Pattern Cup

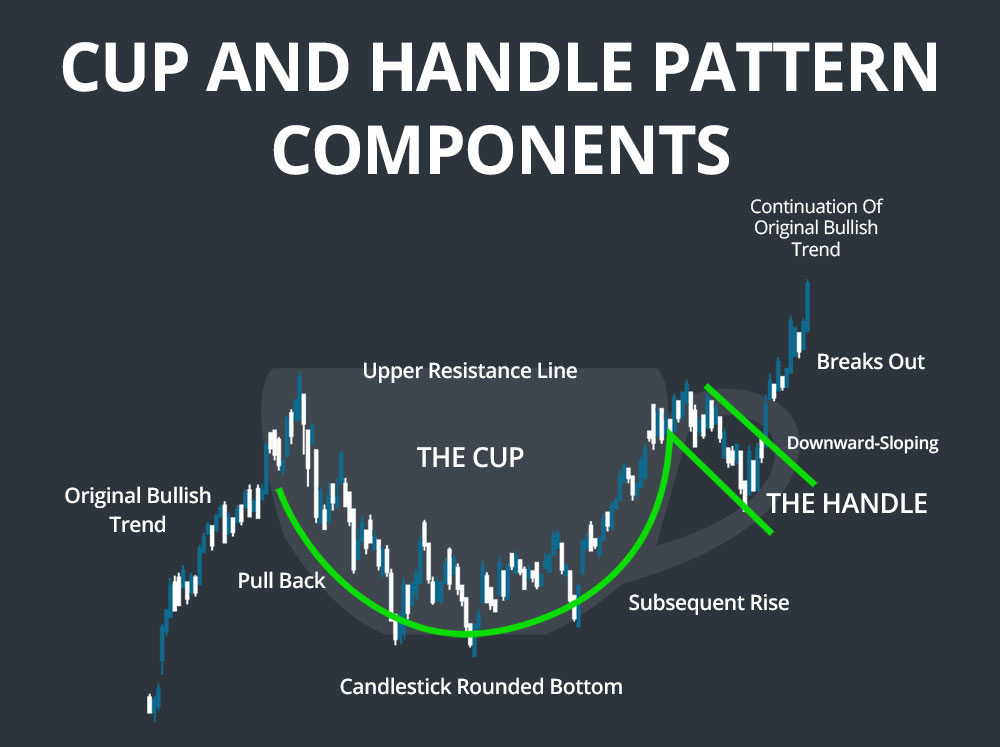

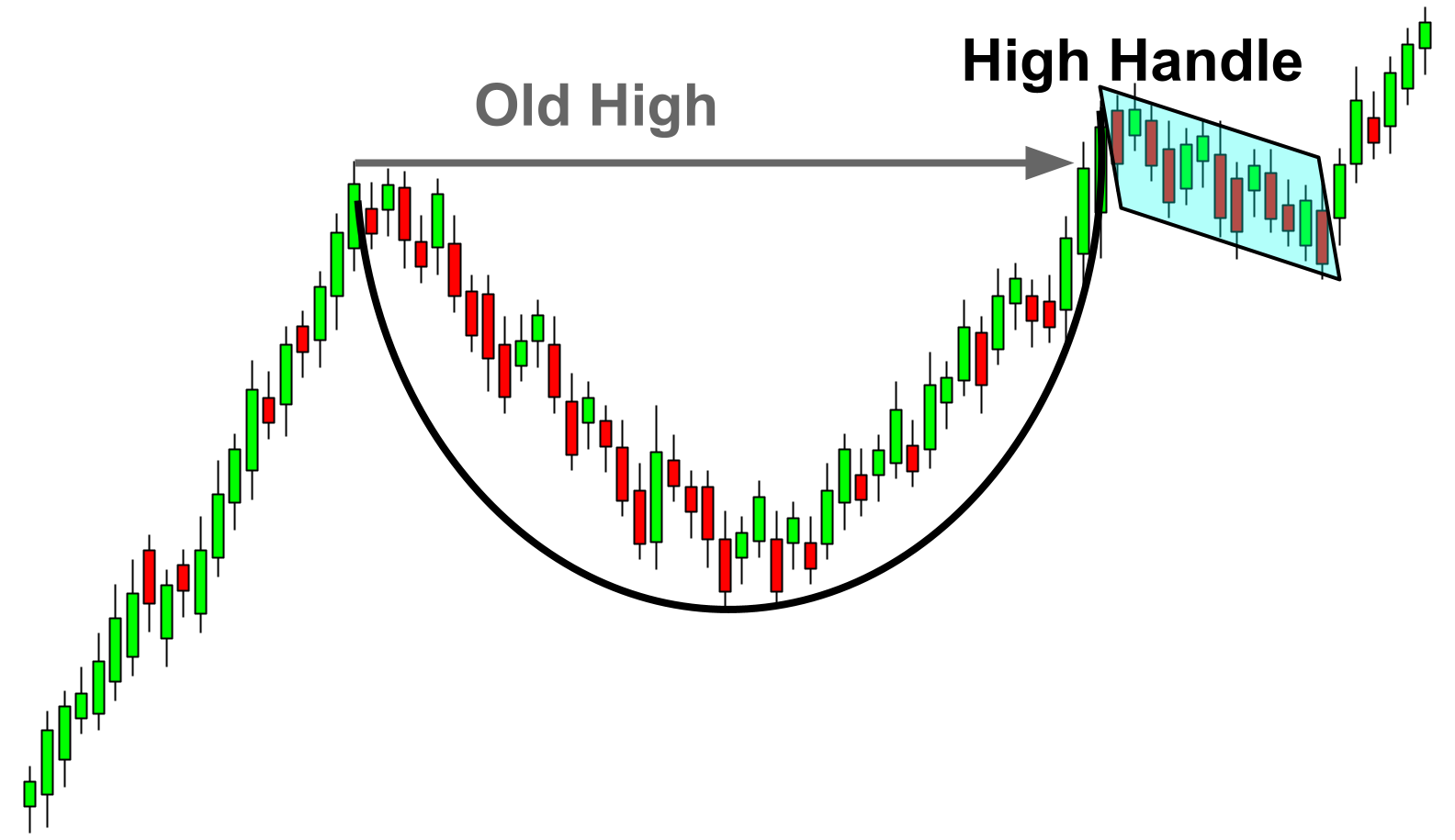

Pattern Cup - A cup and handle pattern acts as a consolidation pattern when it forms in an uptrend. The pattern starts when a stock’s price runs up, then pulls back to form a cup shape. Identify an uptrend and a rounded retracement into that uptrend (the cup). This will enhance your market analysis technique. Web one of the most important chart patterns in the stock market is the cup and handle pattern, invented by william o’neill. Draw the second component of the cup and handle. It also holds the crowd proclaimed title as one of the. Take a look at the chart. Web pull the tape measure snugly. They normally give multifold returns. The cup forms after an advance and looks like a bowl or rounding bottom. Web view risk disclosures. Web technically, a cup and handle pattern on the price of a security is an indicator that looks like a cup with handle, where the cup has a ‘u’ shape and the handle having a slight downward drift. Identify an uptrend and. Web technically, a cup and handle pattern on the price of a security is an indicator that looks like a cup with handle, where the cup has a ‘u’ shape and the handle having a slight downward drift. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a. Web one of the most important chart patterns in the stock market is the cup and handle pattern, invented by william o’neill. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. There are two parts to the pattern: Web the cup and handle security trading pattern is a bullish. A cup and handle pattern acts as a consolidation pattern when it forms in an uptrend. Learn more about the cup and handle pattern, how to identify it on a stock chart, and how you can use it in your trading. Web view risk disclosures. As the name suggests, the pattern is made up of two sections; Web the cup. This pattern occurs regularly within financial markets. Web pull the tape measure snugly. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. They normally give multifold returns. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a. Where did it get its name? Learn more about the cup and handle pattern, how to identify it on a stock chart, and how you can use it in your trading. Web what is a cup and handle pattern? Identify an uptrend and a rounded retracement into that uptrend (the cup). A cup and handle pattern acts as a consolidation. Web a cup and handle pattern resembles the shape of a cup or the letter u, with a rounded bottom forming the cup and a subsequent consolidation or retracement forming a smaller handle, suggesting a potential bullish trend movement in. One of the most common chart patterns is the cup and handle pattern. Web what is the cup and handle. Web the cup and handle security trading pattern is a bullish continuation pattern used in technical analysis. It is considered a signal of an uptrend in the stock market and is used to discover opportunities to go long. It also holds the crowd proclaimed title as one of the. As the name suggests, the pattern is made up of two. The cup and the handle. It is a bullish pattern that indicates a potential trend reversal or continuation of an upward trend. One of the most common chart patterns is the cup and handle pattern. Web it is a bullish continuation pattern that resembles a cup with a handle. Web a cup and handle is both a bullish continuation and. Web the cup and handle pattern is a pattern that traders use to identify whether the price of an asset will continue moving upwards. This will enhance your market analysis technique. It also holds the crowd proclaimed title as one of the. Web what is the cup and handle pattern? How to effectively use the cup and handle pattern (teacup. Web view risk disclosures. Take a look at the chart. Where did it get its name? The pattern starts when a stock’s price runs up, then pulls back to form a cup shape. Web a cup and handle pattern resembles the shape of a cup or the letter u, with a rounded bottom forming the cup and a subsequent consolidation or retracement forming a smaller handle, suggesting a potential bullish trend movement in. It is a bullish pattern that indicates a potential trend reversal or continuation of an upward trend. This pattern occurs regularly within financial markets. Web it is a bullish continuation pattern that resembles a cup with a handle. It gets its name because it resembles a cup with a handle in appearance. The cup forms after an advance and looks like a bowl or rounding bottom. How to effectively use the cup and handle pattern (teacup pattern trading strategy) step #1: The high points of the cup and the handle are aligned on the same horizontal resistance line. Web the cup and handle pattern is a pattern that traders use to identify whether the price of an asset will continue moving upwards. Web do you know what a cup and handle chart pattern is? There are two parts to the pattern: Web one of the most important chart patterns in the stock market is the cup and handle pattern, invented by william o’neill.

Cup and Handle Patterns Comprehensive Stock Trading Guide

How to Trade the Cup and Handle Chart Pattern cup and handle reversal

See How Easily You Can Identify The Cup And Handle Pattern StockManiacs

How To Trade Blog Cup And Handle Pattern How To Verify And Use

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

How To Trade Blog Cup And Handle Pattern How To Verify And Use

Cup And Handle Pattern Artinya

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

:max_bytes(150000):strip_icc()/CupandHandleDefinition1-c721e47fd1f7451997d0d5d941f6e174.png)

Cup and Handle Pattern How to Trade and Target with an Example

Cup and Handle Pattern Meaning with Example

Learn How It Works With An Example, How To Identify A Target.

It’s A Technical Chart Pattern Made Popular By William O’neil In His Book “How To Make Money In Stocks.” It’s A Continuation Pattern That May Indicate Future Gains.

After The Cup Forms, There May Be A Slight Downward Price Consolidation, Creating A Smaller Price Pattern Known As The Handle.

It Is Considered A Signal Of An Uptrend In The Stock Market And Is Used To Discover Opportunities To Go Long.

Related Post: