Payroll Journal Entry Template

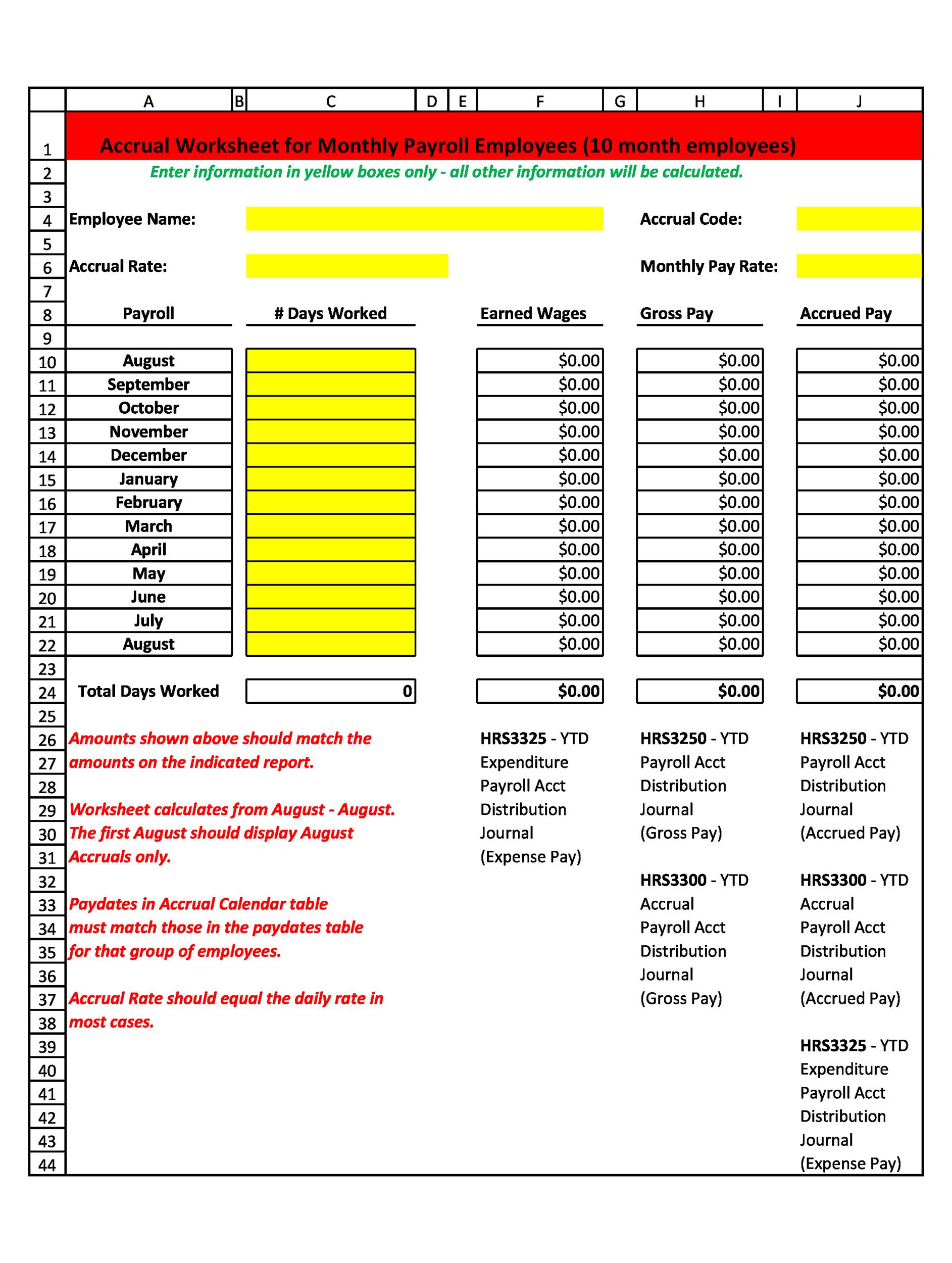

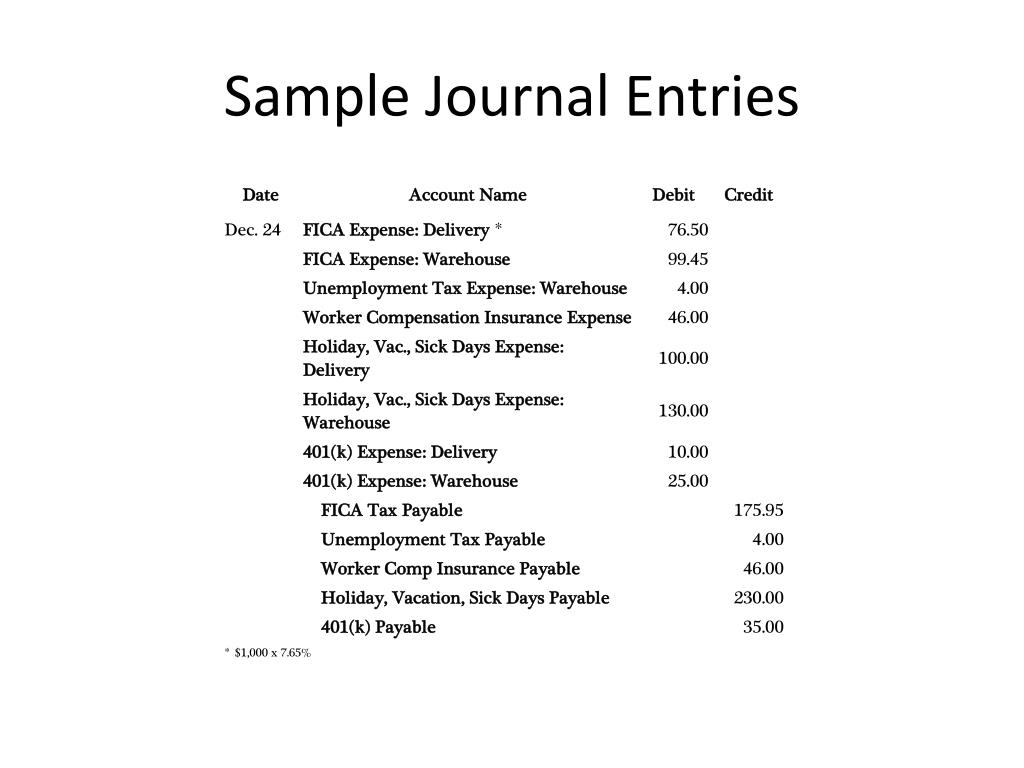

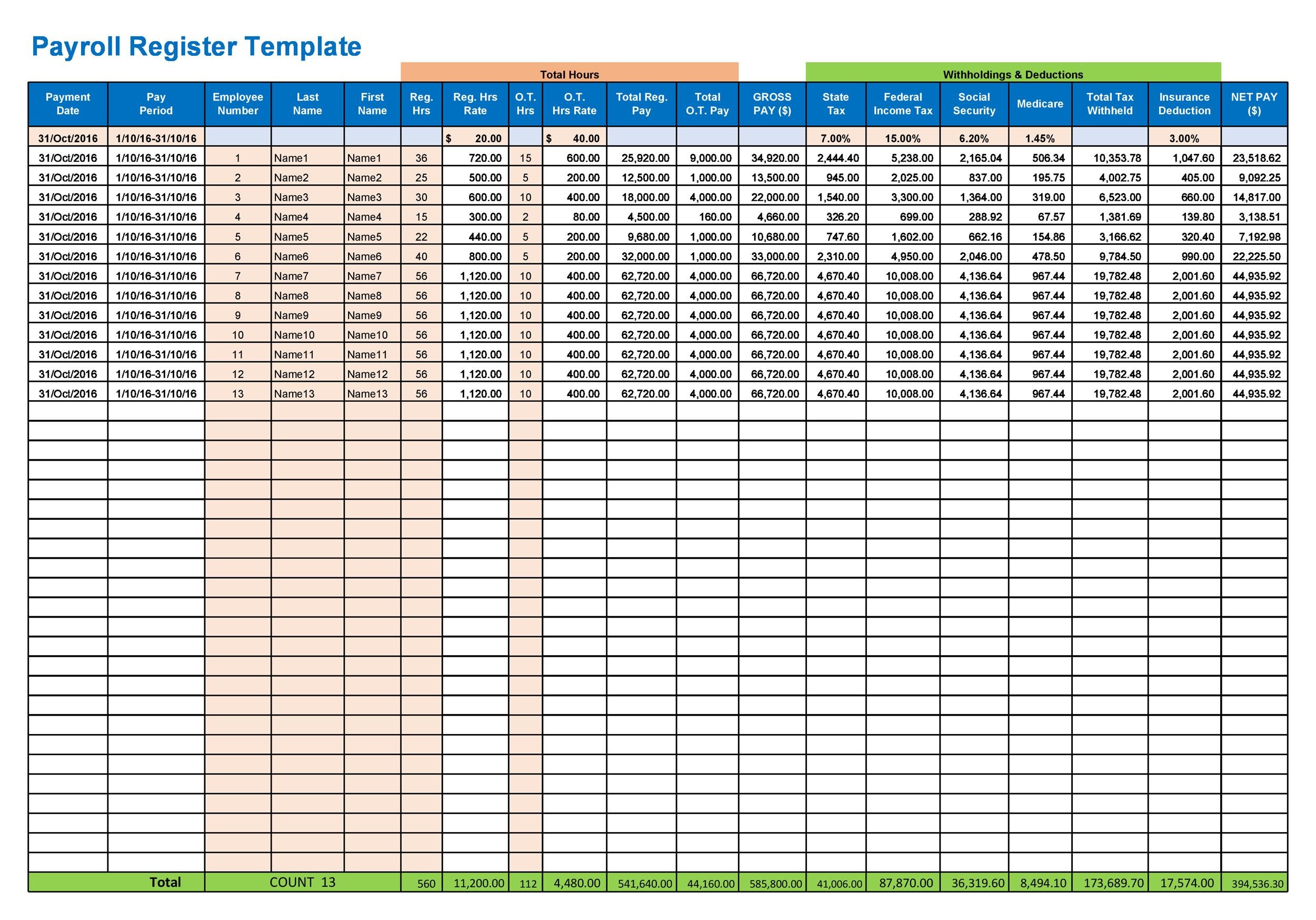

Payroll Journal Entry Template - Choose from spreadsheets and forms for microsoft excel and word, pdf, and google sheets. In the following examples we assume that the employee’s tax rate for social security is 6.2% and that the employer’s tax rate is 6.2%. Web using a payroll journal entry template can help you make sure you don’t miss anything. One method for recording payroll is to create journal entries to account for each piece of payroll, including employee paychecks and employer taxes. Also known as an initial recording, this first entry is very important. While the process may look different for every company, payroll ledgers can include employee compensation, benefits, taxes and deductions. Below is an example of how to record a payroll journal entry transaction. Putting that template in excel can help you make sure your debits equal your credits. A day in the life of an accountant. The payroll accounts have lists of expenses and liabilities. Web a payroll journal entry includes employee wages, direct labor expenses, fica expenses, payroll taxes, and holiday, vacation and sick days in the debit section. Web this page offers a wide variety of free payroll templates that are fully customizable and easy to use. Accruing payroll liabilities, transferring cash, and making payments. Web payroll journal entries record your workers’ pay. Different types of payroll journal entries—initial recording, accrued, and manual—address specific payroll processing needs and ensure comprehensive. Web what is a payroll journal entry? Web this page offers a wide variety of free payroll templates that are fully customizable and easy to use. While the process may look different for every company, payroll ledgers can include employee compensation, benefits, taxes. Web payroll journal entries fall under the payroll account and are part of your general ledger. Record the following expenses in your payroll account: Understanding and accurately recording payroll journal entries are crucial for maintaining financial integrity and compliance in any business. Web here are five steps to preparing a payroll journal entry: Web payroll journal entries record your workers’. There are a few type of payroll journal entries to consider: The payroll accounts have lists of expenses and liabilities. Web here are five steps to preparing a payroll journal entry: The complete guide for beginners. Understanding and accurately recording payroll journal entries are crucial for maintaining financial integrity and compliance in any business. Web payroll journal entries record your workers’ pay alongside overall business expenses. While the process may look different for every company, payroll ledgers can include employee compensation, benefits, taxes and deductions. Understanding and accurately recording payroll journal entries are crucial for maintaining financial integrity and compliance in any business. Assume a company had a payroll of $35,000 for the month. Understanding and accurately recording payroll journal entries are crucial for maintaining financial integrity and compliance in any business. Set aside copies of this information in order to include it in the next payroll. Assume a company had a payroll of $35,000 for the month of april. This entry usually includes debits for the direct labor expense, salaries, and the company's. Web here are some of the more basic steps: Web payroll journal entry examples. A payroll is a list of company employees and the amount they can expect to receive for their work. Journal entries are used in accrual accounting to record payroll expenses that have. Assume a company had a payroll of $35,000 for the month of april. Assume a company had a payroll of $35,000 for the month of april. Payroll can get complicated fast, especially when it comes time to record all those journal entries. Putting that template in excel can help you make sure your debits equal your credits. Determine the specific data sets. One method for recording payroll is to create journal entries to. Determine the specific data sets. Web payroll journal entries record your workers’ pay alongside overall business expenses. Web payroll journal entry examples. Payroll can get complicated fast, especially when it comes time to record all those journal entries. Web a payroll journal entry is a record of your employee wages. Record the following expenses in your payroll account: Payroll can get complicated fast, especially when it comes time to record all those journal entries. Understanding and accurately recording payroll journal entries are crucial for maintaining financial integrity and compliance in any business. The payroll accounts have lists of expenses and liabilities. Set aside copies of this information in order to. Below is an example of how to record a payroll journal entry transaction. Record the following expenses in your payroll account: Also known as an initial recording, this first entry is very important. In this section of small business accounting payroll, we will use a fictitious company to provide examples of journal entries to record gross wages, payroll withholding, and related payroll costs of a. There are a few type of payroll journal entries to consider: Web here are some of the more basic steps: Web payroll journal entry examples. Web in this section of payroll accounting we will provide examples of the journal entries for recording the gross amount of wages, payroll withholdings, and employer costs related to payroll. Web a payroll journal entry is a record of your employee wages. Web using a payroll journal entry template can help you make sure you don’t miss anything. You’ll need to collect a few. One method for recording payroll is to create journal entries to account for each piece of payroll, including employee paychecks and employer taxes. That way, you can look back and see details about employee compensation, such as when you paid it, how much it was, and where the money went. Web updated december 22, 2023. Web payroll journal entries | financial accounting. A payroll is a list of company employees and the amount they can expect to receive for their work.

LO3 Journalizing and Recording Wages and Taxes. ACCT 032 Payroll

Xero Payroll Journal Template Template 2 Resume Examples lV8NWZ6510

40+ Free Payroll Templates & Calculators ᐅ TemplateLab

PPT Chapter 10 Payroll Accounting PowerPoint Presentation, free

Payroll Register Template & Examples for Small Businesses Hourly, Inc.

40+ Free Payroll Templates & Calculators ᐅ TemplateLab

Payroll Journal Entry Template Excel Template 2 Resume Examples

Payroll Journal Entry Template Excel Template 2 Resume Examples

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

FREE 26+ Payroll Templates in Excel

Accruing Payroll Liabilities, Transferring Cash, And Making Payments.

Web Payroll Journal Entries Fall Under The Payroll Account And Are Part Of Your General Ledger.

Payroll Can Get Complicated Fast, Especially When It Comes Time To Record All Those Journal Entries.

Web This Page Offers A Wide Variety Of Free Payroll Templates That Are Fully Customizable And Easy To Use.

Related Post: