Printable Debits And Credits Cheat Sheet

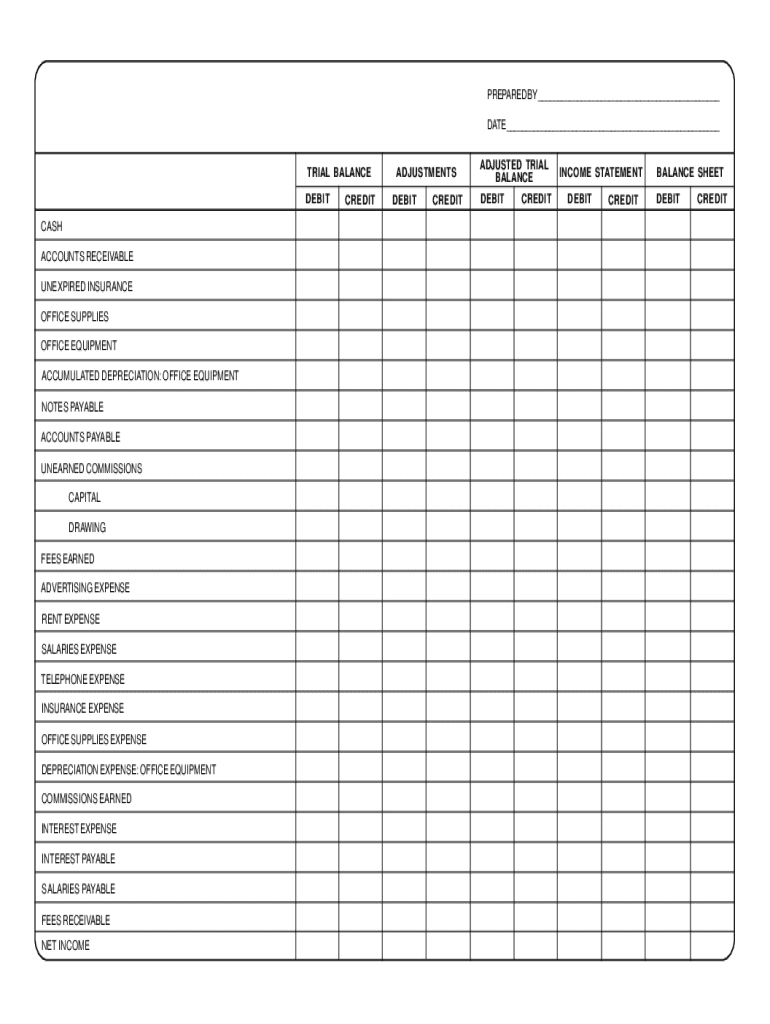

Printable Debits And Credits Cheat Sheet - This free resource is worthy of being hung by your desk. Entering this information in the general journal format, we have: Understanding how debits and credits work is essential for anyone in. Asset debit increase decrease expense debit increase decrease They refer to entries made in accounts to reflect the transactions of a business. When we make payments or withdraw cash from debit cards, we debit our savings or earnings accounts. An accountant would say we are “debiting” the cash bucket by $300, and would enter the following line. Credits are displayed on the right side. The amount of the debit and the credit is $500. 2) if you purchased a fixed asset such as a vehicle,. Record transactions in a general ledger require at least one debit and credit. For example, a debit entry of $100 to a company's bank account increases its assets. 1) creating an invoice or sales receipt to a client: Web debit (dr) & credit (cr) cheat sheet account type normal balance debits: This cheat sheet helps you to keep track. Web debits and credits: Since this was the collection of an account receivable, the credit should be accounts. Web some of the most asked questions by beginning bookkeepers are about how to straighten out debits and credits. The recording of all transactions follows these. 2) if you purchased a fixed asset such as a vehicle,. In accounting, we debit the amount added to assets and expense accounts or deducted from liability, equity, and revenue accounts. Cheat sheets practice questions accounting basics blog contact January 6, 2022 by [email protected] leave a comment. Careful, as banks refer to debit cards, credit cards, account debits, and account credits differently than the accounting system. They refer to entries made. This maintains the accounting equation where assets = liabilities + equity. When we make payments or withdraw cash from debit cards, we debit our savings or earnings accounts. Web this pdf was carefully put together to summarise all of the key information from the debits and credits video on one page. They refer to entries made in accounts to reflect. Or an invoice debits accounts receivable and credits an income account; Web debits & credits increases & decreases bolded: C r edit does have an r in it. Here are some important details that can serve as your debits and credits cheat sheet: Web debits and credits chart. This cheat sheet helps you to keep track. They’re how you’ve used your funds. Web debits and credits follow a basic formula. Web debits and credits chart. In accounting, we debit the amount added to assets and expense accounts or deducted from liability, equity, and revenue accounts. The recording of all transactions follows these. Web debits & credits increases & decreases bolded: Natural balance increase decrease balance sheet asset debit credit contra asset credit debit contra assets: Asset debit increase decrease expense debit increase decrease It doesn’t mean the same thing as it does to a bank. It is known as the accounting equation, which states that assets equal liabilities plus equity. Careful, as banks refer to debit cards, credit cards, account debits, and account credits differently than the accounting system. Web debit (dr) & credit (cr) cheat sheet account type normal balance debits: Since this was the collection of an account receivable, the credit should be. Credits are displayed on the right side. I know many of you get a little confused with the whole debit and credit terminology in accounting. An increase in an asset is a debit, and the ingenious twist of the scheme is that a decrease in a. In accounting, we debit the amount added to assets and expense accounts or deducted. It is known as the accounting equation, which states that assets equal liabilities plus equity. C r edit does have an r in it. Understanding how debits and credits work is essential for anyone in. Credits are displayed on the right side. The recording of all transactions follows these. This maintains the accounting equation where assets = liabilities + equity. Web debits and credits: Web the illustration below summarizes the basic rules for debits and credits. How great would it be to have a cheat sheet to make sure you never mixed them up again. An increase in a liability, owners’ equity, revenue, and income account is recorded as a credit, so the increase side is on the right. For example, a debit entry of $100 to a company's bank account increases its assets. If you have trouble remembering which goes on the left and which on the right, one trick you can do is to think of the letter r for r ight. Web some of the most asked questions by beginning bookkeepers are about how to straighten out debits and credits. Web that’s where debits and credits come in. It can get difficult to track how credits and debits affect your various business accounts. Or an invoice debits accounts receivable and credits an income account; C r edit does have an r in it. When money flows into a bucket, we record that as a debit (sometimes accountants will abbreviate this to just “dr.”) for example, if you deposited $300 in cash into your business bank account: System used to record more than just financial transactions. It doesn’t mean the same thing as it does to a bank. Debits increase assets and decrease liabilities and equity, while credits do the opposite.

Printable Debits And Credits Cheat Sheet

Printable Debits And Credits Cheat Sheet

Printable Debits And Credits Cheat Sheet

Printable Debits And Credits Cheat Sheet

Printable Debit Credit Sheet

Printable Debits And Credits Cheat Sheet

Debits and Credits Cheat Sheet • 365 Financial Analyst

Printable Debits And Credits Cheat Sheet

Printable Debits And Credits Cheat Sheet

Printable Debits And Credits Cheat Sheet

Entering This Information In The General Journal Format, We Have:

Web Debit And Credit Cheat Sheet.

1) Creating An Invoice Or Sales Receipt To A Client:

Web A Debit Increases An Asset Or Expense Account.

Related Post: