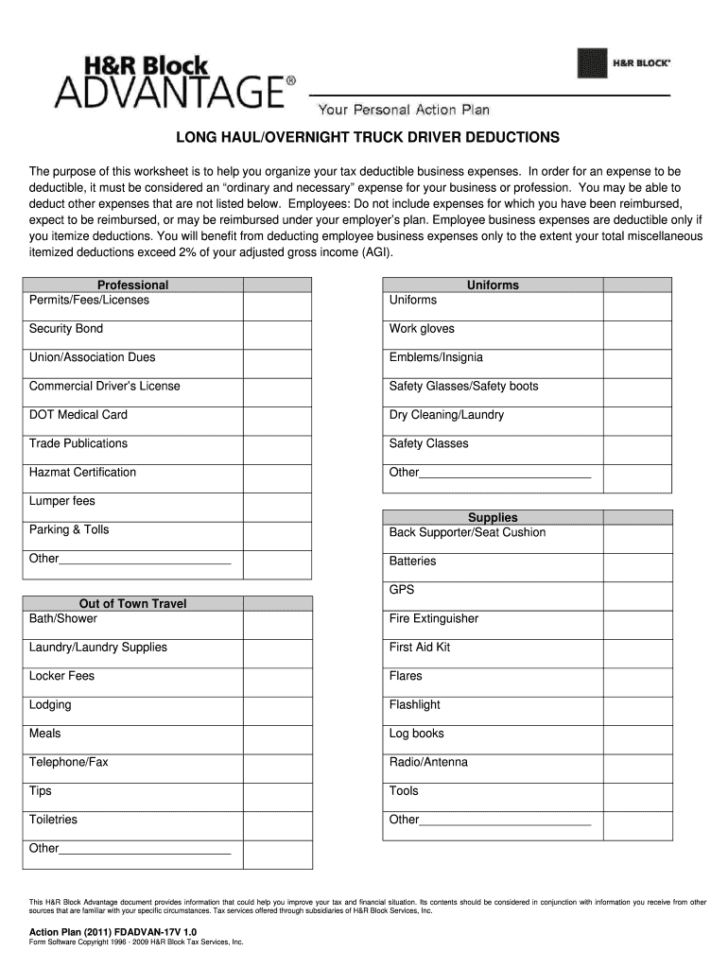

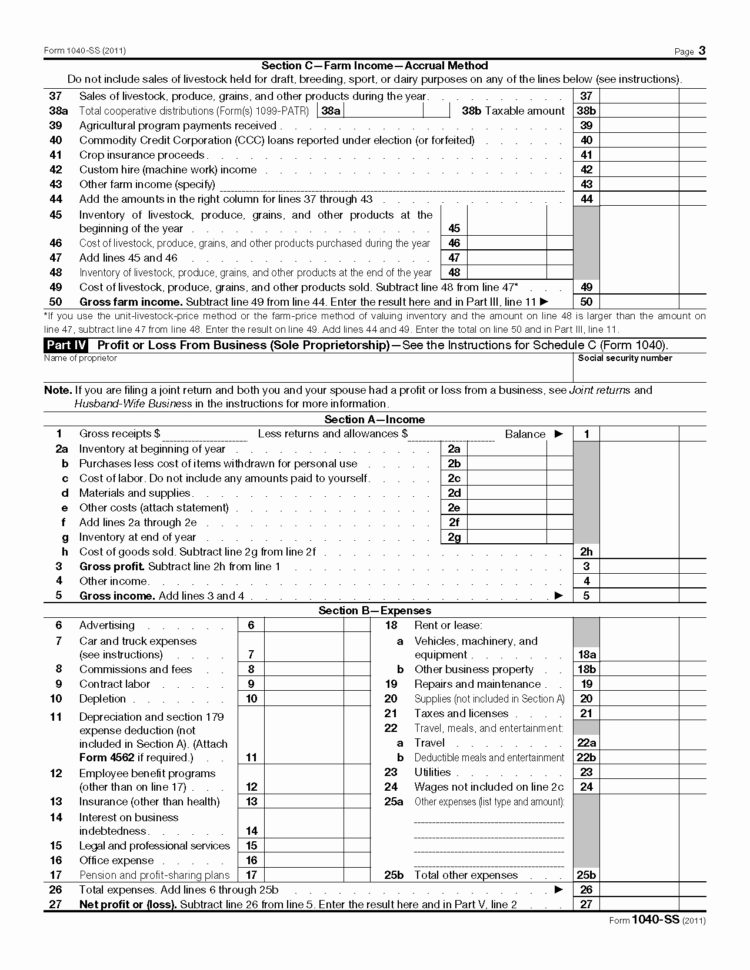

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet - In order for an expense to be deductible, it must be considered an “ordinary. In order for an expense to be deductible, it must be considered an ''ordinary. Web trucker tax deduction worksheet. Web this truck driver expenses worksheet form can help make the process a little easier. Who is eligible to claim tax deductions for truck drivers? Y n *is the evidence written? Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Sales of equipment, machinery, land, buildings held. As of 2020, truck drivers who are classified as independent contractors or owner. Web truck drivers who are independent contractors can claim a variety of tax deductions while on the road. Web mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Web truck drivers who earned more money in 2021 may be able to lower their tax liability. Sales of equipment,. Our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Who is eligible to claim tax deductions for truck drivers? Sales of equipment, machinery, land, buildings held. Mileage, daily meal allowances, truck repair (maintenance), overnight hotel. You cannot legitimately deduct for. Web truck drivers who earned more money in 2021 may be able to lower their tax liability. You cannot legitimately deduct for. Sales of equipment, machinery, land, buildings held. Learn more about irs bracket and tax deduction changes. As of 2020, truck drivers who are classified as independent contractors or owner. Web this truck driver expenses worksheet form can help make the process a little easier. How can you make your trucking. In order for an expense to be deductible, it must be considered an ''ordinary. As of 2020, truck drivers who are classified as independent contractors or owner. Web truck drivers who earned more money in 2021 may be able. Y n office in home deduction do you have an office in your home that you are deducting expenses for? Web this truck driver expenses worksheet form can help make the process a little easier. Web truck drivers who earned more money in 2021 may be able to lower their tax liability. You cannot legitimately deduct for. Web truck drivers. Web truck drivers can claim tax deductions for expenses incurred on the road, including tools and equipment, association dues, and meals while working away from home overnight. In order for an expense to be deductible, it must be considered an ''ordinary. Mileage, daily meal allowances, truck repair (maintenance), overnight hotel. This means you need to keep accurate records of your. Who is eligible to claim tax deductions for truck drivers? Web truck drivers who earned more money in 2021 may be able to lower their tax liability. Consulte nuestras tarifaseasy to use1 price all apps includedfree As of 2020, truck drivers who are classified as independent contractors or owner. Web mileage…only the expenses incurred to operate the truck during that. Web mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Web truck drivers who are independent contractors can claim a variety of tax deductions while on the road. Mileage, daily meal allowances, truck repair (maintenance), overnight hotel. Y n *is the evidence written? You cannot legitimately deduct for. Sales of equipment, machinery, land, buildings held. In order for an expense to be deductible, it must be considered an ''ordinary. Web trucker tax deduction worksheet. Web mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Web truck drivers who earned more money in 2021 may be able. Y n office in home deduction do you have an office in your home that you are deducting expenses for? Web truck rental fees individual at any one time—or in accumulated amounts—during this tax year? Web this truck driver expenses worksheet form can help make the process a little easier. Web mileage…only the expenses incurred to operate the truck during. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Mileage, daily meal allowances, truck repair (maintenance), overnight hotel. Web truck drivers can claim tax deductions for expenses incurred on the road, including tools and equipment, association dues, and meals while working away from home overnight. Y n *is the evidence written? Web this truck driver expenses worksheet form can help make the process a little easier. In order for an expense to be deductible, it must be considered an “ordinary. Learn more about irs bracket and tax deduction changes. Our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! This means you need to keep accurate records of your deductions as well. Web truck rental fees individual at any one time—or in accumulated amounts—during this tax year? You cannot legitimately deduct for. In order for an expense to be deductible, it must be considered an ''ordinary. Sales of equipment, machinery, land, buildings held. As of 2020, truck drivers who are classified as independent contractors or owner. Y n office in home deduction do you have an office in your home that you are deducting expenses for?

Truck Driver Tax Deductions Worksheet —

Owner Operator Truck Driver Tax Deductions Worksheet

Truck Driver T Trucker Tax Deduction Worksheet Perfect —

4 Printable Truck Driver Expense Owner Operator Tax Deductions

Printable Truck Driver Expense Owner Operator Tax Deductions

Tax Deduction List for Owner Operator Truck Drivers

Truck Driver Expense Blank Forms Fill Online Printable —

Tax Deduction Worksheet For Truck Drivers Printable Word Searches

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Printable Truck Driver Expense Owner Operator Tax Deductions

Who Is Eligible To Claim Tax Deductions For Truck Drivers?

Consulte Nuestras Tarifaseasy To Use1 Price All Apps Includedfree

Web The Purpose Of This Worksheet Is To Help You Organize Your Tax Deductible Business Expenses.

Web Truck Drivers Who Are Independent Contractors Can Claim A Variety Of Tax Deductions While On The Road.

Related Post: